Fannie Mae Maximum DTI, or Debt-to-Income ratio, is a pivotal metric in the mortgage landscape. This ratio, set by Fannie Mae, measures the percentage of a borrower's monthly gross income that goes toward paying debts. It's a tool lenders use to assess a borrower's ability to manage and repay their mortgage. By setting a maximum DTI, Fannie Mae ensures borrowers don't take on more housing debt than they can realistically handle, thereby mitigating the risk of default. In essence, this benchmark serves as a financial guardrail, guiding both lenders and borrowers in making responsible and sustainable home financing decisions. To calculate DTI, it's imperative to consider all monthly debt payments. This can include: Credit card payments Student loans Car loans Other monthly obligations Once the total monthly debt is determined, it's divided by the borrower's gross monthly income. The result is the DTI. Fannie Mae often revisits and revises the maximum DTI threshold based on housing trends, economic conditions, and historical loan performance data. Over the years, this figure has adjusted to reflect the evolving nature of borrower risk and the overall health of the housing market. Fannie Mae's maximum DTI is rooted in protecting consumers and the housing market. By setting this limit: Borrowers are less likely to become over-leveraged. The overall lending process maintains its integrity, minimizing the risk of widespread defaults. By having a clear DTI standard, Fannie Mae: Provides lenders with a unified benchmark, streamlining the loan origination process. Ensures the health of the secondary mortgage market, wherein loans are bought and sold after their origination. DTI doesn’t always capture the entire story for the following scenarios: Individuals With high incomes but equally high monthly expenses, the maximum DTI might hinder their borrowing capability. Certain situations, such as unpredictable bonuses, may not be accurately represented by the DTI. There are other crucial financial factors that the DTI might not capture: Borrower's savings and other assets Changes in a borrower’s financial situation after getting the loan, like a significant promotion or inheritance For potential homeowners aiming to get a mortgage under Fannie Mae's guidelines, improving one's DTI can be a game-changer. Consider: Actively paying down high-interest debt. Exploring avenues to increase your income, like side hustles or seeking promotions. If Fannie Mae's maximum DTI proves to be a hurdle, borrowers have alternatives: Non-conforming loans, which don't adhere to Fannie Mae’s standards, might be a viable route. Seeking out lenders who don't underwrite with Fannie Mae might also provide more flexibility in loan terms. Reduce Debt: One of the most direct ways to enhance your DTI is by paying off outstanding debts. This could include credit card balances, car loans, or other personal loans. Increase Your Income: If you can boost your monthly income, whether through a raise, taking on a side job, or other means, it can positively impact your DTI. When applying for a mortgage, ensure that all your debts are visible and declared. Hidden debts that surface later can complicate the approval process. If you have consistent non-traditional income sources, such as freelance work or rentals, ensure these are documented and included. They can positively impact your income, thus enhancing your DTI. Review monthly subscriptions, memberships, or other recurring expenses. Reducing non-essential commitments can free up more of your monthly income, improving your DTI. If your DTI doesn't align with Fannie Mae's standards, don't lose hope. There are alternative financing solutions, like non-conforming loans, that might offer more flexibility in their criteria. Lastly, remember that financial benchmarks like the Fannie Mae Maximum DTI can change. Regularly review the latest guidelines to ensure you're well-prepared when applying for a mortgage. DTI limits haven't always been static. Depending on the economic landscape, Fannie Mae has made adjustments, reflecting a balance between accessibility to loans and ensuring responsible lending. As the economy, housing market, and borrower profiles continue to evolve, shifts in Fannie Mae's maximum DTI can be expected. Such adjustments will invariably influence both lenders and borrowers, dictating loan accessibility and terms. Fannie Mae's Maximum DTI stands as an essential yardstick in the mortgage domain. Calculated by dividing a borrower's total monthly debts by their gross income, this ratio is pivotal in gauging an individual's capability to manage and repay mortgages. The DTI serves a dual purpose: safeguarding borrowers from taking on unmanageable debt and ensuring the stability of the housing market. While it offers a standardized metric for lenders, it's essential to note that it might not always capture a borrower's complete financial narrative. Consequently, potential homeowners should not only strive to align with Fannie Mae's guidelines but also be aware of alternative financing avenues and stay updated with evolving standards. In the dynamic landscape of home financing, understanding and adapting to the nuances of metrics like the Fannie Mae Maximum DTI becomes paramount for both lenders and borrowers.What Is Fannie Mae Maximum DTI?

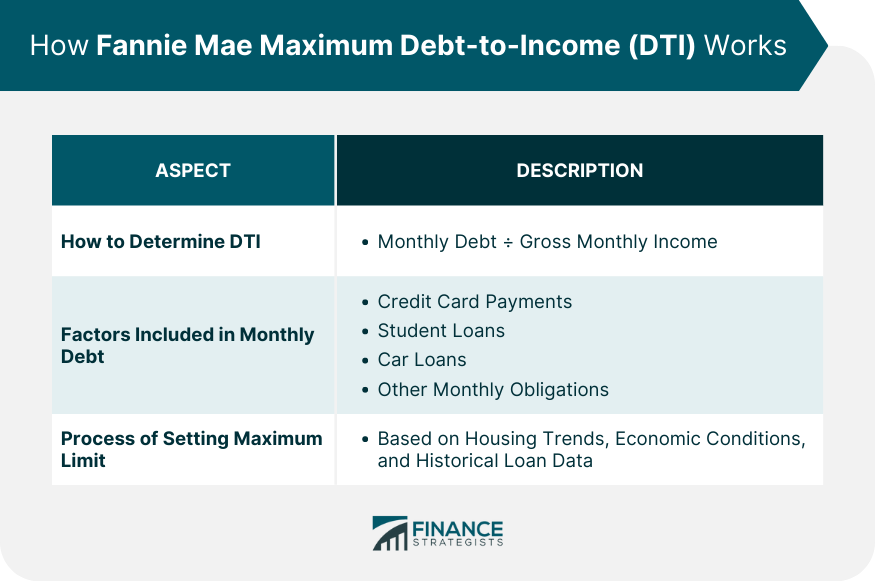

How Fannie Mae Maximum DTI Works

Determine DTI

Setting the Maximum Limit

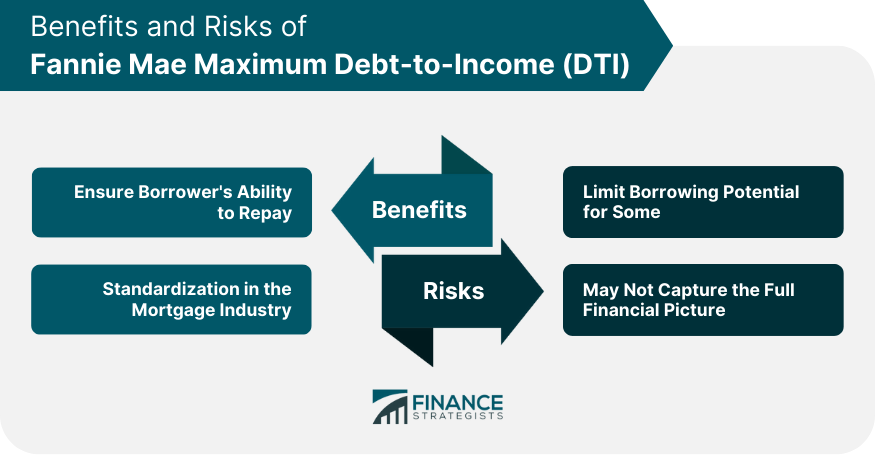

Benefits of Fannie Mae Maximum DTI

Ensure Borrower's Ability to Repay

Standardization in the Mortgage Industry

Risks of Fannie Mae Maximum DTI

Limit Borrowing Potential for Some

May Not Capture the Full Financial Picture

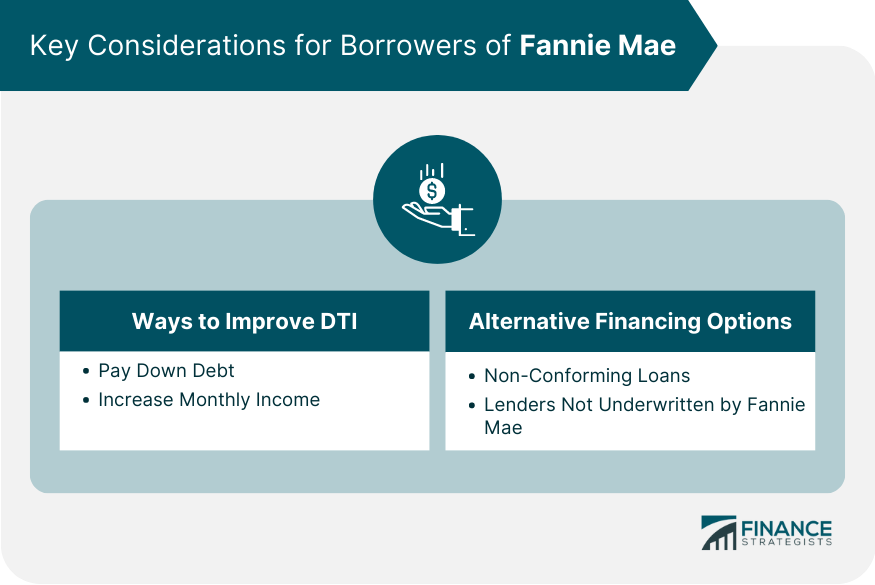

Key Considerations for Borrowers

Ways to Improve DTI Before Applying for a Mortgage

Alternative Financing Options

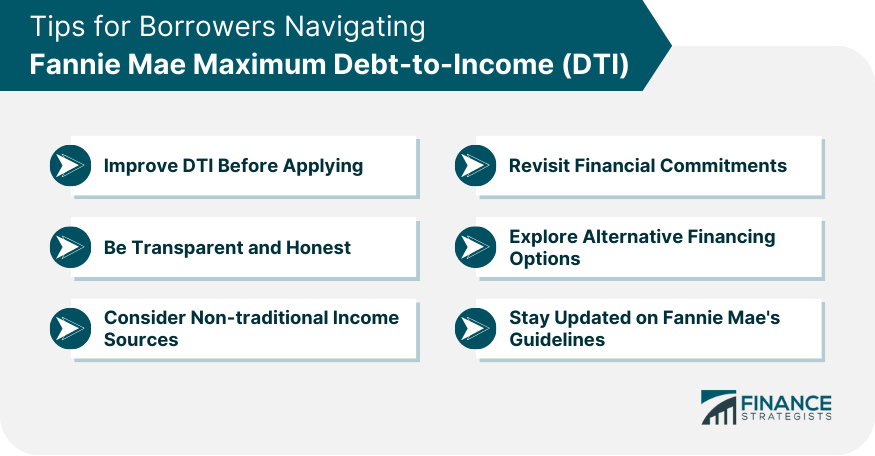

Tips for Borrowers Navigating Fannie Mae Maximum DTI

Improve Your DTI Before Applying

Be Transparent and Honest

Consider Non-Traditional Income Sources

Revisit Financial Commitments

Explore Alternative Financing Options

Stay Updated on Fannie Mae's Guidelines

Evolving Nature of Fannie Mae Maximum DTI

Historical Changes in DTI Limits

Potential Future Adjustments and Their Implications

Conclusion

Fannie Mae Maximum DTI FAQs

The Fannie Mae Maximum DTI (Debt-to-Income ratio) is a threshold set by Fannie Mae to evaluate a borrower's ability to manage and repay a mortgage. It's calculated by dividing a borrower's total monthly debt payments by their gross monthly income.

The Fannie Mae Maximum DTI is crucial because it helps lenders determine if borrowers can afford their loans. A lower DTI indicates that the borrower has a good balance between debt and income, making them a potentially lower risk.

While Fannie Mae has its DTI guidelines, there are other financing options and loan programs available that might have more flexible criteria. If your DTI exceeds Fannie Mae's threshold, you can explore non-conforming loans or other lenders not underwritten by Fannie Mae.

To better align with Fannie Mae Maximum DTI guidelines, consider paying down existing debts, increasing your monthly income, or adjusting other financial obligations.

The Fannie Mae Maximum DTI has been adjusted historically based on housing trends, economic conditions, and loan performance data. While it doesn't change frequently, it can be modified to reflect the current state of the housing market and the economy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.