Fannie Mae and Bankruptcy are the events surrounding the financial crisis of Fannie Mae, a government-sponsored enterprise, during the 2008 global economic crisis. Fannie Mae, or the Federal National Mortgage Association, plays a pivotal role in the U.S. housing market by providing banks with federal money to finance home mortgages. However, in 2008, due to a confluence of factors, including declining housing prices, increased mortgage defaults, and risky financial products, Fannie Mae found itself in a de facto bankruptcy. The U.S. government intervened and placed Fannie Mae under conservatorship to prevent a complete financial meltdown. Since then, Fannie Mae has made significant strides to recover, with improvements in underwriting standards, reduction of risky assets, and a bolstered balance sheet. Yet, it remains under conservatorship, and its future is subject to ongoing discussions about reforms in the housing finance system. When a borrower declares bankruptcy, it does not automatically lead to a foreclosure on the home. Fannie Mae has several policies and options to help borrowers through this difficult financial time. These options often depend on the type of bankruptcy filed: Chapter 7, which involves the liquidation of assets, or Chapter 13, which involves a repayment plan. Fannie Mae aims to avoid foreclosing on properties whenever possible. In the event of bankruptcy, Fannie Mae's Servicing Guide provides that a lender must wait until the borrower defaults on their payment schedule or until the bankruptcy case is closed, whichever comes first, before starting foreclosure proceedings. Fannie Mae offers mortgage modifications and refinancing options for borrowers who are going through bankruptcy. Mortgage modifications could involve reducing the monthly payment, extending the term of the loan, or even deferring some of the loan balance. Refinancing could provide the borrower with a more affordable mortgage payment. In 2008, during the global financial crisis, Fannie Mae found itself at the epicenter of the storm. The decline in housing prices, the surge in mortgage defaults, and risky financial products led to a liquidity crisis for Fannie Mae. The enormity of its obligations compared to its capital resulted in a de facto bankruptcy. The U.S. government, recognizing the systemic risk posed by the collapse of Fannie Mae, intervened to prevent a complete financial meltdown. The government placed Fannie Mae under conservatorship, where it remains to this day. This meant that the U.S. government effectively controlled Fannie Mae's operations. In the aftermath of the crisis, Fannie Mae implemented significant changes. It improved underwriting standards, reduced risky assets, and strengthened its balance sheet. The conservatorship helped Fannie Mae to stabilize, return to profitability, and continue its mission of promoting homeownership and affordable housing. Fannie Mae's bankruptcy had widespread implications for the housing and mortgage market. Its troubles, along with those of Freddie Mac, contributed to the housing market collapse. The aftershocks were felt throughout the financial system and the economy, leading to the most severe recession since the Great Depression. For homeowners and potential buyers, bankruptcy introduced an era of uncertainty. With Fannie Mae and the wider housing finance system in turmoil, borrowers faced higher mortgage rates, stricter underwriting standards, and a decline in housing prices. The effects of Fannie Mae's bankruptcy were profound for investors and stakeholders. The value of shares held by investors plummeted, and some lost their entire investments. The stakeholders, including employees, lenders, and borrowers, faced a period of uncertainty and turbulence. The bankruptcy had major implications for the U.S. economy and the federal government. It was a central event in the 2008 financial crisis, which resulted in a severe recession. The federal government had to intervene, leading to a significant increase in public debt. Fannie Mae faced significant criticism over its handling of the bankruptcy. Critics argued that the company took excessive risks, maintained inadequate capital reserves, and failed to manage its exposures effectively. There were also concerns about the lack of transparency and oversight. The public and governmental response to Fannie Mae's bankruptcy was largely negative. Many blamed the company for contributing to the financial crisis. The government's decision to place Fannie Mae into conservatorship was contentious, with some arguing it was necessary, while others viewed it as a bailout. The bailout and conservatorship of Fannie Mae were fraught with controversy. Critics argued that the move rewarded irresponsible behavior and created moral hazard. Additionally, the ongoing conservatorship has raised concerns about the long-term viability and role of Fannie Mae. Fannie Mae has made significant progress since the 2008 financial crisis. It has returned to profitability, reduced its risky assets, and strengthened its balance sheet. The company remains under conservatorship, but it is in a much stronger financial position than it was immediately after the bankruptcy. Fannie Mae faces several risks and challenges in the future. These include the risk of another housing market downturn, the uncertainty surrounding the end of conservatorship, and the ongoing debate about its role in the housing finance system. There are ongoing discussions about reforms to the housing finance system to prevent future crises. Proposals include reducing the footprint of Fannie Mae and other government-sponsored enterprises, increasing private capital in the mortgage market, and improving regulatory oversight. Fannie Mae, a critical player in the U.S. housing market, experienced a de facto bankruptcy during the 2008 financial crisis due to a convergence of adverse factors, compelling the U.S. government to enforce conservatorship. Despite the bankruptcy's widespread implications, including a housing market collapse and economic recession, Fannie Mae implemented strategies like improved underwriting standards and risk reduction to bolster its recovery. Still, under conservatorship, Fannie Mae's future is tinged with uncertainty, and its role in the housing finance system is subject to continuous debate. In the face of potential challenges such as a possible housing market downturn and questions about the end of conservatorship, discussions persist about housing finance system reforms to prevent future crises. Thus, Fannie Mae's journey illustrates the need for careful risk management and sound oversight in the finance sector.Fannie Mae and Bankruptcy Overview

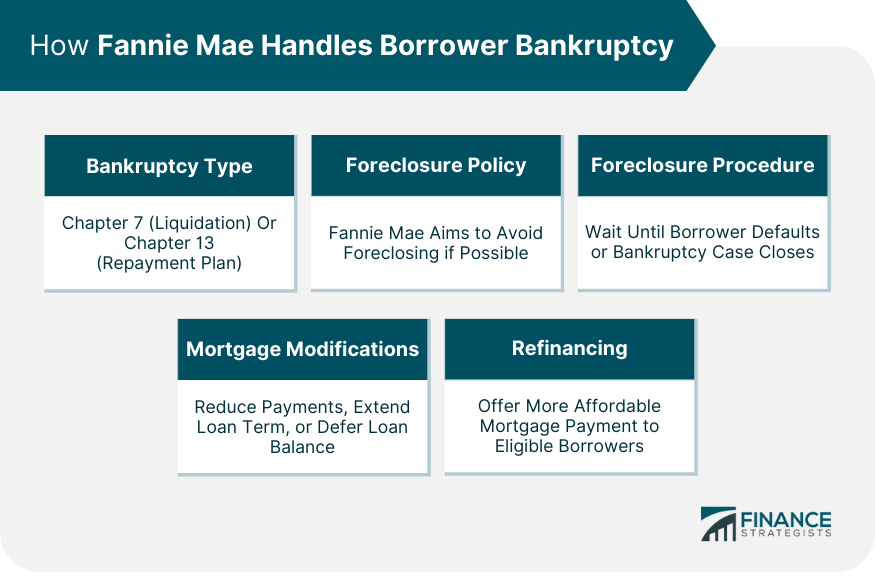

How Fannie Mae Handles Borrower Bankruptcy

Impact on the Loan Status

Fannie Mae's Policies on Foreclosures

Process of Mortgage Modifications and Refinancing

Fannie Mae's Bankruptcy During the 2008 Financial Crisis

Causes Leading to the Bankruptcy

Government Intervention and Conservatorship

Aftermath and Recovery

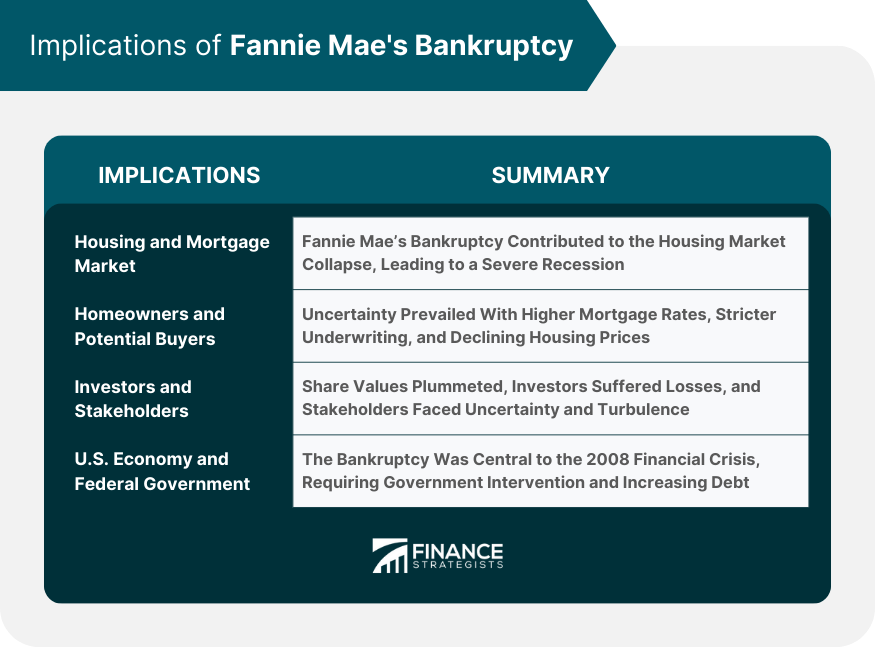

Implications of Fannie Mae's Bankruptcy

Impact on the Broader Housing and Mortgage Market

Implications for Homeowners and Potential Buyers

Effects on Investors and Stakeholders

Impact on the US Economy and Federal Government

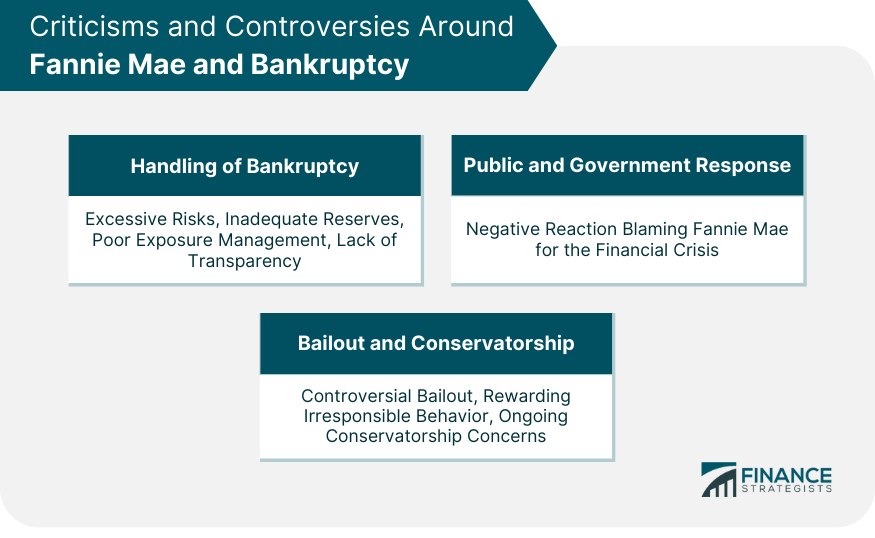

Criticisms and Controversies Around Fannie Mae and Bankruptcy

Critiques of Fannie Mae's Handling of Its Bankruptcy

Public and Governmental Response to Fannie Mae's Bankruptcy

Controversies Around Bailout and Conservatorship

Current Status and Future of Fannie Mae

Fannie Mae's Financial Health Post-Bankruptcy

Potential Risks and Challenges for Fannie Mae's Future

Proposed Reforms and Changes to Prevent Future Bankruptcies

Bottom Line

Fannie Mae and Bankruptcy FAQs

Fannie Mae, or the Federal National Mortgage Association, provides banks with federal money to finance home mortgages. This promotes and maintains affordability in the home mortgage market, enabling more people to buy homes.

Fannie Mae has policies in place to help borrowers going through bankruptcy. Options could include mortgage modifications, like reducing monthly payments, extending the loan term, or deferring some of the loan balance. In some cases, refinancing might also be a possibility.

Fannie Mae's bankruptcy was largely due to a decline in housing prices, a surge in mortgage defaults, and risky financial products. These factors led to a liquidity crisis, and Fannie Mae found it couldn't meet its obligations, leading to bankruptcy.

Fannie Mae's bankruptcy had wide-ranging implications, including impacts on the broader housing and mortgage market, homeowners and potential buyers, investors and stakeholders, and the U.S. economy and federal government. It also led to a severe recession and increased public debt.

Fannie Mae has made a significant recovery since the 2008 financial crisis. It has returned to profitability, reduced its risky assets, and strengthened its balance sheet. However, it remains under government conservatorship, and there are ongoing debates about its role in the housing finance system and potential future risks.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.