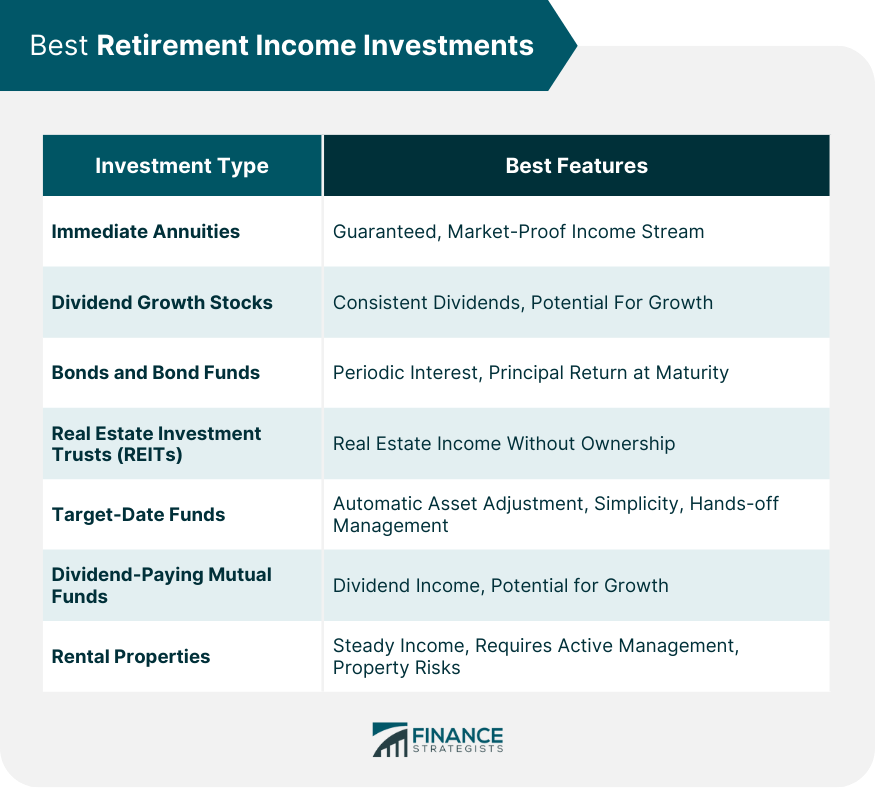

Retirement income investments are financial assets purchased with the aim of generating a steady income stream for retirement. These assets may include a wide range of investment products such as stocks, bonds, mutual funds, annuities, and real estate investments. The key characteristic of these investments is their ability to generate income – either through regular interest or dividend payments, or through a return of capital. Selecting suitable retirement income investments can have a significant impact on financial security and lifestyle quality in retirement. The right investments can generate a steady, reliable income stream that can cover living expenses and provide a cushion for unexpected costs. Immediate annuities are insurance products that provide a guaranteed income stream for life or a specified period in exchange for a lump sum payment. They can be a good choice for retirees looking for a steady, guaranteed income, as the annuity payments are unaffected by market fluctuations. Dividend growth stocks are shares in companies that have a history of consistently increasing their dividend payouts. They offer the potential for both income (through dividends) and capital growth, making them a viable option for those seeking a dual benefit. When you purchase a bond, you're essentially lending money to the issuer (like a government or corporation) in return for periodic interest payments and the return of the principal amount at maturity. They provide a way for individual investors to earn a share of the income produced through real estate ownership – without actually having to go out and buy commercial real estate. Target-date funds are a type of mutual fund that automatically adjusts the asset mix (stocks, bonds, cash) based on a selected time frame, typically your estimated retirement date. They offer a straightforward approach to investing and can be a good choice for individuals seeking simplicity and hands-off management. Dividend-paying mutual funds are funds that invest in dividend-paying stocks. These funds provide an income stream from the dividends paid by the stocks in the fund and can also offer potential for capital appreciation. Rental properties can provide a steady stream of income in retirement. However, they require active management and carry the potential risks of property damage, vacancies, and fluctuating property values. Your investment horizon – the time period over which you expect to hold the investment – also plays a significant role. The longer your investment horizon, the more risk you can generally afford to take on. Your income needs and budget are another critical factor. These needs can dictate the level of income required from your investments, which can, in turn, influence the types of investments that are suitable for you. Diversification and asset allocation are essential components of a well-rounded retirement investment strategy. They involve spreading investments across various asset classes (like stocks, bonds, and real estate) to balance risk and reward. Different types of investments have different tax implications. Understanding these implications can help you maximize your after-tax returns. Strategies like tax-efficient investing and utilizing tax-advantaged accounts (e.g., Roth IRA, 401(k)) can minimize tax burdens. Inflation erodes the purchasing power of money over time. Investments that offer inflation protection can help preserve your purchasing power in retirement. Investments with built-in inflation protection, such as Treasury Inflation-Protected Securities (TIPS) or inflation-indexed annuities, can help grow wealth. Potential returns are one of the primary considerations when choosing retirement income investments. However, it's important to remember that higher potential returns usually come with higher risk. Evaluate the potential risks associated with each investment, such as market volatility, economic factors, and industry-specific risks. Understand how investments have performed during different market conditions to assess their resilience. Liquidity refers to how easily an investment can be converted into cash without significantly impacting its price. Highly liquid investments offer more flexibility but may provide lower returns. Evaluate the costs and fees associated with each investment, including expense ratios, transaction fees, and management fees. Be mindful of the impact of these costs on your overall investment returns, as high fees can significantly erode your gains. For some investors, getting professional advice or opting for professionally managed investments can be a beneficial strategy. Assess the value of professional services, considering factors such as their expertise, track record, and fees, before making a decision. Social Security benefits are a key source of retirement income for many Americans. While they are not an investment per se, they provide a reliable, albeit modest, income stream. Pension plans, offered by some employers, guarantee a specific retirement benefit based on factors like salary, age, and years of service. Annuities, offered by insurance companies, provide a series of payments in exchange for an upfront lump sum or a series of contributions. Bonds are a type of loan made by an investor to a borrower (typically a corporation or government). They offer periodic interest payments and the return of the principal at maturity. Dividend-paying stocks offer income through periodic dividend payments and potential for capital appreciation. REITs own, operate, or finance income-generating real estate and offer a way for individual investors to earn a share of the income produced. Mutual funds and ETFs are investment vehicles that pool investors' money to invest in a diversified portfolio of stocks, bonds, or other assets. A CD is a type of fixed-term deposit offered by banks with a fixed interest rate and maturity date. Rental properties provide income through rental income. However, they require active management and carry the potential risks of property damage, vacancies, and fluctuating property values. Retirement income investments are financial assets bought with the goal of providing a steady income stream in retirement. They may include a variety of investment products, including stocks, bonds, mutual funds, annuities, and real estate. The best retirement income investments include immediate annuities for guaranteed income, dividend growth stocks for dual benefit, bonds and bond funds for reliable earnings. Additionally, REITs for real estate income without ownership, target-date funds for simplicity, dividend-paying mutual funds for income and growth, and rental properties for steady cash flow. When choosing retirement income investments, consider factors such as your risk tolerance, income needs, the need for diversification, tax considerations, and the impact of inflation.What Are Retirement Income Investments?

Best Retirement Income Investments

Immediate Annuities

Dividend Growth Stocks

Bonds and Bond Funds

Real Estate Investment Trusts (REITs)

Target-Date Funds

Dividend-Paying Mutual Funds

Rental Properties

Factors to Consider When Choosing Retirement Income Investments

Risk Tolerance and Investment Horizon

Income Needs and Budget

Diversification and Asset Allocation

Tax Considerations

Inflation Protection

Evaluating the Best Retirement Income Investments

Potential Returns

Risks and Volatility

Liquidity

Costs and Fees

Professional Advice and Management

Other Retirement Income Investments

Social Security

Pension Plans

Annuities

Bonds

Dividend-Paying Stocks

Real Estate Investment Trusts (REITs)

Mutual Funds and Exchange-Traded Funds (ETFs)

Certificate of Deposit (CD)

Rental Properties

Final Thoughts

Best Retirement Income Investments FAQs

Retirement income investments are financial assets purchased with the goal of generating a steady income stream during retirement.

The "best" retirement income investments will depend on individual circumstances, including income needs, risk tolerance, investment horizon, and tax considerations. Some common choices include immediate annuities, dividend growth stocks, and bond funds.

Consider factors such as your risk tolerance, income needs, the need for diversification, tax considerations, and the impact of inflation.

Evaluate potential retirement income investments based on their potential returns, associated risks, liquidity, costs and fees, and the need for professional management.

While they are not investments per se, Social Security benefits and pensions are key sources of retirement income for many people. They provide a steady, reliable income stream.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.