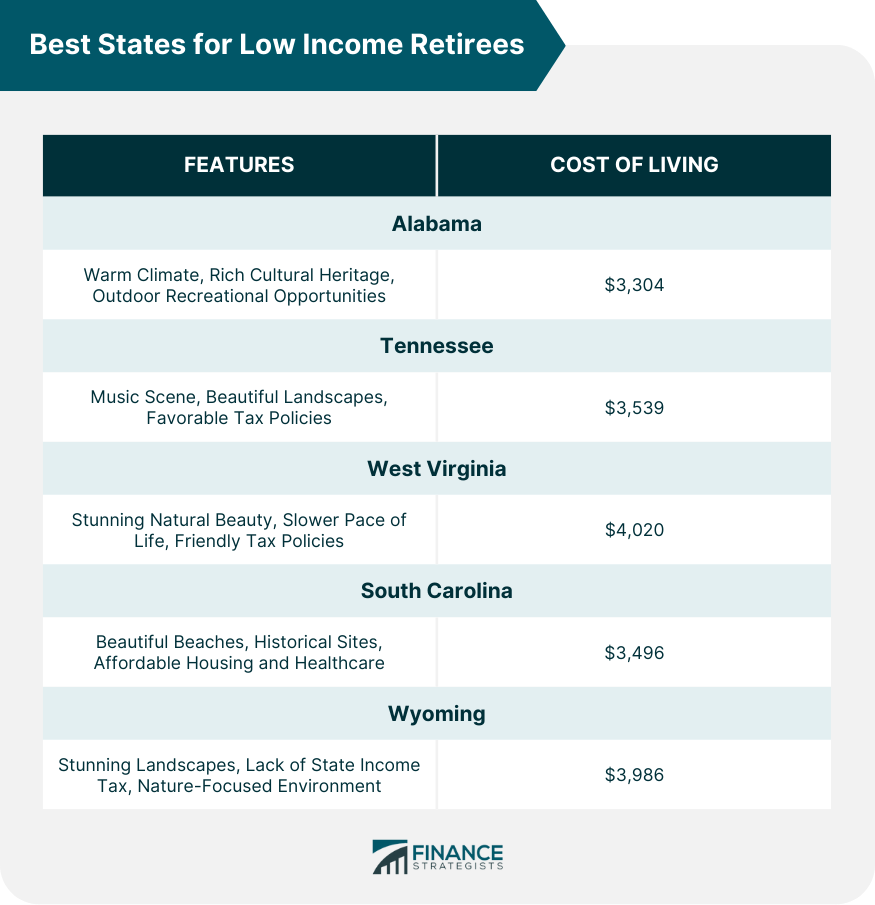

For many low-income retirees, the post-retirement period can be a daunting prospect due to financial constraints. Often, they rely heavily on Social Security payments and may not have substantial savings to back them up. Consequently, where they choose to retire can make a significant difference in their financial comfort. The cost of living can vary greatly from state to state, impacting retirees' quality of life significantly. It's crucial to identify states that offer a favorable combination of low living costs, access to quality healthcare, and a supportive community environment for low-income retirees. When evaluating the affordability of a state, it's important to consider factors such as the overall cost of living, including housing, utilities, groceries, and other daily necessities. Some states have a lower cost of living compared to others, making it easier for retirees with limited income to meet their basic needs and have some financial stability. These states may have lower housing costs, lower taxes, and more affordable healthcare options, which can significantly impact the retirees' budget and financial well-being. It's important to consider factors such as the availability of healthcare facilities, the quality of medical care, and the affordability of healthcare services. Some states have a well-developed healthcare infrastructure with a range of medical facilities, specialists, and hospitals, while others may have limited options, particularly in rural areas. Additionally, states that have programs or initiatives to provide affordable healthcare options, such as Medicaid expansion or assistance programs for low-income individuals, can be particularly beneficial for low-income retirees. A supportive community and opportunities for social engagement can greatly enhance the quality of life for retirees. When choosing a state for retirement, it's important to consider the availability of community resources and social activities specifically tailored to seniors. States that prioritize the well-being of their aging population may have well-established senior centers, recreational facilities, and programs that offer various social activities and opportunities for older adults to connect with others. Access to cultural events, volunteer opportunities, and other social engagement options can contribute to a fulfilling retirement experience. For retirees who no longer drive or prefer not to rely solely on private transportation, accessibility and transportation options are important considerations. Walkability of the area, availability of public transportation, and the proximity of essential services like grocery stores, medical facilities, and leisure activities are factors that can significantly impact the quality of life for low-income retirees. States with well-developed public transportation systems, pedestrian-friendly infrastructure, and services specifically designed for older adults, such as paratransit services, can provide retirees with convenient and reliable transportation options. Alabama is known for its warm climate, rich cultural heritage, and southern hospitality. It also boasts numerous outdoor recreational opportunities, from its beautiful beaches to hiking in its national parks. Alabama consistently ranks among the states with the lowest cost of living in the country. Housing is particularly affordable, making it an attractive choice for low-income retirees. The average cost of living in Alabama is $3,304 per month. This includes housing, food, transportation, healthcare, and other expenses. Tennessee is renowned for its music scene, notably in cities like Nashville and Memphis. The state also features beautiful landscapes, from the Smoky Mountains to numerous lakes and rivers. The Volunteer State is another region where retirees can make the most of a smaller retirement budget. Housing costs are significantly below the national average, and state tax policies are also favorable to retirees. Tennessee's cost of living is $3,539 monthly and remains one of the lowest in the United States. For low-income retirees, this means their dollar can stretch further in Tennessee compared to other states. West Virginia is known for its stunning natural beauty, with opportunities for outdoor recreation such as hiking, fishing, and whitewater rafting. Its slower pace of life can be a welcome respite for retirees looking for a peaceful retirement. In West Virginia, both housing and healthcare costs are well below the national average. Furthermore, the state's tax policies are quite friendly to seniors. The average cost of living in West Virginia is $4,020 per month. This includes housing, food, transportation, healthcare, and other expenses. South Carolina offers a charming blend of beautiful beaches, historical sites, and excellent culinary scene. Cities like Charleston and Myrtle Beach are particularly popular among retirees. In South Carolina, the cost of living is below the national average. The state offers affordable housing and a competitive healthcare sector. South Carolina continues to offer a cost of living at $3,496 per month that is attractive to low-income retirees. From housing to healthcare, retirees can find much to appreciate in this southern state. Wyoming is perfect for nature-loving retirees, with its stunning landscapes including Yellowstone National Park and Grand Teton National Park. The state also has a low population density for those who prefer a quieter, less crowded environment. Wyoming's affordability is enhanced by its lack of state income tax. Although some costs, like healthcare, can be higher than national averages, overall, the state presents a balanced offering for retirees. Despite some fluctuations, Wyoming's monthly cost of living at $3,986 remains competitive, particularly when factoring in the tax benefits. Housing costs vary by region, with more rural areas offering the most affordability. Take the time to identify your priorities and what matters most to you in a retirement location. This can include factors such as affordability, healthcare accessibility, community support, climate, proximity to family and friends, and recreational opportunities. Look into the cost of living in potential retirement locations. Consider factors such as housing prices, utility costs, groceries, transportation expenses, and taxes. It's important to find a location where your retirement income can comfortably cover your daily expenses and leave room for leisure activities and unexpected costs. Evaluate the healthcare options available in the areas you're considering. Look into the quality and availability of medical facilities, doctors, and specialists. Additionally, consider whether there are affordable healthcare programs or initiatives in place that can assist low-income retirees. Numbers and statistics can only tell you so much about a place. Whenever possible, visit the potential retirement locations you're considering. Spend time in the community, explore the amenities, and get a feel for the overall atmosphere. Reach out to current residents, local senior centers, or community organizations in the areas you're interested in. These individuals and groups can provide valuable insights into what it's like to retire in a particular location. They can share their experiences, offer advice, and provide information about community resources and support networks. Based on affordability, healthcare accessibility, and quality of life, Alabama, Tennessee, West Virginia, South Carolina, and Wyoming stand out as attractive options for low-income retirees. Retirement should be a period of comfort and enjoyment. Low-income retirees can find a state that not only fits their budget but also enhances their retirement years by considering factors such as cost of living, healthcare, and community support. Low-income retirees may also consider states that offer tax incentives or exemptions specifically tailored for seniors, which can further stretch their limited income and improve their financial well-being during retirement.Overview of Retirement

Criteria for Evaluating Best States for Low-Income Retirees

Affordability

Healthcare Accessibility

Community and Social Engagement

Accessibility and Transportation

Best States for Low Income Retirees

Alabama

Tennessee

West Virginia

South Carolina

Wyoming

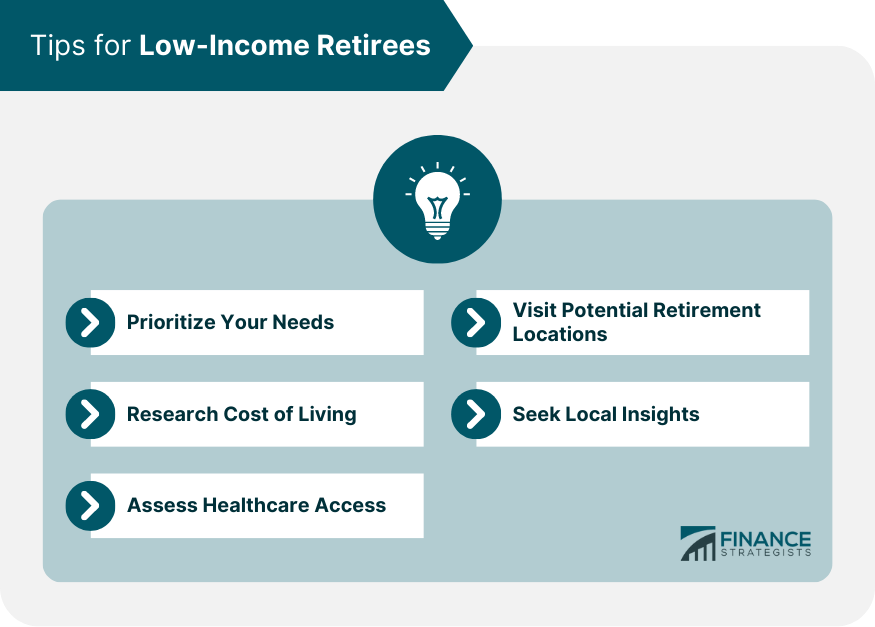

Tips for Low-Income Retirees

Prioritize Your Needs

Research Cost of Living

Assess Healthcare Access

Visit Potential Retirement Locations

Seek Local Insights

The Bottom Line

Best States for Low Income Retirees FAQs

The best state will depend on the individual's specific needs and preferences. However, states like Alabama, Tennessee, West Virginia, South Carolina, and Wyoming are generally good options due to their affordability and quality of life for seniors.

Consider factors such as the cost of living, access to healthcare, opportunities for social engagement, and accessibility to essential services and public transportation.

While the cost of living is important, other factors such as healthcare access, community and social engagement, and the overall quality of life should also be considered.

States may be more affordable due to lower housing costs, favorable tax policies for seniors, or a lower cost of living in general.

Consider the average costs of housing, utilities, healthcare, and everyday expenses. Websites such as the U.S. Bureau of Labor Statistics or cost-of-living calculators can provide helpful information.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.