A Financial Planner for Retirement is a professional who assists individuals in preparing and strategizing for their financial needs post-retirement. This involves assessing current financial status, setting retirement goals, and devising a comprehensive plan to ensure a comfortable retirement. They consider multiple factors like life expectancy, desired retirement lifestyle, potential medical expenses, and inflation. Their expertise ensures that individuals can maintain their desired standard of living after they stop working. Hiring a financial planner for retirement is particularly beneficial for those who feel overwhelmed by the multitude of investment options or are unsure of how much they need to save. They help in navigating tax laws, maximizing social security benefits, and allocating assets effectively. It's a proactive step towards a secure and stress-free retirement. However, when hiring one, it's essential to ensure they have relevant credentials and a fee structure aligned with your interests. The financial advisory world is vast, with varied professionals. But when it comes to retirement planning, it's essential to choose experts with the right credentials. Certifications like the Certified Financial Planner (CFP) mark are indicative of rigorous training and adherence to ethical standards. Additionally, a planner's experience, especially in handling portfolios resembling the client's, offers invaluable insights. Money matters, especially when planning for a phase where income might be static. Understanding how a financial planner is compensated is crucial. Whether it's a fee-only model, commission-based, or a hybrid, clients must weigh the advantages and disadvantages, aligning them with their comfort and financial scenarios. Beyond credentials and fees, it's the planner's investment philosophy that can make a profound difference. Some planners might have an aggressive approach, while others are more conservative. Aligning this philosophy with personal comfort levels and financial aspirations ensures a harmonious journey to retirement. At the core of retirement planning is investment. Here, financial planners shine with guidance on asset allocation and diversification. Recognizing that each client's risk tolerance and time horizon are distinct, they craft portfolios that reflect these parameters. Moreover, they engage in continuous risk assessment, ensuring that the investment trajectory aligns with changing market conditions and personal milestones. While retirement planning focuses on individual comfort, many also seek to ensure their heirs are financially secure. Estate planning, therefore, becomes paramount. Financial planners delve into the minutiae, from ensuring assets are transferred with minimal tax implications to setting up trusts and wills that mirror the client's wishes. Taxes are an inevitable part of financial landscapes, but with astute planning, their impact can be optimized. Financial planners offer strategies that minimize tax burdens during retirement. This includes advising on tax-efficient withdrawal strategies from retirement accounts like IRAs and 401(k)s, ensuring retirees can enjoy their savings with minimal tax intrusion. Retirement might signal the end of active work, but it's also a phase that might demand specific insurance products. Whether it's long-term care insurance to navigate potential health challenges or annuities to ensure a steady income, financial planners guide clients through these choices. Their focus remains on balancing costs with benefits, ensuring retirees are shielded from unforeseen financial shocks. Every great journey begins with a single step. In the realm of retirement planning, this step is the initial consultation. Here, clients and planners discuss aspirations, current financial status, risk appetites, and more. This session lays the foundation, providing the planner with insights to curate the retirement roadmap. With insights from the initial consultations, planners draft a comprehensive retirement blueprint. But crafting the plan is only half the battle. The next phase is execution—implementing investment strategies, setting up necessary financial products, and initiating any recommended actions. Markets ebb and flow, personal circumstances shift, and economic landscapes change. Recognizing this dynamism, financial planners engage in continuous monitoring. Regular check-ins ensure performance reviews and adjustments are made to align with evolving conditions, ensuring the retirement journey remains on track. The financial world is complex, and retirement planning is no exception. Financial planners bring a depth of knowledge that can be pivotal. They understand the nuances of retirement savings, from maximizing contributions to avoiding premature withdrawals that can incur penalties. Moreover, their awareness of potential pitfalls, and more importantly, strategies to avoid them, can be the difference between a restful retirement and one plagued by financial anxieties. Retirement isn't a one-size-fits-all venture. Everyone has unique dreams, needs, and financial situations. Financial planners dive into these personal intricacies, curating retirement plans tailored to individual aspirations. Whether it's traveling the world, buying that dream home by the beach, or ensuring comfortable living standards, they craft strategies aligned with these goals. Moreover, life is dynamic. As personal circumstances or economic environments shift, financial planners adjust strategies to stay on target. The journey to retirement isn't a set-it-and-forget-it affair. It necessitates continuous oversight. Financial planners provide this through periodic reviews, ensuring retirement goals remain on track. If market turbulence or personal circumstances demand, they're poised to recommend strategic shifts, ensuring the ship remains steadfastly directed towards retirement goals. Hiring a financial planner can be expensive, especially if they charge a percentage of your investment or a retainer. Over time, these fees can significantly eat into your retirement savings. Some planners may have additional costs or might push for investments that benefit them through commissions, adding to the overall expense. Some financial planners might recommend certain products or services not because they are the best fit for the client, but because they offer the advisor higher commissions. A planner affiliated with a particular financial institution might prioritize products from their company over better options available elsewhere. Not every financial planner will provide bespoke advice tailored to individual needs. Some might offer generic solutions, which might not be optimal for unique retirement goals. Some advisors might make future projections based purely on past performances, which might not always be a reliable predictor. A frequent refrain, especially among younger individuals, is that retirement is ages away. However, the power of compound interest and the benefits of early investments can't be overstated. Starting early affords the luxury of time, which can be a powerful ally in wealth accumulation. This misconception can be a costly one. While high-net-worth individuals certainly benefit from financial planners, even those with modest incomes can gain immensely. By leveraging a planner's expertise, individuals can optimize savings, minimize costs, and set themselves on a path to a more prosperous retirement. The digital age has ushered in a plethora of tools and platforms, leading some to assume retirement planning can be a DIY endeavor. While these tools offer value, they can't replicate the personalized advice and deep expertise that a seasoned financial planner brings. Moreover, navigating the complexities of financial decisions necessitates a human touch, which tools alone can't provide. A Financial Planner for Retirement plays an indispensable role in navigating the intricate realm of post-work life finances. Their deep expertise spans from leveraging the potency of compound interest to crafting tailored strategies aligned with individual aspirations. While some might believe that such planners cater solely to the affluent, their services prove invaluable for a diverse range of financial backgrounds. A prevalent misconception posits that digital tools can replace these professionals, but the unique blend of personalized advice and dynamic adjustments they offer is unparalleled. Choosing the right planner involves a thorough evaluation of their credentials, fee structure, and investment philosophy. As retirement isn't a static journey, continuous monitoring and adjustments by these experts ensure that individuals remain on a steadfast path to their desired financial future. In essence, engaging with a Financial Planner for Retirement is a proactive investment in a secure and fulfilling retirement.Financial Planner for Retirement Overview

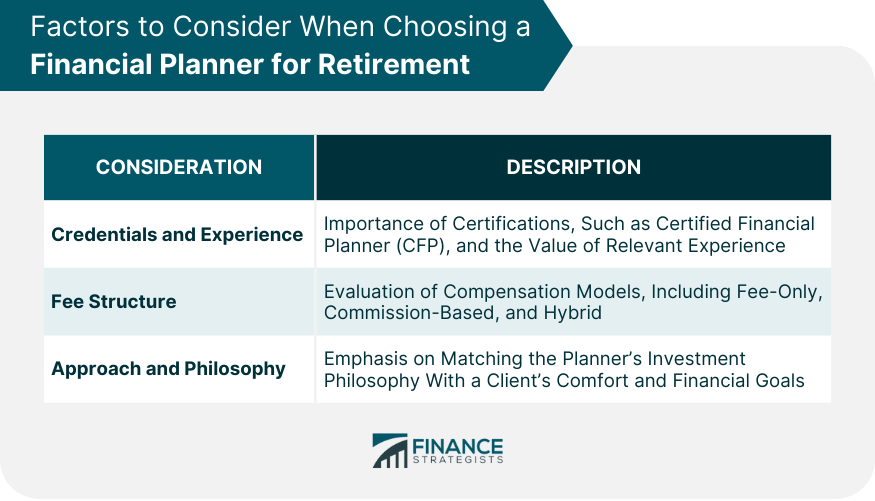

Factors to Consider When Choosing a Financial Planner for Retirement

Credentials and Experience

Fee Structure

Approach and Philosophy

Services Offered by a Financial Planner for Retirement

Investment Advice

Estate Planning

Tax Planning

Insurance Planning

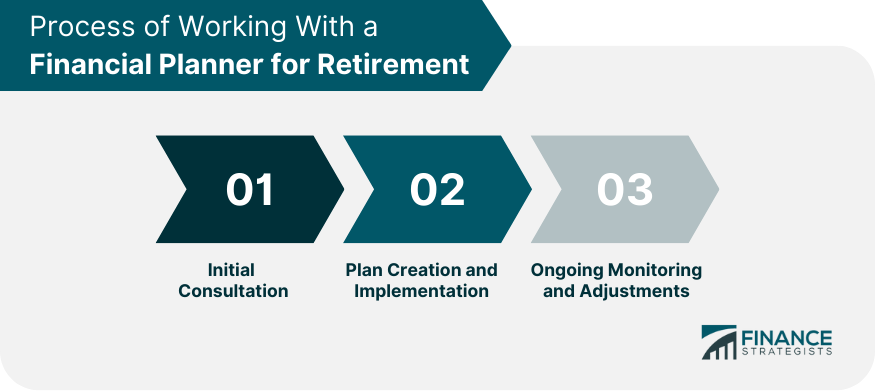

Process of Working With a Financial Planner for Retirement

Step 1: Initial Consultation

Step 2: Plan Creation and Implementation

Step 3: Ongoing Monitoring and Adjustments

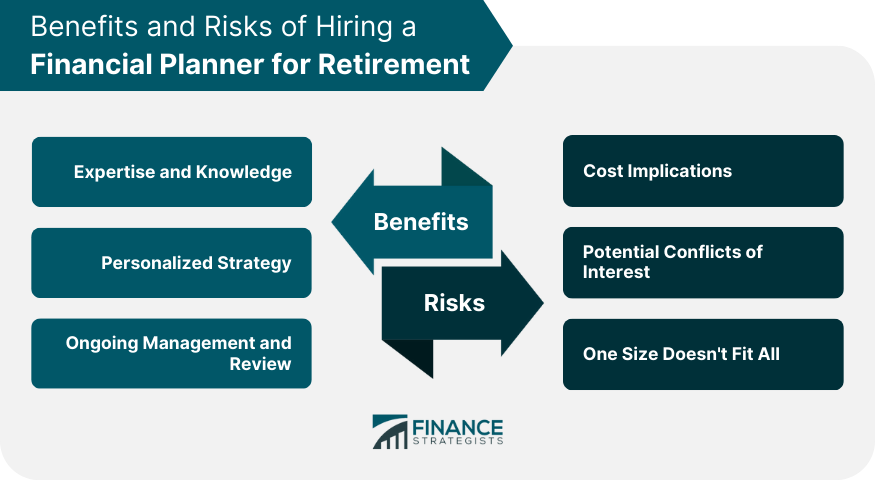

Benefits of Hiring a Financial Planner for Retirement

Expertise and Knowledge

Personalized Strategy

Ongoing Management and Review

Risks of Hiring a Financial Planner for Retirement

Cost Implications

Potential Conflicts of Interest

One Size Doesn't Fit All

Common Misconceptions about Financial Planners for Retirement

It’s Too Early to Plan for Retirement

Financial Planners Are Only for the Wealthy

I Can Do It Myself Using Online Tools

Conclusion

Financial Planner for Retirement FAQs

Starting early with a Financial Planner for Retirement allows you to maximize the benefits of compound interest, set long-term strategies, and make adjustments over time, leading to a more secure retirement.

While it's possible to manage retirement funds independently, a Financial Planner for Retirement provides expert advice, personalized strategies, and ongoing management that can optimize returns and mitigate risks.

A Financial Planner for Retirement continuously monitors market conditions, economic shifts, and personal circumstances, making strategic adjustments to investments, asset allocations, and other financial strategies to keep your retirement goals on track.

No. While wealthy individuals can benefit, even those with modest incomes can leverage a Financial Planner for Retirement's expertise to optimize savings, minimize costs, and create effective retirement strategies.

The frequency varies based on individual needs. However, it's generally recommended to have at least an annual review with your Financial Planner for Retirement to assess progress and make any necessary adjustments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.