A Checkbook Control IRA is a self-directed retirement account that allows investors to make investment decisions directly, without seeking approval from a custodian. This is achieved by establishing a Limited Liability Company (LLC) within the IRA, which enables the account holder to act as the manager of the LLC and have direct access to the IRA funds through a checking account. Checkbook Control Individual Retirement Accounts (IRAs) are a unique type of retirement investment account that provides investors with greater control and flexibility over their investment choices. Checkbook Control IRAs offer several benefits to investors, including increased investment options, quick decision-making, reduced custodian fees, and potential tax advantages. Checkbook Control IRAs emerged as a result of changes in tax laws and IRS rulings in the early 2000s. These changes allowed investors to take greater control of their retirement accounts and diversify their investments beyond traditional options such as stocks, bonds, and mutual funds. There are two primary types of Checkbook Control IRAs: the Self-Directed IRA LLC and the Solo 401(k) Plan with Checkbook Control. Understanding the differences between these two options can help investors choose the best fit for their individual needs. A Self-Directed IRA LLC combines the benefits of a self-directed IRA with the limited liability protection of an LLC. This structure allows investors to access a wider range of investments and provides greater control over investment decisions. A Solo 401(k) Plan with Checkbook Control is designed for self-employed individuals or small business owners with no full-time employees other than themselves and their spouse. This plan offers similar investment options and control as a Self-Directed IRA LLC, but with additional contribution limits and potential loan features. While both options provide investors with checkbook control and expanded investment choices, the Solo 401(k) Plan has higher contribution limits, which may be beneficial for those looking to maximize their retirement savings. Additionally, the Solo 401(k) Plan may offer greater asset protection and loan features not available in a Self-Directed IRA LLC. Setting up a Checkbook Control IRA involves several steps, including selecting a custodian, establishing an LLC, funding the LLC with IRA assets, and opening a checking account for the LLC. The first step in establishing a Checkbook Control IRA is selecting a custodian that specializes in self-directed IRAs. It is essential to choose a reputable custodian with experience in handling alternative investments and Checkbook Control IRAs. The next step is to set up an LLC within the self-directed IRA. This process includes filing articles of organization with the state, obtaining an Employer Identification Number (EIN) from the IRS, and creating an operating agreement that outlines the management and ownership of the LLC. Once the LLC is established, the IRA custodian will transfer the IRA assets to the new LLC. This process is known as a "direct rollover" and is not considered a taxable event. The final step is to open a checking account in the name of the LLC. This account will be used to make investments and manage the funds within the Checkbook Control IRA. It is important to maintain accurate records and ensure that all transactions are made solely for the benefit of the IRA. Checkbook Control IRAs offer a wide range of investment options, allowing investors to diversify their retirement portfolios beyond traditional assets. Investors can use Checkbook Control IRAs to purchase various types of real estate, including residential, commercial, and undeveloped land. Real estate investments can generate rental income, capital appreciation, and potential tax benefits. Checkbook Control IRAs can also be used to invest in private equity, including startups and small businesses. Additionally, investors can provide private loans, such as mortgage notes or bridge loans, to borrowers. Investing in physical precious metals, such as gold and silver, can provide a hedge against inflation and market volatility. Checkbook Control IRAs can also be used to invest in other commodities, such as oil and gas interests. Other alternative investments available to Checkbook Control IRA investors include tax liens, structured settlements, and cryptocurrency. These investments can offer additional diversification and potential returns for investors. It is crucial for investors to be aware of prohibited transactions that can result in significant penalties and tax consequences. These include transactions with disqualified persons, self-dealing, and investments in collectibles. Checkbook Control IRAs offer several tax advantages, such as tax-deferred growth on investments, Roth IRA tax-free growth, and potential strategies to minimize Unrelated Business Taxable Income (UBTI) and Unrelated Debt-Financed Income (UDFI). Traditional IRA investments grow on a tax-deferred basis, meaning that taxes are not due until funds are withdrawn during retirement. Roth IRA investments grow tax-free, allowing investors to withdraw funds during retirement without paying taxes on qualified distributions. Checkbook Control IRA investors should be aware of UBTI and UDFI, which can result in taxes on certain investment income. However, there are strategies available to minimize or avoid these taxes, such as using a blocker corporation or structuring investments to qualify for exceptions. While Checkbook Control IRAs offer many benefits, investors should also be aware of potential risks and considerations, including legal and regulatory compliance, diversification and investment risks, and custodian fees and other costs. Failure to comply with IRS rules and regulations can result in severe penalties, including disqualification of the IRA and immediate taxation. Investing in alternative assets can carry unique risks, and it is essential for investors to diversify their portfolios and conduct thorough due diligence on potential investments. While Checkbook Control IRAs can help reduce custodian fees, investors should be aware of other costs associated with setting up and managing these accounts, such as LLC formation and annual state fees, as well as ongoing accounting and legal fees. To get the most out of a Checkbook Control IRA, investors should consider the following strategies and best practices: Investors should stay up-to-date with the latest trends, regulations, and investment opportunities. This includes regularly attending seminars, reading industry publications, and participating in online forums related to Checkbook Control IRAs and alternative investments. A well-diversified portfolio helps mitigate risks and can lead to more stable long-term returns. Investors should consider investing in a mix of asset classes, including real estate, private equity, and precious metals, to achieve a balanced and diversified portfolio. Building a team of experienced professionals, such as accountants, attorneys, and financial advisors, can provide valuable guidance and support in managing a Checkbook Control IRA. These experts can help navigate complex regulations, identify potential pitfalls, and ensure the account remains compliant. Before committing to any investment, investors should conduct thorough due diligence, which includes researching the investment, understanding potential risks and rewards, and assessing how the investment aligns with their overall investment strategy and retirement goals. Regularly reviewing and monitoring investments is essential to ensure they are performing as expected and to make adjustments as necessary. This includes tracking the performance of individual investments, as well as the overall portfolio, and making adjustments to align with changing goals and market conditions. Checkbook Control IRAs offer an appealing option for savvy investors seeking greater control, flexibility, and diversification in their retirement portfolios. By carefully weighing the benefits and risks, and with the support of experienced professionals, investors can successfully utilize Checkbook Control IRAs to achieve their retirement goals. By following these best practices and working closely with experienced professionals, investors can effectively manage their Checkbook Control IRA and work towards achieving their retirement goals. The flexibility and control offered by these accounts can be a powerful tool for those seeking to diversify their retirement savings and take an active role in managing their investments.What Are Checkbook Control IRAs?

Benefits of Checkbook Control IRAs

History and Emergence of Checkbook Control IRAs

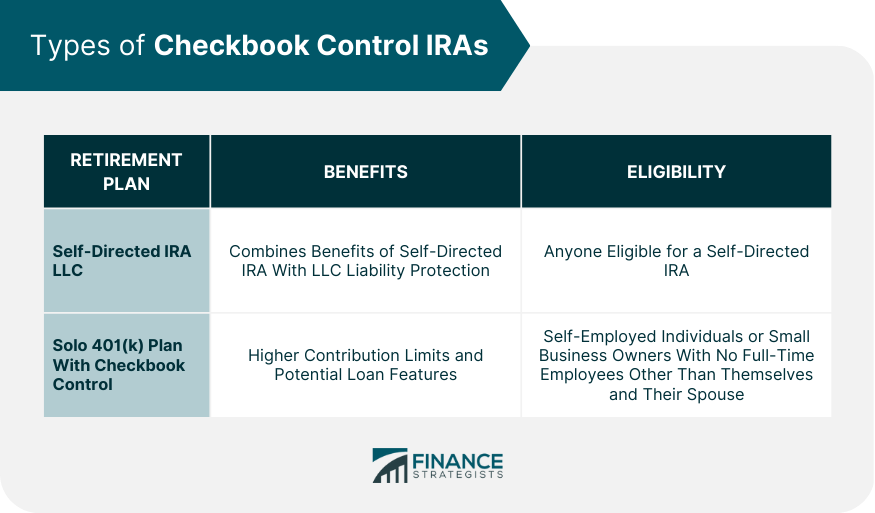

Types of Checkbook Control IRAs

Self-Directed IRA LLC

Solo 401(k) Plan With Checkbook Control

Comparison of Self-Directed IRA LLCs and Solo 401(k) Plans

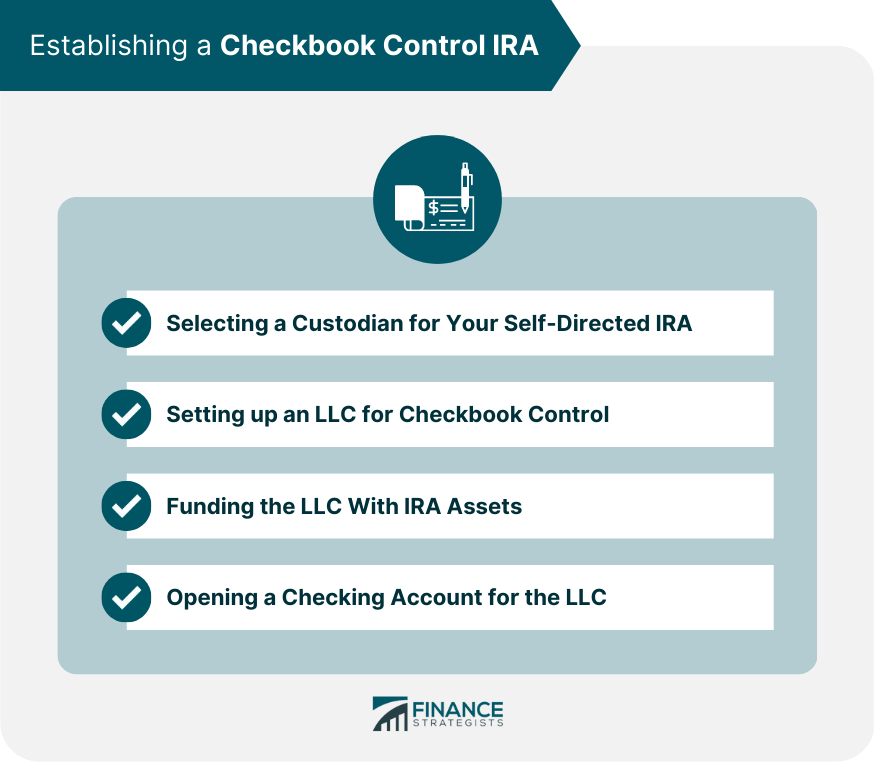

Establishing a Checkbook Control IRA

Selecting a Custodian for Your Self-Directed IRA

Setting up an LLC for Checkbook Control

Funding the LLC With IRA Assets

Opening a Checking Account for the LLC

Investment Options With Checkbook Control IRAs

Real Estate Investments

Private Equity and Lending

Precious Metals and Commodities

Other Alternative Investments

Prohibited Transactions to Avoid

Tax Implications and Benefits

Tax-Deferred Growth on Investments

Roth IRA and Tax-Free Growth

Unrelated Business Taxable Income (UBTI) and Unrelated Debt-Financed Income (UDFI)

Potential Risks and Considerations

Legal and Regulatory Compliance

Diversification and Investment Risks

Custodian Fees and Other Costs

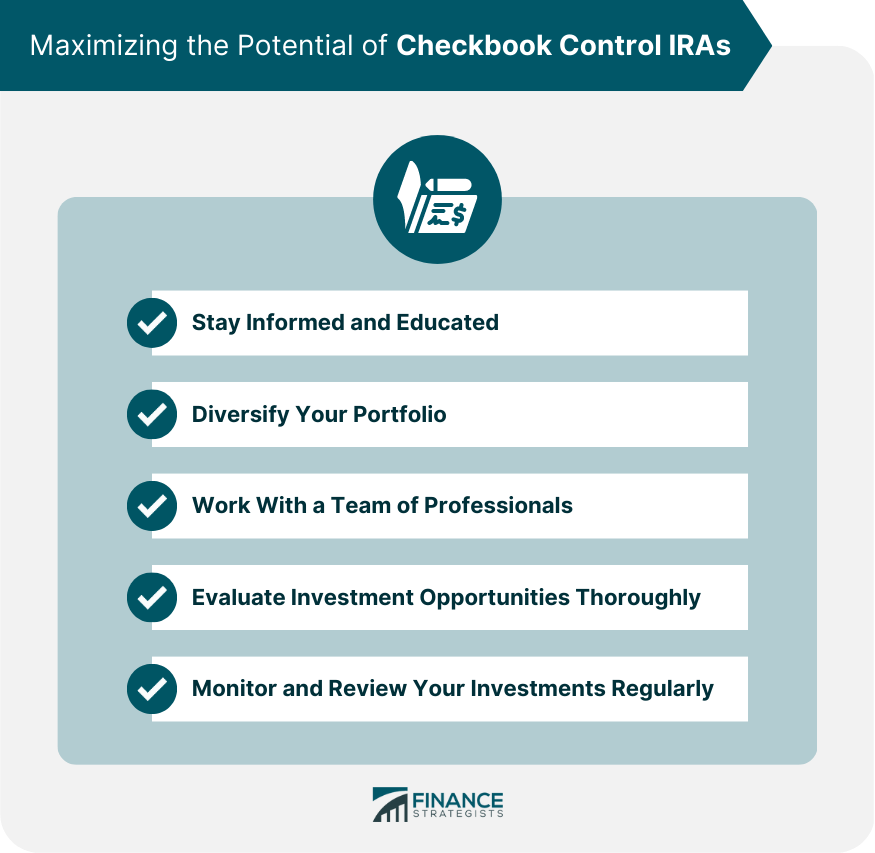

Maximizing the Potential of Checkbook Control IRAs

Stay Informed and Educated

Diversify Your Portfolio

Work With a Team of Professionals

Evaluate Investment Opportunities Thoroughly

Monitor and Review Your Investments Regularly

Conclusion

Checkbook Control IRAs FAQs

A Checkbook Control IRA is a type of self-directed Individual Retirement Account (IRA) that allows account holders to have greater control over their investments. With a Checkbook Control IRA, the account holder can write checks and make investments directly from the IRA, without needing to go through a custodian.

Anyone who is eligible to open a self-directed IRA can open a Checkbook Control IRA. This includes individuals who have earned income and are under the age of 70 ½. However, it is important to note that not all IRA custodians offer Checkbook Control IRAs, so it is important to do your research before opening one.

One of the main benefits of a Checkbook Control IRA is that it allows for greater flexibility and control over investment decisions. With a Checkbook Control IRA, the account holder can invest in a wide range of assets, including real estate, private equity, and precious metals. Additionally, Checkbook Control IRAs may offer tax benefits, including the ability to defer taxes on investment gains.

Yes, there are some risks associated with Checkbook Control IRAs. One of the main risks is that the account holder is solely responsible for making investment decisions and managing the account. This can be challenging for those who are not experienced with investing. Additionally, there are risks associated with investing in non-traditional assets, such as real estate, which can be illiquid and difficult to value.

To open a Checkbook Control IRA, you will need to find a custodian who offers this type of account. Once you have found a custodian, you will need to complete an application and provide the necessary documentation, such as your Social Security number and proof of income. Once your account is open, you can begin making investments directly from the IRA using the checkbook provided by the custodian.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.