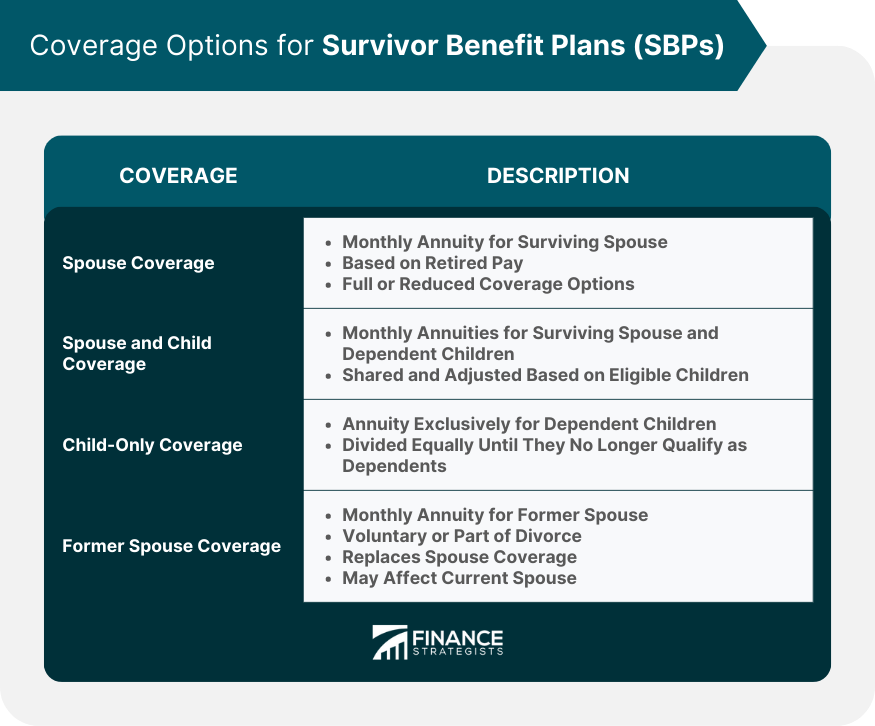

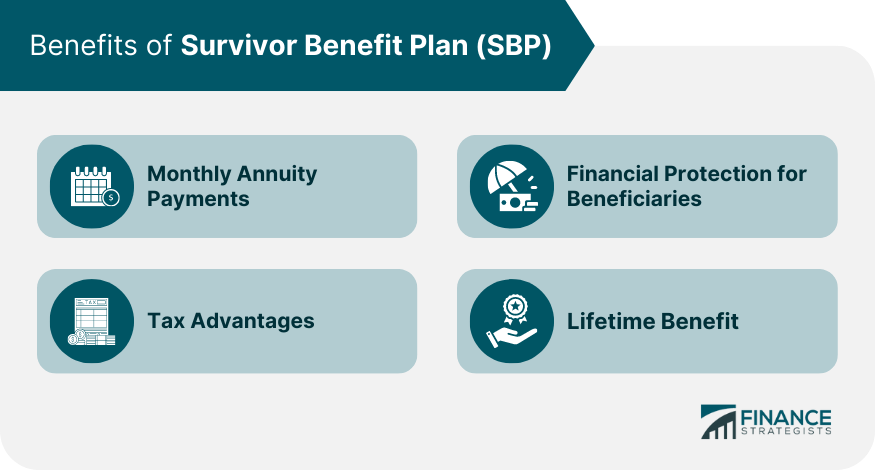

The Survivor Benefit Plan (SBP) is a government-backed insurance program that provides a monthly annuity to beneficiaries of deceased military service members and retirees. SBP is designed to protect military families from financial hardship by providing a portion of the service member's retirement pay to eligible beneficiaries. The program aims to offer peace of mind and stability to military families during difficult times. Eligible beneficiaries include spouses, former spouses, dependent children, and in some cases, other designated individuals. The service member or retiree can choose the coverage type and beneficiary during enrollment. Active-duty service members are automatically enrolled in SBP upon retirement, with their spouses and dependent children as default beneficiaries. Members can change coverage options or decline coverage before retiring, but they must do so in writing. Retirees who did not initially enroll in SBP can opt in during specific open enrollment periods or after experiencing a qualifying life event. These opportunities are limited, and the retiree may need to provide proof of insurability. Spouse coverage ensures that the surviving spouse receives a monthly annuity after the service member's death. The annuity is a percentage of the service member's retired pay, with the option to choose full or reduced coverage. Spouse and child coverage provides monthly annuities to both the surviving spouse and dependent children. The annuity amount is shared among the beneficiaries and adjusted according to the number of eligible children. Child-only coverage is available for service members who want to provide financial support exclusively to their dependent children. The annuity is divided equally among the eligible children until they no longer qualify as dependents. Former spouse coverage allows service members to provide a monthly annuity to a former spouse, either voluntarily or as part of a divorce agreement. This coverage replaces spouse coverage and may have implications for current spouses. SBP participants pay premiums based on their coverage type and the desired benefit amount. Premiums are deducted from the service member's retired pay and are partially tax-deductible. The government shares the cost of SBP coverage by subsidizing a portion of the premiums. The exact amount of the subsidy depends on the service member's years of service and the coverage type selected. Annuity payments are calculated based on the service member's retired pay and the chosen coverage percentage. The base amount, which ranges from 35% to 55%, determines the monthly annuity for beneficiaries. SBP annuity payments are adjusted annually for inflation, ensuring that beneficiaries maintain purchasing power over time. These COLAs are based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). SBP premiums are partially tax-deductible, reducing the participant's taxable income. Additionally, annuity payments to beneficiaries are taxable, but often at a lower rate than the service member's retired pay. SBP provides financial protection for beneficiaries, ensuring they have a stable income after the service member's death. This benefit helps maintain the family's standard of living and provides a sense of security during a difficult time. SBP annuities are paid to beneficiaries for their lifetime or until they no longer qualify for benefits, such as when a child reaches adulthood or a surviving spouse remarries before age 55. This long-term support can be an essential source of income for beneficiaries. Open enrollment periods are infrequent opportunities for retirees who did not initially enroll in SBP to opt-in. During these periods, retirees may need to provide proof of insurability and may face higher premiums due to their age or health status. Certain life events, such as marriage, divorce, or the birth of a child, can prompt changes in SBP coverage. Service members and retirees should review their coverage options and update their beneficiaries as needed following these events. Participants can voluntarily terminate their SBP coverage, but they must do so in writing and receive the consent of their spouse, if applicable. Terminating coverage forfeits all benefits and premiums paid into the plan. Reinstating SBP coverage is possible in limited circumstances, such as after a divorce or remarriage. The service member or retiree must submit a request for reinstatement within a specified time frame and may need to provide proof of insurability. SBP is integrated with military retirement pay, providing a portion of the service member's retired pay to beneficiaries upon the member's death. The annuity is based on the chosen coverage percentage and is subject to annual cost-of-living adjustments. Dependency and Indemnity Compensation is a tax-free monthly benefit paid by the Department of Veterans Affairs to eligible survivors of service members who died in the line of duty or due to service-related injuries or illnesses. DIC benefits may offset SBP annuity payments, but the surviving spouse can receive both benefits if eligible for the Special Survivor Indemnity Allowance (SSIA). Survivors of service members may be eligible for various VA benefits, including education, health care, and home loan programs. These benefits are separate from SBP and can provide additional support for military families. Life insurance policies can complement SBP coverage, providing additional financial security for beneficiaries. Service members and retirees should evaluate their family's financial needs and consider whether additional life insurance is necessary. The Survivor Benefit Plan is a government-backed insurance program that provides a monthly annuity to beneficiaries of deceased military service members and retirees. Eligible beneficiaries include spouses, former spouses, dependent children, and other designated individuals. SBP coverage options include spouse, spouse and child, child-only, and former spouse coverage, with premiums based on coverage type and desired benefit amount. Benefits of SBP include monthly annuity payments, tax advantages, financial protection for beneficiaries, and lifetime benefits. SBP is integrated with military retirement pay and can be supplemented by Dependency and Indemnity Compensation and various Veterans Affairs benefits. Life insurance policies can also complement SBP coverage. Enrollment in SBP is automatic for active-duty service members and can be opted into for retirees during specific open enrollment periods or after experiencing a qualifying life event. Terminating or changing SBP coverage is possible through open enrollment periods, life events, voluntary termination, or reinstatement.What Is the Survivor Benefit Plan (SBP)?

Enrollment in SBP

Automatic Enrollment for Active-Duty Service Members

Opting in for Retirees

Coverage Options

Spouse Coverage

Spouse and Child Coverage

Child-Only Coverage

Former Spouse Coverage

Costs of Enrollment

Premiums

Cost-Sharing Between the Government and the Participant

Benefits of SBP

Monthly Annuity Payments

Calculation of Annuity Payments

Inflation Adjustments (Cost-of-Living Adjustments - COLA)

Tax Advantages

Financial Protection for Beneficiaries

Lifetime Benefit

Terminating or Changing SBP Coverage

Open Enrollment Periods

Life Events That May Prompt Changes

Voluntary Termination

Reinstatement of Coverage

SBP and Other Benefits

Integration with Military Retirement Pay

Dependency and Indemnity Compensation (DIC)

Veterans Affairs (VA) Benefits

Life Insurance Policies

Final Thoughts

Survivor Benefit Plan (SBP) FAQs

The Survivor Benefit Plan (SBP) is a government-backed insurance program that provides a monthly annuity to beneficiaries of deceased military service members and retirees. It ensures financial security for surviving family members after the service member's passing, helping maintain their standard of living and offering peace of mind during difficult times.

Active-duty service members are automatically enrolled in SBP upon retirement, with their spouses and dependent children as default beneficiaries. Retirees who did not initially enroll can opt in during specific open enrollment periods or after experiencing a qualifying life event, though they may need to provide proof of insurability.

SBP offers four coverage options: spouse coverage, spouse and child coverage, child-only coverage, and former spouse coverage. The service member or retiree can choose the coverage type and beneficiary during enrollment, taking into consideration their family's financial needs and preferences.

Yes, participants can terminate or change their SBP coverage in certain circumstances, such as during open enrollment periods, after qualifying life events, or through voluntary termination. However, termination may result in the forfeiture of all benefits and premiums paid into the plan, and reinstatement of coverage is limited to specific situations.

SBP is integrated with military retirement pay, providing a portion of the service member's retired pay to beneficiaries upon their death. DIC benefits, paid by the VA to eligible survivors, may offset SBP annuity payments, but the Special Survivor Indemnity Allowance (SSIA) allows for concurrent receipt of both benefits in some cases. VA benefits and life insurance policies can provide additional support to military families alongside SBP.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.