The Fannie Mae Income Limits have established benchmarks that dictate the maximum income a borrower can earn to be eligible for certain Fannie Mae-sponsored loan products. These limits are crafted based on regional economic nuances, ensuring they align with the average income levels across various areas. The primary objective behind setting these limits is to fulfill Fannie Mae's core mission of aiding low and moderate-income families in acquiring homes. Factors like geographical location, property type, and prevailing economic indicators heavily influence these thresholds. For instance, regions with higher median incomes, such as metropolitan areas, will typically have higher income limits compared to rural zones. With these constraints in place, Fannie Mae ensures that its financial products remain accessible and beneficial to its target demographic, thereby playing a pivotal role in the broader housing market. Fannie Mae establishes income thresholds for borrowers on a national scale. To meet the eligibility criteria, your income must not exceed 80% of the median income for your specific area. For example, if your locality boasts a median annual income of $80,000, then you're required to earn $64,000 or below to be eligible for participation in the Fannie Mae HomeReady program. To determine your qualification based on the 2024 income limits, Fannie Mae offers a convenient solution: the AMI Lookup Tool. By entering your address into this tool, you'll receive comprehensive information regarding your county's area median income, helping you determine whether you meet the stipulated criteria. Location plays a paramount role. In areas where the median income is significantly high, the income limits are adjusted accordingly, and vice versa. For instance, San Francisco, known for its skyrocketing property prices and elevated median incomes, would have a different limit compared to a smaller town in Mississippi. The size and type of property also dictate the limit. Naturally, a duplex or a larger property would have a higher income threshold compared to a single-family residence due to the larger loan amounts required. Fannie Mae doesn’t set these figures in isolation. Past data, economic forecasts, inflation rates, and other financial predictors collectively shape income limits. Quite straightforwardly, if a borrower’s income exceeds the set limit for a certain loan product, they are deemed ineligible. This system ensures fairness and keeps the target demographic in focus. Occasionally, those who fit within the income brackets might also enjoy favorable interest rates. The terms of their loans could be more lenient, reflecting the intent to support low and moderate-income earners. The most evident difference is loan access. However, it also often translates to the broader borrowing experience, with those below the limit sometimes having access to more supportive resources, counseling, and financial education. The year 2023 witnessed a slight increase in the income limits, reflective of the inflationary trends and rising median incomes across multiple regions. Over half a decade, there has been a steady rise in these limits, underscoring the economic growth and the inflationary pressures in the housing market. If the present economic markers are anything to go by, the trajectory for these limits seems upward, albeit at a controlled pace. Barring unforeseen economic upheavals, we can anticipate a steady rise in the coming years. Periodically, Fannie Mae rolls out programs targeting specific demographics, like first-time homebuyers, which may have different income parameters. While rare, certain situations like natural disasters or economic downturns might see temporary adjustments or exceptions to cater to affected populations. Income limits aren't the only determinants. The presence of co-borrowers, their incomes, and other financial factors (like credit scores) can influence eligibility. Fannie Mae and other financial institutions offer online calculators, allowing potential borrowers to input their details and ascertain their eligibility instantaneously. Direct consultation remains a valuable tool. Lenders and financial advisors can provide tailored advice, ensuring borrowers are fully informed. To validate income claims, borrowers must furnish relevant documents, like tax returns, wage slips, and other proofs of income. These limits often dictate the pool of potential borrowers, impacting lenders' outreach and marketing strategies. Lenders might offer alternative loan products or provide financial counseling to those teetering around the set limits. Adherence not only aligns lenders with Fannie Mae's guidelines but also builds trust and credibility in the market, fostering long-term relationships with borrowers. The Fannie Mae Income Limits for 2024 reflect a conscious effort to cater to diverse economic realities across regions, thereby staying true to the mission of supporting low and moderate-income families. By considering various determinants such as geographical location, property size, and economic indicators, these limits not only dictate loan eligibility but also potentially offer more favorable interest rates and terms to those within the defined income brackets. The slight increase from 2024, continuing the trend from the past five years, indicates adaptability to inflationary pressures and evolving housing market conditions. For both borrowers and lenders, understanding and navigating these income limits is pivotal, ensuring accessibility to desired loan products and fostering trust in the broader housing landscape.Fannie Mae Income Limits Overview

What Are the Fannie Mae Income Limits for 2024?

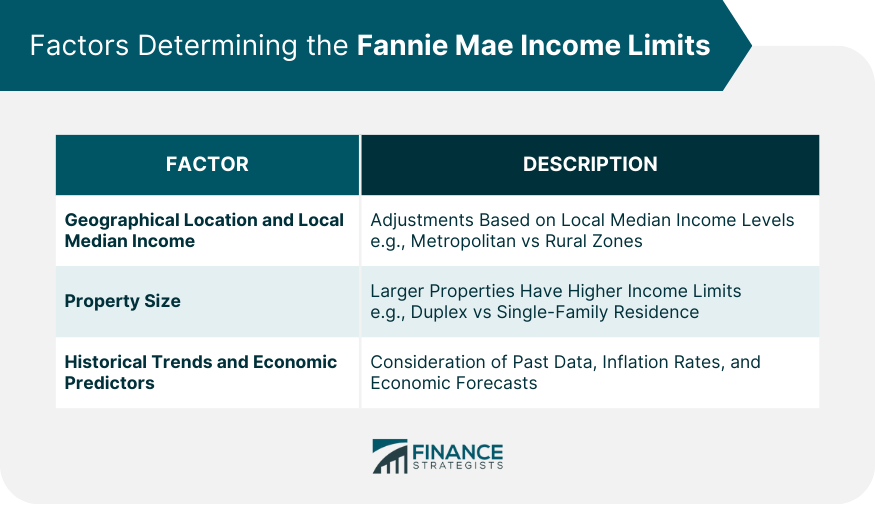

Factors Determining the Fannie Mae Income Limits

Geographical Location and Local Median Income

Property Size (e.g., Single Family, Duplex, etc)

Historical Trends and Economic Predictors

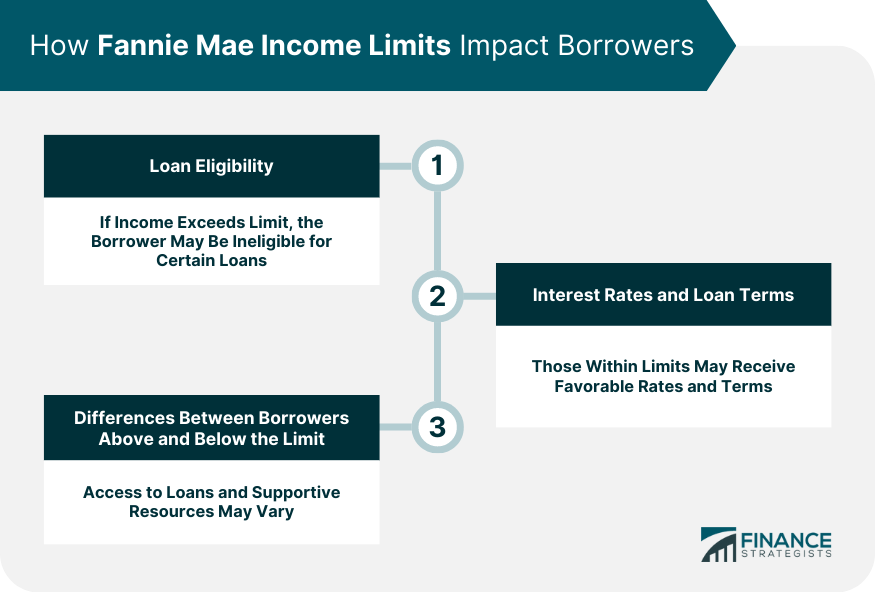

How Fannie Mae Income Limits Impact Borrowers

Loan Eligibility

Interest Rates and Loan Terms

Differences Between Borrowers Above and Below the Limit

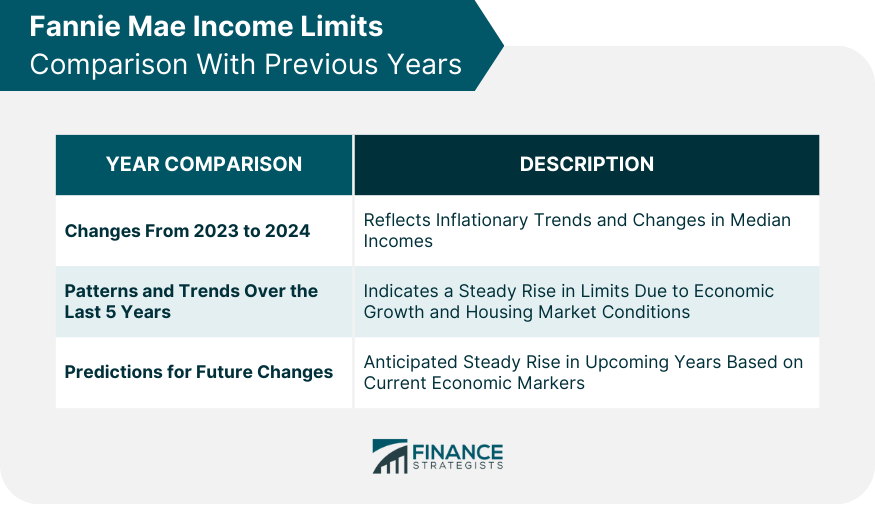

Fannie Mae Income Limits Comparison With Previous Years

Changes From 2023 to 2024

Patterns and Trends Over the Last 5 Years

Predictions for Future Changes

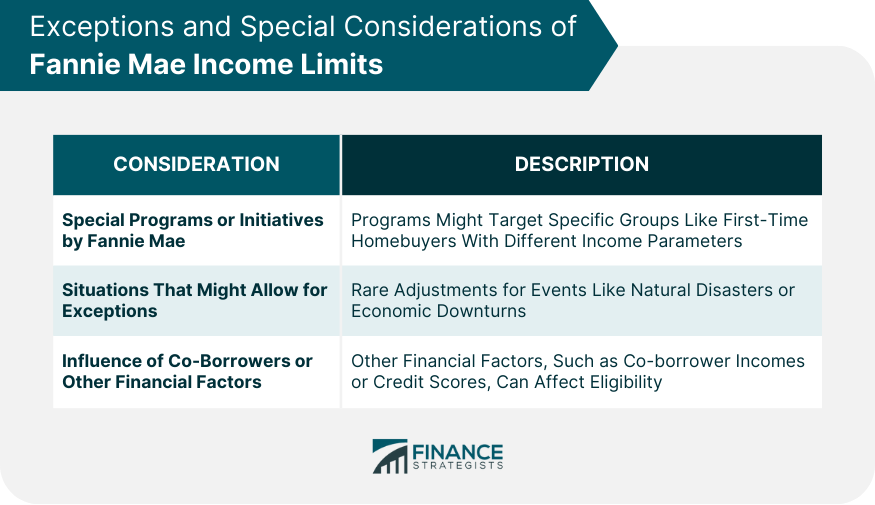

Exceptions and Special Considerations of Fannie Mae Income Limits

Special Programs or Initiatives by Fannie Mae

Situations That Might Allow for Exceptions

Influence of Co-Borrowers or Other Financial Factors

How to Determine Eligibility Based on Fannie Mae Income Limits

Online Tools and Calculators

Contacting Lenders and Financial Advisors

Required Documentation for Verification

Fannie Mae Income Limits Implications for Lenders

How Income Limits Influence Lending Decisions

Strategies for Addressing Borrowers Near the Limit

Lender Benefits of Adhering to Income Limits

Conclusion

Fannie Mae Income Limits FAQs

The Fannie Mae Income Limits 2024 refer to the maximum annual earnings a borrower can have to qualify for certain Fannie Mae loan products. These limits vary based on location and property size.

The Fannie Mae Income Limits 2024 were adjusted to reflect current economic conditions, inflationary trends, and changes in median incomes across various regions.

If a borrower's income exceeds the specified Fannie Mae Income Limits 2024 for a particular loan product, they may be deemed ineligible. However, those within the limits might also enjoy favorable terms and rates.

While the Fannie Mae Income Limits 2024 are standard, there are special programs or situations (e.g., natural disasters) where exceptions or adjustments might be made.

For detailed, region-specific information on Fannie Mae Income Limits 2024, it's best to visit the official Fannie Mae website or consult with lenders and financial advisors in your area.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.