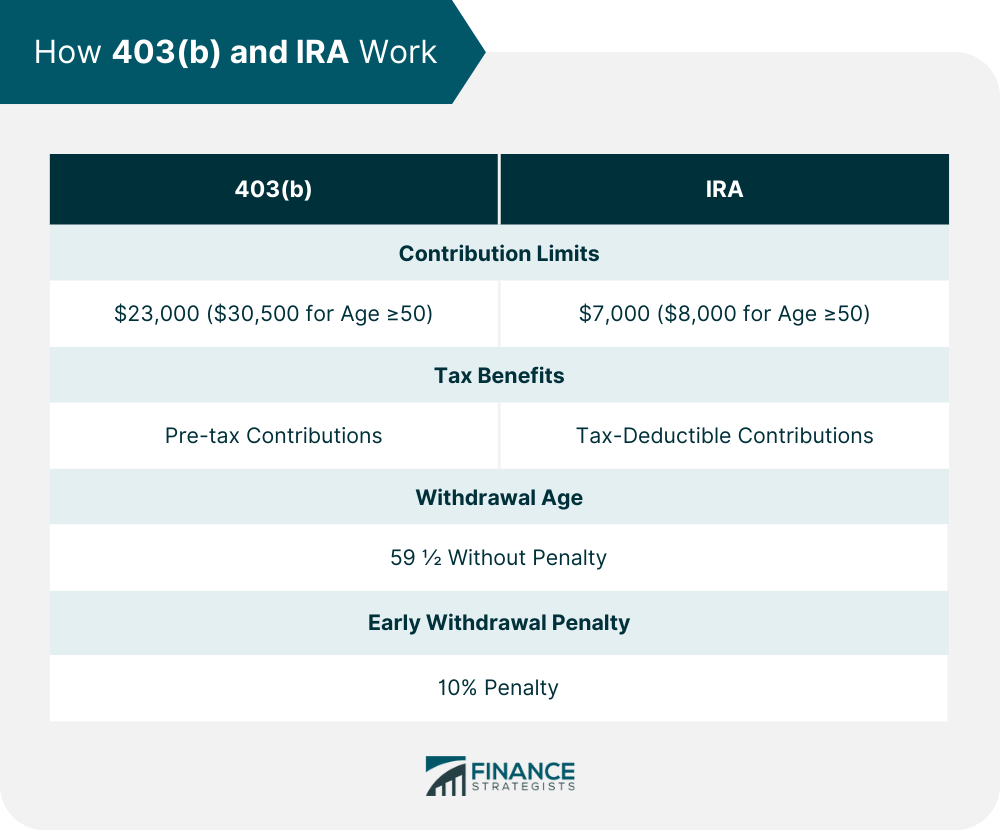

A 403(b) plan is a retirement savings option for employees of public schools, tax-exempt organizations, and certain ministers. It allows these employees to contribute part of their salaries on a pre-tax basis. On the other hand, an Individual Retirement Account (IRA) is a retirement savings account available to nearly anyone with earned income. The purpose of both these accounts is to help individuals save for retirement and grow their investments tax-deferred. However, when comparing 403(b) vs. IRA, the primary considerations include contribution limits, availability of employer match, the range of investment choices, and individual tax circumstances. Each plan has its own advantages, so it's crucial for savers to understand their unique features when planning for retirement. In 2024, the standard contribution limit for a 403(b) plan is $23,000. However, if you're age 50 or older, you're allowed to make additional catch-up contributions of $7,500, bringing the total possible contribution to $30,500 per year. The contribution limits for an IRA are significantly lower. In 2024, you can contribute up to $7,000 ($8,000 if you're 50 or older). These limits are the same for traditional and Roth IRAs and are combined for all your IRA accounts. 403(b) contributions are typically made with pre-tax dollars, which can help lower your taxable income. This means you won't pay taxes on the money until you withdraw it in retirement. In a traditional IRA, your contributions may be tax deductible, depending on your income and whether you or your spouse have a retirement plan at work. Like a 403(b), you'll pay taxes when you withdraw money in retirement. In general, you can start taking distributions from 403(b) without penalty once you reach age 59 ½. Taking distributions before this age will typically trigger a 10% early withdrawal penalty, along with the regular income tax. Similar to a 403(b), you can start taking distributions from an IRA without penalty once you reach age 59 ½. Early withdrawal is also subject to a 10% penalty, in addition to regular income tax, with certain exceptions. Consider your employment status. If you work for a non-profit organization that offers a 403(b) with matching contributions, it could be a good option for you. Additionally, if you wish to save more than the IRA contribution limit, a 403(b) would allow you to do so. Choosing an IRA over a 403(b) might be advantageous if you value having a broader range of investment options and more control over your investments. Also, if you anticipate being in a lower tax bracket in retirement, a traditional IRA might make more sense for you. Having both a 403(b) and an IRA allows you to diversify your retirement savings. This strategy can provide a mix of investment options and tax advantages. With both a 403(b) and an IRA, you can contribute to both accounts simultaneously, potentially increasing your total retirement savings. Just be sure to adhere to the respective contribution limits for each account. If you have both a 403(b) and an IRA, it's important to coordinate your distributions in retirement to ensure you meet the required minimum distributions (RMDs) for each account and to strategize which account to draw from first. Employer Matching Contributions: One significant advantage of 403(b) plans is the potential for employer-matching contributions. If your employer offers this benefit, it's like receiving free money towards your retirement savings. Higher Contribution Limits: Another advantage of 403(b) plans is their high contribution limit. The ability to save up to $23,000, or $30,500 if you're over 50, makes 403(b) a powerful savings tool, particularly for high earners. Investment Flexibility: IRAs generally offer a much broader range of investment options compared to 403(b) plans. You have the freedom to invest in individual stocks, bonds, exchange-traded funds (ETFs), mutual funds, and more. Accessible to Everyone: Unlike 403(b) plans, which are only available to certain employees, nearly anyone with earned income can contribute to an IRA. This accessibility makes IRAs a universal tool for retirement savings. Limited Investment Choices: The investment options in a 403(b) plan are generally limited to the choices provided by the plan sponsor. This lack of flexibility can be a disadvantage if the available investment options do not align with your retirement goals. Less Control Over Investments: Because 403(b) plans are employer-sponsored, the employer or plan administrator typically has control over the plan's features and investment options. This means you have less personal control compared to an IRA. Lower Contribution Limits: The main limitation of an IRA is the low contribution limit. At just $7,000 per year (or $8,000 for those aged 50 or older), it may not be enough for those who wish to save aggressively for retirement. No Employer Contributions: Unlike 403(b), IRAs do not offer employer contributions. All contributions are made by the individual, which could be a disadvantage for those who have access to employer-matching contributions through a 403(b) plan. Both 403(b) and IRA offer valuable opportunities for retirement savings, each with its unique features and advantages. A 403(b) provides higher contribution limits and possible employer-matching contributions, beneficial for those in specific sectors such as public schools, tax-exempt organizations, and some ministers. On the contrary, an IRA, which has lower contribution limits and no employer contributions, is accessible to all and offers more diverse investment options. It's critical to consider factors like your employment status, tax circumstances, retirement goals, and investment preferences when deciding between these two. Some individuals might benefit from contributing to both increased overall contributions and investment diversification. However, it's equally important to navigate potential pitfalls like adhering to contribution limits and coordinating distributions for each account. Essentially, the choice between 403(b) and IRA lies in aligning your retirement plan with your personal financial situation and long-term objectives.403(b) vs IRA Overview

How 403(b) and IRA Work

Contribution Limits of 403(b)

Contribution Limits of IRA

Tax Benefits in 403(b)

Tax Benefits in IRA

Withdrawal Terms for 403(b)

Withdrawal Terms for IRA

When to Choose a 403(b) Over an IRA

When to Choose an IRA Over a 403(b)

Considerations for Having Both a 403(b) And an IRA

Benefits of Diversification

Potential for Higher Overall Contributions

Coordinating Distributions

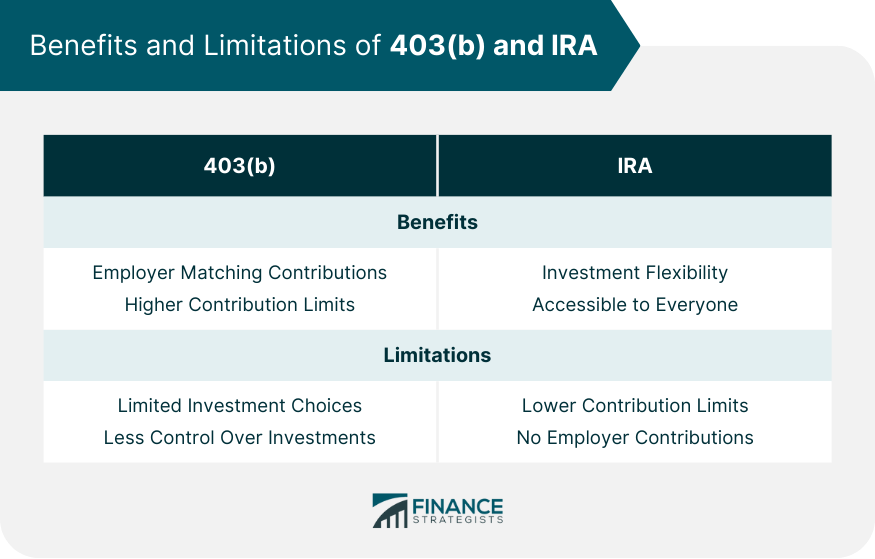

Benefits of 403(b) and IRA

403(b) Benefits

IRA Benefits

Limitations of 403(b) and IRA

403(b) Limitations

IRA Limitations

Final Thoughts

403(b) vs IRA FAQs

The main difference lies in who can contribute and how much they can contribute. A 403(b) is a retirement plan for specific employees of public schools, tax-exempt organizations, and certain ministers with higher contribution limits. An IRA (Individual Retirement Account), on the other hand, is open to nearly anyone with earned income but has lower contribution limits.

Yes, you can contribute to both a 403(b) and an IRA. This allows for higher total contributions toward retirement savings. However, it's essential to adhere to the respective contribution limits for each account.

Both 403(b) and traditional IRA contributions are made with pre-tax dollars, which can help lower your taxable income for the year you contribute. This means you won't pay taxes on the money until you withdraw it in retirement.

For both a 403(b) and an IRA, you can start taking distributions without penalty once you reach age 59 ½. Early withdrawals (before age 59 ½) are typically subject to a 10% penalty in addition to regular income tax.

Employer contributions are only possible with a 403(b) and not with an IRA. If your employer matches your 403(b) contributions, it's like receiving free money toward your retirement savings.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.