The U.S. secondary mortgage market plays a pivotal role in shaping the nation's housing finance system. It's here that lenders sell mortgages, freeing up funds to lend to other potential homeowners. This recycling of capital ensures liquidity in the housing market and, in many ways, democratizes the dream of homeownership. The efficient functioning of this market is integral to the health of the broader economy, as housing is a significant contributor to national GDP. Additionally, this market's resilience directly influences consumer confidence in housing investments. Government-sponsored entities (GSEs) have been instrumental in bolstering the secondary mortgage market. These institutions, though separate in operations and missions, collectively influence the mortgage landscape, affecting both lenders and borrowers. Their efforts ensure that lending institutions have the resources to provide home loans to consumers nationwide. They act as intermediaries, helping to balance the interests of both lenders and borrowers. Fannie Mae, formally known as the Federal National Mortgage Association, was founded in 1938. Born out of the New Deal era, it was created to stimulate the stagnant housing market during the Great Depression. Initially, it operated as a government entity but transitioned to a private corporation in 1968. The shift aimed to reduce government intervention while still leveraging Fannie Mae's capabilities to influence the housing market positively. The organization's growth has paralleled the evolution of the American housing market itself. The central mission of Fannie Mae revolves around providing liquidity to the mortgage market. By purchasing and guaranteeing mortgages, Fannie Mae ensures that lenders have consistent access to funds. This facilitates a smooth lending process, benefiting both financial institutions and borrowers. Its operations have expanded over the years to adapt to market changes, ensuring that lending remains consistent even in challenging economic climates. This adaptability has cemented its role as a cornerstone of the housing finance sector. Fannie Mae typically buys conventional or conforming loans. These are mortgages that adhere to the size and standards set by the institution. They may include both fixed-rate and adjustable-rate mortgages, catering to a wide spectrum of homeowners. The consistency in purchasing these loans means that lenders have a clearer understanding of the criteria needed for their loans to be bought. This often leads to more uniformity in lending standards, benefiting consumers. By buying such a vast range of mortgages, Fannie Mae aids in standardizing mortgage terms and rates. Their actions indirectly influence the mortgage rates set by lenders and have a ripple effect on the broader housing market dynamics. Over the years, their influence has been credited with making housing more affordable for many Americans. By consistently purchasing mortgages, they offer lenders the liquidity needed to keep mortgage rates competitive. Being a cornerstone of the housing finance ecosystem, Fannie Mae has been lauded for its contributions to market stability. Its consistent purchasing provides predictable liquidity. However, detractors often point to potential systemic risks tied to its sheer size and the implicit government backing it enjoys. While the institution has fostered significant growth in homeownership rates, concerns about its dominant position in the market persist. Freddie Mac, known more formally as the Federal Home Loan Mortgage Corporation, came into existence in 1970. It was established to compete with Fannie Mae, thus eliminating a monolithic system and fostering competition in the secondary mortgage market. The presence of another significant player aimed to diversify the market, potentially reducing systemic risks associated with a single dominant entity. Though similar in many respects to Fannie Mae, Freddie Mac's core objective diverges slightly. While both GSEs aim to provide liquidity, Freddie Mac also focuses extensively on supporting smaller banks, often those that operate at the community level. This emphasis ensures that local communities have a voice in the broader housing finance conversation. By catering to smaller institutions, Freddie Mac helps maintain a diverse lending landscape. Freddie Mac, like Fannie Mae, primarily buys conforming loans. However, its unique focus means it often purchases mortgages from smaller lenders, acting as a bridge between local banks and the broader secondary market. This approach ensures that community banks remain competitive, leading to better service and more personalized offerings for borrowers. Freddie Mac’s presence ensures that even smaller banks can lend confidently, knowing they have an avenue to sell their mortgages. This results in more competitive rates for borrowers and a healthier, more diversified lending landscape. In essence, Freddie Mac acts as a guardian of equitable lending, ensuring that financial powerhouses don't overshadow community banks. While Freddie Mac is celebrated for its role in democratizing lending, it isn't without criticisms. Like Fannie Mae, the implicit government guarantee it enjoys raises concerns about potential bailouts, stirring debates about the broader implications for the U.S. economy. Critics argue that its operations, while well-intentioned, could pose significant risks in the event of economic downturns. Ginnie Mae, or the Government National Mortgage Association, was established in 1968. Unlike its counterparts, Fannie Mae and Freddie Mac, Ginnie Mae operates as a government entity, backed by the full faith and credit of the U.S. government. Its unique position within the government structure means it carries a distinct set of responsibilities and objectives, tailored to cater to particular sections of society. The organization's primary mission centers on promoting homeownership among underserved sections of society. It achieves this by guaranteeing government-backed mortgages, such as those from the Federal Housing Administration (FHA) and the Department of Veterans Affairs (VA). This guarantee has far-reaching implications, allowing lenders to confidently provide loans to groups that might otherwise struggle to secure financing. In doing so, Ginnie Mae plays a pivotal role in democratizing homeownership. Ginnie Mae's role isn't to buy mortgages but to guarantee the timely payment of principal and interest on MBS. By doing this, it encourages investors to participate in the secondary mortgage market, knowing their investments are secure. This guarantee acts as a beacon of confidence for investors, drawing capital to the housing finance sector and aiding in overall market stability. The majority of loans securitized as Ginnie Mae MBS are FHA and VA loans. These are designed to help specific groups, such as low-income families or veterans, access affordable homeownership. The close relationship with these government entities ensures that Ginnie Mae's operations align with broader national housing goals. Their collaborative efforts work towards a shared vision of inclusive homeownership. Ginnie Mae's full government backing is both its strength and a point of contention. While the guarantee it offers bolsters market confidence, critics argue that it exposes taxpayers to potential risks, especially in economic downturns. Nevertheless, the institution's track record and its commitment to underserved communities make it an indispensable part of the housing finance ecosystem. All three GSEs share the overarching goal of ensuring stability in housing finance. They collectively act as the backbone of the secondary mortgage market, each playing its part to ensure liquidity and market confidence. Their coordinated efforts ensure that economic fluctuations don't translate into erratic mortgage availability for the average American. While each GSE has its distinct criteria and focuses, together they shape the broader lending landscape. Lenders, knowing they can sell to or get a guarantee from one of these entities, often align their lending standards accordingly. This collaboration ensures a semblance of uniformity across the lending spectrum, fostering an environment where borrowers have clarity about their mortgage prospects. Their combined efforts sustain the secondary mortgage market, making it a vibrant and essential part of the U.S. financial landscape. By buying, guaranteeing, or securitizing mortgages, they provide lenders the means to keep lending, ensuring a steady flow of capital into the housing market. While Fannie Mae emerged out of the Great Depression to stimulate housing, Freddie Mac was introduced to infuse competition. Ginnie Mae, on the other hand, was birthed to guarantee government-backed loans. Each entity's historical trajectory shapes its present-day operations and priorities. While Fannie Mae and Freddie Mac predominantly deal with conventional loans, Ginnie Mae stands apart in guaranteeing government-backed mortgages. This distinction means each entity caters to different segments of society, ensuring that a broad spectrum of borrowers has access to homeownership. Given their varying structures and missions, these entities fall under different regulatory purviews. While all are subject to extensive oversight, the nature and extent vary, reflecting their unique roles in the housing finance matrix. Together, these GSEs play a pivotal role in shaping mortgage rates. Their operations either directly or indirectly influence how lenders price their loans. By providing consistent liquidity or guarantees, they ensure that lenders have the confidence to offer competitive rates to borrowers. Their combined operations are a significant boon to the U.S. economy. Beyond just housing, their influence permeates sectors like construction, real estate, and even retail, given the interconnectedness of these industries. While their operations have undeniably positive effects, they also introduce potential systemic risks. The scale of their operations, coupled with the implicit or explicit government backing, means that any financial missteps could have broader economic implications. The GSEs directly influence how easily consumers can access mortgages and at what rates. Their operations ensure that lenders have a ready avenue to offload mortgages, often making home loans more accessible and affordable to the average American. Over the years, the collective actions of the GSEs have contributed to fluctuations in homeownership rates. Their influence, combined with broader economic factors, shapes the nation's homeownership narrative. The successes and challenges faced by these entities directly impact the dream of homeownership for countless Americans. For existing homeowners, the GSEs offer avenues for refinancing. Their guidelines and operations can influence the ease and rates at which homeowners can refinance their existing mortgages, impacting long-term financial planning. The refinance options they enable can translate to significant savings for homeowners, aiding in financial security. Innovation in housing finance, from green housing loans to flexible lending terms, often finds roots in the practices and guidelines set by these entities. Their willingness to buy or guarantee new loan types can spur innovation in the broader market. As these GSEs adapt and evolve, they also pave the way for novel approaches to housing finance, ensuring that the market remains responsive to changing consumer needs. In the intricate tapestry of the U.S. housing finance system, Fannie Mae, Freddie Mac, and Ginnie Mae emerge as vital threads, each playing a unique yet interconnected role. By ensuring liquidity, fostering competition, and guaranteeing loans, these government-sponsored entities (GSEs) collectively underpin the secondary mortgage market. Their operations not only influence lending standards and mortgage rates but also directly impact homeownership accessibility and affordability. While their contributions have undeniably democratized the dream of homeownership, they also bring potential financial risks, warranting ongoing scrutiny and oversight. As they navigate the challenges and opportunities of an ever-evolving housing landscape, these entities remain foundational to the broader economic narrative, influencing sectors beyond housing and shaping the financial destinies of countless Americans.Overview of the US Secondary Mortgage Market

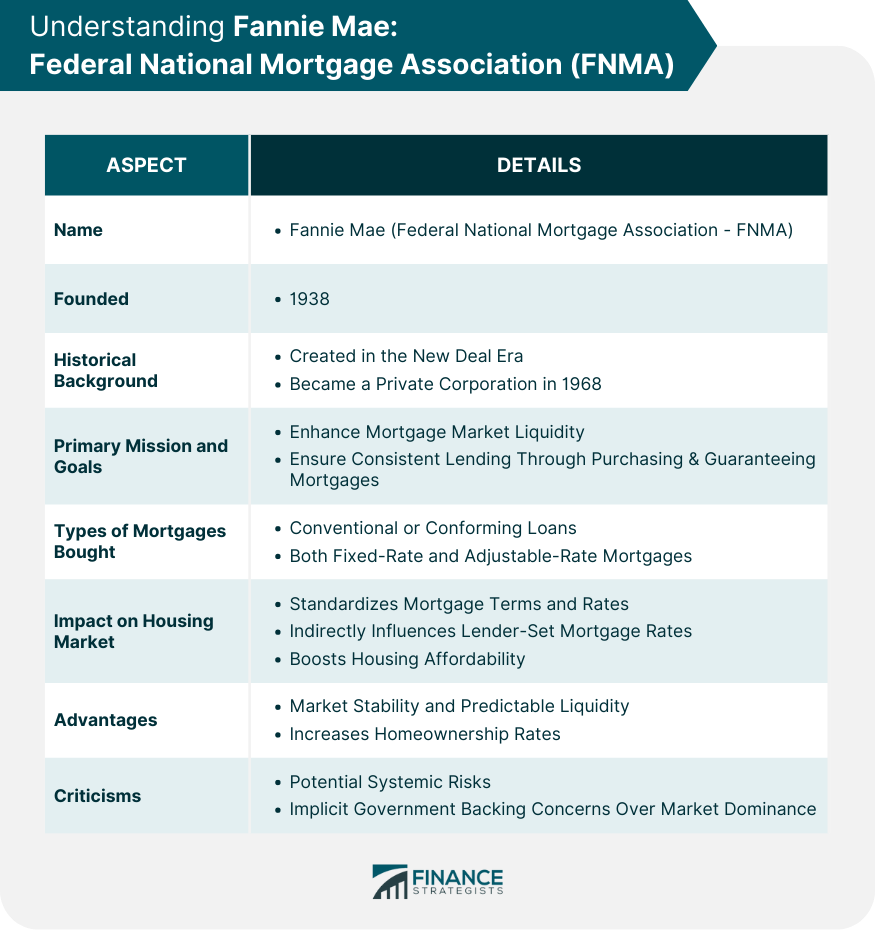

Understanding Fannie Mae: Federal National Mortgage Association (FNMA)

Historical Background and Establishment

Primary Mission and Goals

Key Features and Operations

Types of Mortgages Bought

Impact on the Housing Market

Advantages and Criticisms of Fannie Mae

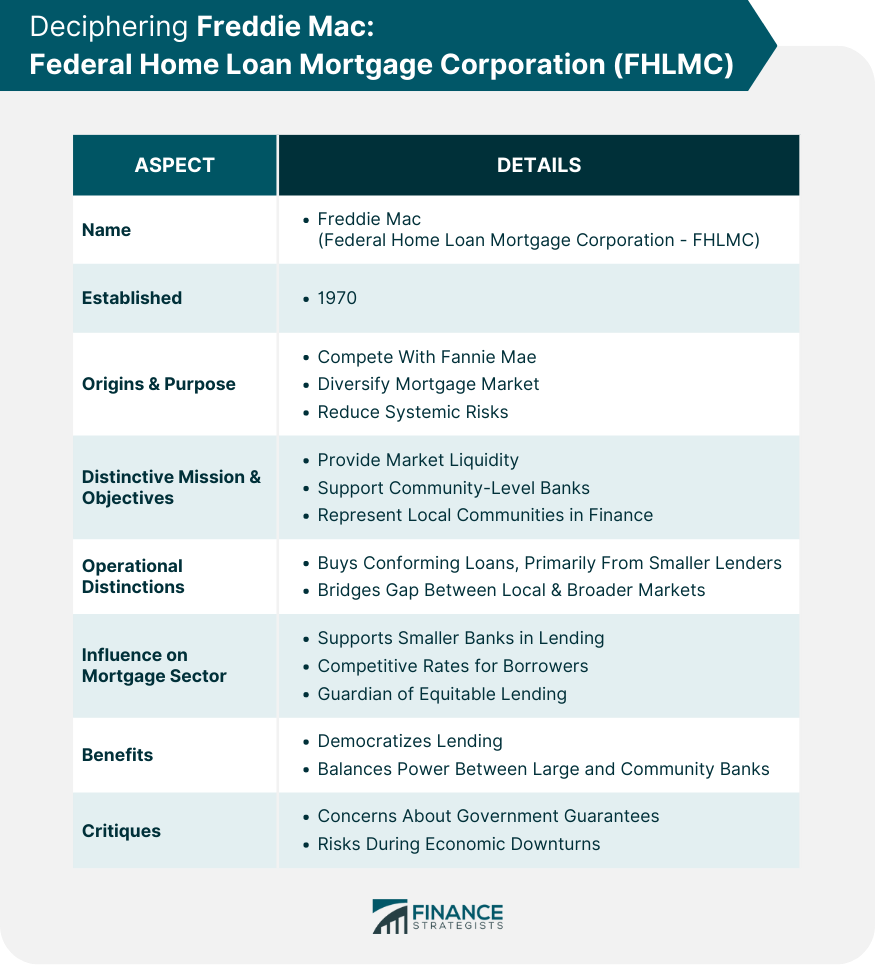

Deciphering Freddie Mac: Federal Home Loan Mortgage Corporation (FHLMC)

Origins and Reasons for Creation

Distinctive Mission and Objectives

Operational Distinctions

Mortgages Targeted and Purchased

Influence on Mortgage Lenders and Borrowers

Benefits and Critiques of Freddie Mac

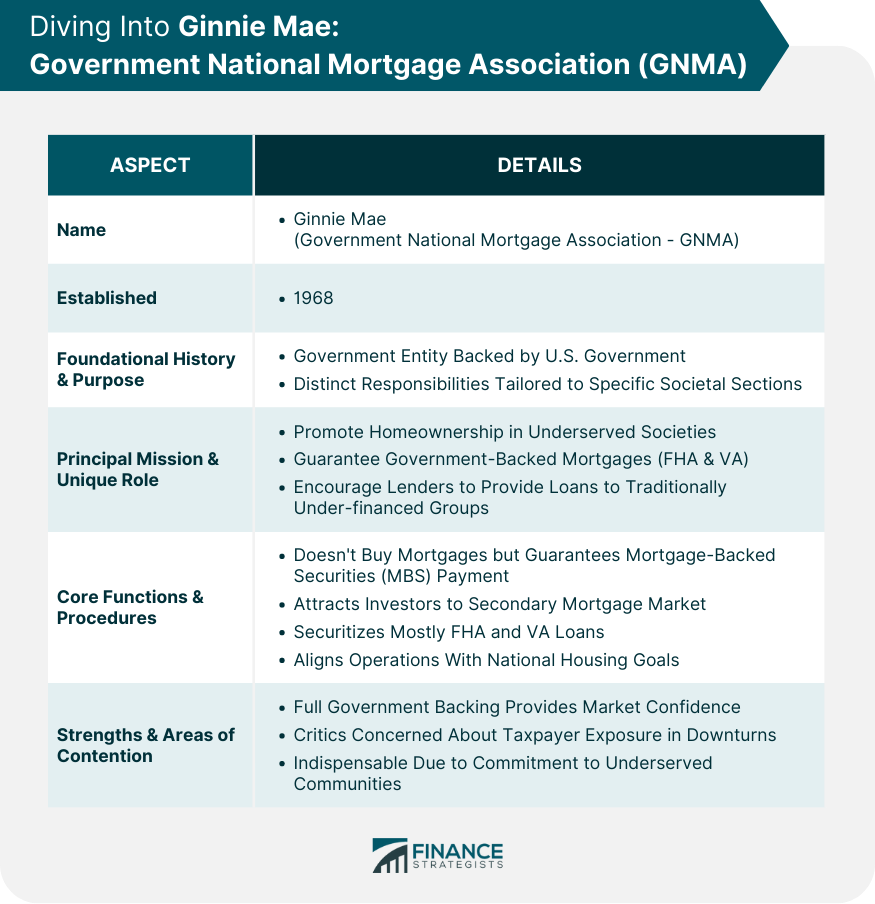

Diving Into Ginnie Mae: Government National Mortgage Association (GNMA)

Foundational History and Purpose

Principal Mission and Unique Role

Core Functions and Procedures

Guarantee of Mortgage-Backed Securities (MBS)

Relation to Federal Housing Administration (FHA) and Other Government Loans

Strengths and Areas of Contention for Ginnie Mae

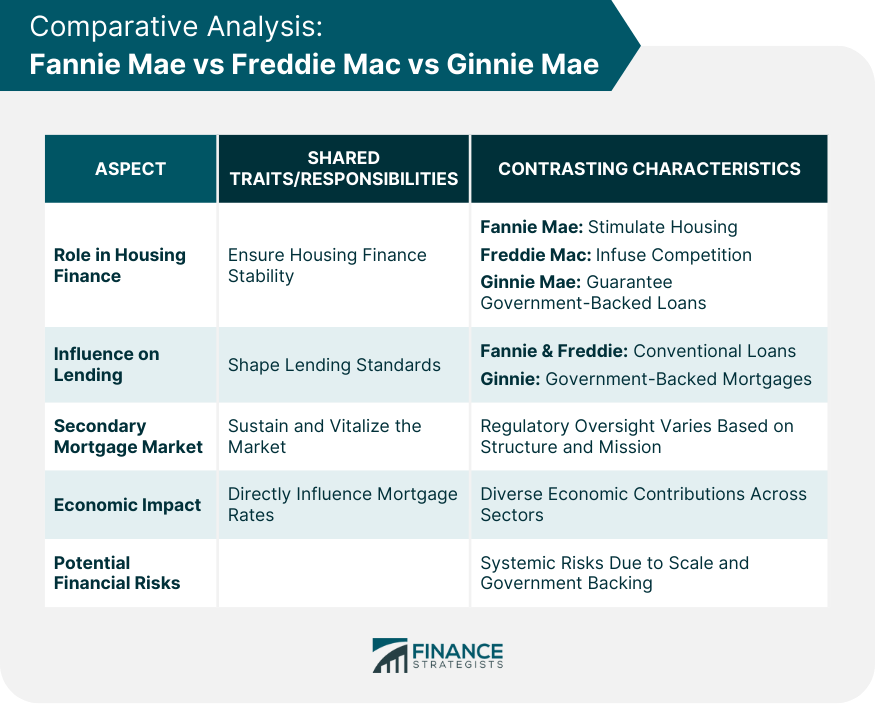

Comparative Analysis: Fannie Mae vs Freddie Mac vs Ginnie Mae

Shared Responsibilities

Stabilizing Housing Finance

Influence on Lending Standards

Role in Secondary Mortgage Market

Contrasting Characteristics

Historical Developments

Mortgage Types Handled

Regulatory Oversight

Economic and Housing Impacts

Influence on Mortgage Rates

Economic Contributions

Potential Financial Risks

GSEs and the Homeowner: Direct and Indirect Impacts

Mortgage Availability and Affordability

Homeownership Rates Over Time

Impact on Refinancing Opportunities

Effect on Housing Innovation and Flexibility

Bottom Line

Fannie Mae vs Freddie Mac vs Ginnie Mae FAQs

Fannie Mae provides liquidity by purchasing and guaranteeing mortgages, ensuring consistent funds for lenders.

While both provide liquidity, Freddie Mac has a specific focus on supporting smaller, community-level banks.

Ginnie Mae guarantees government-backed mortgages, such as FHA and VA loans, promoting homeownership among underserved groups.

Collectively, they influence lending standards and liquidity, indirectly shaping mortgage rates offered by lenders.

They ensure stability, liquidity, and diversity in the housing finance sector, making home loans more accessible and affordable.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.