The Fannie Mae Affordable Housing Goal is a targeted initiative by Fannie Mae, a leading government-sponsored entity in the U.S. housing sector. This goal is designed to enhance homeownership opportunities, particularly for underserved and marginalized communities. At its core, the initiative seeks to make housing more accessible by adjusting loan criteria, promoting responsible lending, and collaborating with various stakeholders to address housing disparities. By emphasizing affordable housing, Fannie Mae aspires to bridge the gap in the housing market, ensuring more Americans have the chance to own a home. Through this goal, the organization plays a crucial role in fostering a more inclusive and stable housing ecosystem. Broadened Criteria: One of the primary objectives is to ease the criteria for homeownership, ensuring more people qualify for housing loans. Reach Underserved Communities: Prioritize communities and populations that have traditionally been marginalized or left out of the housing boom. Reduce Volatility: By providing consistent demand through the promotion of affordable housing, the aim is to minimize sharp market fluctuations. Promote Predictability: A stable housing market is a predictable one. Ensuring that housing prices don't see wild swings is crucial for long-term planning for both individuals and institutions. Boost Local Economies: When more people can buy homes, local economies see a surge in growth due to increased demand for goods, services, and property-related transactions. Job Creation: Construction, maintenance, and various housing-related services see a boom, leading to more employment opportunities. Promote Responsible Lending: One key objective is to ensure that in the quest for affordable housing, lending institutions do not resort to subprime lending, which can be detrimental in the long run. Collaborate With Lenders: Fannie Mae works closely with lending partners to ensure that their loan offerings align with the broader goal of housing affordability without compromising on financial stability. Influence Housing Policy: By taking the lead, Fannie Mae aims to influence broader housing policies at both the state and federal levels, advocating for rules that promote affordability. Set Benchmarks for the Industry: Through its initiatives, Fannie Mae sets standards that other institutions in the housing sector can emulate or adopt. Central to achieving the Affordable Housing Goal is Fannie Mae's criteria for loan purchases. Essentially, they prioritize loans that are in line with fostering affordable housing. This includes lower interest rates, flexible payment terms, and even reduced down payment requirements for qualifying homes. By adjusting the criteria, Fannie Mae ensures that a larger segment of the population can access home loans. Realizing the mammoth task ahead, Fannie Mae leans heavily on collaborations. It partners with lenders, local housing advocates, non-profit organizations, and other stakeholders. These partnerships foster a network where information, resources, and strategies are shared to ensure that affordable housing reaches those who need it most. To keep the initiative on track, Fannie Mae has implemented a robust performance measurement system. This includes tracking the number of loans that fit the affordable housing criteria, gauging the demographic and geographic reach of these loans, and regularly reviewing the criteria to ensure it meet the ever-changing housing landscape. One of the most tangible benefits of this initiative is the upsurge in homeownership. By making housing more affordable, more individuals and families are able to transition from renting to owning. This not only provides them with a valuable asset but also fosters a sense of stability and community belonging. The ripple effects of this goal can be felt throughout the housing market. With more people able to buy homes, there's a reduction in market volatility. Stable demand ensures consistent growth, mitigates sudden price surges, and guards against abrupt market downturns. Beyond the realm of finance and real estate, the societal implications of the Affordable Housing Goal are profound. Communities with higher homeownership rates often see improved local economies, lower crime rates, and enhanced overall well-being. Schools benefit from more consistent student populations, and local businesses thrive with stable customer bases. The ambitious nature of the goal has sparked concerns about potential overreach. In trying to make housing exceedingly affordable, there's a lurking danger of incentivizing subprime lending – offering loans to those who might not be in a position to repay them. Such a vast initiative is not without its challenges in oversight. Fannie Mae grapples with accurately tracking progress, managing vast amounts of data, and ensuring that all partners adhere to the shared mission. The broader economic conditions, from interest rate fluctuations to economic recessions, can pose formidable challenges. While Fannie Mae’s goal is steadfast, external factors can sometimes derail progress or necessitate strategy recalibration. Economic downturns, such as the 2008 recession, required Fannie Mae to rethink and recalibrate. In such times, the emphasis has often shifted to ensuring housing market stability while continuing to champion affordability. Fannie Mae’s directive has not existed in isolation. Its emphasis on affordable housing has set a precedent, prompting other housing institutions to adopt similar goals or adjust their strategies in light of Fannie Mae’s initiatives. One of the cornerstones of this initiative is the revised criteria for loan purchases. By prioritizing loans that cater to affordable housing, Fannie Mae has ensured more accessibility for potential homeowners. This involves Flexible Payment Terms: Adjusted loan terms that account for varying income levels. Reduced Down Payments: Decreasing the initial payment burden for qualifying homes. Interest Rate Considerations: Offering competitive interest rates that make homeownership more attainable. A goal of this magnitude requires collective effort. Hence, Fannie Mae has embraced a strategy of collaboration. Partnerships With Lenders: Collaborating with various lending institutions to align loan offerings with the affordable housing goal. Engaging Housing Advocates: By working closely with local housing champions and non-profits, Fannie Mae ensures that its initiatives are grounded in the community’s real needs. Stakeholder Workshops: Organizing sessions to gather feedback, insights and fine-tune the approach in real-time. To ensure that the goal is on course, Fannie Mae places a premium on performance measurement. Data Analysis: Leveraging data analytics to monitor the types and demographics of the loans being availed. Feedback Loops: Establishing channels for continuous feedback to refine strategies. Milestones: Setting clear milestones and benchmarks to assess the progress and effectiveness of the initiatives. Recognizing the dynamic nature of the housing market, policy flexibility remains a key strategy. Regular Policy Reviews: Periodic evaluations to ensure policies remain relevant and effective. Economic Sensitivity: Adjust strategies based on broader economic indicators to ensure resilience during downturns and leverage booms. The Fannie Mae Affordable Housing Goal represents a transformative approach to U.S. housing. By focusing on broadened access to homeownership, especially for underserved communities, it addresses market gaps and fosters stability. This objective, underpinned by strategies like adjusted loan criteria and collaboration, extends beyond simple real estate metrics, touching economic growth, societal betterment, and enhanced community welfare. However, like all ambitious endeavors, it's not without challenges. As the landscape shifts, Fannie Mae's continuous refinement and adaptive policies ensure its initiatives remain effective and responsive. In essence, Fannie Mae's dedication to affordable housing encapsulates its commitment to a more inclusive, equitable, and robust housing ecosystem.What Is Fannie Mae Affordable Housing Goal?

Objectives of Fannie Mae Affordable Housing Goal

Ensure Homeownership Access

Stabilize the Housing Market

Foster Economic Growth

Encourage Sustainable Lending Practices

Advocate for Policy Change

How Fannie Mae Affordable Housing Goal Works

Loan Purchase Criteria

Collaboration Dynamics

Performance Measurement

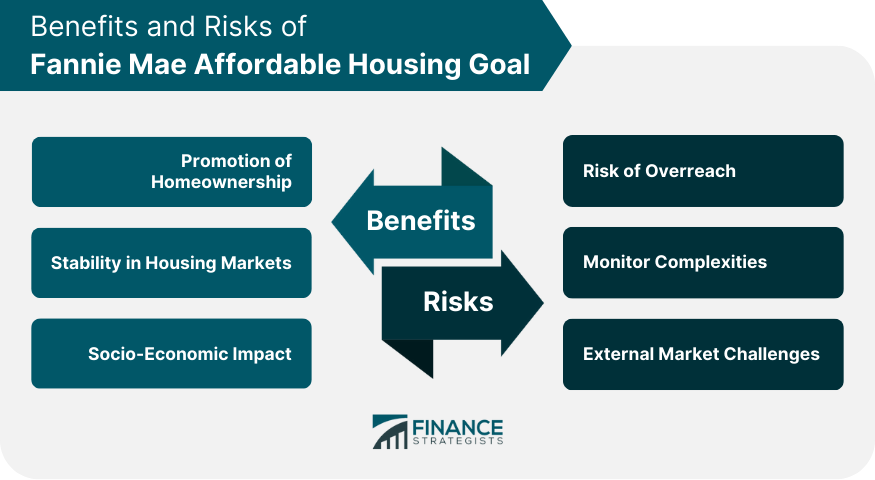

Benefits of Fannie Mae Affordable Housing Goal

Promotion of Homeownership

Stability in Housing Markets

Socio-Economic Impact

Risks of Fannie Mae Affordable Housing Goal

Risk of Overreach

Monitor Complexities

External Market Challenges

Policy Implications and Adjustments

Responses to Economic Challenges

Influence on Other Housing Entities

Implementation Strategies of Fannie Mae Affordable Housing Goal

Adjusted Loan Purchase Criteria

Collaborative Outreach

Performance Tracking

Policy Refinement

Conclusion

Fannie Mae Affordable Housing Goal FAQs

The Fannie Mae Affordable Housing Goal is an initiative by Fannie Mae to increase homeownership opportunities, especially within underserved communities, by adjusting loan purchase criteria and partnering with various stakeholders.

The goal was established to address disparities in the housing market, ensuring that more people, particularly in economically disadvantaged communities, have access to affordable housing options.

It promotes homeownership by setting loan purchase criteria that prioritize affordable housing, collaborating with lenders and housing advocates, and consistently measuring and adjusting its performance to serve a wider population.

Yes, challenges include potential risks of overreach leading to subprime lending, complexities in monitoring progress, and external market challenges like economic downturns that can affect the goal's realization.

Absolutely. Fannie Mae’s emphasis on affordable housing has set a precedent, prompting other housing institutions to adopt similar goals or adjust their strategies in light of Fannie Mae’s initiatives.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.