Delayed Financing Exception is a boon for savvy real estate investors and buyers. In essence, it's a refinancing method tailored for those who've made property purchases outright with cash. Traditionally, there's a waiting period before a recently purchased property can be refinanced. However, with the Delayed Financing Exception, this waiting game is virtually eliminated, allowing individuals to refinance their property almost immediately after their cash purchase. It provides immediate liquidity, giving cash buyers the flexibility to regain most of their investment swiftly. This method not only supports the dynamism of the real estate market by incentivizing cash transactions but also ensures that significant funds aren't tied up in assets for prolonged periods. In essence, it merges the benefits of both cash purchases and traditional financing, offering a middle ground with notable financial advantages. Not all properties qualify for this exception. Primary residences, second homes, and investment properties often do, but commercial properties and other unique real estate types might not. It's essential to check with a lending institution about specific eligibility requirements. While the delayed financing exception accelerates the refinancing process, there's still a brief window—usually a month or so—after the cash purchase, during which refinancing cannot occur. Lenders typically require proof of the original cash transaction, ensuring the property was indeed bought without traditional financing methods. This often entails presenting settlement statements and other pertinent documentation. The ability to quickly free up cash is, without a doubt, the most significant advantage of the Delayed Financing Exception. Buyers who have spent a substantial sum in a cash transaction can retrieve most of their liquidity, enabling them to have ready cash for other potential investments or necessities. Purchasing with cash often provides buyers with an edge in property negotiations. Sellers are generally inclined towards cash offers as they eliminate uncertainties tied to loan approvals. With the Delayed Financing Exception, buyers can maintain this edge while still accessing the benefits of financing post-purchase. Having already completed a cash purchase, buyers might find themselves in a more favorable position when approaching lenders. As a result, they may secure better loan terms, reduced interest rates, or more flexible repayment structures than they would with traditional financing. The Delayed Financing Exception doesn't mean sacrificing the benefits of a cash purchase. Buyers can still enjoy swift closings, reduced need for certain contingencies, and stronger positions in competitive markets. At the same time, they can regain liquidity, blending the best of both cash and financed transactions. For investors, in particular, this mechanism offers the flexibility of swiftly moving funds between properties or other investment avenues. By not having their capital tied up for extended periods, they can seize new opportunities as they arise. Since the Delayed Financing Exception allows for quicker refinancing, buyers might end up paying less interest over time compared to traditional mortgage refinancing, especially if they decide to pay off the loan faster given the equity they already have in the property. Most lenders will have a cap on the amount they're willing to lend, regardless of the property's value. The LTV ratio, which is the ratio of a loan to the value of an asset purchased, is an essential consideration. The Delayed Financing Exception doesn't always guarantee the most favorable interest rates. The rate you're offered can be influenced by various factors, including market conditions, your creditworthiness, and the lender's policies. Because of the expedited nature of delayed financing, some associated costs might be higher than with standard refinancing. Not all lenders offer the Delayed Financing Exception, as it's a specialized refinancing method. There's always a risk that a lender might decline the refinancing application if they find discrepancies in documentation or if the property's appraisal doesn't meet their expectations. Property values can fluctuate, and if the value of your property decreases shortly after purchasing, this could impact the amount you can refinance. The Delayed Financing Exception, being a unique financial mechanism, is not as well-known as other refinancing methods. To begin the process, a buyer will typically reach out to a mortgage broker or lender familiar with the delayed financing exception. Their expertise can guide the buyer through the intricacies of this specialized refinancing method. Proof of the cash transaction is paramount. This can include bank statements showing the withdrawal for the purchase, the property's closing statement, and sometimes, even proof of the source of the funds. An up-to-date property appraisal might also be required to determine the current value and thus the amount that can be refinanced. While quicker than traditional refinancing, the process isn't instantaneous. Delays can arise from incomplete documentation, appraisal discrepancies, or unforeseen lender issues. It's advisable to be prepared for potential roadblocks. The primary distinction is, of course, the speed. While traditional refinancing may require a waiting period (often six months post-purchase), the delayed financing exception dramatically shortens this timeframe. Standard refinancing could see buyers waiting for months to access funds, but with the delayed financing exception, this period is significantly reduced, offering quicker liquidity. Like all refinancing, there are costs involved. However, because of the expedited nature of delayed financing, sometimes these costs can be slightly higher than those of traditional refinancing. Each lending institution will have its fee structure, so it's crucial to compare and contrast. Given that the buyer originally purchased the property with cash, the equity situation is different than if they had utilized traditional financing. With the delayed financing exception, the loan-to-value ratio might be more favorable, meaning the homeowner retains a significant amount of equity post-refinance. Delayed Financing Exception serves as an innovative strategy for real estate enthusiasts, especially those making cash purchases. It significantly reduces the refinancing waiting period, offering immediate liquidity and retaining the perks of a cash transaction. Such flexibility is pivotal in a dynamic real estate market. While it offers a series of benefits such as leverage in negotiations and potential for attractive loan terms, it's imperative to acknowledge the associated risks like fluctuating interest rates and limited lender availability. Moreover, understanding property qualifications and navigating the refinancing process with a well-informed lender ensures a smoother experience. In comparing this method to traditional refinancing, the defining advantage is its speed and agility in accessing funds. Ultimately, the Delayed Financing Exception bridges the gap between immediate cash purchases and the realm of financing, presenting a valuable alternative in property transactions.Delayed Financing Exception Overview

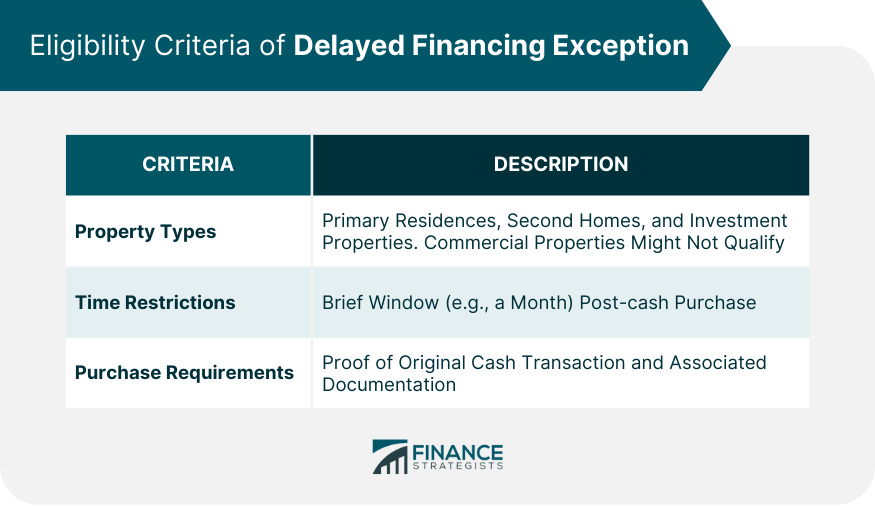

Eligibility Criteria of Delayed Financing Exception

Property Types and Qualifications

Time Restrictions

Previous Property Purchase Requirements

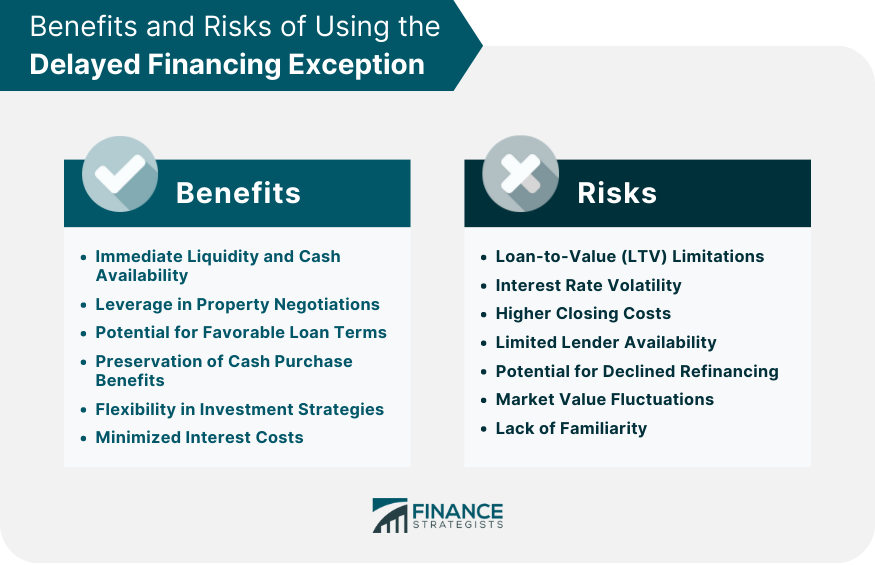

Benefits of Using the Delayed Financing Exception

Immediate Liquidity and Cash Availability

Leverage in Property Negotiations

Potential for Favorable Loan Terms

Preservation of Cash Purchase Benefits

Flexibility in Investment Strategies

Minimized Interest Costs

Risks of Using the Delayed Financing Exception

Loan-to-Value (LTV) Limitations

Interest Rate Volatility

Higher Closing Costs

Limited Lender Availability

Potential for Declined Refinancing

Market Value Fluctuations

Lack of Familiarity

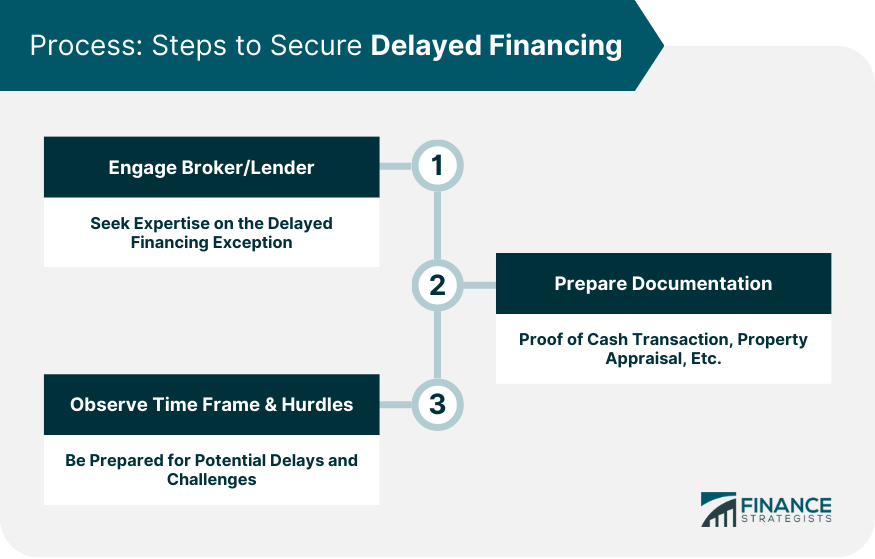

Steps to Secure Delayed Financing

Engage With a Mortgage Broker or Lender

Provide Required Documentation

Observe Time Frame and Potential Hurdles

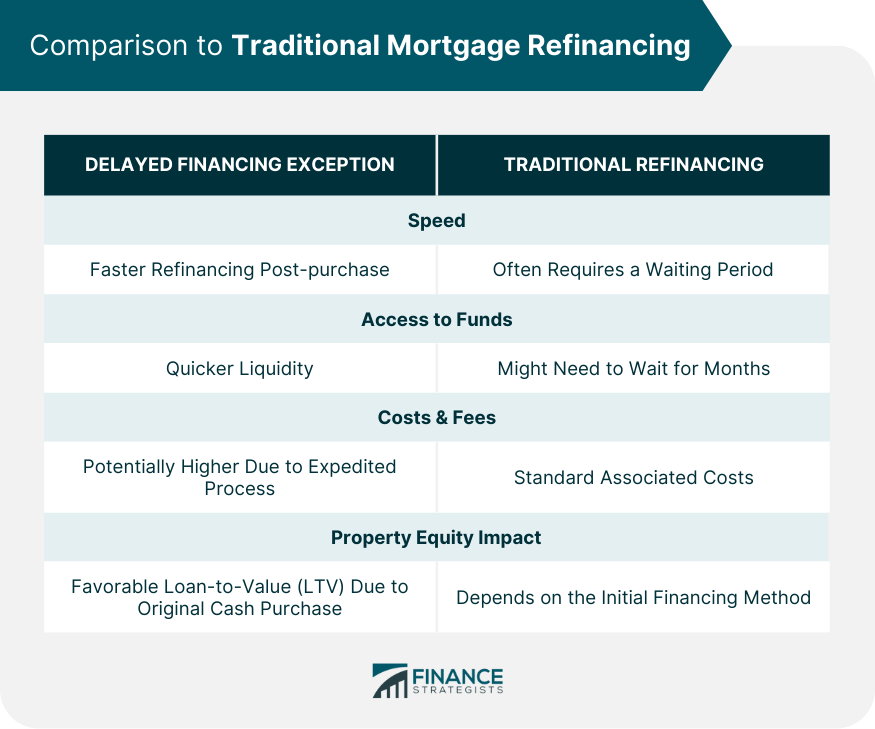

Comparison to Traditional Mortgage Refinancing

Key Differences

Time to Access Funds

Costs and Fees Comparison

Impact on Property Equity

Conclusion

Delayed Financing Exception FAQs

The Delayed Financing Exception is a refinancing method that allows individuals who've purchased the property with cash to refinance almost immediately, bypassing the typical waiting period associated with standard refinancing.

The Delayed Financing Exception was introduced to incentivize cash transactions in the real estate market, ensuring that liquidity isn't tied up in assets for extended periods.

No, not all properties qualify. While primary residences, second homes, and investment properties often do, certain properties, like commercial ones, might not be eligible. It's best to consult with a lending institution about specific criteria.

The main difference lies in the speed. While traditional refinancing might require a buyer to wait for several months post-purchase, the Delayed Financing Exception significantly shortens this timeframe, offering faster access to liquidity.

Yes, there can be drawbacks, including potential limitations on the loan-to-value ratio, varying interest rates based on individual circumstances, and potentially higher closing costs when compared to traditional refinancing.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.