One of the essential components of retirement planning in the United States is the 401(k) plan. This employer-sponsored retirement savings plan offers tax benefits, the potential for employer matching contributions and can significantly impact your long-term financial future. In a 401(k) plan, participants contribute a portion of their paycheck before taxes, which can potentially lower their overall taxable income. Over time, this money can grow on a tax-deferred basis, meaning you don't pay taxes on your contributions or earnings until you start taking distributions in retirement. It's also crucial to understand that 401(k) plans have specific rules for withdrawal, including potential penalties for early withdrawal before reaching the age of 59 ½ years. It's vital to understand the ramifications of a career transition on your 401(k) plan to make informed decisions that support your retirement goals. When the time comes to depart from your job, either due to a new career opportunity, an unfortunate layoff, or an anticipated retirement, questions about the future of your 401(k) funds will inevitably surface. Your 401(k) account remains intact after you leave your job, and you retain ownership of the assets you've accrued. However, the ability to contribute to it via your former employer ceases. This does not mean that your 401(k) becomes stagnant; your investments continue to potentially earn returns, but you can no longer enhance your savings through contributions or capitalize on employer-matched contributions through this account. Key to understanding the post-job-change status of your 401(k) is becoming familiar with vested benefits. While your personal contributions to a 401(k) plan are always 100% vested, meaning you fully own them, your employer's matching contributions may be subject to a vesting schedule. This vesting schedule delineates what proportion of your employer's contributions you truly own based on your duration of employment. Full vesting ensures complete ownership of the money in your 401(k), encompassing both your contributions and those made by your employer. If you're not fully vested, some or all employer contributions may be forfeited upon leaving. One potential route to take is to let your 401(k) stay with your former employer. This choice's primary advantage is its simplicity; your investments remain in place, and no immediate action is necessary on your part. However, there are also significant drawbacks to this path. There may be higher administrative and management fees associated with a former employer's 401(k) plan than with an Individual Retirement Account (IRA) or a new employer's plan. You also have a set range of investment options and can't make any further contributions. Additionally, managing multiple 401(k) accounts from different employers can become complex. This option could be advantageous if you appreciate your current investment selections, are satisfied with the fee structure, and don't wish to engage in immediate decision-making about your retirement funds. However, it's wise to evaluate the long-term implications before choosing this option. If your new employer offers a 401(k) plan and accepts rollovers, you might consider transferring your previous 401(k) into the new plan. To achieve this, check your new employer's plan rules and ask for a rollover form if permitted. After completing and submitting the form, the funds are moved to your new plan. Transferring to your new employer's 401(k) plan has the advantage of consolidating your retirement savings, simplifying management, and allowing ongoing pre-tax contributions. Furthermore, employer-sponsored plans often provide protection from creditors and allow for loans against your balance. Conversely, the new plan may restrict investment choices, and the plan's administrative costs could be higher than those of an IRA. Furthermore, if you're unhappy with the plan's offerings or costs, you may find it difficult to move your funds again. This is an appealing option if you favor a streamlined approach to managing your retirement savings and if your new employer's plan has favorable terms, low costs, and quality investment choices. Rolling your 401(k) into an IRA is another viable option. To execute this, you'll need to set up an IRA account with a financial institution of your choice. Request a direct rollover from your previous employer to avoid any penalties. IRAs often offer a broader spectrum of investment choices, providing an opportunity for a more personalized retirement savings strategy. They also typically have lower costs than 401(k) plans and provide greater flexibility in terms of withdrawals for qualifying expenses. On the other hand, managing an IRA requires more active participation in investment decisions. Also, unlike a 401(k), IRAs do not offer the same level of protection from creditors in all states and do not allow for loans. An IRA rollover is a suitable choice if you're seeking a more diversified investment strategy, are comfortable making investment decisions, or are trying to consolidate various retirement accounts for easier management. Cashing out your 401(k) means withdrawing all your money in one go. This option comes with significant financial drawbacks. The distributed amount gets added to your taxable income for the year, possibly propelling you into a higher tax bracket, and a 10% early withdrawal penalty applies if you're under 59 1/2. Cashing out is generally not the best decision due to the hefty financial penalties. However, it could be the last resort in dire financial situations, although it should only be considered after exploring all other options. Your age is a significant factor in what happens to your 401(k) when you change jobs because of the rules regarding early withdrawal. If you are under 59 1/2 years old and you withdraw money from your 401(k), you may be subjected to a 10% early withdrawal penalty in addition to the regular income tax. However, if you're over 55 and lose your job, you may be able to withdraw without the penalty, depending on the specifics of your plan. Your expected retirement timeline can impact how you should manage your 401(k) upon changing jobs. If you're close to retirement, you may want to consider a more conservative approach to investing, whereas if retirement is several years away, you could afford to take more risks. Moreover, the timeline may affect your decision whether to leave the money in your old plan, roll it over to a new employer's plan, or transfer it to an IRA. Your current financial needs can significantly influence what you choose to do with your 401(k) funds when changing jobs. If you are experiencing financial hardship, you may consider withdrawing some funds, but be aware of the potential penalties and tax implications. If you're financially stable, it might be better to leave your money invested for future growth. Your long-term financial goals are crucial when deciding what to do with your 401(k) upon changing jobs. If you aim to retire early, you might need to contribute more to your plan or consider more aggressive investments. If your goal is financial stability in your retirement years, you may want to focus on more secure, low-risk investments. The fees associated with your new employer's 401(k) plan or an IRA can eat into your savings, affecting your final retirement balance. Lower fees are generally preferable. Also, consider the investment options in the new plan. A diverse range of choices allows you to customize your portfolio according to your risk tolerance and financial goals. Make sure you understand the terms, fees, and investment options of any new plan before deciding to roll over your 401(k). Navigating the transitions that come with a job change can be challenging, and understanding how this shift impacts your 401(k) is crucial. Decisions about leaving the account with a former employer, transferring it to a new employer's plan, rolling it over into an IRA, or cashing it out should be informed by several factors. These include your age, anticipated retirement timeline, current financial needs, long-term goals, and the costs and investment options associated with your new employer's plan or an IRA. Keep in mind that every situation is unique, and the optimal decision for one person may not be the best for another. A skilled financial advisor can provide tailored recommendations based on your personal circumstances and financial goals. Overview of 401(k)

Immediate Implications of a Job Change on Your 401(k)

Status of Your 401(k) When You Leave Your Job

Understanding Vested Benefits

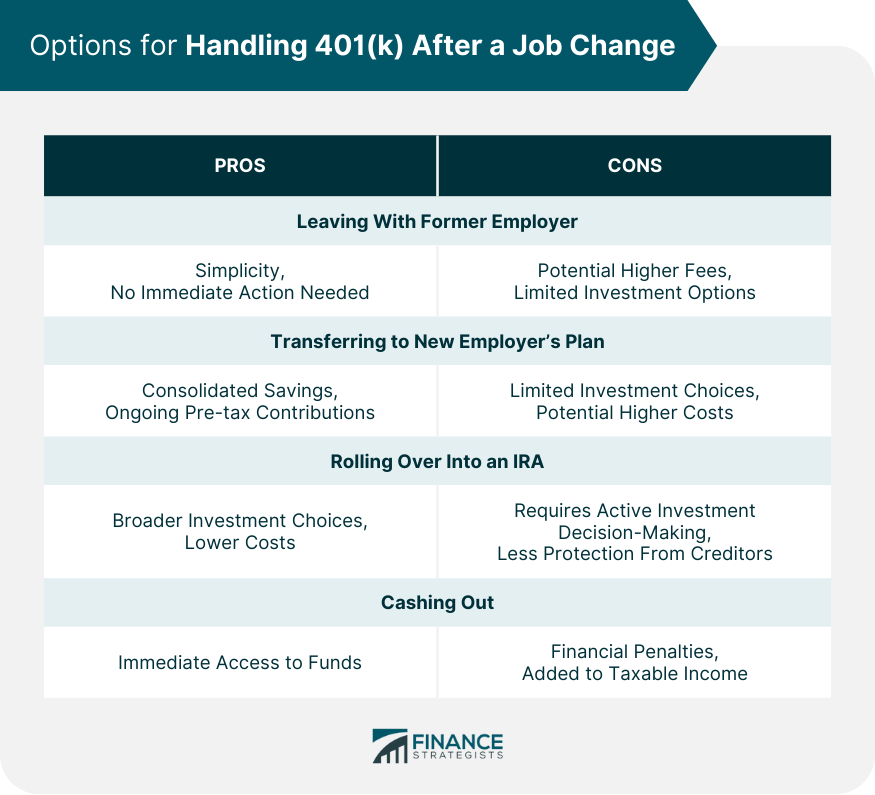

Options for Handling 401(k) After a Job Change

Leaving the 401(k) With Former Employer

Pros and Cons

When Might This Be a Good Choice

Rolling Over the 401(k) Into a New Employer's Plan

Steps to Follow

Pros and Cons

When Might This Be a Good Choice

Rolling Over the 401(k) Into an Individual Retirement Account (IRA)

Steps to Follow

Pros and Cons

When Might This Be a Good Choice

Cashing Out the 401(k)

Understanding the Penalties and Tax Consequences

When Might This Be a Good Choice

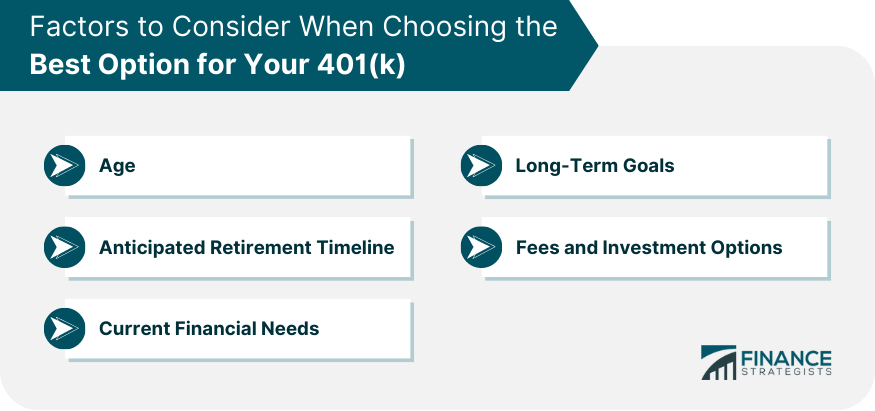

Factors to Consider When Choosing the Best Option for Your 401(k)

Age

Anticipated Retirement Timeline

Current Financial Needs

Long-Term Goals

Fees and Investment Options

The Bottom Line

Options and Factors for Handling 401(k) After a Job Change FAQs

When you change jobs, your 401(k) remains intact and you continue to own your contributions and any vested employer contributions. However, you can no longer make contributions through your previous employer.

Yes, you can leave your 401(k) with your previous employer. However, you won't be able to make additional contributions and you might have to pay higher fees.

Yes, if your new employer's 401(k) plan accepts rollovers, you can transfer your old 401(k) to the new one, which simplifies management of your retirement savings.

Yes, rolling your 401(k) into an IRA is an option after a job change. An IRA can offer more investment options and potentially lower fees.

Cashing out your 401(k) means withdrawing the money as a lump sum. However, this approach usually incurs immediate tax implications and potential early withdrawal penalties.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.