Vested benefits are specific entitlements earned by employees that cannot be revoked by an employer. They are typically obtained after meeting predetermined criteria, such as completing a certain number of years of service. Once vested, these benefits become the employee's irrevocable right, ensuring that they are eligible to receive them in the future. Common types of vested benefits include retirement plans, pensions, stock options, and employer-contributed savings plans. Vested benefits provide employees with a sense of financial security and incentivize long-term commitment to the organization. Understanding vested benefits is crucial for both employers and employees. For employers, vesting schedules can serve as a retention tool, encouraging employees to stay with the company for longer periods. For employees, vested benefits constitute an essential part of their compensation and can significantly contribute to their long-term financial security. Proper comprehension of these benefits allows employees to make informed decisions about job changes and retirement planning. One of the most common types of vested benefits is found in 401(k) retirement savings plans. An employee's own contributions to a 401(k) are always fully vested. However, employer contributions, such as matching contributions, often come with a vesting schedule. Traditional defined-benefit pension plans also typically include vested benefits. After a certain number of years of service, an employee becomes entitled to receive a pension in retirement, regardless of whether they remain with the employer until retirement age. In profit-sharing plans, companies distribute a portion of their profits to employees. These contributions are usually subject to a vesting schedule, ensuring that only long-term employees receive the full benefit. Employee Stock Options (ESOs) give employees the right to buy a specific number of company shares at a predetermined price. Typically, these options vest over time, aligning employee interests with those of the company's shareholders. RSUs are company shares given to an employee through a vesting plan and distribution schedule after reaching certain milestones. They're designed to retain talent and align the goals of the employees with the company. Performance shares are awards that vest upon the achievement of company-defined performance criteria. They represent a commitment from the employee to meet these performance targets within a specified period. Under a cliff vesting schedule, an employee becomes fully vested after a specific period of service. If an employee leaves before this date, they forfeit all non-vested benefits. Graded vesting schedules gradually increase the percentage of vested benefits over time. For example, an employee might become 20% vested after two years, 40% after three, and so on until reaching 100%. In some cases, benefits may be immediately vested. This means the employee has a right to the full amount of the benefit as soon as it is provided, with no risk of forfeiture. Some companies establish custom vesting schedules to meet their unique needs. These schedules may combine elements of a cliff, graded, and immediate vesting. Generally, an employee must remain employed to continue vesting in their benefits. If employment terminates before benefits are fully vested, the non-vested portion may be forfeited. Vesting schedules often depend on years of service. The more years an employee has served, the larger the portion of their benefits that will be vested. In some cases, vesting is contingent on company performance. For example, performance shares only vest if the company meets certain financial or operational targets. Sometimes, employee performance can affect vesting. This is especially true with performance shares or other incentive-based vesting schedules, where vesting might accelerate if an employee meets or exceeds certain goals. Laws and regulations can also impact vesting. For example, the Employee Retirement Income Security Act (ERISA) in the U.S. sets minimum vesting standards for retirement plans to protect the interests of participants. In traditional 401(k) and pension plans, both the employee's contributions and the vested employer's contributions are tax-deferred until withdrawn in retirement. Withdrawals before age 59.5 may be subject to a penalty in addition to ordinary income tax. In Roth 401(k) plans, employee contributions are made with after-tax dollars, so qualified withdrawals in retirement are tax-free. As for employer contributions, they are made with pre-tax dollars and are taxable upon withdrawal. Incentive Stock Options (ISOs) offer favorable tax treatment if certain conditions are met. The spread between the exercise price and the market price at exercise is not subject to ordinary income tax if the shares are held for a specified period. However, it may be subject to Alternative Minimum Tax (AMT). With NQSOs, the spread at exercise is taxed as ordinary income, regardless of how long the shares are held. For RSUs, the value of the shares at vesting is considered ordinary income and is taxable at that time. Employees should regularly monitor their vesting progress to understand how much of their benefits are currently vested. This information is usually available through the employer or plan administrator. Vesting milestones, such as the end of a cliff vesting period, can significantly impact an employee's financial situation. Employees should plan for these events and consider their potential financial implications. Vested benefits often represent a significant portion of an employee's net worth, especially in the case of stock options or RSUs. Therefore, it's important to consider these benefits in the context of the employee's overall investment portfolio and diversification strategy. Given the complexity of vested benefits and their tax implications, employees may benefit from seeking advice from financial professionals. Such professionals can provide personalized advice based on the employee's specific circumstances and goals. Vested benefits are specific entitlements earned by employees that cannot be revoked by an employer. They include retirement plans, pensions, stock options, and employer-contributed savings plans. Vested benefits provide financial security and incentivize long-term commitment. They are subject to vesting schedules, which can be cliff, graded, immediate, or custom. Factors affecting vested benefits include employment status, years of service, company and employee performance, and regulatory requirements. Tax implications vary for retirement plans and stock options. Managing vested benefits involves monitoring progress, planning for milestones, diversifying investments, and seeking professional advice. Understanding and optimizing vested benefits is crucial for employees' financial well-being.Definition of Vested Benefit

Importance of Vested Benefit

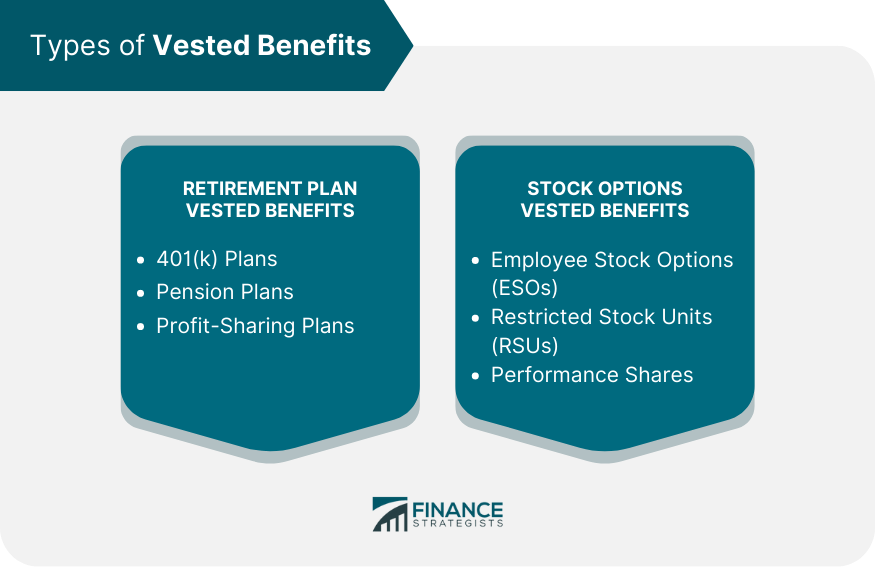

Types of Vested Benefits

Retirement Plan Vested Benefits

401(k) Plans

Pension Plans

Profit-Sharing Plans

Stock Option Vested Benefits

Employee Stock Options (ESOs)

Restricted Stock Units (RSUs)

Performance Shares

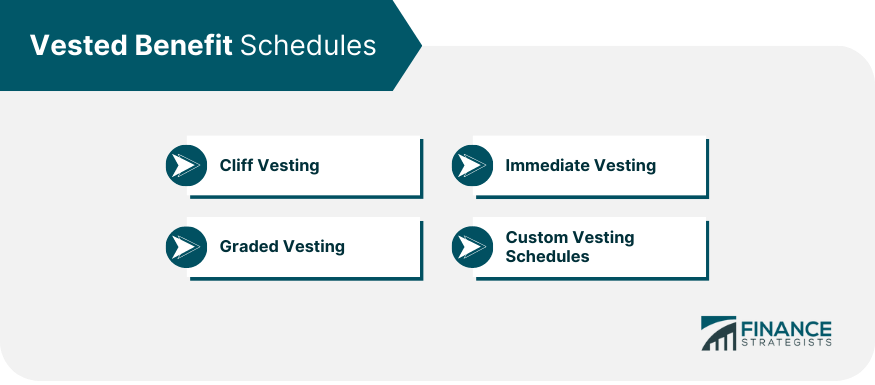

Vested Benefit Schedules

Cliff Vesting

Graded Vesting

Immediate Vesting

Custom Vesting Schedules

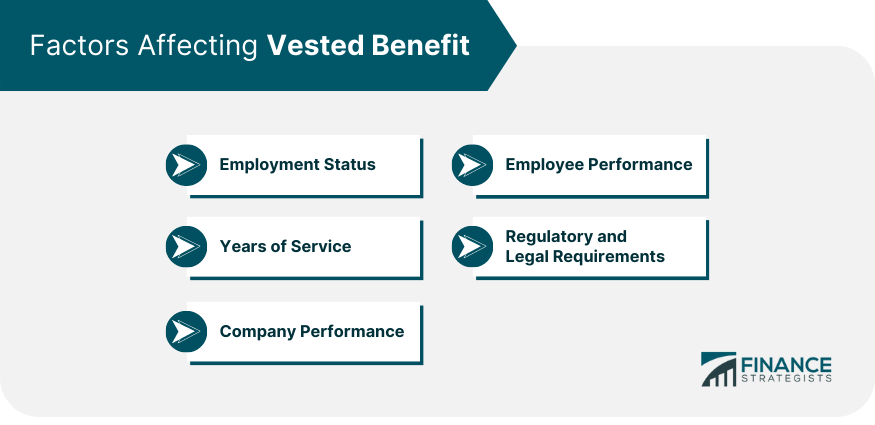

Factors Affecting Vested Benefit

Employment Status

Years of Service

Company Performance

Employee Performance

Regulatory and Legal Requirements

Tax Implications of Vested Benefits

Taxation of Retirement Plan Vested Benefits

Traditional 401(k) and Pension Plans

Roth 401(k) Plans

Taxation of Stock Options Vested Benefits

Incentive Stock Options (ISOs)

Non-Qualified Stock Options (NQSOs)

Restricted Stock Units (RSUs)

Vested Benefit Management and Best Practices

Monitoring Vested Benefit Progress

Planning for Vesting Milestones

Diversification and Risk Management Strategies

Seeking Professional Financial Advice

Conclusion

Vested Benefit FAQs

Vested benefits refer to an employee's right to receive certain benefits from their employer after fulfilling certain conditions, typically a specific period of service. Examples include benefits from retirement plans like 401(k)s and pension plans and from stock options like Employee Stock Options (ESOs) and Restricted Stock Units (RSUs).

Vested benefits can significantly enhance an employee's financial security. They represent an additional form of compensation beyond salary, potentially amounting to a substantial sum over time. Depending on the type of benefit and vesting schedule, vested benefits may provide a source of retirement income or a significant financial windfall when stock options or RSUs vest.

Effective management of vested benefits involves understanding your company's vesting schedule, monitoring your progress toward vesting milestones, and planning for the potential financial and tax implications of vested benefits. Diversification and risk management strategies are also important, especially for benefits like stock options that can represent a significant portion of your wealth. You may also want to consider seeking professional financial advice to help navigate these complexities.

Yes, vested benefits are often subject to taxation. However, the timing and rate of taxation can vary depending on the type of benefit. For instance, with traditional 401(k) plans and pension plans, taxes are deferred until the money is withdrawn in retirement. In contrast, with stock options or RSUs, taxes are often due when the options are exercised or the RSUs vest.

Effective management of vested benefits involves understanding your company's vesting schedule, monitoring your progress toward vesting milestones, and planning for the potential financial and tax implications of vested benefits. Diversification and risk management strategies are also important, especially for benefits like stock options that can represent a significant portion of your wealth. You may also want to consider seeking professional financial advice to help navigate these complexities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.