A 401(k) plan is primarily a tool for retirement savings, but in certain situations, it can also serve as a source of loan. Many, but not all, 401(k) plans permit participants to borrow from their own savings. The advantage of borrowing from your 401(k) plan is that you are essentially borrowing from yourself, meaning the interest you pay on the loan goes back into your own account. However, the process is not without its complications, including potential tax implications and the risk of stunting the growth of your retirement savings. The Internal Revenue Service (IRS) sets limits on how much you can borrow from your 401(k) plan. Generally, if your plan permits loans, the maximum amount that can be taken as a loan is (1) the greater of $10,000 or 50% of your vested account balance, or (2) $50,000, whichever is less. If your vested account balance is less than $10,000, you can still borrow up to $10,000 if your plan allows it. However, there are also other factors that can influence the maximum borrowing amount, such as the vesting schedule, account balance, and any employer-specific restrictions. The maximum amount you can borrow from your 401(k) plan is subject to several determining factors. Your vesting schedule determines how much of your 401(k) account balance is actually yours to borrow against. While your own contributions are always 100% vested, your employer's contributions might vest over time, according to the schedule set in the plan. Therefore, if your employer contributions are not fully vested, they may not count toward the total amount you can borrow. Your account balance also affects how much you can borrow from your 401(k) plan. The IRS allows you to borrow up to 50% of your vested account balance or $50,000, whichever is less. However, if your vested account balance is less than $20,000, you may be able to borrow up to $10,000, provided your plan allows it. Your employer may limit the number of loans you can have outstanding at any given time or set a minimum loan amount to prevent excessive borrowing. Be sure to check your plan's terms for any such restrictions. Determining your eligibility for a 401(k) loan involves examining your employment status and plan participation, understanding the plan-specific rules and policies, and acknowledging the IRS regulations and limitations. Your employment status can impact your eligibility for a 401(k) loan. As a general rule, you need to be currently employed and an active participant in the plan to be eligible to borrow. If you leave your job, either voluntarily or involuntarily, your loan may become due more quickly. Each 401(k) plan may have its own rules and policies regarding loans. Some plans may not allow loans at all, while others may allow loans only for specific purposes, such as to pay education or medical expenses. It's crucial to review the specific rules of your plan to understand the loan terms and any restrictions. The IRS has regulations and limitations that affect your eligibility for a 401(k) loan. For instance, the IRS imposes the aforementioned loan limits and requires that loans be repaid within a specified period. Typically, you must repay a 401(k) loan within five years, and payments must usually be made at least quarterly. However, if you use the loan to purchase a primary residence, the repayment period may be longer. The interest rate on a 401(k) loan is often comparable to the rates on other types of personal loans. The rate is usually prime rate plus 1%, and the interest goes back into your 401(k) account. However, there may be origination fees or other costs associated with the loan. Loan repayments are typically made through payroll deductions. Each paycheck will have a portion deducted to repay the loan. This ensures that repayments are made regularly and that the loan is repaid within the required time frame. If you fail to repay your 401(k) loan as agreed, the IRS considers the unpaid balance to be a premature distribution, which is subject to income tax at your ordinary tax rate, as well as an additional 10% early withdrawal penalty if you are under the age of 59.5. Before deciding to borrow from your 401(k) plan, it's worth considering other options that may be more advantageous or less risky. Personal loans can be an effective alternative to 401(k) loans. They are versatile and can be used for various purposes, including consolidating debt, making home improvements, or covering large expenses. Personal loans typically have fixed interest rates, and your repayment schedule is determined at the outset, helping you budget for your repayments. If you own a home, you may be able to borrow against your equity. Home equity loans and lines of credit often offer lower interest rates than personal loans or credit cards because the loan is secured by your home. However, the risk is that if you fail to repay the loan, the lender could foreclose on your home. Credit cards can be a quick and convenient way to cover expenses, particularly for smaller amounts. However, interest rates on credit cards are typically higher than those on personal loans or home equity loans, and the risk of getting into high-interest debt is greater. A well-stocked emergency fund can save you from having to borrow in the face of unexpected expenses. It's generally recommended to have three to six months' worth of living expenses saved in an emergency fund. If you don't have an emergency fund, consider starting one. The general limit amount for borrowing from a 401(k) plan is typically the greater of $10,000 or 50% of your vested account balance, up to a maximum of $50,000. However, other factors, such as the vesting schedule, account balance, and employer-specific restrictions, can influence the maximum borrowing amount. It is crucial to review your plan's rules and policies, be aware of IRS regulations and limitations, and consider the potential impact on your retirement savings and tax implications. Repayment terms, including the repayment period, interest rates, and fees, should also be carefully considered. Exploring alternative options and seeking professional financial advice can help you make an informed decision that aligns with your long-term financial goals.Borrowing From a 401(k) Plan

General Loan Limits

Factors Influencing the Maximum Borrowing Amount From 401(k) Plan

Vesting Schedule

Account Balance

Employer Restrictions

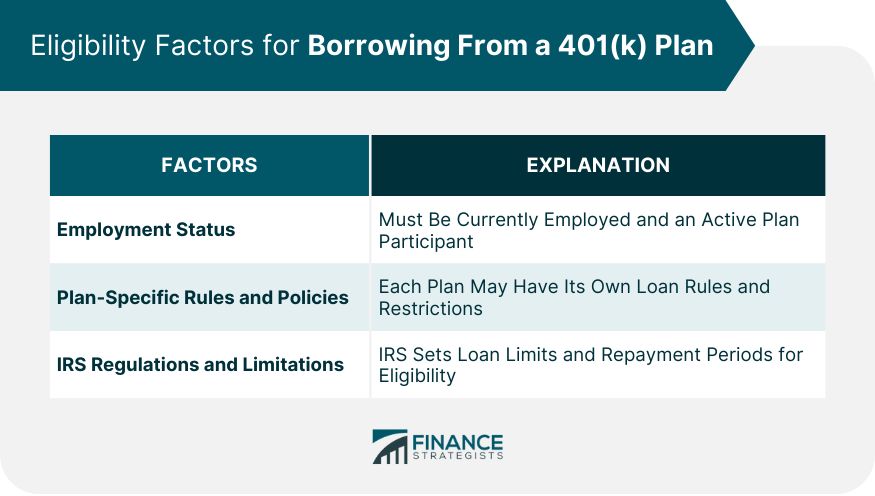

Eligibility for Borrowing From a 401(k) Plan

Employment Status and Plan Participation

Plan-Specific Rules and Policies

IRS Regulations and Limitations

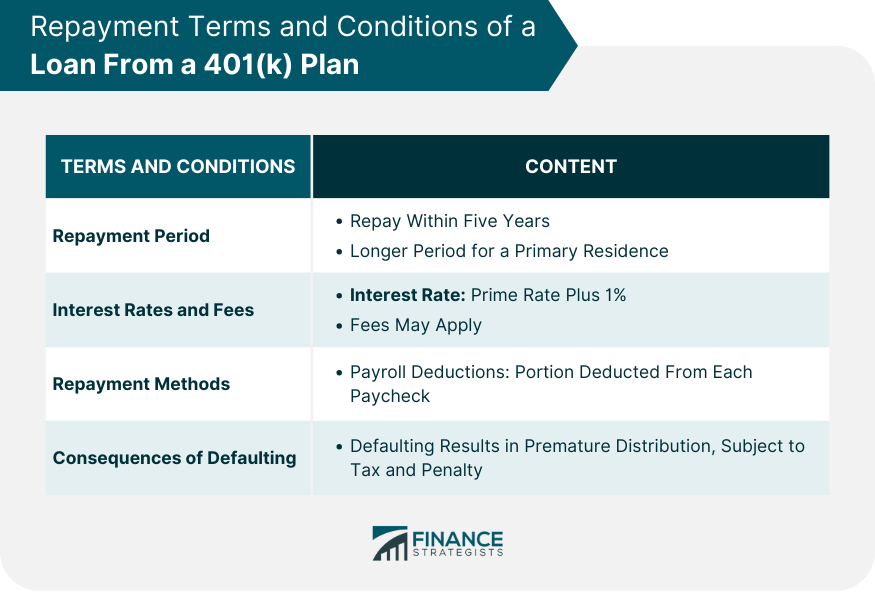

Repayment Terms and Conditions of a Loan From 401(k) Plan

Repayment Period

Interest Rates and Fees

Repayment Methods

Consequences of Defaulting on the Loan

Alternative Options to Borrowing From a 401(k) Plan

Personal Loans

Home Equity Loans or Lines of Credit

Credit Cards

Emergency Funds

Conclusion

How Much Can You Borrow From Your 401(k) Plan? FAQs

If you default on your 401(k) loan, the IRS will consider it a "deemed distribution." This means the unpaid balance is considered a withdrawal and is subject to income tax at your ordinary rate. If you're under the age of 59.5, you'll also be subject to a 10% early withdrawal penalty.

Whether you can take out a 401(k) loan and what you can use it for depends on the specific rules of your plan. While some plans may allow loans for any reason, others may only allow them for certain purposes, such as paying for education, buying a home, or medical expenses.

A 401(k) loan is a loan you take from your 401(k) account and plan to repay, typically through payroll deductions. A hardship withdrawal, on the other hand, is a withdrawal you make from your 401(k) because of an immediate and heavy financial need. Hardship withdrawals are subject to income tax and possibly an early withdrawal penalty, and unlike loans, they do not need to be repaid.

There may be fees associated with taking out a 401(k) loan. These can include origination fees, maintenance fees, or other administrative costs. The exact fees depend on your specific plan.

Yes, you can continue to make contributions to your 401(k) while you have a loan. However, these contributions will be separate from your loan repayments, and your total paycheck deduction will be the sum of your loan repayments and your ongoing contributions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.