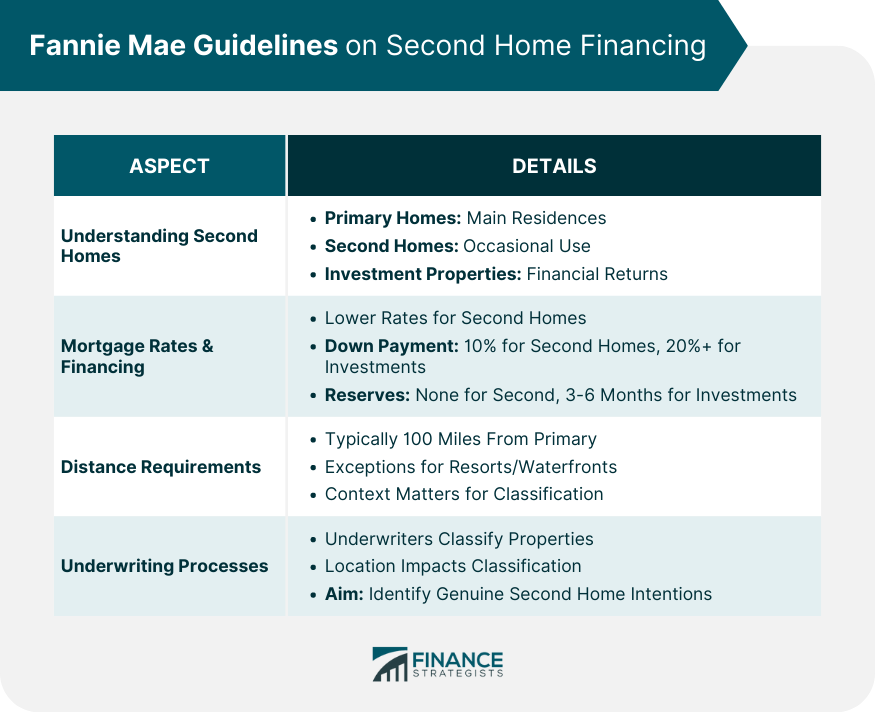

Fannie Mae, formally known as the Federal National Mortgage Association (FNMA), is a government-sponsored enterprise (GSE) in the United States. Established in 1938, its primary mission is to ensure liquidity, stability, and affordability in the housing market. Fannie Mae doesn't originate or provide mortgages to homeowners directly. Instead, it purchases mortgages from banks and other lending institutions, which allows these lenders to free up funds to offer more home loans. By doing this, Fannie Mae ensures that money is consistently available for mortgages, irrespective of economic conditions. This purchase of mortgages is then bundled together and sold as mortgage-backed securities to investors. Over the years, Fannie Mae's role has been pivotal in making homeownership accessible for millions of Americans, acting as a cornerstone of the residential mortgage market. Navigating the world of mortgages reveals nuances that, though may seem trivial, hold weight in the financing arena. Primary owner-occupant homes, for instance, represent the homeowner's main residence, a space they will live in for most of the year. Comparatively, second homes follow suit but with the variance of occasional use, while investment properties take on a whole new meaning, primarily designed for income generation or capital appreciation. Second homes serve as vacation getaways or family retreats, while investment properties primarily exist for financial returns through renting or resale. When it comes to financing, second homes generally stand on more favorable ground. They typically feature lower interest rates than investment properties, further enticing homeowners to consider this venture. This preferential treatment is primarily attributed to the perceived lower risk associated with second homes. However, no financial decision comes without its parameters. Acquiring a second home does demand certain prerequisites. One of the most notable is the down payment requirement which, for second homes, typically starts at 10%. This contrasts with the heftier 20% or more often demanded for investment properties. Furthermore, while second home financing is free from reserve requirements, investment homes might call for reserves ranging from three to six months. The geographic placement of a second home also plays into Fannie Mae's guidelines. Typically, the unwritten rule emphasizes that the second home should be at least 100 miles away from the primary residence. This criterion, however, is flexible. For instance, proximity to popular resort areas or waterfront locations can provide plausible rationale for closer distances. Understanding the reason behind this is straightforward. A nearby property could be perceived as an investment opportunity, rather than a genuine need for a second home. But if someone from Chicago, for example, wished to buy a waterfront property just a few miles away, the context of its location would justify its classification as a second home. Diving deeper into the decision-making process, mortgage underwriters hold the keys. Their job? Classifying properties as either second homes or investment properties. Naturally, a home in Florida purchased by someone from Illinois would raise no eyebrows. But a property in a Chicago suburb? That’s bound to invite scrutiny. The essence here lies in the property making sense as a second home. Underwriters are seasoned professionals, experienced in distinguishing genuine purchases from those with hidden intentions. While both can be vehicles for financial growth, investment properties and second homes cater to different needs. An investment property is primarily about returns. Think rental income, tax benefits, and eventual resale value. In contrast, second homes provide homeowners with a personal retreat, a place to unwind or to spend holidays. Yet, from a lender's perspective, risks associated with investment properties are generally higher. After all, financial return is uncertain and fluctuates based on market dynamics. This variability translates into stringent lending criteria for investment properties as opposed to second homes. It's universally acknowledged in the financial sphere: higher risks equate to higher costs. Hence, the interest rates for investment properties are usually steeper than those for second homes. Investment properties inherently carry greater uncertainties, especially in volatile markets. In the same vein, second homes, perceived as lower risk, enjoy more favorable rates. This distinction, though seemingly slight, can result in significant savings over the tenure of a mortgage. The realm of real estate financing is peppered with various requirements, with the down payment being a pivotal one. Investment properties, given their risk profile, often demand heftier down payments—sometimes upwards of 20%. Second homes, conversely, can be secured with a more modest 10% upfront. These variations underscore the lender's perspective on risk. A more substantial down payment on investment properties acts as a buffer, safeguarding the lender's interests amidst market volatilities. The financial journey doesn't end with mortgage payments. Both second homes and investment properties come bundled with tax implications. Investment properties, for example, allow owners to deduct expenses related to upkeep and maintenance. Simultaneously, they might be subjected to capital gains tax upon sale. On the other hand, second homes, if rented out for less than 14 days a year, can offer tax-free rental income. Yet, they also come with their unique set of deductions and liabilities, emphasizing the importance of thorough financial planning. A common misconception is that one must own a primary residence to qualify for a second home. Not so with Fannie Mae's guidelines. Whether you're renting, living with family, or in any other living situation, the possibility of owning a second home remains intact. Take, for instance, an individual residing with parents in New York, yet yearning for sunnier days in California. Under Fannie Mae, they can indeed secure the Californian property as a second home, provided they meet other eligibility criteria. Eligibility isn't solely about property types and locations. Financial health plays a crucial role. A typical requirement for second homes under Fannie Mae is a 10% down payment. Yet, that's just one piece of the puzzle. Lenders meticulously evaluate the borrower's debt-to-income (DTI) ratio. This metric, gauging monthly debt obligations against gross income, aids lenders in determining a borrower's capability to manage repayments. Notably, both the primary and proposed second home mortgages weigh in on this calculation. Financial hiccups, like bankruptcy, can be daunting. However, they aren't necessarily full stops on dreams of owning a second home. Fannie Mae provides clear guidance on waiting periods post-bankruptcy, with durations varying based on bankruptcy type. Furthermore, foreclosure, another financial setback, comes with its set of timelines. These stipulations are designed to ensure that borrowers have recuperated financially before venturing into a new mortgage. While guidelines provide structure, every financing journey is unique. Special circumstances abound, and Fannie Mae recognizes this. Whether it's a unique property type or an unconventional employment scenario, underwriters wield the discretion to evaluate on a case-by-case basis. Underwriters aren't mere gatekeepers; they're trained professionals attuned to nuances. Their role, though pivotal, is rooted in understanding individual circumstances, ensuring the right borrowers get the right loans. Fannie Mae’s guidelines aren't mere red tape. They hold tangible implications for borrowers. On the bright side, they pave the way for well-structured, affordable financing solutions for second homes. However, navigating them requires diligence and an understanding of the nuances involved. Borrowers benefit from these guidelines, which aim to ensure that financing is available to deserving candidates. Yet, they also pose challenges, making it crucial for borrowers to familiarize themselves with requirements and criteria. Beyond the property's nature and its geography, individual financial profiles stand central to loan approvals. Two critical components surface: credit history and stability of income. A robust credit score acts as testament to a borrower's financial discipline, while consistent income provides reassurance on the repayment front. Yet, it's a holistic picture that underwriters seek. A less-than-stellar credit score might be balanced out by a sizable down payment or significant savings. Every financial story is unique, and Fannie Mae’s guidelines are designed to accommodate this diversity. Guidelines, while structured, need not be daunting. With the right strategies, borrowers can position themselves favorably. Research, for starters, acts as a formidable ally. Familiarizing oneself with down payment norms, interest rates, and property distinctions can ease the process considerably. Moreover, potential pitfalls await the uninformed. Yet, with proper guidance and understanding, these can be avoided. Whether it's ensuring the property aligns with second home classifications or maintaining a healthy DTI ratio, the journey to securing second home financing, though intricate, is certainly achievable. Navigating the realm of second home financing under Fannie Mae’s guidelines reveals a landscape teeming with nuance and opportunity. These guidelines, grounded in ensuring market stability, liquidity, and affordability, serve as both a beacon and a safeguard for prospective borrowers. Whether delineating between primary homes, second homes, and investment properties or understanding the intricacies of mortgage rates and down payment requisites, each parameter holds weight. Furthermore, while individual financial profiles and histories play pivotal roles, the overarching narrative is clear: Fannie Mae's guidelines are crafted to ensure a balanced and accessible housing market. As borrowers step into this world, armed with knowledge and diligence, the path to homeownership, even for a second home, emerges as both an achievable and rewarding journey.Overview of Fannie Mae

Fannie Mae Guidelines on Second Home Financing

Understanding Second Homes

Mortgage Rates and Financing Requirements for Second Homes

Distance Requirements and Their Rationale

Underwriting Processes for Second Homes

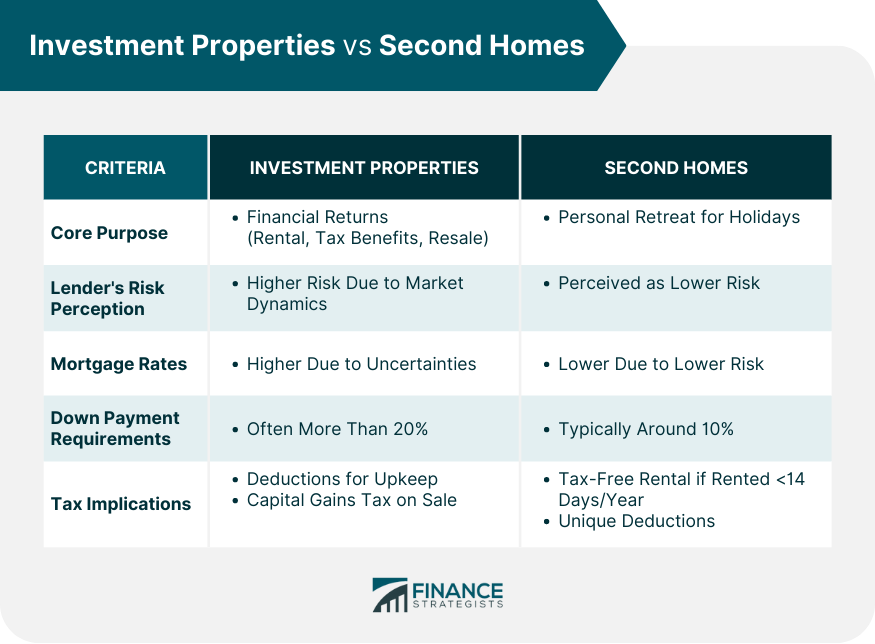

Investment Properties vs Second Homes

Core Differences

Mortgage Rates Comparison

Down Payment Requirements

Tax Implications

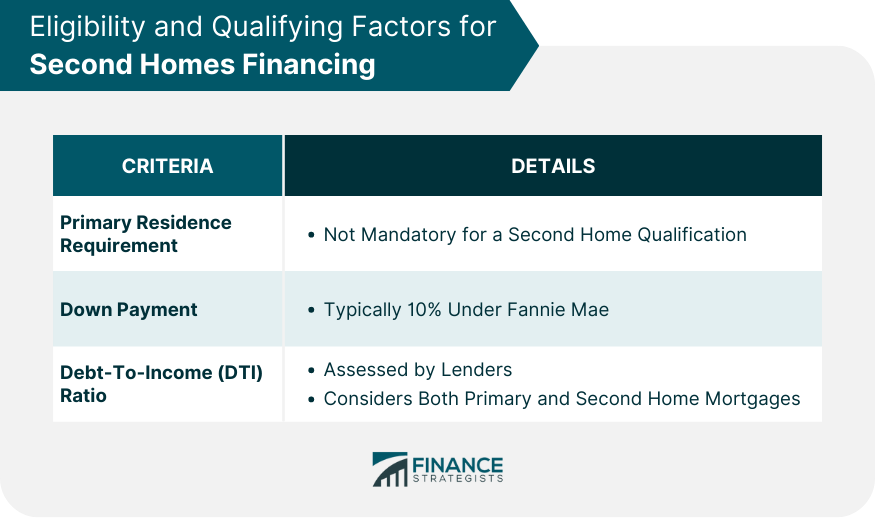

Eligibility and Qualifying Factors for Second Homes Financing

Primary Residence Not a Prerequisite

Down Payment and Debt to Income Ratios

Special Circumstances of Second Homes Financing

Second Home Financing Post-Bankruptcy

Exceptions and Other Considerations

Implications for Borrowers

Understanding the Impact of Fannie Mae Guidelines

Factors Influencing Loan Approval

Strategies for Navigating the Guidelines

Bottom Line

Fannie Mae Guidelines on Second Home Financing FAQs

They provide criteria for purchasing second homes, covering down payment, distance requirements, and underwriting processes.

Second homes are meant for personal use, while investment properties are primarily for generating income or capital appreciation.

Yes, typically a second home should be at least 100 miles away from the primary residence, though there are exceptions.

A 10% down payment is generally the minimum requirement for second homes.

Fannie Mae has waiting periods post-bankruptcy, with durations varying based on the bankruptcy type. Foreclosures also come with specific timelines.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.