The Fannie Mae Multifamily Loan is a specialized financial solution crafted to support real estate investors and developers in the multifamily housing sector. Operating under Fannie Mae's Delegated Underwriting and Servicing (DUS) program, this loan is tailored to the unique needs of multifamily property owners. Rather than a one-size-fits-all approach, it offers a suite of products catering to various property types, from traditional apartments to senior residences and student housing. The loan boasts competitive interest rates, flexible terms, and often non-recourse structures, making it a sought-after choice for many in the real estate industry. Whether you're aiming to purchase, refinance, or rehabilitate multifamily properties, the Fannie Mae Multifamily Loan serves as a reliable financing cornerstone. The journey begins with the borrower submitting a detailed application to a DUS lender, elaborating on the property's specifics and financial position. After thorough vetting, the DUS lender gives a preliminary nod, setting the stage for further scrutiny. At this juncture, an intensive examination of the property's physical and financial aspects occurs. Expect property inspections, appraisals, and market analyses. With due diligence cleared, loan documents are drafted and agreed upon, and the loan is finally disbursed. Eligibility encompasses a diverse range of properties, from traditional apartments to targeted housing like senior or student residences. A stipulated occupancy rate, generally above 85%, ensures the viability of the investment. Loans can range from short-term (5-10 years) to long-term (up to 30 years), with amounts varying based on property type and borrower qualification. Targeted at smaller properties, these loans typically cater to projects requiring less substantial amounts. This variant addresses properties offering reduced rents to low-income households. Tailored for properties housing senior citizens, ensuring they have safe and accessible living spaces. These loans cater to properties hosting manufactured homes, ensuring affordability without compromising on quality. Focused on properties near educational institutions, catering to the unique needs of student populations. For property owners keen on enhancing energy efficiency or those owning green-certified buildings, this loan type provides incentives. Due to government backing, borrowers can often avail of interest rates lower than traditional financing avenues. A range of loan terms ensures that borrowers can choose a structure aligning with their financial strategy. A standout feature is a non-recourse structure means borrowers aren't personally liable should defaults occur. The property itself acts as collateral. Borrowers can refinance their loans, capturing lower interest rates or drawing equity from their property's appreciation. Its broad acceptance criterion ensures diverse property types, from student housing to senior residences, find financial backing. Given the magnitude of funds and the government's involvement, the eligibility bar is set high, sometimes sidelining smaller investors. Paying off loans early might attract penalties, discouraging borrowers from wrapping up their debts ahead of schedule. Borrowers need to furnish third-party reports like appraisals and property inspections, which can be time-consuming and expensive. Not every Fannie Mae Multifamily Loan can be assumed by another party. There are restrictions that can hinder property sale prospects. Borrowers can pick between loans with steady interest rates (fixed rate) or those that change based on market dynamics (variable rate). Some loans offer an initial period where only interest is payable, enhancing cash flow for borrowers. Loan costs aren't uniform. Based on factors like loan amount and term, borrowers might face different pricing structures. To curtail risks, there's a ceiling on how much can be borrowed against the property's value, usually up to 80%. Borrowers furnish detailed financial statements, offering insights into their fiscal health. A professional appraisal ascertains the property's market value. Lenders dive deep into borrowers' histories, ensuring creditworthiness. The Fannie Mae Multifamily Loan is a versatile financing tool, designed specifically for the multifamily housing sector. Operated under the Delegated Underwriting and Servicing (DUS) program, it addresses a myriad of property types, from traditional apartments to specialized housing like student and senior residences. Its competitive rates, flexible terms, and non-recourse nature make it a valuable asset for real estate developers and investors. While it offers various products catering to unique needs, including green financing and affordable housing, potential borrowers must navigate stringent eligibility criteria and be aware of accompanying fees. Partnering with DUS lenders, this loan streamlines the multifamily property financing process, ensuring both borrower needs and industry standards are met.What Is Fannie Mae Multifamily Loan?

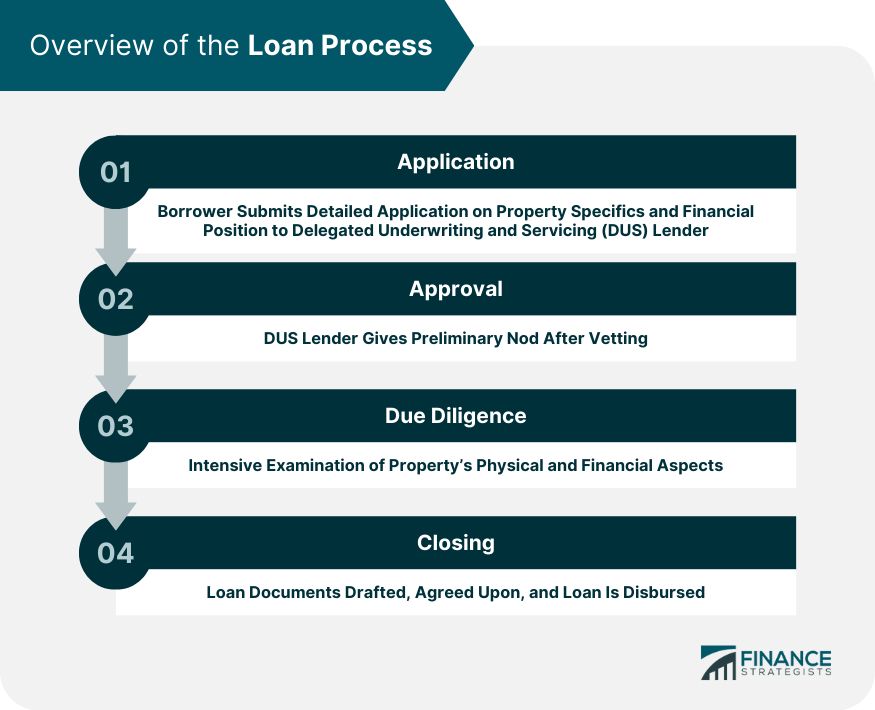

Process of Fannie Mae Multifamily Loan

Application

Approval

Due Diligence

Closing

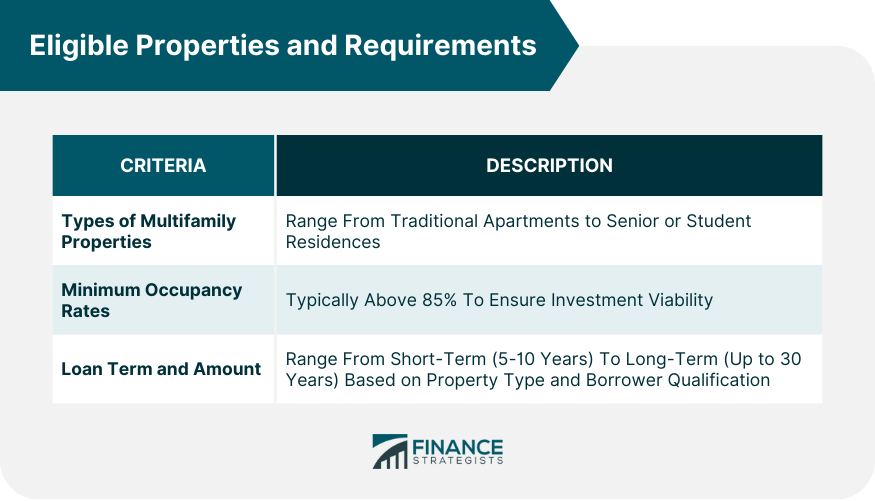

Eligible Properties and Requirements

Types of Multifamily Properties

Minimum Occupancy Rates

Loan Term and Amount

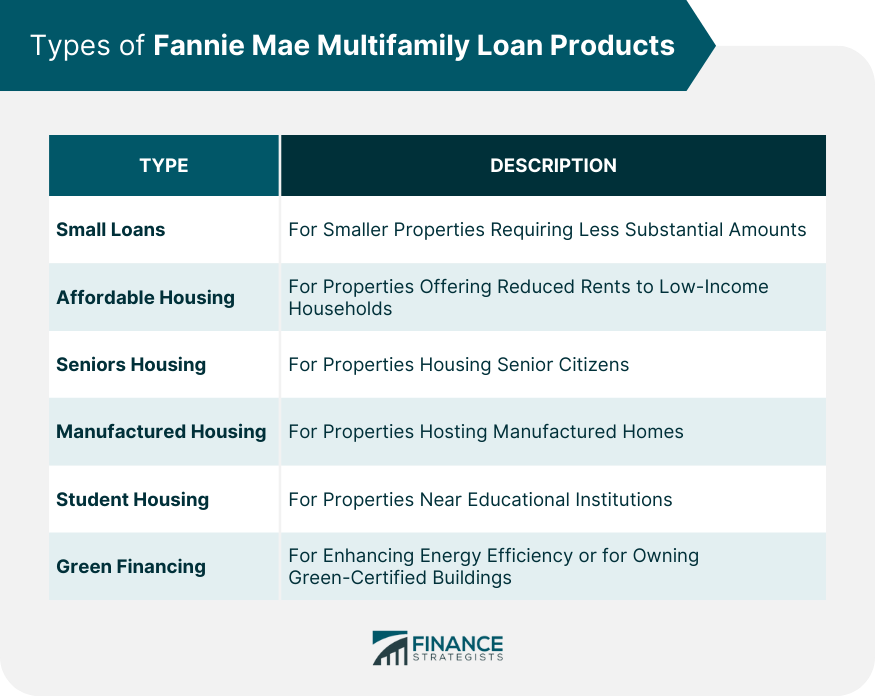

Types of Fannie Mae Multifamily Loan Products

Small Loans

Affordable Housing

Seniors Housing

Manufactured Housing Communities

Student Housing

Green Financing

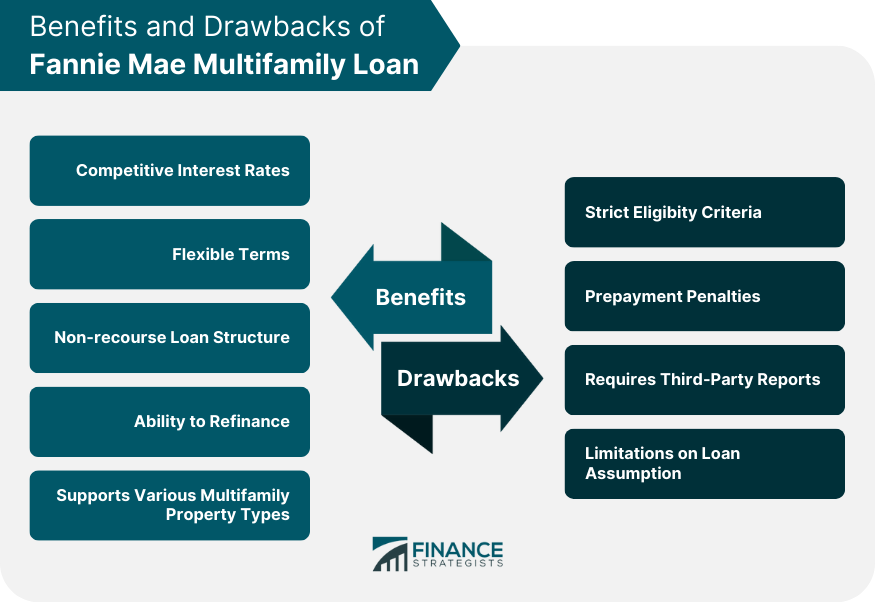

Benefits of Fannie Mae Multifamily Loan

Competitive Interest Rates

Flexible Terms

Non-recourse Loan Structure

Ability to Refinance

Supports Various Multifamily Property Types

Drawbacks of Fannie Mae Multifamily Loan

Strict Eligibility Criteria

Prepayment Penalties

Requires Third-Party Reports

Limitations on Loan Assumption

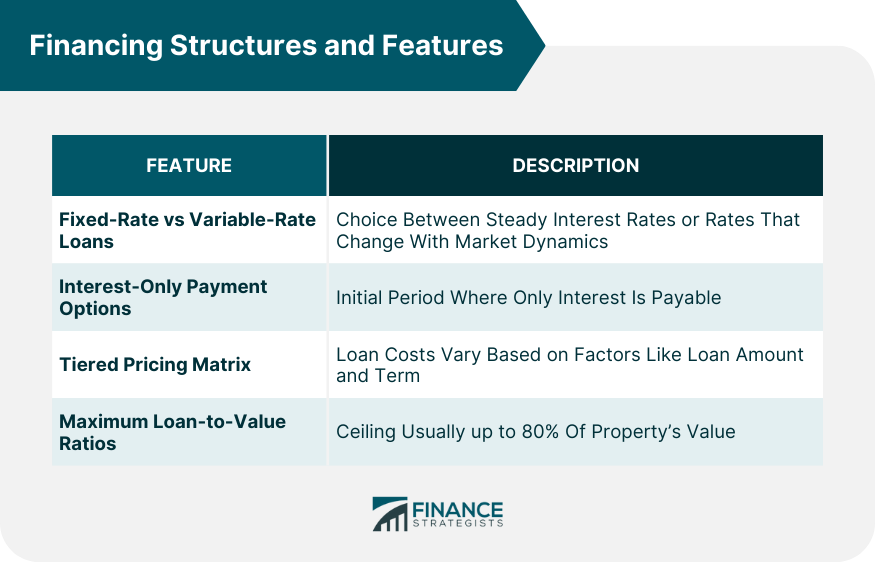

Financing Structures and Features

Fixed-rate vs Variable-rate Loans

Interest-Only Payment Options

Tiered Pricing Matrix

Maximum Loan-to-Value Ratios

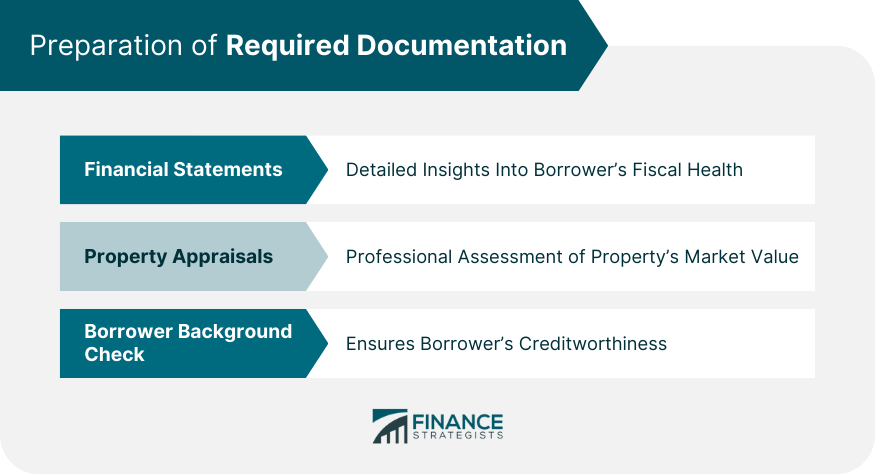

Preparation of Required Documentation

Financial Statements

Property Appraisals

Borrower Background Check

Conclusion

Fannie Mae Multifamily Loan FAQs

A Fannie Mae Multifamily Loan is a financing solution offered through Fannie Mae's Delegated Underwriting and Servicing (DUS) program, specifically designed to cater to the needs of multifamily property owners.

The application process begins with the borrower submitting a detailed application to a DUS lender. Upon vetting, the lender approves the preliminary application, conducts due diligence, including property inspections and appraisals, and then proceeds to the loan closing and disbursement.

Eligible properties range from traditional apartments to specific housing types like senior residences, student housing, and manufactured housing communities, provided they meet certain occupancy rates and other requirements.

Yes, there are various products under the Fannie Mae Multifamily Loan umbrella, including Small Loans, Affordable Housing loans, Seniors Housing loans, Manufactured Housing Community loans, Student Housing loans, and Green Financing loans.

Some primary benefits include competitive interest rates, flexible loan terms, non-recourse loan structures, the ability to refinance, and support for a diverse range of multifamily property types.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.