A Crypto IRA marries the time-tested structure of an Individual Retirement Account (IRA) with the dynamic world of digital currencies. It is a vehicle that allows you to invest in cryptocurrencies within the tax-advantaged framework of an IRA. Picture this as a marriage between forward-looking technology and traditional financial strategy. The Crypto IRA thrives on the premise of aiding you to invest in cryptocurrencies with a future-oriented approach, all while enjoying the tax perks that come with retirement planning. Retirement planning is not a new concept, but in the age of digital revolutions, it's essential to adapt and harness the potential of emerging financial trends. The Crypto IRA bridges the gap between the tried-and-true methods of financial security and the exciting possibilities of cryptocurrencies. It's not just about adding a dash of crypto to your portfolio; it's about recognizing the growth potential of these digital assets and the role they play in diversifying your retirement strategy. By incorporating cryptocurrencies into retirement planning, you're essentially placing a bet on their longevity and influence in the broader financial landscape. To dive into the Crypto IRA journey, you start by picking the right IRA type based on your risk appetite and goals. Whether you go with a traditional IRA for tax-deferred growth or a Roth IRA for tax-free withdrawals, the choice shapes your investment trajectory. Once that's squared away, the spotlight shifts to choosing a reliable crypto IRA custodian. This guardian of your digital treasures ensures your assets are well managed and compliant with the rules, all while safeguarding them from potential threats. Putting funds into your Crypto IRA requires some strategic moves. You can contribute existing cryptocurrencies or convert traditional money into digital assets. Here's the catch: just like regular IRAs, Crypto IRAs have contribution limits that differ based on your chosen IRA type and personal situation. The tax implications are no small matter, either. The way you fund your Crypto IRA can impact how much you owe in taxes, so it's smart to consult tax professionals who specialize in this intersection of technology and finance. Your Crypto IRA is ready to rock, and now comes the exhilarating task of steering your crypto ship. You'll want to keep a keen eye on your investments, tracking market trends and making informed decisions. Whether you're looking to spread your crypto eggs across multiple baskets or adapt to changing market dynamics, a solid strategy is vital. Don't forget the security front, either. The virtual nature of cryptocurrencies makes them prone to hacking and theft, so staying vigilant in protecting your assets is a non-negotiable part of the game. The Crypto IRA beckons with the allure of diversification. Cryptocurrencies are known to march to the beat of their own drum, often exhibiting minimal correlation with traditional investments. This unique characteristic can act as a shield, buffering your portfolio from the wild swings of more traditional assets. Plus, let's talk about the elephant in the room: the potential for sky-high returns. While cryptocurrencies might dance on the edge of volatility, they've also demonstrated staggering growth, attracting investors who dream of exceptional gains. Tax perks? Check. A Crypto IRA offers a buffet of tax benefits that can supercharge your retirement strategy. If you're a fan of tax deductions, certain Crypto IRAs let you contribute pre-tax income, potentially reducing your current tax bill. And then there's the whole tax-deferred growth phenomenon. Imagine your crypto assets ballooning in value, all the while shielded from immediate taxation. The Roth Crypto IRA is no wallflower either; it offers tax-free withdrawals during your golden years, including any earnings that have piled up. These tax-friendly attributes have the power to reshape your financial future. It's no secret that the cryptocurrency arena has transformed from a niche curiosity to a global financial force. As blockchain technology reshapes industries and garners acceptance from institutions, the growth potential of established cryptocurrencies is hard to ignore. The long-haul outlook of a Crypto IRA aligns with the ethos of long-term investing, inviting you to strap in for the ride and witness the evolution of digital assets on a global scale. While short-term market swings might create ripples, the historic surge of major cryptocurrencies points to the potential for prolonged growth. Brace yourself for the ride because the cryptocurrency market isn't for the faint of heart. The wild price swings are part and parcel of this realm, bringing both exhilarating highs and stomach-churning lows. While volatility might be candy for short-term traders, it poses a challenge for those seeking stable, long-term retirement growth. A strong stomach for risk and a game plan to weather the storm are prerequisites for Crypto IRA investors. Navigating the sea of regulations governing cryptocurrencies is a bit like sailing through uncharted waters. The legal landscape for these digital assets is ever-evolving, with governments and regulatory bodies grappling to define how cryptocurrencies fit into the established financial fabric. As a Crypto IRA investor, you're not only keeping an eye on the market but also on shifting regulations that could potentially influence how your crypto holdings are treated from a legal and tax perspective. Staying informed and collaborating with experts well-versed in this cryptic dance between law and technology is paramount. The allure of a Crypto IRA lies in its ability to reshape retirement planning, blending the dynamic world of cryptocurrencies with the stability of traditional financial structures. It's a bold step into a new realm, one that demands careful consideration, in-depth research, and a willingness to embrace the ever-evolving landscape of digital finance. As you weigh the benefits against the challenges, remember that a Crypto IRA isn't just about seizing the moment; it's about harnessing the potential of digital assets while paving a path towards a secure and prosperous retirement journey. When it comes to Crypto IRAs, the first step is to gauge your risk tolerance and define your investment horizon. Cryptocurrencies are known for their market volatility, which can translate into roller-coaster price swings. Therefore, it's vital to assess your comfort level with the potential ups and downs that come with the territory. Retirement investments, including those in a Crypto IRA, are typically designed for the long haul. This means you need to align your investment approach with the understanding that the value of your assets might fluctuate over time, but the ultimate goal is to ride out these fluctuations for potential long-term gains. Before leaping into the world of Crypto IRAs, ample research and due diligence are your best friends. Start by understanding the mechanics of cryptocurrencies – what they are, how they work, and the technology behind them. This knowledge will empower you to make informed decisions about which crypto assets to include in your IRA. It's essential to remember that not all cryptocurrencies are created equal. Some might promise the moon and stars but lack the underlying substance to deliver. Digging deep into the fundamentals of each cryptocurrency you're considering can help you separate the wheat from the chaff. Additionally, don't underestimate the significance of understanding the technology that powers your chosen cryptocurrencies. Cryptocurrencies are built on blockchain technology, and grasping the basics of how this technology functions can provide valuable insights into the potential longevity and utility of the cryptocurrencies you're eyeing. This isn't about becoming a tech guru overnight; it's about equipping yourself with enough knowledge to make informed investment choices that align with your financial goals. The Crypto IRA stands as a bridge between tradition and innovation, offering a unique avenue for retirement investors. As you contemplate embarking on this digital journey, remember to evaluate your risk tolerance and embrace the long-term nature of retirement investments. With the volatility of cryptocurrencies as a backdrop, diligent research and due diligence become your guiding lights. Understanding the technology underpinning cryptocurrencies is a powerful tool to separate potential winners from noise. This fusion of calculated risk, thorough understanding, and strategic planning forms the bedrock of a successful Crypto IRA experience. By blending the allure of digital assets with the stability of retirement planning, you unlock the potential to reshape your financial future. The Crypto IRA is more than a trend; it's a glimpse into the evolving landscape of investment. As you step into this arena, armed with knowledge and a clear vision, you embark on a path that may hold the key to a secure and prosperous retirement journey.What Is a Crypto IRA?

Purpose and Importance

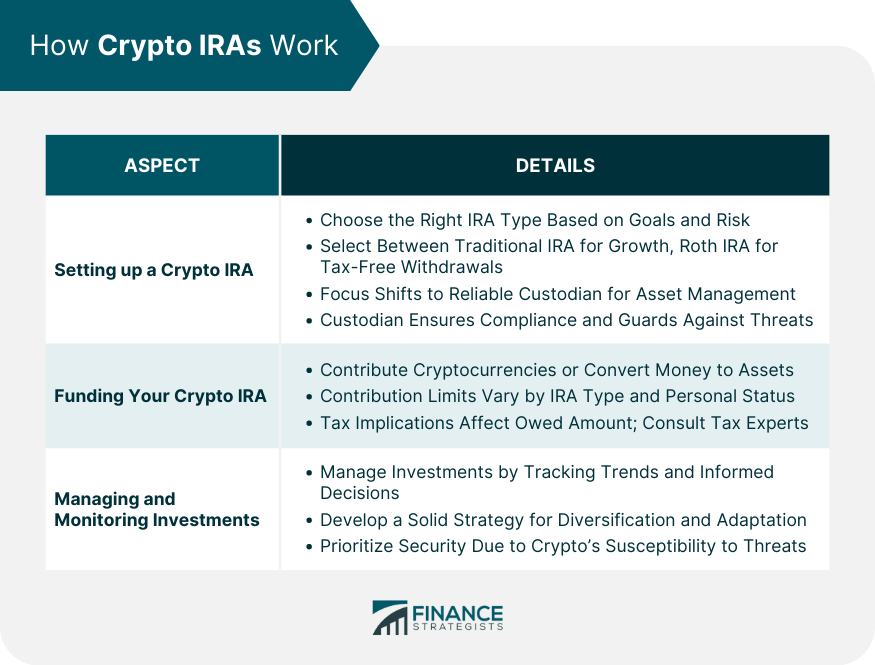

How Crypto IRAs Work

Setting up a Crypto IRA

Funding Your Crypto IRA

Managing and Monitoring Investments

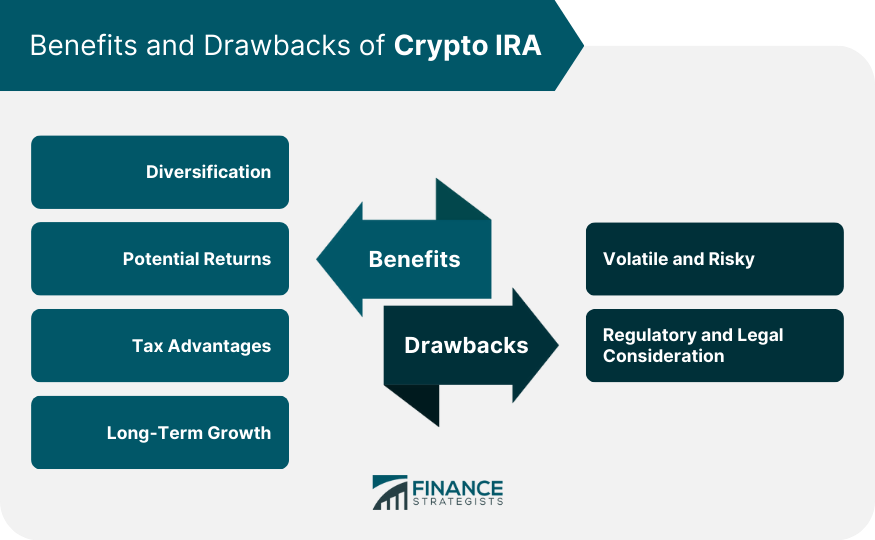

Benefits and Advantages of Crypto IRAs

Diversification and Potential Returns

Tax Advantages

Long-Term Growth Potential

Drawbacks and Challenges of Crypto IRAs

Volatility and Risk

Regulatory and Legal Considerations

Considerations for Investing in a Crypto IRA

Risk Assessment and Investment Horizon

Research and Due Diligence

Conclusion

Crypto IRA FAQs

Crypto IRA is a retirement account that allows you to invest in cryptocurrencies while enjoying the tax advantages of a traditional Individual Retirement Account (IRA).

Crypto IRA operates like a regular IRA, but it focuses on cryptocurrencies. You choose an IRA type, fund the account with cryptocurrencies or fiat currency, and manage the investments while enjoying potential tax benefits.

Crypto IRA offers diversification through cryptocurrencies, potential for high returns, and tax advantages based on your chosen IRA type, including tax-deferred growth or tax-free withdrawals during retirement.

The primary risk of a Crypto IRA is the volatility of the cryptocurrency market, which can lead to rapid gains or losses. Regulatory uncertainties and security concerns related to digital assets are also potential challenges.

First, assess your risk tolerance and long-term investment horizon. Conduct thorough research on cryptocurrencies you intend to include, and understand their underlying technology. Collaborate with experts and stay informed about regulatory changes to make well-informed investment decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.