In-kind withdrawals are a type of withdrawal from an investment account that involves taking out securities or physical assets rather than cash. This can be useful for transferring assets or taking advantage of tax-loss harvesting strategies. However, it's important to consider the potential tax implications and consult a professional before making any withdrawals. In-kind withdrawals can involve various types of assets, including securities, real estate, personal property, and other investments. Securities are financial instruments that represent ownership or debt. They can be divided into several categories: Stocks: Shares of ownership in a company Bonds: Debt securities issued by governments or corporations Mutual Funds: Pooled investment vehicles that hold a diversified portfolio of assets Exchange-Traded Funds (ETFs): Investment funds that are traded on stock exchanges like individual stocks In-kind withdrawals can also involve the transfer of real property, such as land or buildings. Tangible personal property, like vehicles, art, or jewelry, can also be subject to in-kind withdrawals. Investors may choose to withdraw other types of investments, such as gold and precious metals or collectibles, in-kind. In-kind withdrawals involve a series of steps to transfer assets. The in-kind withdrawals typically include determining the value of the assets, transferring ownership, and handling any tax implications. Before initiating an in-kind withdrawal, it is essential to establish the fair market value of the assets involved. This may require professional appraisals or consultations with financial advisors. There are two primary methods for transferring securities in kind: Transferring real estate in-kind involves: The process for transferring personal property in kind includes: There are several reasons investors might opt for in-kind withdrawals over cash withdrawals. In-kind withdrawals can offer tax advantages: Lowering Capital Gains Tax: Transferring assets in-kind can help minimize capital gains tax liabilities, as no sale occurs, and thus, no gains are realized. Avoiding Early Withdrawal Penalties: In certain situations, in-kind withdrawals can help investors avoid penalties associated with early withdrawals from tax-advantaged accounts. By withdrawing assets in kind, investors can maintain their positions in specific securities or real estate investments. In-kind withdrawals can simplify the transfer of assets between accounts or individuals, streamlining estate planning and gifting processes. In-kind withdrawals help simplify estate planning by transferring assets directly to beneficiaries without liquidation. While in-kind withdrawals offer several advantages, they also come with risks and potential drawbacks. In-kind withdrawals involving illiquid assets, such as real estate or collectibles, may take time to convert into cash quickly, limiting the investor's flexibility. Establishing the fair market value of certain assets, especially unique or illiquid ones, can be challenging and may require costly professional appraisals. In-kind withdrawals can lead to legal disputes, particularly in situations where assets are jointly owned or subject to liens or encumbrances. Although in-kind withdrawals can offer tax advantages in some cases, they may also create unexpected tax liabilities or reporting requirements. Various regulatory bodies and legal frameworks govern in-kind withdrawals. The Internal Revenue Service (IRS) has rules and guidelines for in-kind withdrawals' tax implications. Investors should consult with tax services professionals to ensure compliance. Securities transfers, including in-kind withdrawals, are subject to Securities and Exchange Commission (SEC) regulations. Investors should work with their brokerage firms or financial advisors to ensure compliance with these rules. In addition to federal regulations, in-kind withdrawals may be subject to state and local laws, particularly when transferring real estate or personal property. In-kind withdrawals can play a role in various unique financial situations. Withdrawals from retirement accounts, such as Individual Retirement Accounts (IRAs) and 401(k) plans, may involve in-kind transfers. These transactions can have tax implications and may be subject to early withdrawal penalties. In-kind withdrawals can be used as part of charitable giving and gifting strategies, enabling donors to transfer assets directly to recipients or charitable organizations while potentially enjoying tax benefits. In the context of divorce, in-kind withdrawals can facilitate the division of assets between spouses while minimizing tax liabilities and preserving investment positions. In-kind withdrawals present a valuable financial tool for investors seeking to access, manage, or transfer their assets without liquidating their positions. This method offers several benefits, including potential tax advantages, the preservation of investment positions, and the facilitation of more straightforward asset transfers in various situations, such as estate planning, charitable giving, and divorce settlements. However, it is essential to remember that in-kind withdrawals also come with risks and challenges. Illiquid assets may limit an investor's flexibility, and the difficulty in determining the fair market value of certain assets can lead to complications. The potential for legal disputes and the need to navigate complex tax implications and reporting requirements can make in-kind withdrawals a more involved process than cash withdrawals. Given the complexities and potential drawbacks, investors considering in-kind withdrawals should thoroughly research and understand the implications of this financial strategy. Consulting with financial and legal professionals is crucial to ensure compliance with relevant regulations and assess the potential tax consequences associated with in-kind withdrawals. These professionals can provide tailored advice and guidance based on the investor's unique financial goals and situation.What Are In-Kind Withdrawals?

Types of In-Kind Withdrawals

Securities

Real Estate

Personal Property

Other Investments

Mechanics of In-Kind Withdrawals

Process Overview

Determining the Value of In-Kind Assets

Steps for Transferring Securities

1. Brokerage Account Transfers: Investors can transfer securities between brokerage accounts using a process called the Automated Customer Account Transfer Service (ACATS).

2. Direct Registration System (DRS) Transfers: In some cases, securities can be transferred using the DRS, which involves registering the securities directly with the issuer or its transfer agent.

Steps for Transferring Real Estate

1. Deed Transfers: The property's ownership must be legally transferred through a deed.

2. Tax Implications and Reporting Requirements: Real estate transfers may have tax consequences, and both parties must adhere to any reporting requirements.

Steps for Transferring Personal Property

1. Documenting Ownership: Ownership documentation, such as titles or bills of sale, should be provided.

2. Valuation and Appraisal: An appraisal may be necessary to establish the property's fair market value.

3. Transfer Procedures: The transfer of ownership must be completed according to relevant regulations and laws

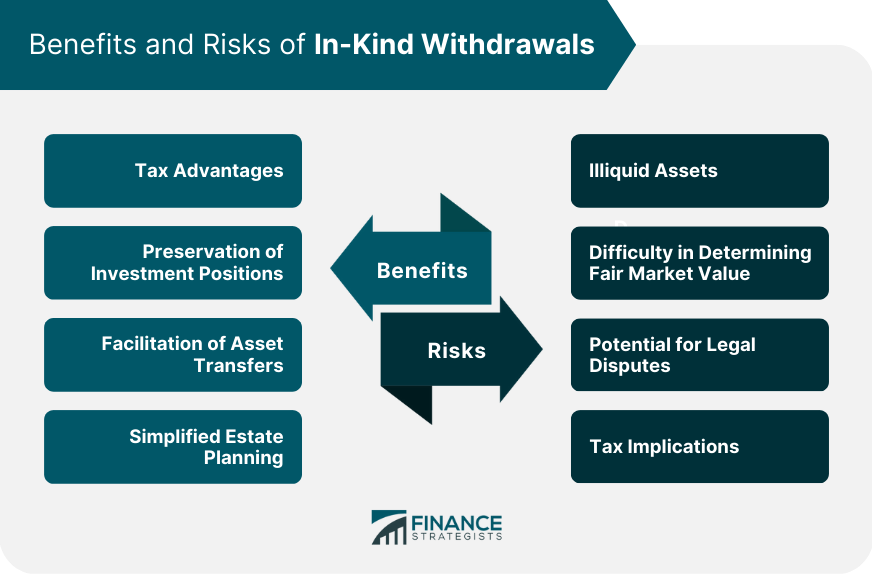

Benefits of In-Kind Withdrawals

Tax Advantages

Preservation of Investment Positions

Facilitation of Asset Transfers

Simplified Estate Planning

Risks and Disadvantages of In-Kind Withdrawals

Illiquid Assets

Difficulty in Determining Fair Market Value

Potential for Legal Disputes

Tax Implications

Regulatory and Legal Considerations of In-Kind Withdrawals

IRS Regulations

Securities and Exchange Commission (SEC) Rules

State and Local Regulations

Special Situations and Considerations of In-Kind Withdrawals

In-Kind Withdrawals From Retirement Accounts

Charitable Giving and Gifting Strategies

Divorce and Asset Division

Conclusion

In-Kind Withdrawals FAQs

In-kind withdrawals refer to the process of withdrawing assets from an investment account in the form of physical assets or securities rather than cash.

In-kind withdrawals involve taking out securities or assets from an investment account, while cash withdrawals involve taking out cash. In-kind withdrawals are generally used to transfer assets to another account or to a different investment vehicle.

In-kind withdrawals are typically available from investment accounts such as brokerage accounts, mutual funds, exchange-traded funds (ETFs), and retirement accounts.

Yes, in-kind withdrawals can trigger capital gains taxes if the value of the assets being withdrawn has increased since their purchase. It's important to consult a tax professional before making any in-kind withdrawals to understand the tax implications fully.

In-kind withdrawals can be useful in situations where an investor wants to transfer assets to another account or investment vehicle without selling them and incurring transaction fees or taxes. In-kind withdrawals can also be used to take advantage of tax-loss harvesting strategies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.