The interest rates set by Fannie Mae play a crucial role in the broader mortgage industry. These rates determine the cost at which Fannie Mae purchases loans from primary lenders, indirectly influencing the rates offered to consumers. Factors like macroeconomic indicators, housing market conditions, and Federal Reserve policies can sway these rates. Often, Fannie Mae's rates are more stable and lower than traditional bank rates, aiming to ensure market stability and promote homeownership. Fannie Mae expects a slight softening in the 30-year fixed mortgage rate as 2024 progresses. A decline from 6.5% to 6% over the course of the year is a noticeable change, and it can have implications for both homebuyers and the housing market in general. Even a 0.5% decline in interest rates can have a significant impact on the affordability of homes. For borrowers, this could mean reduced monthly payments or the ability to afford a slightly more expensive home. Homeowners with rates higher than 6% may see this as an opportunity to refinance, especially if they missed out on the lower rates from previous years. Refinancing can reduce monthly payments or allow homeowners to tap into their home equity. Lower mortgage rates tend to spur demand. If rates are anticipated to decrease further or remain low, it could bolster home sales as potential buyers try to lock in favorable rates. If demand increases due to the lowered rates, and there isn't a corresponding rise in supply, it could put upward pressure on home prices. However, this also depends on other factors, such as job growth, wage growth, and overall economic health. A forecasted decrease in mortgage rates might reflect broader economic trends. Fannie Mae could be predicting slower economic growth, subdued inflation, or other macroeconomic factors that would lead the Federal Reserve and other central banks to keep interest rates lower. Real estate investors, especially those leveraging their purchases, might find the slightly lower rates to be an incentive to purchase properties, either to rent or to sell at a profit later. The direction of interest rates, and particularly mortgage rates, can influence consumer sentiment. If rates are dropping or expected to drop, it might signal economic uncertainty to some, while others might view it as a good time to borrow. Fannie Mae's interest rates have seen their share of ups and downs. For instance, the high inflation era of the 1980s led to soaring rates, while the post-2008 era saw historically low rates due to expansive monetary policy. Economic downturns, such as the 2008 financial crisis, saw Fannie Mae's rates drop to stimulate borrowing. On the other hand, policy changes, like interest rate hikes by the Federal Reserve, often result in corresponding increases. For borrowers, Fannie Mae rates influence the affordability of mortgages. Lower rates can lead to cheaper borrowing costs, affecting mortgage types and influencing decision-making. From the lender's perspective, these rates directly affect risk management. Lenders might be more willing to lend when they know they can sell the mortgage to Fannie Mae. This also aids in portfolio diversification. Fannie Mae is pivotal in the secondary mortgage market. Buying and securitizing loans, it provides the necessary liquidity, ensuring that capital keeps flowing in the housing market. Freddie Mac, another significant GSE, shares many similarities with Fannie Mae. However, their interest rate-setting mechanisms and portfolios differ slightly, catering to different sections of the housing market. Unlike Fannie and Freddie, Ginnie Mae only deals with government-insured mortgages, such as those from the VA or FHA. Their rates often reflect the risk associated with these government-backed loans. • Economic Indicators Commonly Watched: Economists and industry experts keep a close eye on indicators like the unemployment rate, GDP growth, and inflation to predict Fannie Mae's interest rate movements. • Role of Federal Reserve Announcements and Actions: The Federal Reserve's actions, especially regarding the federal funds rate, play a massive role in influencing Fannie Mae's rates. Announcements related to economic outlooks and policy changes are scrutinized for potential impacts. • Other Predictive Tools and Analytics Used by Professionals: Apart from macroeconomic indicators, professionals utilize advanced analytics, historical data, and predictive modeling to forecast interest rate changes. Fannie Mae's primary objective is market stability. By providing consistent liquidity and setting benchmark rates, it prevents volatile rate fluctuations that could deter potential homebuyers. While many laud Fannie Mae's stabilizing role, critics argue that its influence can sometimes distort the housing market. There are concerns about taxpayer liabilities, especially given the 2008 bailout, and debates on the degree of government involvement in housing finance. Fannie Mae's role in shaping the U.S. mortgage landscape is undeniable. By determining the interest rates at which it purchases loans, it indirectly influences consumer lending rates and ensures liquidity in the housing market. Economic indicators, the Federal Reserve's decisions, and broader market conditions impact these rates. Their potential decline or stability not only affects homebuyer affordability but also drives refinancing activities, housing demand, and investor interests. While agencies like Freddie Mac and Ginnie Mae offer similar functionalities, their rate-setting mechanisms and target portfolios distinguish them. Observers utilize varied techniques, from monitoring traditional economic indicators to leveraging sophisticated analytics to anticipate rate changes. Fannie Mae's efforts to maintain market stability are often praised, but criticisms exist, primarily centered around the potential for market distortion. Recognizing the interconnectedness of these factors is essential for understanding the intricacies of the U.S. housing finance system.Fannie Mae Interest Rates Overview

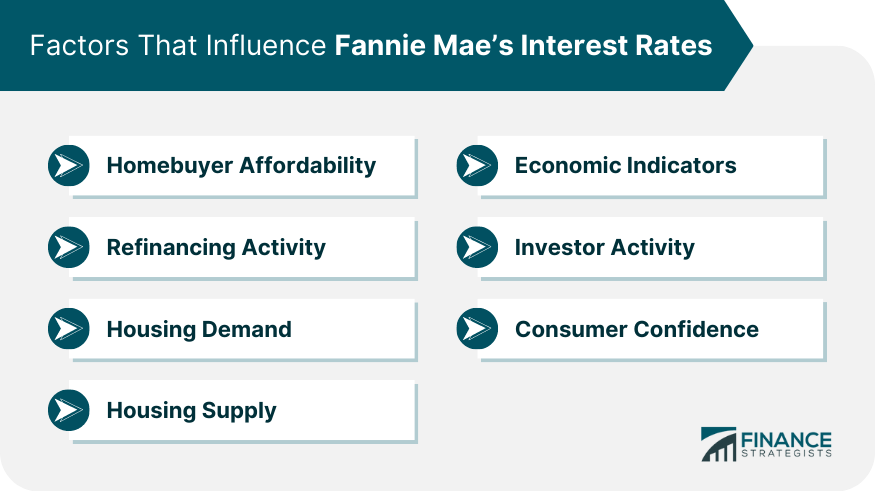

Factors That Influence Fannie Mae Interest Rates

Homebuyer Affordability

Refinancing Activity

Housing Demand

Housing Supply

Economic Indicators

Investor Activity

Consumer Confidence

Historical Perspective of Fannie Mae Interest Rates

Trends and Fluctuations in Fannie Mae Interest Rates Over the Years

Significant Events Impacting These Rates

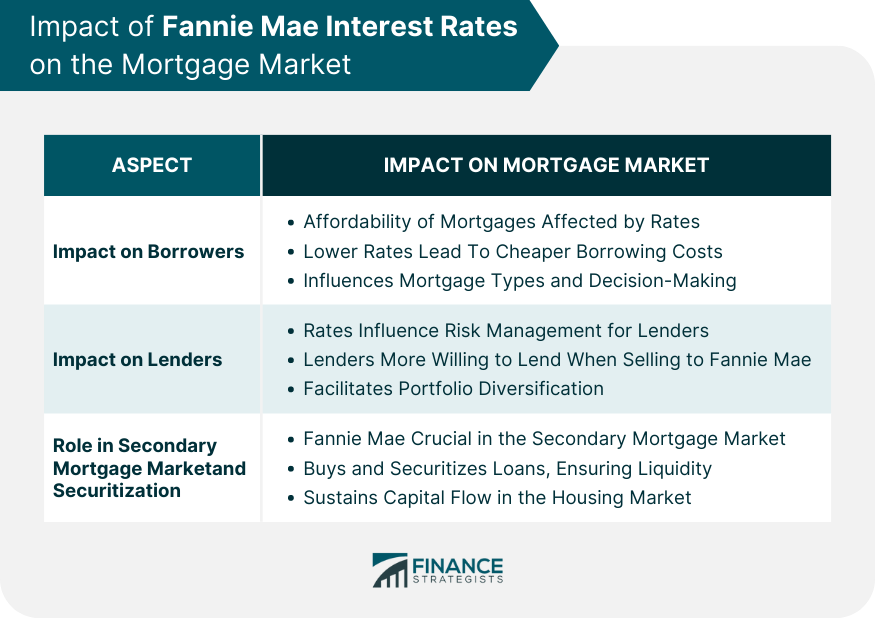

Impact of Fannie Mae Interest Rates on the Mortgage Market

Impact on Borrowers

Impact on Lenders

Role in the Secondary Mortgage Market and Securitization

Fannie Mae Interest Rates Comparison With Other US Housing Agencies

Freddie Mac

Ginnie Mae and Its Unique Role in the Market

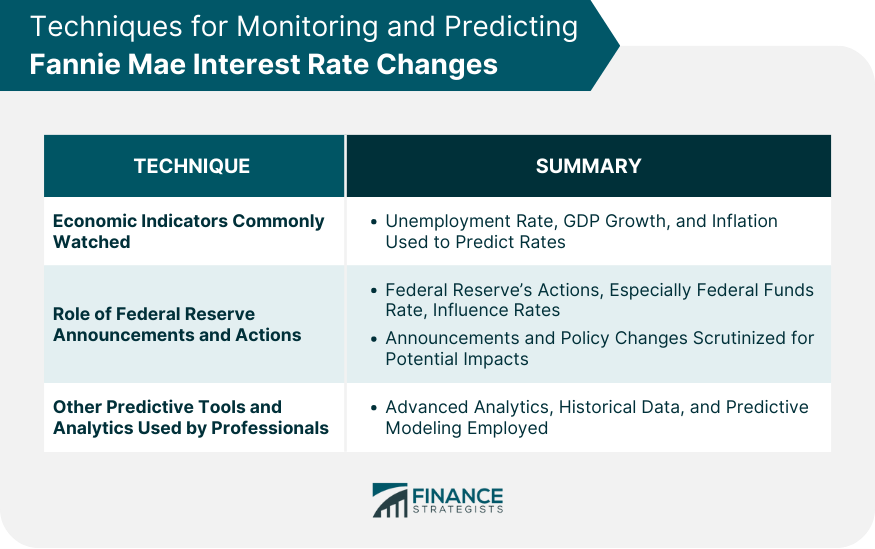

Techniques for Monitoring and Predicting Fannie Mae Interest Rate Changes

Benefits and Criticisms of Fannie Mae's Interest Rate Policies

How These Policies Aim to Stabilize the Housing Market

Concerns and Criticisms

Conclusion

Fannie Mae Interest Rates FAQs

Fannie Mae provides liquidity to the U.S. mortgage market. It purchases mortgages from lenders, converts them into mortgage-backed securities (MBS), and then sells these MBS to investors, ensuring a continuous flow of capital for lenders to issue more loans.

Fannie Mae's interest rates are typically more stable and often lower than those of traditional banks. While bank rates are influenced by individual policies and profit needs, Fannie Mae's rates aim to ensure housing market stability and consistent liquidity.

Fannie Mae's interest rates indirectly influence the rates offered to homebuyers. Lower rates from Fannie Mae can lead to more affordable mortgages, affecting the types of loans available and the decision-making process for potential homebuyers.

While all three are government-sponsored enterprises, Freddie Mac and Fannie Mae have similar roles but cater to different sections of the housing market. Ginnie Mae, on the other hand, deals exclusively with government-insured mortgages, such as those from the VA or FHA.

Yes, while many appreciate Fannie Mae's stabilizing influence, critics argue that its significant presence can sometimes distort the housing market. Concerns include potential taxpayer liabilities, especially in light of events like the 2008 bailout and ongoing debates about the extent of government involvement in housing finance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.