Assets, in their various forms, can serve as crucial indicators of an individual's or entity's financial stability and strength. When used as qualifying income, assets highlight the potential of generating consistent and reliable revenue streams beyond traditional wage-based earnings. For instance, real estate can be a substantial income source: a rental property not only appreciates over time but also yields regular rental income. Likewise, dividends from stocks and interest from bonds represent income derived from investments. Retirement accounts, upon reaching a certain age, permit systematic withdrawals, offering another form of steady income. Business ownership, especially if profit-sharing is involved, can also be factored in as qualifying income. Essentially, when assets generate predictable returns or have the potential for liquidation at consistent values, they can be considered as qualifying income, providing a more comprehensive view of one's financial health. Owning real estate can be a significant source of income. Rental properties, in particular, offer a steady stream of revenue from tenants. Even if the property is not rented out, it can be sold, and the equity is used as a form of income. Dividends from stocks and interest from bonds are other forms of income derived from assets. A diversified portfolio can offer periodic returns that can be considered as qualifying income, especially if there's a consistent history of dividends or interest. Upon reaching a certain age, individuals can withdraw from their retirement accounts like 401(k)s or IRAs. These withdrawals, especially if done regularly, can be considered as qualifying income. Profits from a business, especially if one holds a significant stake or ownership interest, can be another source of qualifying income. This includes dividends, profit-sharing, or even sales from business assets. Suppose you have a savings account with a market value (also known as the account balance) of $10,000, and the interest rate on this savings account is 2.5% per year. Income From Asset = $10,000 x 0.025 (2.5% Expressed as a Decimal) Income From Asset = $10,000 x 0.025 Income From Asset = $250 So, the income from this savings account would be $250 per year. Income from assets can come in the form of periodic payments or lump sums. Periodic payments, like monthly rents or quarterly dividends, provide a steady stream of income. On the other hand, lump sums, like the sale of a property or a business, offer a one-time large payment. Market Volatility: The value of assets, especially stocks, can fluctuate based on market conditions. This can affect the income one can derive from these assets. Interest Rates: Changes in interest rates can impact the returns from bonds and other interest-bearing assets. Depreciation: Over time, tangible assets like real estate or machinery might depreciate in value, impacting the potential income from such assets. Asset Performance: The performance of a particular asset, like the profitability of a business or the yield of a bond, can directly impact the income derived from it. Different jurisdictions have various regulations about what counts as qualifying income. For example, some might only recognize certain kinds of assets or require a specific period of asset performance history. Income from assets is often subject to taxes. Depending on the jurisdiction, there might be capital gains tax, income tax, or other relevant taxes. It's essential to understand the tax implications when considering assets as qualifying income. Using assets as qualifying income isn't without risks. Market downturns, asset depreciation, or sudden changes in economic conditions can impact asset values. It's crucial to diversify assets, regularly review asset performance, and possibly seek professional financial advice. Assets, regardless of their type, face exposure to unpredictable market fluctuations and wider economic challenges. Real estate, for example, is not immune; property values can experience sharp declines during economic downturns. Moreover, geopolitical tensions, inflation rates, and changes in governmental policies can also influence the market, further amplifying these risks. It's important to recognize that no asset class is entirely immune to these broad economic shifts, and hence, their ability to serve as a stable qualifying income can be compromised. While some assets can be promptly liquidated, others require more time and effort. Stocks, being a part of a dynamic market, can usually be sold relatively quickly. In contrast, tangible assets like real estate or rare collectibles may demand more time to find a suitable buyer, especially at desired price points. This extended time frame can hinder one's ability to quickly leverage them as an immediate income source, especially in urgent financial situations Assets, by their very nature, don't always maintain a consistent value. They can appreciate, bringing in higher returns or depreciating, leading to potential losses. Diversifying the asset portfolio is one primary way to handle such fluctuations, as the performance of one asset might offset the decline of another. Additionally, staying informed about market trends and making periodic adjustments or rebalancing can help maintain a portfolio's target asset allocation and risk levels. Addressing the challenges of using assets as qualifying income requires a strategic approach. Diversification, spreading investments across various asset classes, is a key tactic to reduce the potential impact of a poorly performing asset. Investing in traditionally stable assets, such as bonds or blue-chip stocks, can offer more security. Hedging strategies, which involve taking an offsetting position in a related security, can also safeguard against market volatility. Collaborating with financial experts equipped with deep market insights and tailored advice can be invaluable in navigating the complexities and ensuring that assets consistently serve as reliable qualifying income sources. Assets play a pivotal role in augmenting an individual's or entity's financial profile by serving as qualifying income. From real estate's dual benefits of appreciation and rental income to the dividends from stocks and regular withdrawals from retirement accounts, these assets diversify income sources beyond conventional wage earnings. It's essential to understand their liquidity, the potential for value fluctuations, and the associated market risks. Proper management strategies, like diversification and hedging, can alleviate some challenges posed by these uncertainties. Yet, the regulatory framework and tax implications further underscore the importance of informed decisions when leveraging assets in this capacity. Collaborating with financial experts and staying abreast of market trends ensures that assets remain a robust and reliable income qualifier.How Can Assets Be Used as Qualifying Income?

Types of Assets That Can Be Used as Qualifying Income

Real Estate

Stocks and Bonds

Retirement Accounts

Business Ownership Interests

Calculating Income From Assets

Formula and Calculation

Periodic Payments vs Lump Sum

Factors Affecting Income Calculation From Assets

Legal and Financial Aspects of Using Assets as Qualifying Income

Regulatory Framework and Requirements

Tax Implications

Risk Management and Mitigation Strategies

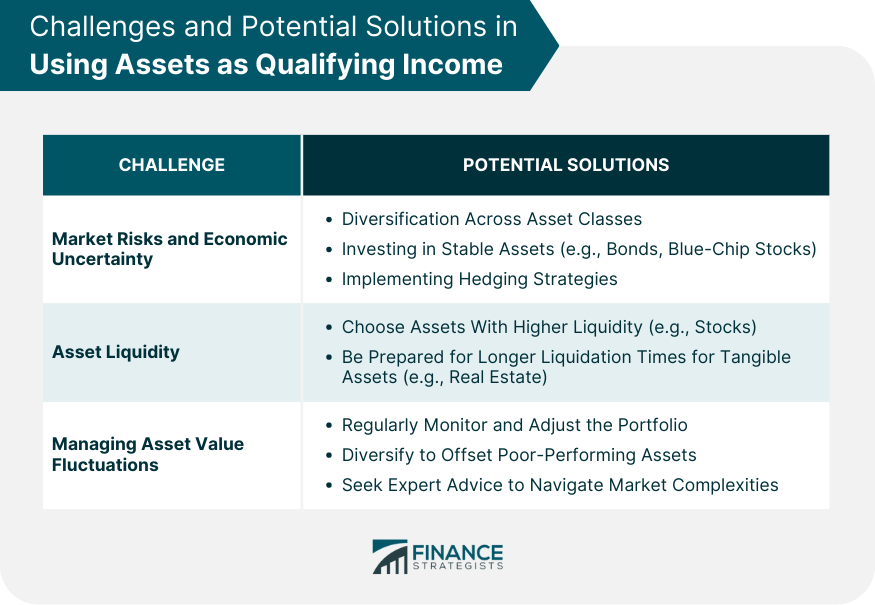

Challenges and Potential Solutions in Using Assets as Qualifying Income

Market Risks and Economic Uncertainty

Asset Liquidity

Managing Asset Value Fluctuations

Potential Solutions

Bottom Line

Assets as Qualifying Income FAQs

Assets are tangible or intangible resources with potential economic value. In the context of qualifying income, assets are resources that can generate a steady stream of revenue, such as rental income from real estate, dividends from stocks, or withdrawals from retirement accounts.

Income from assets is typically calculated by multiplying the total value of the asset by its rate of return or yield. For example, a rental property worth $500,000 with an annual return of 5% would generate an income of $25,000.

Income from assets is often subject to various taxes, such as capital gains tax or income tax, depending on the jurisdiction and the type of income. It's essential to consult local tax regulations or a tax professional to understand the specific implications of your situation.

Challenges can be mitigated by diversifying the asset portfolio, investing in more stable assets, and considering hedging strategies. Regularly reviewing asset performance, rebalancing the portfolio, and seeking professional financial advice can also help manage potential risks.

Yes, different jurisdictions have various regulations about what counts as qualifying income. Some might only recognize specific types of assets, or they might require a certain period of asset performance history. It's vital to understand local regulations or work with a financial expert familiar with the specific requirements.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.