Fannie Mae, formally known as the Federal National Mortgage Association (FNMA), is a government-sponsored enterprise (GSE) established in 1938 to support the U.S. housing market. Its primary mission is to provide liquidity, stability, and affordability to the mortgage market. It achieves this by purchasing mortgages from lenders, bundling them, and then selling them as mortgage-backed securities to investors. By doing so, lenders are provided with the capital needed to make more home loans available to consumers. Over the decades, Fannie Mae has been a pivotal player in the expansion of homeownership in the U.S. Although it operates under a congressional charter, it's a shareholder-owned company, meaning its profits are returned to shareholders. Its operations, alongside other GSEs like Freddie Mac, are integral to the functioning and accessibility of America's housing finance system. Fannie Mae offers the Manufactured Community Housing Loan to promote homeownership in the US, especially among underserved communities. These loans specifically target manufactured homes, which are often more affordable than traditional brick and mortar homes, offering a viable homeownership pathway to many Americans. Manufactured homes provide a fusion of modern design with affordability, making them an attractive choice for many. Fannie Mae recognizes this potential and aims to make the home-buying process as seamless as possible for this segment. A deep understanding of eligibility can streamline your application process. First, the property types eligible are predominantly manufactured homes, which are factory-built, but they should meet specific safety and quality standards. Second, borrowers need to fulfill certain income, credit, and employment conditions. Lastly, the location and community standards play a pivotal role; for instance, the community should have amenities and infrastructures that adhere to Fannie Mae's criteria. While these criteria may seem extensive, they ensure both the borrower's and lender's security, creating a win-win situation. Manufactured homes have grown in popularity due to their affordability and reduced environmental impact. They are homes built in factories and then transported to a chosen location. However, not all manufactured homes qualify; they must adhere to the Federal Manufactured Home Construction and Safety Standards. These standards ascertain that the homes are built under stringent conditions, guaranteeing longevity and safety for its inhabitants. Prospective borrowers must meet particular criteria. A steady employment history and a certain credit score range are often necessary. It's not just about numbers; the borrower's credit behavior and financial discipline are scrutinized to gauge their ability to repay the loan. Fannie Mae seeks to ensure that the borrower can comfortably manage their loan repayments without sacrificing their quality of life. The location of the manufactured home can influence its eligibility. Homes should be situated in approved communities that maintain specific standards concerning amenities, management practices, and overall upkeep. These standards aim to ensure that homeowners live in environments that are conducive to their well-being and growth. Before diving into the application, it's wise to determine if you're a fitting candidate. Check the property type, your financial standing, and the community standards. Some preliminary research can save time and effort down the road. Knowing where you stand can also give you confidence throughout the process, ensuring you're well-prepared for each step. Documentation serves as the backbone of your application. Typical documents include proof of income, employment verification, and credit reports. Having these in order ensures a smoother process. Organized and prompt documentation can expedite the approval process, as it allows the lender to get a clear and comprehensive understanding of your financial profile. Once documentation is ready, the actual application begins. It's a comprehensive form that captures the borrower's financial life. Accuracy is paramount; any discrepancies can lead to delays or denials. A thorough and honest application is not just a formality but a testament to a borrower's reliability. After submission, there's a waiting period. The lender will conduct a preliminary review, scrutinizing the details provided. It's a phase of anticipation, but patience is key. This review is critical as it determines if the application progresses or if there are areas needing further clarification. An integral part of the process is the property's evaluation. An inspector checks for adherence to safety and quality standards, while an appraiser determines the home's market value. This dual evaluation ensures that the property is a solid investment both in terms of safety and financial viability. Once all steps are complete, you'll receive the lender's decision. A positive outcome means you're one step closer to homeownership, while a denial often comes with feedback, providing a chance to rectify issues. It's a monumental phase, as it signifies the culmination of your efforts and the start of your homeownership journey. With an approval, the final step is ironing out the loan's specifics. This includes finalizing interest rates, monthly payments, and other pertinent details. It's a collaborative process, ensuring both lender and borrower are on the same page, setting the stage for a successful loan tenure. One notable advantage of this loan is the competitive interest rates it offers. Borrowers can secure these loans at rates that often rival, if not beat, many conventional home loans. This affordability can translate into significant savings over the loan's lifespan. Competitive rates mean borrowers can enjoy more financial flexibility, potentially using the savings for other life goals. Tailoring your loan term based on your financial situation is an option here. Whether you're looking for a shorter-term to pay off your loan quickly or a longer one to keep monthly payments low, there's likely a term that fits your needs. This flexibility ensures that homeownership doesn't become a financial burden but remains a joyful journey. By opting for this loan, borrowers indirectly support the broader mission of affordable housing. These loans help individuals enter the housing market, often for the first time, promoting diverse communities and ensuring everyone has a shot at the American dream. Every loan sanctioned adds to the dream of creating inclusive communities where every individual has an equal footing. High down payments can be a barrier for many. Fortunately, this loan often comes with reduced down payment requirements, making the initial step towards homeownership less burdensome. This means potential homeowners can enter the market faster, without having to wait years saving for a down payment. For those looking to refinance, the process can be smoother and more efficient. Borrowers might find opportunities to lock in lower rates or adjust their terms with minimal hassle. Such streamlined processes ensure that borrowers can adapt their loans to changing financial circumstances with ease. Interest rates are susceptible to market dynamics. While fixed-rate loans offer stability, adjustable-rate mortgages can fluctuate. Borrowers should understand this aspect, gauging how potential rate changes might impact their monthly payments and overall loan cost. Real estate is generally seen as appreciating, but it's not guaranteed. Factors like economic downturns or local developments can affect property values. It's essential to view the property not just as a home but also as an investment, understanding potential risks and rewards. Failure to meet loan obligations can lead to default. It's a grave concern, potentially leading to foreclosure. Borrowers should be aware of their responsibilities, ensuring they manage their finances in a way that accommodates timely loan repayments. Housing markets aren't always stable. Economic shifts, policy changes, or global events can sway them. While homeownership is a long-term commitment, understanding short-term market dynamics can offer insights, helping in making informed decisions. While your initial calculations might factor in present tax and insurance rates, these can change. Increased property taxes or insurance premiums can affect monthly expenditures. Being prepared for such eventualities ensures sustained financial well-being. Paying off a loan ahead of schedule might seem like a smart move, but some loans come with prepayment penalties. These are fees for settling the loan before the end of its term. It's vital to understand these nuances, ensuring you make decisions that are both financially and strategically sound. Traditional home loans, the most common type, offer a straightforward path to homeownership. They come with varying terms and interest rates based on market conditions and borrower eligibility. While they serve a broad audience, they might not be tailored for niche markets like manufactured homes. Backed by the Federal Housing Administration, FHA loans are known for their lower down payments and more lenient credit requirements. They're popular among first-time homebuyers and those with less-than-perfect credit. However, they come with mandatory mortgage insurance premiums, adding to the loan's cost. For veterans, active-duty service members, and certain military spouses, VA loans are a boon. Guaranteed by the U.S. Department of Veterans Affairs, these loans offer zero down payment and competitive rates. They celebrate and honor the service of military personnel by providing them with favorable homeownership conditions. USDA loans target rural and suburban homebuyers who might struggle with traditional financing. Backed by the U.S. Department of Agriculture, they often require no down payment. They aim to boost rural economies by promoting homeownership in less densely populated areas. For luxury homes and properties in high-cost areas, jumbo loans come into play. They exceed the loan limits set by Fannie Mae and Freddie Mac. Due to the larger amounts involved, they come with stricter credit requirements and larger down payments. They cater to a specific segment, ensuring that even luxury properties are within reach for eligible borrowers. Mortgage brokers act as intermediaries, bridging borrowers with suitable lenders. They understand the intricacies of the mortgage landscape and can guide borrowers, offering options that align with their needs. Their expertise can simplify the loan-seeking process, making it less daunting and more efficient. Choosing the right lender is as critical as choosing the right home. Different lenders have varied offerings and terms. It's essential to find one that understands your needs and offers terms that align with your financial landscape. A trustworthy lender not only provides funds but also guides and supports throughout the loan's lifespan. The Fannie Mae Manufactured Community Housing Loan presents a tailored solution for those seeking homeownership via manufactured homes, a segment offering affordability and modern design. This loan product not only bridges financial gaps with competitive rates and flexible terms but also advances the broader goal of affordable housing. While it's vital to appreciate the benefits, potential homeowners must be aware of inherent risks like interest rate fluctuations and property depreciation. In comparison with other housing loans, this product serves a specific niche, showcasing the diversity in the housing finance market. Engaging with mortgage brokers can further simplify the journey, guiding borrowers to suitable lenders. As homeownership remains a significant milestone for many Americans, understanding and leveraging such tailored solutions can be the key to realizing this dream.Overview of Fannie Mae

Understanding the Fannie Mae Manufactured Community Housing Loan

Definition and Purpose

Eligibility Criteria

Property Types

Borrower Requirements

Location and Standards

Application and Approval Process of the Fannie Mae Manufactured Community Housing Loan

Determine Eligibility

Collect Necessary Documentation

Complete Loan Application

Await Preliminary Review

Undergo Property Inspection and Appraisal

Receive Loan Decision

Finalize Loan Terms

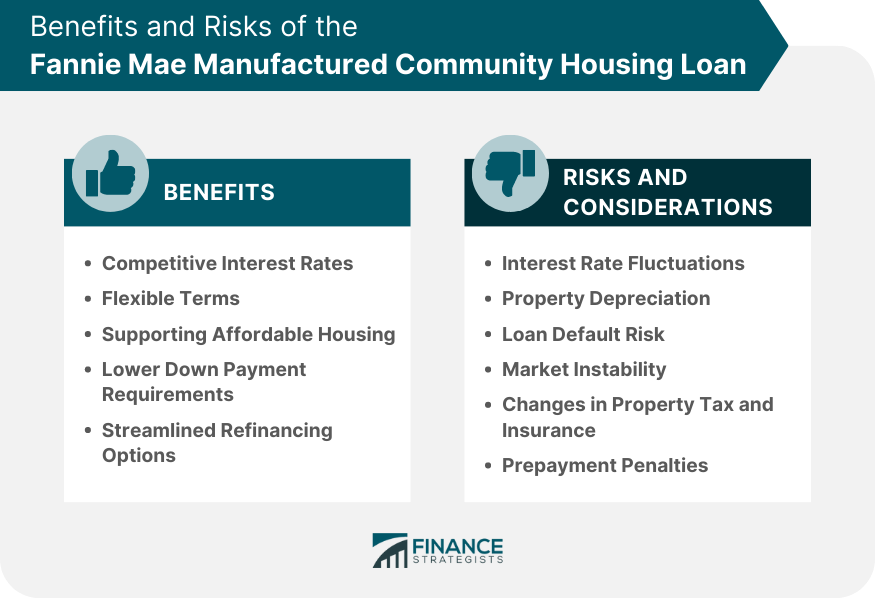

Benefits of the Fannie Mae Manufactured Community Housing Loan

Competitive Interest Rates

Flexible Terms

Supporting Affordable Housing

Lower Down Payment Requirements

Streamlined Refinancing Options

Risks and Considerations of the Fannie Mae Manufactured Community Housing Loan

Interest Rate Fluctuations

Property Depreciation

Loan Default Risk

Market Instability

Changes in Property Tax and Insurance

Prepayment Penalties

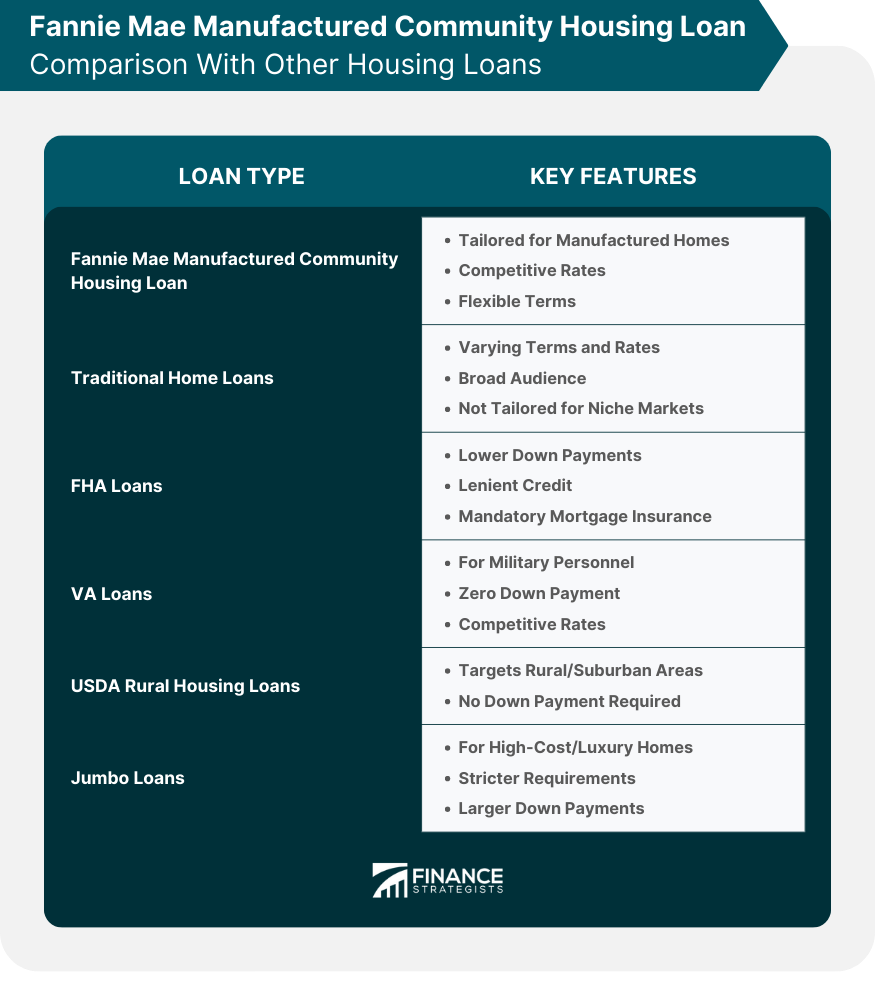

Fannie Mae Manufactured Community Housing Loan Comparison With Other Housing Loans

Traditional Home Loans

FHA Loans

VA Loans

USDA Rural Housing Loans

Jumbo Loans

Role of Mortgage Brokers and Lenders

How Mortgage Brokers Can Assist

Finding a Suitable Lender

Bottom Line

Fannie Mae Manufactured Community Housing Loan FAQs

It's a loan offered by Fannie Mae targeting manufactured homes, promoting affordable homeownership.

It specifically targets manufactured homes, offering competitive rates, lower down payments, and tailored benefits.

Key benefits include competitive interest rates, flexible terms, lower down payments, and contribution to affordable housing.

Steps include determining eligibility, collecting documentation, completing the application, property inspection, and finalizing loan terms.

Risks include interest rate fluctuations, property depreciation, loan default risk, and market instability.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.