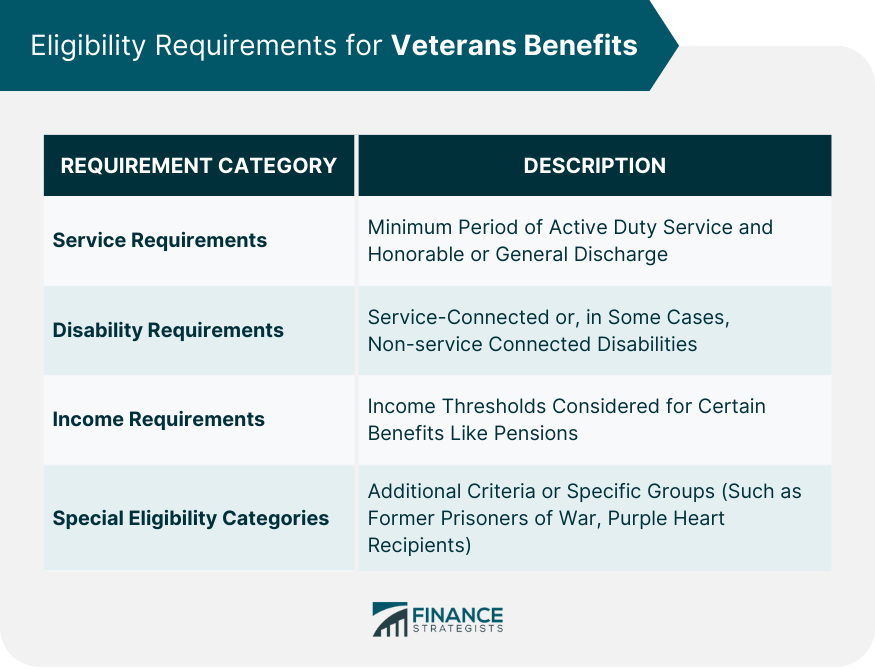

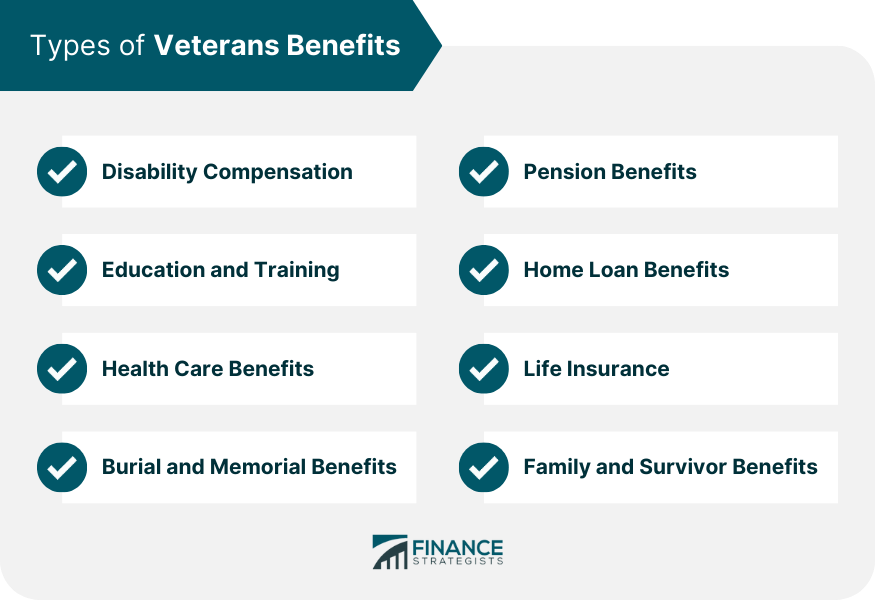

Veterans benefit planning is the process of helping veterans and their families understand and access the benefits and services available to them through the Department of Veterans Affairs (VA). These benefits can include medical care, disability compensation, pension benefits, education and training, home loans, and more. Veterans benefit planning often involves working with veterans and their families to assess their needs and eligibility for different types of benefits. It can also involve helping them navigate the application process and advocating for their rights and entitlements. To qualify for veterans benefits, one must meet specific service requirements, including: 1. Length of Service: Generally, a veteran must have completed a minimum period of active duty service. 2. Type of Discharge: Veterans must have received an honorable or general discharge to be eligible for most benefits. Some benefits require a disability to be connected to military service: 1. Service-Connected Disabilities: These are disabilities that were incurred or aggravated during active military service. 2. Non-service Connected Disabilities: In some cases, veterans with disabilities not related to service may still qualify for certain benefits. Income thresholds are often considered for some benefits, such as pensions. Certain benefits have additional eligibility criteria or may apply to specific groups, such as former prisoners of war or Purple Heart recipients. This benefit provides tax-free monetary compensation to veterans with disabilities resulting from their military service. Veterans with limited income and who meet specific service requirements may qualify for pension benefits, which provide supplemental income. This program provides financial support for education and housing to veterans with at least 90 days of active duty service after September 10, 2001. This program offers educational benefits to eligible veterans who served during specific periods or in specific roles. The VR&E program assists veterans with service-connected disabilities in obtaining and maintaining suitable employment or achieving independence in daily living. The VA home loan program helps eligible veterans purchase, build, or refinance a home by guaranteeing a portion of the loan, enabling them to receive more favorable loan terms. Veterans can refinance their existing mortgage to lower interest rates and monthly payments. These grants provide financial assistance to veterans with specific service-connected disabilities to adapt or purchase a home that accommodates their needs. Eligible veterans can receive comprehensive health care benefits, including preventative, primary, and specialized care, through the VA health care system. Veterans can access various life insurance programs to provide financial security for their families. These benefits include burial in a national cemetery, headstones, markers, and presidential memorial certificates. Spouses, dependents, and survivors of veterans may be eligible for benefits such as education, health care, and financial assistance. The application process varies depending on the specific benefit being sought. Generally, it involves submitting an application form along with the required documentation. Documentation may include discharge papers (DD-214), medical records, and proof of service. VSOs can provide guidance and assistance throughout the application process, ensuring that veterans submit accurate and complete applications. If a claim is denied or a veteran disagrees with a decision, they can appeal through a multi-step process involving reconsideration, review, and hearings. Assessing the Current Financial Situation: An essential first step in financial planning is evaluating one's current financial situation, including income, expenses, assets, and liabilities. Establishing Short-Term and Long-Term Financial Goals: Identify financial goals, such as buying a home, funding education, or planning for retirement, and determine the time frame for achieving these goals. Creating a Budget and Savings Plan: Develop a budget to track income and expenses, identifying areas for potential savings and ensuring funds are allocated towards financial goals. Retirement Planning: Plan for retirement by understanding the available benefits, such as military pensions and Social Security, and investing in additional savings vehicles like IRAs or 401(k)s. Estate Planning: Includes creating a will, designating beneficiaries, establishing trusts, and considering powers of attorney to ensure a veteran's assets are distributed according to their wishes and their family is provided for in the event of their passing. The VA oversee veterans benefits and provides information on eligibility, applications, and available programs. These agencies offer additional resources and support for veterans at the state and local levels. VSOs, such as the American Legion and Veterans of Foreign Wars, provide support, resources, and advocacy for veterans and their families. Many non-profit organizations and charities offer assistance and resources for veterans, ranging from financial support to career services. Various websites and tools can help veterans research, apply for, and manage their benefits, such as eBenefits, the National Resource Directory, and VA benefits calculators. Veterans benefits planning is an essential process for those who have served in the military to ensure they take full advantage of the available benefits. By understanding eligibility requirements, navigating the application process, and addressing financial planning aspects such as budgeting and retirement, veterans can achieve both short-term and long-term goals. Leveraging resources and support from government organizations, Veterans Service Organizations (VSOs), and non-profit organizations can provide valuable guidance throughout the planning process. Ultimately, proactive benefits planning enables veterans to maximize their benefits and secure a stable and prosperous future for themselves and their families.Veterans Benefits Planning Overview

Eligibility Requirements for Veterans Benefits

Service Requirements

Disability Requirements

Income Requirements

Other Special Eligibility Categories

Types of Veterans Benefits

Disability Compensation

Pension Benefits

Education and Training

Post-9/11 GI Bill

Montgomery GI Bill

Vocational Rehabilitation and Employment (VR&E)

Home Loan Benefits

VA Home Loans

Home Loan Refinancing

Adapted Housing Grants

Health Care Benefits

Life Insurance

Burial and Memorial Benefits

Family and Survivor Benefits

Navigating the Benefits Application Process

Steps to Apply for Benefits

Obtain Required Documentation

Working With a Veterans Service Officer (VSO)

Appealing Decisions and Denials

Financial Planning for Veterans

Support and Resources for Veterans Benefits Planning

Government Organizations

Department of Veterans Affairs

State and Local Veterans Agencies

Non-governmental Organizations

Veterans Service Organizations

Non-profit Organizations and Charities

Online Resources and Tools

Bottom Line

Veterans Benefits Planning FAQs

Veterans benefits planning is a process that helps veterans identify, understand, and access the various benefits available to them, such as disability compensation, education, and health care. This planning is crucial to ensure veterans maximize the benefits they earned through their service and secure a stable future for themselves and their families.

Veterans benefits planning assists veterans in understanding and utilizing the benefits available to them, which can have a significant impact on their financial and retirement planning. By maximizing benefits such as disability compensation, pensions, and education assistance, veterans can reduce expenses, increase income, and achieve both short-term and long-term financial goals.

Various resources are available to support veterans benefits planning, including government organizations like the Department of Veterans Affairs (VA) and state and local veterans agencies, non-governmental organizations such as Veterans Service Organizations (VSOs) and non-profit organizations, and online resources and tools to help veterans research, apply for, and manage their benefits.

A Veterans Service Officer (VSO) can play a vital role in veterans benefits planning by providing guidance and assistance throughout the benefits application process. VSOs can help veterans understand eligibility requirements, gather required documentation, submit accurate and complete applications, and even assist with appeals if a claim is denied or a veteran disagrees with a decision.

Key considerations for successful veterans benefits planning include understanding eligibility requirements for various benefits, navigating the application process, financial planning (including budgeting, retirement planning, and estate planning), and leveraging available resources and support from government and non-governmental organizations. Proactive planning and seeking professional guidance can help veterans maximize their benefits and secure a stable future.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.