A 401(k) loan is a borrowing option that allows individuals to access funds from their retirement savings. Instead of going through a traditional lender, individuals borrow money from their own 401(k) account. The loan must be repaid with interest, typically within a specified timeframe. Not all 401(k) plans offer loan options, so it's essential to check if your plan allows for borrowing. If eligible, there are certain limitations to consider. The maximum loan amount is usually a percentage of your vested balance, typically up to $50,000 or 50% of the account balance, whichever is lower. Additionally, there may be restrictions on the number of loans you can have outstanding at a given time. One significant risk of taking a 401(k) loan is the reduction in your retirement account balance. The borrowed amount, along with the interest, is temporarily removed from your investments, potentially affecting your long-term earnings potential. By withdrawing funds from your 401(k) account, you miss out on potential compounding growth. Even if you repay the loan with interest, the impact of lost investment returns during the loan period can significantly affect your retirement savings over time. While the repayments for a 401(k) loan are typically made with after-tax money, the interest you pay on the loan is not tax-deductible. This means you may be paying taxes on that money twice – once when it goes into your 401(k) account and again when you withdraw it during retirement. If you default on a 401(k) loan by failing to make repayments as scheduled, the loan is considered an early withdrawal. This triggers taxes on the outstanding loan balance, and if you are under the age of 59½, you may also face a 10% early withdrawal penalty. When you take a 401(k) loan, your contributions to the account are temporarily halted or reduced. This interruption can make it challenging to catch up on missed contributions, potentially derailing your retirement savings trajectory. 401(k) loans often come with the loss of employer matches during the loan repayment period. This means you miss out on the opportunity to maximize your employer's contributions, which can significantly impact your long-term retirement savings. A change in employment status, such as losing your job or switching employers, can complicate loan repayment. If you cannot repay the loan balance within the required time frame, it may lead to default and the associated tax implications and penalties. Unforeseen financial setbacks, such as medical emergencies or major expenses, can further strain your ability to repay a 401(k) loan. These unexpected events can have long-term consequences on your retirement savings and financial stability. One of the main advantages of a 401(k) loan is the speed at which you can obtain funds. Unlike traditional loans that involve lengthy application processes, a 401(k) loan allows for quick access to money during urgent situations. 401(k) loans often have lower interest rates compared to other forms of borrowing, such as credit cards or personal loans. Since you are essentially borrowing from yourself, the interest paid on the loan goes back into your own retirement account. Unlike other loans that require credit checks and qualification assessments, a 401(k) loan does not consider your creditworthiness. This makes it an attractive option for individuals with less-than-perfect credit or those who might not qualify for other types of loans. Building a robust personal budget and establishing an emergency fund are essential components of financial planning. By setting aside funds for emergencies and unexpected expenses, you can reduce the need to borrow from your retirement savings in the first place. Before considering a 401(k) loan, it's advisable to explore other loan options that may carry lower risks. For example, a home equity line of credit or a personal loan from a reputable lender might provide more favorable terms and avoid potential impacts on your retirement savings. When faced with financial decisions, it's wise to seek guidance from financial professionals. Consulting a certified financial planner or advisor can help you evaluate your options, understand the potential risks involved, and make informed choices that align with your long-term financial goals. 401(k) loans can provide individuals with quick access to funds from their retirement savings. However, it is crucial to understand and carefully consider the associated risks. The immediate risks include a potential impact on retirement savings due to a reduction in account balance and lost investment returns. Additionally, there may be tax implications and penalties, such as double taxation on loan repayments and early withdrawal penalties for defaulting on the loan. In the long term, taking a 401(k) loan can disrupt your retirement savings trajectory, making it challenging to catch up on missed contributions and causing you to miss out on employer matches and other benefits. Unemployment, job changes, and unexpected financial setbacks also increase the likelihood of defaulting on the loan. It is advisable to explore alternative options, such as personal budgeting, emergency funds, and lower-risk loan alternatives, before considering a 401(k) loan. Seeking guidance from financial professionals can help you make informed decisions that align with your long-term financial goals.Overview of 401(k) Loans

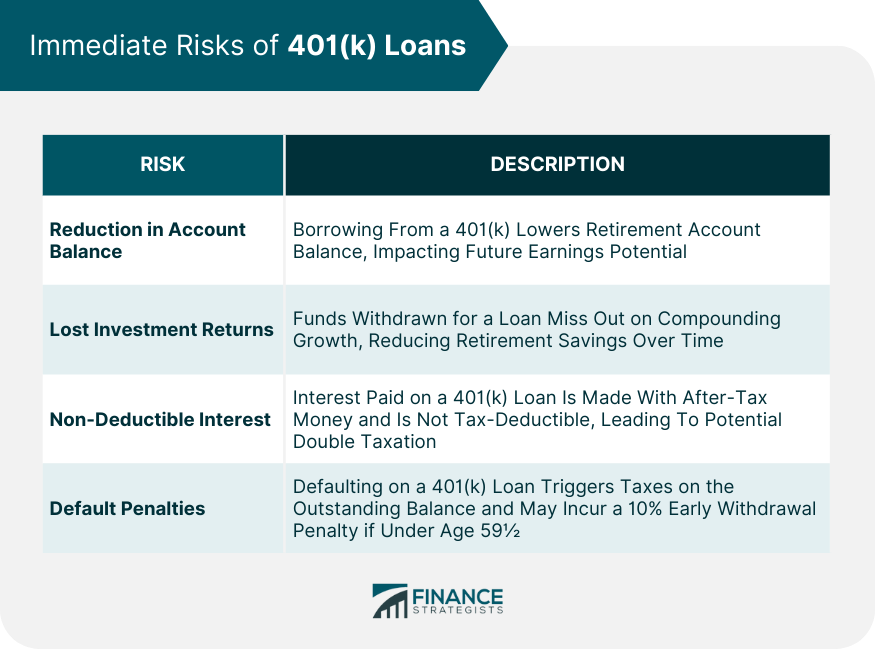

Immediate Risks of 401(k) Loans

Potential Impact on Retirement Savings

Reduction in Account Balance and Future Earnings Potential

Intensity Effect of Lost Investment Returns

Possible Tax Implications and Penalties

Tax Treatment of Loan Repayments and Interest

Early Withdrawal Penalties for Default on the Loan

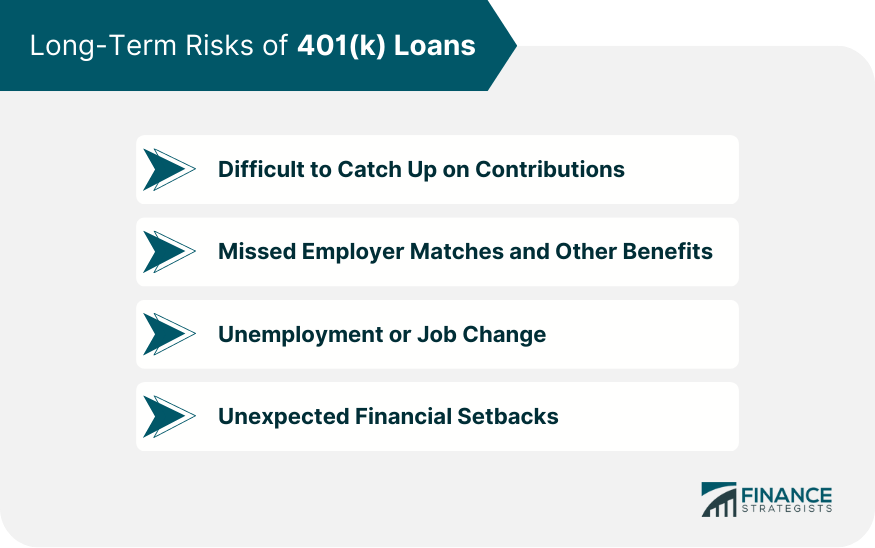

Long-Term Risks of 401(k) Loans

Disruption of Retirement Savings Trajectory

Difficult to Catch Up on Contributions

Missed Employer Matches and Other Benefits

Increased Likelihood of Defaulting on the Loan

Unemployment or Job Change

Unexpected Financial Setbacks

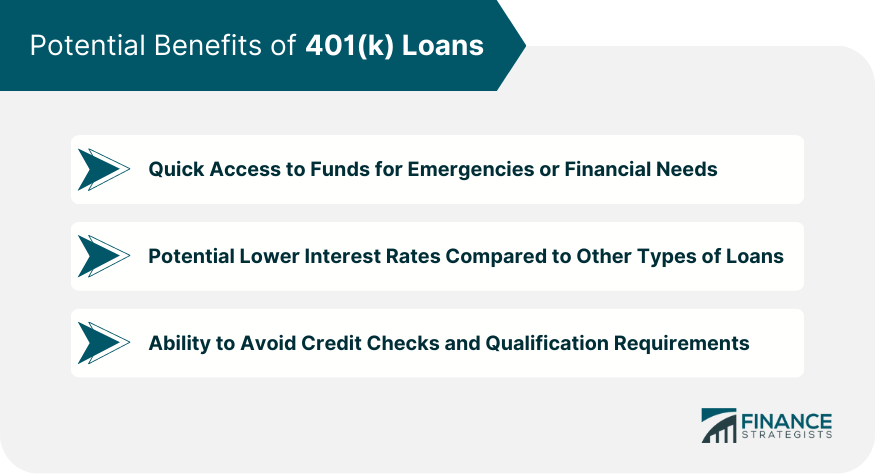

Potential Benefits of 401(k) Loans

Quick Access to Funds for Emergencies or Financial Needs

Potential Lower Interest Rates Compared to Other Types of Loans

Ability to Avoid Credit Checks and Qualification Requirements

Alternative Options to Consider

Personal Budget and Emergency Funds

Explore Other Loan Options With Lower Risks

Seek Financial Advice From Professionals

Bottom Line

401(k) Loan Risks FAQs

Immediate risks of 401(k) loans include potential reductions in retirement savings and lost investment returns due to the temporary withdrawal of funds.

Yes, there are tax implications and penalties. The interest paid on the loan is not tax-deductible, and defaulting on the loan can lead to taxes on the outstanding balance and potential early withdrawal penalties.

401(k) loans can disrupt long-term retirement savings by making it difficult to catch up on missed contributions and causing individuals to miss out on employer matches and other benefits.

Risks of defaulting on a 401(k) loan include tax implications, early withdrawal penalties, and the potential impact on an individual's financial stability and retirement savings.

Yes, alternative options include personal budgeting and emergency funds, exploring other loan avenues with lower risks, and seeking financial advice from professionals. These options can help individuals avoid the risks associated with 401(k) loans.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.