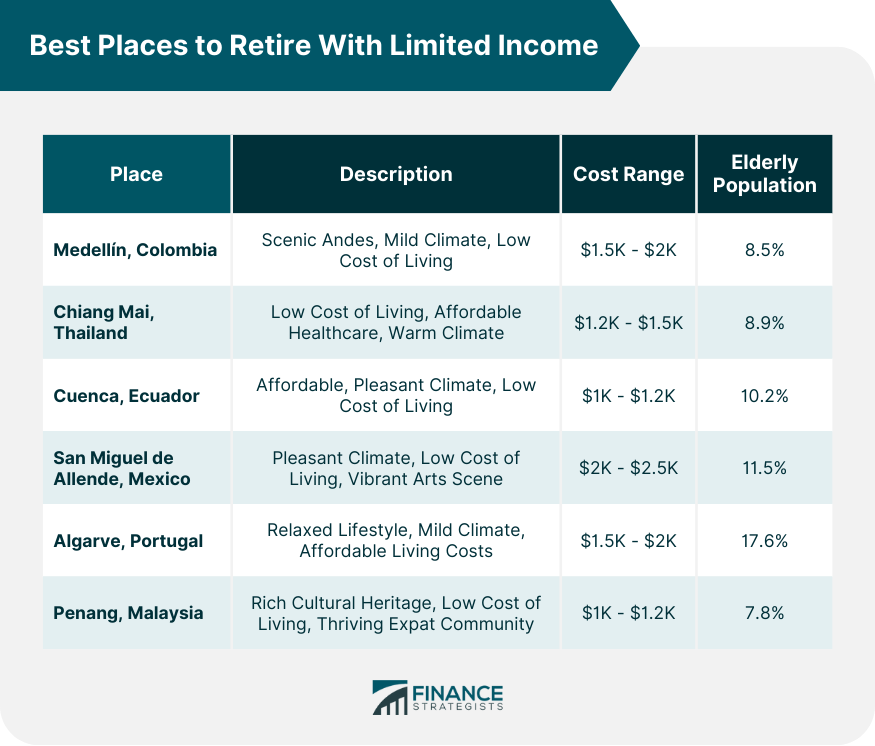

Entering the golden years of retirement with a limited income requires careful planning and thoughtful consideration, especially when it comes to choosing the right place to live. The location of retirement plays a significant role in dictating the quality of life and the financial sustainability of a retiree. It's not only about the picturesque landscapes or warm weather; the decision also hinges on economic factors, accessibility to healthcare, social connectivity, and overall safety. A strategic choice can stretch the income further and offer a comfortable and enriching life post-retirement. On the contrary, a less thoughtful decision may lead to financial strain and compromise the joy of these well-deserved years of relaxation. Nestled in the scenic Andes Mountains, Medellín boasts a mild climate, breathtaking landscapes, and a low cost of living. The city offers affordable housing options, inexpensive healthcare, and a well-developed transportation system. Medellín is known for its vibrant cultural scene, welcoming locals, and a range of recreational activities, making it an attractive destination for retirees. The cost of living in Medellín is very affordable for retirees. A couple can live comfortably on $1,500-$2,000 per month. The city has a vibrant expat community and a wide range of activities and amenities for retirees. The share of the population aged 65 and over is 8.5%. Chiang Mai is a charming city in northern Thailand that has become increasingly popular among retirees. The city offers a low cost of living, affordable healthcare, and a warm climate. With its rich cultural heritage, ancient temples, and bustling markets, Chiang Mai provides retirees with a unique and immersive experience. Additionally, the city's large expatriate community provides opportunities for socializing and making new connections. Chiang Mai is another very affordable city for retirees. A couple can live comfortably on $1,200-$1,500 per month. The city has a rich cultural history and a variety of temples, museums, and markets to explore. The share of the population aged 65 and over is 8.9%. Cuenca, located in the highlands of Ecuador, is a picturesque colonial city known for its affordability and quality of life. Retirees can enjoy a low cost of living, including affordable healthcare and housing options. Cuenca's well-preserved historic center, pleasant climate, and friendly locals make it an ideal place for retirees seeking a tranquil and culturally rich environment. Cuenca is a beautiful colonial city with a low cost of living. A couple can live comfortably on $1,000-$1,200 per month. The city has a mild climate, friendly people, and a variety of restaurants, shops, and cultural attractions. The share of the population aged 65 and over is 10.2%. Situated in the central highlands of Mexico, San Miguel de Allende is a vibrant and picturesque colonial town. The city offers retirees a pleasant climate, a low cost of living, and a strong sense of community. With its cobblestone streets, colorful architecture, and lively arts scene, San Miguel de Allende provides retirees with a charming and enriching retirement experience. San Miguel de Allende is a popular retirement destination with a high cost of living. A couple can live comfortably on $2,000-$2,500 per month. The city has a vibrant arts scene, a historic downtown, and a variety of restaurants, shops, and cultural attractions. The share of the population aged 65 and over is 11.5%. Known for its stunning coastline, Algarve is a region in southern Portugal that offers a relaxed and affordable retirement lifestyle. The area boasts a mild climate, beautiful beaches, and picturesque fishing villages. Retirees can enjoy a low cost of living, excellent healthcare, and a range of recreational activities, including golfing and water sports. The welcoming local community and expatriate network make it easy to integrate into the vibrant Algarve lifestyle. The Algarve is a popular retirement destination with a moderate cost of living. A couple can live comfortably on $1,500-$2,000 per month. The region has a mild climate, beautiful beaches, and a variety of golf courses, restaurants, and shops. The share of the population aged 65 and over is 17.6%. Penang, an island off the west coast of Malaysia, is renowned for its rich cultural heritage, delicious cuisine, and affordability. Retirees can take advantage of the low cost of living, modern healthcare facilities, and a diverse expatriate community. With its UNESCO-listed historic sites, bustling street markets, and stunning natural landscapes, Penang offers retirees a unique blend of culture, leisure, and affordability. Penang is a beautiful island with a low cost of living. A couple can live comfortably on $1,000-$1,200 per month. The island has a rich cultural heritage, a variety of temples, mosques, and museums, and a thriving food scene. The share of the population aged 65 and over is 7.8%. First on the list of considerations is the cost of living in a prospective retirement location. It's paramount to understand how far your retirement income will stretch in a given area. Essential expenses like housing, utilities, groceries, and transportation can greatly vary from one place to another. Take into account your lifestyle and spending habits to create a realistic monthly budget. Use online cost of living calculators to compare the costs between your current city and potential retirement destinations. These tools can provide a comprehensive view of the economic landscape and help you evaluate if a location fits well within your retirement budget. Taxes can take a significant bite out of your retirement income, so understanding the tax landscape in your prospective retirement area is crucial. Some states offer tax advantages to retirees, including exemptions from social security income and pension income. Others might impose high taxes that can strain your retirement budget. Investigate not only state income taxes but also sales taxes and property taxes. If you plan to own a home in retirement, the property tax can significantly impact your annual expenses. Engage with a financial advisor or do extensive online research to grasp the tax laws and regulations, ensuring your retirement income stays as intact as possible. As we age, access to quality healthcare becomes increasingly important. Evaluate the healthcare facilities and services available in the areas you're considering for retirement. Look at the proximity of hospitals and clinics, availability of specialized medical services, and the reputation of healthcare providers in the area. Consider, too, the cost of healthcare. Some areas might have high-quality healthcare facilities but at steep prices. Others might have more affordable healthcare but fewer specialists or facilities. Balance your healthcare needs and budget to choose a location that offers quality healthcare within a price range you’re comfortable with. While it might seem trivial compared to financial and healthcare considerations, don't underestimate the impact of climate and weather on your retirement life. If you enjoy outdoor activities, a location with pleasant weather year-round might be a good fit. On the other hand, if you're a fan of the four seasons, a state that experiences a varied climate might be more appealing. Remember, weather conditions also affect the cost of living. For instance, a warmer climate might result in high air conditioning costs, while colder climates can lead to higher heating bills. Also, certain climates might exacerbate health issues, like arthritis or respiratory problems. Considering your lifestyle and health in conjunction with the local climate can lead to a more comfortable retirement. Retiring in a place with low crime rates can provide peace of mind and contribute to your overall well-being. Safety plays a crucial role, especially for those who plan to live alone. Research the crime rates in your potential retirement spots, looking at both property crimes and violent crimes. Reliable sources for such information include local police departments, city websites, and online databases that provide crime statistics. Talking to residents in the community can also give you a sense of the safety level in the area. Your retirement years should be carefree and enjoyable, so prioritizing safety in your location choice is essential. Retirement is the time to engage in activities you love and explore new hobbies. Hence, the availability of social and recreational activities is a significant factor when choosing your retirement location. Does the community offer clubs, classes, or groups that align with your interests? Are there parks, museums, theaters, or shopping centers nearby? A location with a vibrant social scene can enrich your retirement life, helping you stay active and connected. Furthermore, consider the physical geography of the area. If you enjoy hiking, a mountainous region could be perfect. If you love the beach, retiring near the coast could bring daily joy. Staying close to family and friends can provide a strong social network and emotional support during your retirement years. Having loved ones nearby not only facilitates regular get-togethers but also ensures a support system in case of emergencies. On the flip side, retiring away from family might be an opportunity for new adventures. However, consider the ease and affordability of travel back to see family and friends. You might also evaluate the guest accommodations for when loved ones visit. The emotional component of retirement should not be overlooked, and maintaining close relationships contributes significantly to a happy retirement. Initiating retirement savings at an early stage allows your investments to compound over time, increasing your retirement nest egg. Regularly contribute to retirement accounts such as 401(k)s or IRAs to maximize growth potential. Evaluate your current expenses and design a comprehensive budget for your retirement years. Prioritize essential needs like housing, healthcare, and basic living expenses, and allocate funds accordingly to maintain financial stability. Before entering retirement, strive to pay off high-interest debts such as credit cards or loans. By reducing debt, you'll have more disposable income available for other essential expenses, ensuring a more comfortable retirement. Research locations that offer a lower cost of living, affordable healthcare options, and favorable tax policies for retirees. Look for areas that align with your desired lifestyle and financial capabilities, ensuring that your retirement savings stretch further. Familiarize yourself with available retirement benefits such as Social Security and Medicare. Understand the eligibility criteria and determine the optimal time to claim these benefits to maximize your monthly income and financial security. Choosing the right place to retire on a limited income requires a blend of financial, lifestyle, and emotional considerations. Factors such as the cost of living, taxation, healthcare facilities, climate, safety, recreational activities, and proximity to family and friends all play a role in making the golden years truly golden. The decision demands a careful evaluation of these elements, aligning them with personal preferences and financial capacity. It is crucial to remember that retirement is a significant life transition, and the location you choose greatly influences your retirement experience. Engage in thorough research, seek professional advice if needed, and take time to make a decision. After all, retirement is a time to enjoy the fruits of your labor, and a thoughtfully selected location can provide a comfortable and fulfilling lifestyle in your golden yearsChoosing the Best Place to Retire With Limited Income

Best Places to Retire With Limited Income

Medellín, Colombia

Chiang Mai, Thailand

Cuenca, Ecuador

San Miguel de Allende, Mexico

Algarve, Portugal

Penang, Malaysia

Factors to Consider

Cost of Living

Taxation

Healthcare Facilities and Services

Climate and Weather

Safety and Crime Rates

Social and Recreational Activities

Proximity to Family and Friends

Strategies for a Comfortable Retirement on a Limited Income

Start Saving Early

Create a Budget

Minimize Debt

Explore Affordable Retirement Destinations

Maximize Retirement Benefits

The Bottom Line

Best Places to Retire With Limited Income FAQs

Factors to consider include cost of living, taxation, healthcare facilities, climate, safety, and proximity to family and friends.

Yes, many countries offer affordable healthcare options for retirees, such as Colombia, Ecuador, and Portugal.

Yes, there are places with affordable housing options, like Mexico, Thailand, and Malaysia, where retirees can find suitable accommodations within their budget.

Absolutely! Cities like Medellín, Chiang Mai, and San Miguel de Allende offer a wide range of social and recreational activities to keep retirees engaged and entertained.

Planning ahead, researching cost of living, budgeting, and taking advantage of affordable destinations with a good quality of life can help you enjoy a comfortable retirement within your financial means.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.