Planning for retirement requires careful consideration of your future goals and the financial resources needed to support them. As you embark on this journey, it is essential to assess your retirement goals and determine the income necessary to maintain your desired lifestyle. Understanding the factors that influence the amount of income you will need during your retirement years is a crucial first step in securing a comfortable and worry-free future. Retirement goals can vary greatly from person to person. Some individuals may dream of traveling the world, indulging in new hobbies, or pursuing their passions without financial constraints. Others may prioritize a simple and frugal lifestyle that focuses on spending quality time with loved ones or engaging in meaningful community activities. Regardless of your personal aspirations, identifying and articulating your retirement goals is essential for creating a solid financial plan. A common rule of thumb in financial planning is the 80% rule. It suggests that you will need to replace around 80% of your pre-retirement income to maintain your current lifestyle in retirement. While this rule provides a starting point, it may not be accurate for everyone due to varying personal circumstances, so a detailed review of your expenses and lifestyle is recommended. This includes housing, food, utilities, and healthcare costs, which are all fundamental expenses you need to consider when planning for retirement. The kind of lifestyle you plan to lead during retirement, such as whether you wish to travel frequently, dine out often, or engage in hobbies, significantly impacts your retirement income needs. Advances in healthcare mean longer life expectancies. Your anticipated health condition and expected lifespan will significantly influence how much you need to save for retirement. The cost of living is likely to increase over time due to inflation. Therefore, your retirement income should be able to accommodate these future cost increases. The amount of retirement income you'll need is influenced by the returns on your investments. The better your investments perform, the less income you'll need to draw from other sources. Start by listing your current expenses and adjusting them according to your retirement plans. For example, work-related costs like commuting or professional clothing will likely disappear, while leisure and hobby-related expenses may increase. Remember to factor in inflation when estimating future costs. A 2-3% annual inflation rate can significantly impact your retirement savings over several decades. Social security is a significant component of retirement income for many. Be sure to consider these benefits along with any other guaranteed income sources, such as pensions or annuities, when calculating your retirement income needs. Healthcare is often one of the highest costs in retirement. Factor in the cost of health insurance premiums, out-of-pocket costs, and potential long-term care needs. The importance of starting early cannot be overstated. The power of compound interest means that the sooner you start saving, the more your money can grow. Aim to maximize contributions to retirement accounts like 401(k)s and IRAs. Diversify your investments to balance growth potential with risk. Relying solely on social security for retirement income is risky. It's essential to plan for multiple income sources. These can include employer-sponsored retirement plans, personal savings and investments, annuities and life insurance, and even part-time work or side businesses in retirement. In addition to increasing your income, consider ways to reduce your expenses. This could involve downsizing your home, moving to a less expensive area, cutting unnecessary expenses, or even considering healthcare cost containment strategies like choosing cost-effective providers or care options. Retirement income planning doesn't stop once you've created a plan. It's crucial to stay flexible and adapt to changes and risks. 1. Changes in Income and Lifestyle: Your income and lifestyle will likely change over time. Be prepared to adjust your retirement income plan to account for these changes. 2. Market Volatility and Investment Risk: The market can be unpredictable, impacting the value of your investments. Regularly review your investment strategy to ensure it aligns with your risk tolerance and retirement goals. 3. Longevity Risk: Living longer than expected can be a risk if you outlive your savings. Consider strategies to mitigate this risk, such as annuities that provide income for life. 4. Health Risks and the Cost of Long-Term Care: Health problems can arise unexpectedly, leading to significant expenses. Long-term care insurance can help manage these costs. Understanding your retirement income needs is an essential aspect of financial planning. A number of factors, such as living costs, lifestyle preferences, expected lifespan, inflation, and investment returns, all influence these needs. It's crucial to estimate current and future expenses, taking into account changes in retirement, inflation, and sources of guaranteed income. Diversifying your income sources, starting your savings early, and being prudent with expenses can ensure you meet your retirement income needs. However, always be prepared to adapt your plans to accommodate changes and risks, including changes in income, market volatility, and unexpected health costs. As this process requires meticulous calculation and planning, seeking professional financial advice might be beneficial. Secure your future by effectively planning today, and look forward to a worry-free retirement.Understanding Retirement Goals and Financial Requirements

The 80% Rule

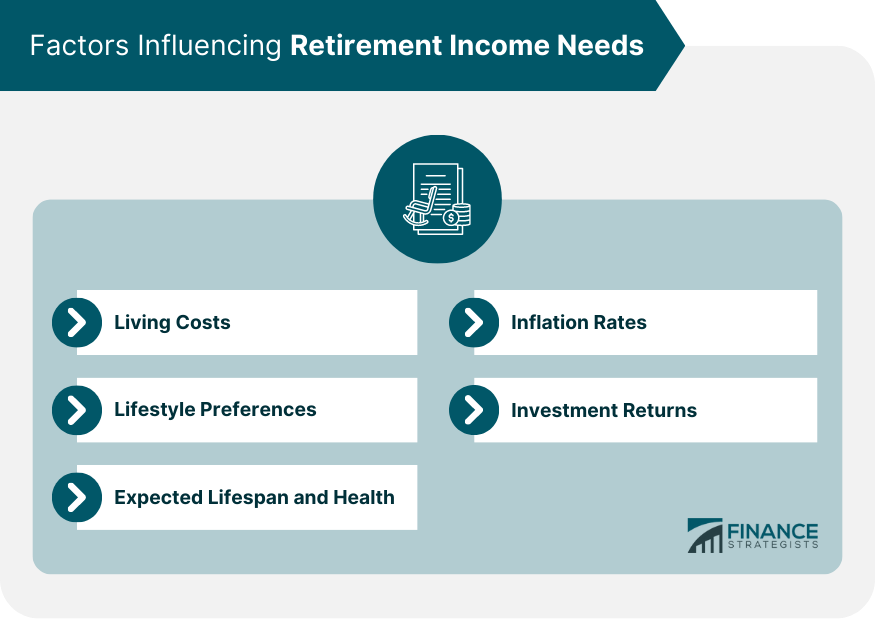

Factors Influencing Retirement Income Needs

Living Costs

Lifestyle Preferences

Expected Lifespan and Health

Inflation Rates

Investment Returns

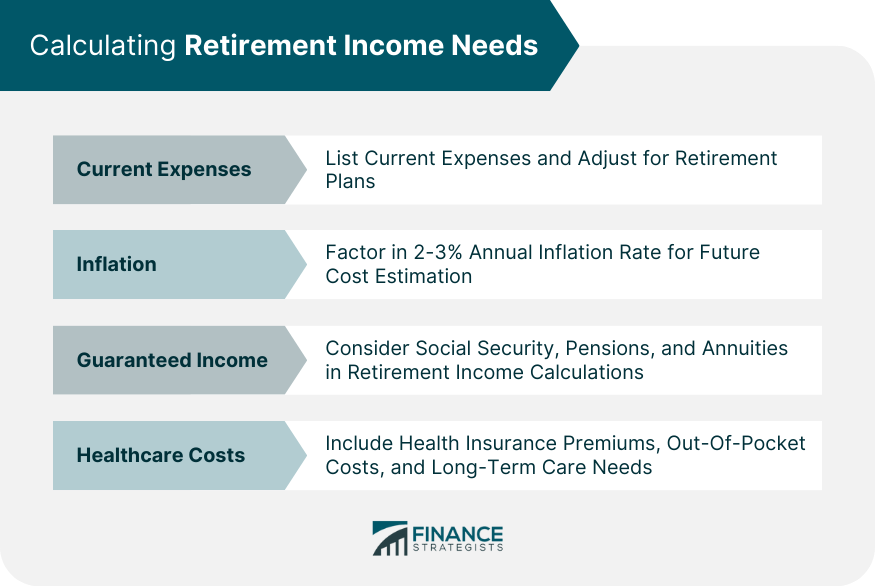

How to Calculate Your Retirement Income Needs

Estimating Current Expenses and Adjusting for Retirement

Incorporating Inflation Into Your Calculations

Social Security and Other Guaranteed Income Sources

Considering Healthcare Costs and Long-Term Care Needs

Strategies to Meet Retirement Income Needs

Saving and Investing

Planning for Multiple Sources of Income

Reducing Expenses

Navigating Changes and Risks in Retirement Income Planning

Conclusion

How Much Income Will I Need for Retirement? FAQs

Your required retirement income will be dependent on your lifestyle choices, including travel. If you plan to travel frequently, you should account for travel expenses when calculating your retirement income needs. It's important to estimate these costs and add them to your retirement budget.

If you plan to retire early, you'll need a higher retirement income due to a longer retirement period. It's important to consider how you'll cover healthcare costs before you're eligible for Medicare and how you'll fund your retirement until you can access Social Security or retirement accounts without penalty.

If you underestimate your retirement income needs, you may risk running out of money in retirement. It's crucial to consider all potential expenses, inflation, and unexpected costs. Regularly reviewing and adjusting your retirement plan can help manage this risk.

If you have significant health issues, your retirement income needs may be higher due to increased medical and care costs. You should consider your current and potential future healthcare costs in your retirement income calculations and explore options like long-term care insurance.

To calculate your retirement income needs, start by estimating your current and future expenses. Adjust these for changes you expect in retirement and account for inflation. Add any expected healthcare costs and long-term care needs. Subtract any guaranteed income sources like Social Security to determine how much income you need from your savings and investments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.