Medicaid planning is the process of preparing for and maximizing the benefits of Medicaid, a government program that provides health care coverage to low-income individuals, families, and seniors. The goal of Medicaid planning is to ensure that those who need long-term care can access and pay for it without depleting their financial resources. Medicaid planning can involve various strategies, such as spending down assets, transferring assets, and creating trusts. It is essential to understand the specific rules and regulations surrounding Medicaid eligibility and to consult with a knowledgeable professional to navigate the complex planning process. Medicaid planning is crucial because it can help protect an individual's financial well-being and ensure access to necessary long-term care services. Without proper planning, the cost of long-term care can be financially devastating for many families, leaving them with limited options for care and support. Moreover, Medicaid planning can help individuals and families to preserve their hard-earned assets for future generations. By understanding and utilizing the available strategies, individuals can minimize the financial impact of long-term care and ensure a more secure future for themselves and their loved ones. To qualify for Medicaid, applicants must meet specific income and asset requirements. Income limits vary by state and household size, but they are generally based on the federal poverty level. Assets, which include both financial resources and property, are also considered when determining eligibility. Some assets are exempt from consideration, such as a primary residence, one vehicle, and certain personal belongings. Non-exempt assets, like bank accounts, investments, and additional properties, are counted and must fall below a certain threshold for an individual to qualify for Medicaid. Exempt assets are those that do not count towards Medicaid eligibility, allowing applicants to keep them without affecting their eligibility status. Examples of exempt assets include a primary residence, a single vehicle, household furnishings, and personal items like clothing and jewelry. Non-exempt assets, on the other hand, are counted towards Medicaid eligibility and may need to be spent down or transferred to meet the asset limits. Common non-exempt assets include checking and savings accounts, stocks and bonds, and additional real estate properties. Spend-down techniques involve reducing an individual's countable assets to meet Medicaid's asset limits. This can include paying off debts, making home repairs or improvements, purchasing a vehicle, or prepaying funeral expenses. The goal is to utilize assets in a way that benefits the individual or their family while still allowing them to qualify for Medicaid. It is essential to approach spend-down strategies carefully, as improper spending can lead to a period of Medicaid ineligibility. Consulting with a professional experienced in Medicaid planning can help ensure that spend-down techniques are used appropriately and effectively. Transferring assets is another strategy used in Medicaid planning to reduce an individual's countable assets. This can include gifting assets to family members, transferring assets to a trust, or selling assets below market value. However, it is crucial to be aware of the Medicaid look-back period, which is a period during which asset transfers may be scrutinized and potentially lead to a period of ineligibility. The look-back period varies by state but is generally five years. Transferring assets within the look-back period can result in a penalty period during which the individual is ineligible for Medicaid benefits. It is essential to work with a knowledgeable professional when considering asset transfers as part of Medicaid planning. Annuities and promissory notes are financial tools that can be used in Medicaid planning to convert non-exempt assets into income streams, helping individuals qualify for Medicaid while preserving their resources. An annuity is a contract with an insurance company that provides periodic payments in exchange for an upfront investment. When structured correctly, an annuity can be considered a non-countable asset for Medicaid eligibility purposes. However, it is crucial to consult with a professional to ensure the annuity complies with Medicaid rules. Promissory notes are written agreements in which one party promises to pay another party a specific amount of money at a future date or on-demand. In Medicaid planning, promissory notes can be used to convert non-exempt assets into a stream of income, making them countable for eligibility purposes. It is essential to work with a knowledgeable professional when using promissory notes in Medicaid planning to ensure compliance with state and federal regulations. An irrevocable income-only trust (IIOT) is a type of trust that can be used in Medicaid planning to protect assets while still allowing the trust creator (grantor) to receive income from the trust. Once assets are transferred into an IIOT, they are no longer considered countable assets for Medicaid eligibility purposes. The grantor cannot access the trust principal, but they can receive income generated by the trust assets. It is crucial to work with an experienced professional when establishing an IIOT to ensure it is properly structured and complies with Medicaid rules and regulations. A special needs trust (SNT) is a legal arrangement designed to provide financial support to a person with disabilities without jeopardizing their eligibility for government benefits like Medicaid. The trust is established with the disabled person's assets or assets from a third party, such as a family member. Assets held in a properly structured SNT are not considered countable for Medicaid eligibility purposes. This allows the beneficiary to maintain their government benefits while still having access to additional funds for their care and well-being. It is essential to work with an experienced professional when setting up a special needs trust to ensure compliance with state and federal regulations. A pooled income trust is a type of trust established and managed by a nonprofit organization that pools the assets of multiple individuals with disabilities for investment purposes. Each beneficiary has a separate account within the trust, and the income generated by the trust assets is used to pay for the beneficiary's needs. Assets held in a properly structured pooled income trust are not considered countable for Medicaid eligibility purposes. This allows beneficiaries to maintain their government benefits while still having access to additional funds for their care and well-being. It is essential to work with an experienced professional when setting up a pooled income trust to ensure compliance with state and federal regulations. Long-term care insurance is a type of insurance policy designed to cover the costs of long-term care services, such as nursing home care, assisted living, and home health care. These policies can help protect an individual's assets and provide additional options for long-term care beyond Medicaid. Purchasing long-term care insurance can be a proactive strategy in Medicaid planning, ensuring that an individual has access to quality care while preserving their financial resources. It is essential to work with a knowledgeable professional when considering long-term care insurance to find the right policy that meets an individual's needs and budget. Home and community-based services (HCBS) are programs and services designed to help individuals with disabilities and seniors age in place, receiving care and support in their homes and communities rather than institutional settings like nursing homes. Medicaid often covers HCBS for eligible individuals as an alternative to more costly institutional care. Incorporating HCBS into Medicaid planning can help individuals maintain a higher quality of life and independence while still accessing necessary long-term care services. Working with a professional experienced in Medicaid planning can help identify the appropriate HCBS programs and services that best meet an individual's needs. Veteran's benefits and programs are available to eligible veterans and their spouses, providing additional financial support and resources for long-term care needs. Some of these benefits, such as the Aid and Attendance program, can be used to supplement Medicaid benefits or help cover the costs of long-term care not covered by Medicaid. Including veteran's benefits and programs in Medicaid planning can help eligible individuals access a broader range of care options and minimize the financial burden of long-term care. It is essential to consult with a knowledgeable professional to understand and utilize these benefits effectively. A power of attorney (POA) is a legal document that allows an individual (the principal) to designate another person (the agent) to make financial and legal decisions on their behalf. A health care proxy, also known as a medical power of attorney, allows the agent to make health care decisions for the principal when they are unable to do so themselves. Incorporating a POA and health care proxy into Medicaid planning can help ensure that an individual's wishes are respected and that their financial and medical affairs are managed appropriately in the event of incapacity. Working with an experienced professional can help create these documents to meet an individual's unique needs and preferences. Guardianship and conservatorship are legal processes in which a court appoints a person (the guardian or conservator) to manage the personal, financial, or medical affairs of an incapacitated individual. These processes can be necessary when an individual has not established a power of attorney or health care proxy and becomes unable to make decisions for themselves. Understanding the potential need for guardianship or conservatorship in Medicaid planning can help individuals and their families prepare for the possibility of incapacity and ensure that their financial and medical affairs are managed appropriately. Consulting with a knowledgeable professional can help navigate the complex legal processes involved in establishing guardianship or conservatorship. Medicaid estate recovery is a process in which states may seek reimbursement from the estates of deceased Medicaid recipients for certain long-term care expenses. This process can result in a significant financial impact on an individual's heirs and beneficiaries. Incorporating strategies to minimize the effects of Medicaid estate recovery in Medicaid planning can help protect an individual's assets and preserve their legacy for future generations. Working with an experienced professional can help identify the appropriate strategies to limit the potential impact of estate recovery on an individual's estate. An elder law attorney is a legal professional who specializes in the unique legal and financial issues affecting seniors and their families. These attorneys can help with Medicaid planning, estate planning, long-term care planning, and other related matters. Working with an elder law attorney in Medicaid planning can help ensure that an individual's plan is comprehensive, compliant with state and federal regulations, and tailored to their unique needs and circumstances. An experienced attorney can also help individuals and families navigate the complex legal processes involved in Medicaid planning and long-term care. Selecting the right professional to assist with Medicaid planning is crucial to the success of the plan. It is essential to choose a professional with the appropriate experience, knowledge, and credentials to address the specific needs and goals of the individual. Factors to consider when choosing a professional include their educational background, professional certifications, years of experience, and client testimonials. It is also important to ensure that the professional is well-versed in the specific state's Medicaid rules and regulations, as these can vary significantly from state to state. When engaging in Medicaid planning, there are several common mistakes to avoid. These mistakes can lead to financial penalties, periods of ineligibility, or the loss of assets. Some common mistakes include: Waiting too long to begin the planning process, which can limit the available options and strategies. Transferring assets without understanding the Medicaid look-back period and its potential consequences. Failing to consult with a knowledgeable professional, leading to non-compliant plans or missed opportunities. Not considering the impact of long-term care costs on an individual's estate and the potential need for estate planning. Working with an experienced professional can help individuals and families avoid these common mistakes and develop a comprehensive and effective Medicaid plan. As government policies and regulations continue to evolve, it is essential to stay informed about changes to Medicaid and their potential impact on Medicaid planning. Changes to eligibility requirements, asset limits, and available services can significantly affect an individual's long-term care plan and access to benefits. Working with a knowledgeable professional and regularly reviewing and updating one's Medicaid plan can help ensure that the plan remains effective and compliant with current regulations. As the demand for long-term care services grows due to an aging population, new trends in long-term care are emerging. These trends include advances in home and community-based services, the integration of technology into care delivery, and the development of innovative care models that prioritize person-centered care. Understanding and incorporating these trends into Medicaid planning can help individuals access a broader range of care options and improve their overall quality of life. Medicaid planning is not a one-time event but an ongoing process that should be revisited and updated regularly. Changes in an individual's personal circumstances, financial situation, or health care needs may necessitate adjustments to the plan to ensure continued access to necessary long-term care services. Working with a trusted professional and engaging in regular planning can help individuals and their families navigate the complexities of Medicaid and long-term care, protect their assets, and ensure a more secure future.What Is Medicaid Planning?

Understanding Medicaid Eligibility

Income and Asset Requirements

Exempt and Non-Exempt Assets

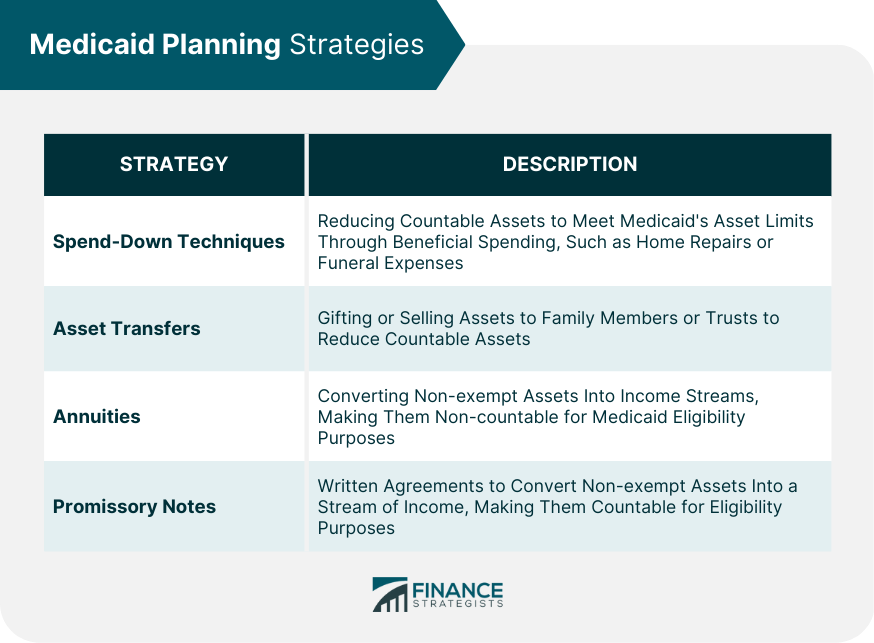

Strategies for Medicaid Planning

Spend-Down Techniques

Asset Transfers

Annuities and Promissory Notes

Utilizing Trusts in Medicaid Planning

Irrevocable Income-Only Trusts

Special Needs Trusts

Pooled Income Trusts

Long-Term Care Planning

Long-Term Care Insurance

Home and Community-Based Services (HCBS)

Veteran's Benefits and Programs

Legal Considerations for Medicaid Planning

Power of Attorney and Health Care Proxy

Guardianship and Conservatorship

Medicaid Estate Recovery

Working With a Medicaid Planning Professional

Role of an Elder Law Attorney

Choosing the Right Professional

Common Mistakes to Avoid

Bottom Line

Medicaid Planning FAQs

Medicaid planning is the process of rearranging your finances to meet the eligibility requirements for Medicaid coverage of long-term care.

Some strategies for Medicaid planning include spend-down techniques, asset transfers, and the use of annuities and promissory notes. These techniques can help individuals reduce their countable assets to meet Medicaid eligibility requirements while still preserving their resources.

Trusts can be used in Medicaid planning to protect assets while still allowing the individual to receive income generated by the assets. Irrevocable income-only trusts (IIOTs) and pooled income trusts are two examples of trusts used in Medicaid planning. Special needs trusts (SNTs) are also commonly used to provide financial support to a person with disabilities without jeopardizing their eligibility for government benefits like Medicaid.

Legal considerations for Medicaid planning include establishing a power of attorney and health care proxy, preparing for the possibility of guardianship or conservatorship, and planning for potential Medicaid estate recovery.

A trust can help protect your assets while still allowing you to qualify for Medicaid coverage. An experienced attorney can help you determine the right trust strategy for your situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.