Retirement homes, also known as assisted living facilities, nursing homes, or long-term care facilities, provide valuable care and support to elderly individuals who require assistance with daily activities. Retirement homeowners, operators, and managers must ensure their businesses are adequately protected against potential risks, including property damage, liability claims, and medical malpractice. Retirement home insurance policies provide a crucial layer of protection for these businesses, covering everything from property damage to medical expenses. Retirement home insurance provides financial protection to retirement homes in case of unexpected events such as property damage, liability claims, or business interruption. These homes are exposed to various risks, including natural disasters, accidents, and lawsuits, which can result in significant financial losses. Such insurance policies are designed to help protect against these risks by providing coverage for different losses and expenses. When a retirement home purchases an insurance policy, they pay a premium to the insurance company, which is typically based on factors like the size of the retirement home, the level of risk associated with the business, and the coverage limits selected. Once the policy is in place, the retirement home is covered against the specific risks outlined. In the event of a covered loss or event, the retirement home can file a claim with the insurance company. The claims process typically involves providing documentation of the loss or damage, including photographs, estimates, and other relevant information. The insurance company will then evaluate the claim and determine the amount of coverage available based on the specific terms of the policy. Retirement home insurance policies typically include three primary types of coverage: property insurance, liability insurance, and business interruption insurance. It covers the building, equipment, and inventory of a retirement home. Property insurance is essential for protecting the physical assets of the business against damage or loss. In the event of a fire, natural disaster, or other unforeseen events that damages the building, property insurance can provide funds to repair or rebuild the facility. Additionally, property insurance can also provide coverage for equipment and inventory, including medical equipment, furniture, and supplies. It is designed to insulate retirement homeowners, operators, and managers against potential lawsuits or claims. Liability insurance covers bodily injury and property damage, medical expenses, and employee practices. For example, if a resident of a retirement home slips and falls, liability insurance can provide coverage for their medical expenses and any legal claims that may arise. Additionally, liability insurance can also safeguard employee practices, such as wrongful termination or discrimination claims. Business interruption insurance shields against loss of income and additional expenses in the event of a disaster, accident, or other untoward events that interrupts the normal operation of a retirement home. For example, if a retirement home is forced to close temporarily due to a hurricane, earthquake, or fire, business interruption insurance can provide funds to cover lost income and other expenses, such as temporary relocation costs. Retirement homeowners, operators, and managers must ensure that the insurance policy provides adequate coverage and meets the needs of the business. These factors include coverage limits, premium costs, and deductibles. These refer to the maximum amount of coverage provided by the insurance policy. It is essential to consider the specific needs of the business when choosing coverage limits to ensure that there is adequate protection against potential risks. For example, a retirement home with a high-value property and expensive equipment may require higher coverage limits than others with less expensive property, equipment, and inventory. These refer to the amount the business must pay for the insurance policy. Premium costs are affected by various factors, including the size of the retirement home, the level of risk associated with the business, and the coverage limits selected. When choosing a policy, it is important to consider the premium costs and how they will impact the financial viability of the business. The premiums paid must be commensurate with the quality of service provided. These reflect the amount of out-of-pocket expenses that the business must pay before the insurance policy begins to cover the costs of a claim. Deductibles are a way to share the risk between the retirement home and the insurance company. When selecting a retirement home insurance policy, it is important to consider the deductible amount carefully. Generally, policies with higher deductibles have lower premiums, while policies with lower deductibles have higher premiums. Retirement homes must balance the cost of the premiums against the deductible amount to find the right policy for their specific needs. Retirement homes should also consider supplemental coverage options that may be available beyond the standard types of coverage included in a basic insurance policy. For example, retirement homes may want to consider additional coverage for professional liability, cyber liability, or employment practices liability, depending on the specific needs of the business. It is important to evaluate the risks associated with the operation of the business and select a policy that provides coverage for these risks. Retirement homes should also consider the reputation and financial stability of the insurance company when selecting a policy. It is essential to select an insurance company with a proven track record of providing high-quality service and prompt claims handling. Furthermore, retirement homes should choose an insurance company that is financially stable and has a strong credit rating to ensure that they can meet their financial obligations in the event of a large-scale disaster or other insurable events. Retirement home insurance provides advantages to owners, operators, and managers, including protection of assets, risk management, and peace of mind. Retirement home insurance protects against financial loss resulting from property damage, liability claims, or other unexpected events. The physical assets of a retirement home, including the building, equipment, and inventory, are valuable and essential to the operation of the business. Property insurance provides coverage for these assets and can help to ensure that the business can recover from unexpected events that damage or destroy these assets. Liability insurance provides coverage for potential lawsuits or claims, protecting the financial viability of the business and providing peace of mind for the owners, operators, and managers. Retirement home insurance policies are an essential tool for managing risk associated with operating a retirement home. Retirement homes face many risks, including property damage, liability claims, and natural disasters. Insurance policies provide a crucial layer of protection against these risks and can help to mitigate potential losses associated with these events. Additionally, having insurance coverage in place can help to reduce the potential for legal action, as residents and their families may be less likely to pursue legal action if they know that the retirement home has insurance coverage in place. Finally, having retirement home insurance can provide peace of mind to owners, operators, and managers of retirement homes. Running a retirement home can be stressful, and unexpected events can cause significant financial and emotional strain. Having insurance coverage in place can help to alleviate some of this stress and provide peace of mind knowing that the business is adequately protected against potential risks. While retirement home insurance is an essential tool for protecting the financial viability of a retirement home, there are also some disadvantages to consider. Retirement homes may find it difficult to afford the premiums associated with insurance policies, particularly if they require high coverage limits or have a history of claims. The insurance cost can be a significant financial burden on the retirement home, particularly if the policy includes a low deductible. Retirement home insurance policies may not cover every type of loss or expense the business may encounter. While policies typically cover property damage, liability claims, and business interruption, retirement homes may require additional coverage for specific risks associated with their business. For example, retirement homes may need additional coverage for professional liability or cyber liability. Filing a claim can be a meticulous and time-consuming process, particularly for large or complex claims. Additionally, retirement homes may experience delays in receiving payment for claims, which can impact their ability to recover from the financial impact of a covered event. Retirement home insurance policies may include exclusions and limitations that can impact the coverage provided by the policy. For example, policies may exclude coverage for certain natural disasters or limit coverage for certain liability claims. Retirement homes must carefully review their policy to ensure that they understand any exclusions or limitations that may impact their coverage. Retirement home insurance is an essential tool for protecting the physical assets and financial viability of retirement homes. Policies can provide coverage for property damage, liability claims, and business interruption, helping to mitigate potential losses associated with unexpected events. When choosing a policy, it is essential to consider factors such as coverage limits, premium costs, and deductibles to ensure that the policy provides adequate protection for the business. The benefits of having retirement home insurance include protection of assets, risk management, and peace of mind, while drawbacks are related to costs, limited coverage, claims handling, and exclusions. Owners, operators, and managers of retirement homes should consult with an insurance broker to determine the best policy for their specific needs and ensure that their business is adequately protected.Retirement Home Insurance: Overview

How Does Retirement Home Insurance Work?

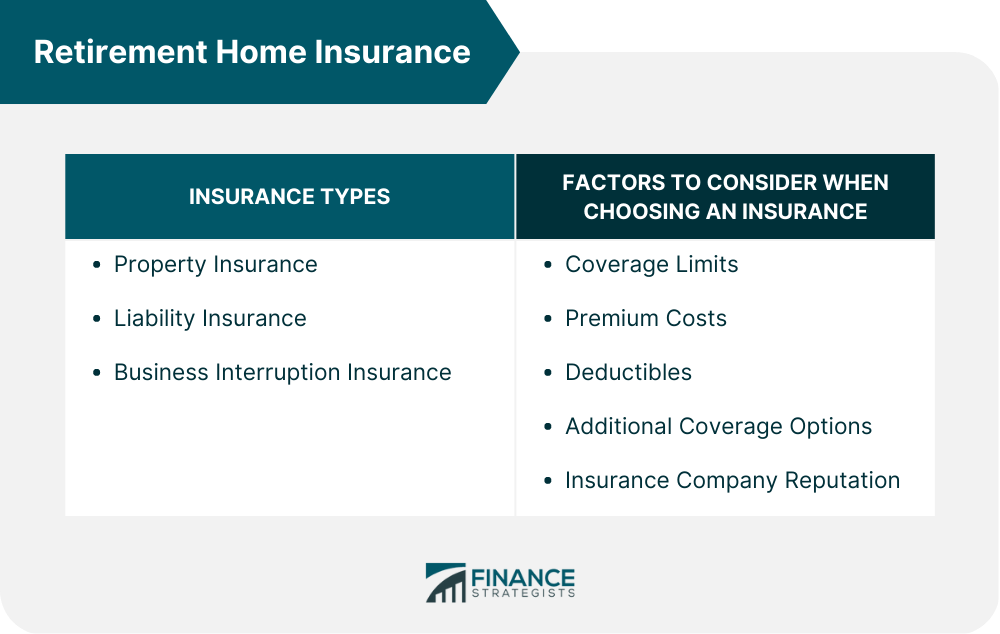

Types of Retirement Home Insurance

Property Insurance

Liability Insurance

Business Interruption Insurance

Factors to Consider When Choosing Retirement Home Insurance

Coverage Limits

Premium Costs

Deductibles

Additional Coverage Options

Insurance Company Reputation

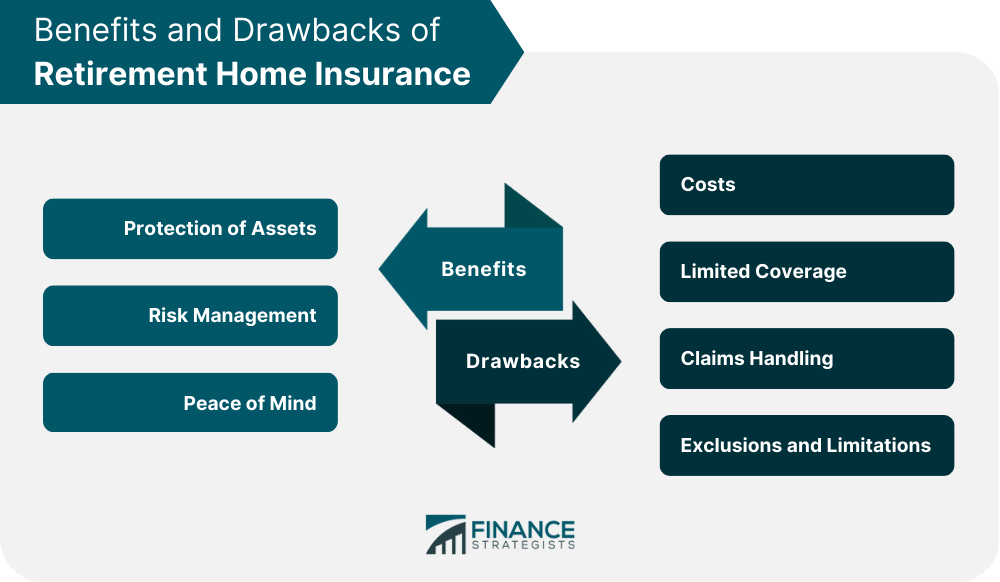

Benefits of Retirement Home Insurance

Protection of Assets

Risk Management

Peace of Mind

Drawbacks of Retirement Home Insurance

Cost

Limited Coverage

Claims Handling

Exclusions and Limitations

Final Thoughts

Retirement Home Insurance FAQs

Retirement home insurance is a type of insurance policy designed to protect retirement homes against potential risks such as property damage, liability claims, and business interruption.

Retirement home insurance typically includes three primary types of coverage: property insurance, liability insurance, and business interruption insurance. These types of coverage provide protection against different types of risks that retirement homes may encounter.

Retirement homes are exposed to a variety of risks, including property damage, liability claims, and business interruption. Insurance policies provide a crucial layer of protection against these risks and can help to mitigate potential losses associated with unexpected events.

The cost of retirement home insurance varies depending on various factors, including the size of the retirement home, the risk associated with the business, and the coverage limits selected. Retirement homes should work with an insurance agent to obtain a quote and select a policy that provides adequate coverage at a reasonable cost.

Retirement homes should consider factors such as coverage limits, premium costs, deductibles, additional coverage options, and insurance company reputation. It is essential to evaluate the specific risks associated with the operation of the business and select a policy that provides adequate coverage against potential risks. Retirement homes should work with an insurance agent to select a policy that meets their specific needs and budget.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.