Uniform policy provisions refer to standardized terms and conditions included in insurance policies, designed to provide consistency, fairness, and protection to policyholders. They are especially prevalent in health insurance policies and serve to simplify policy language and prevent misunderstandings between insurers and insured individuals. Uniform policy provisions aim to eliminate ambiguity, encourage transparency, and promote consumer confidence in the insurance industry. Additionally, uniform provisions promote fairness and efficiency in the market by creating a level playing field for all insurers. They reduce the potential for unfair competitive practices and help maintain a stable, trustworthy environment for consumers, regulators, and insurers alike. The regulatory framework surrounding uniform policy provisions is established by state and federal insurance regulators, who are responsible for creating and enforcing insurance laws and regulations. The National Association of Insurance Commissioners (NAIC) serves as a coordinating body that brings together state regulators to develop model laws and guidelines, which can then be adopted by individual states. The NAIC's Model Health Insurance Policy Provisions Law is one such example, which outlines the standard and optional provisions to be included in health insurance policies. State regulators have the authority to require insurers operating in their jurisdictions to include specific uniform provisions in their policies. These requirements ensure that health insurance policies meet minimum standards for coverage, consumer protection, and transparency, while still allowing for flexibility and customization based on individual state preferences and consumer needs. The entire contract provision clarifies that the policy, along with any attached endorsements or riders and the completed application, represents the complete agreement between the insured and the insurer. This provision prevents disputes over verbal or written agreements that are not part of the policy document itself. Any changes to the policy must be approved in writing by an executive officer of the insurance company, ensuring that policy alterations are properly documented and authorized. Moreover, the entire contract provision establishes that no agent or representative of the insurer has the authority to modify the policy or waive its provisions. This limitation helps maintain the integrity of the insurance contract and ensures that policyholders receive the coverage they have agreed to and paid for. The time limit on certain defenses provision sets a specific time frame within which an insurer can contest the validity of a policy based on misrepresentations or omissions made by the policyholder during the application process. Typically, a policy cannot be contested after it has been in force for a specified period, such as two years. This provision provides a degree of protection to policyholders by limiting the time an insurer has to challenge the policy, offering them more security and peace of mind. Furthermore, this provision also protects insurers by allowing them to contest policies within a reasonable time frame if there is evidence of fraud or material misrepresentation. By striking a balance between the rights of the insured and the insurer, this provision encourages honesty and transparency in the insurance application process. The grace period provision establishes a specific amount of time, usually 30 or 31 days, during which a policyholder can make a late premium payment without the policy lapsing. This provision offers policyholders flexibility and protection in case of financial difficulties or other circumstances that might temporarily prevent them from making timely premium payments. During the grace period, the policy remains in force, and the insurer is still obligated to pay any covered claims that arise. However, if the policyholder does not make the premium payment within the grace period, the policy may lapse, and the insurer is no longer obligated to provide coverage. In such cases, the insured may need to apply for reinstatement or seek a new policy, which could result in higher premiums, reduced coverage, or denial of coverage altogether. The reinstatement provision outlines the conditions and procedures for reinstating a lapsed health insurance policy. If a policy has lapsed due to non-payment of premiums, the policyholder may apply for reinstatement within a specified time frame, typically up to five years from the due date of the unpaid premium. To reinstate the policy, the insured must submit a written application, provide evidence of insurability, and pay any outstanding premiums plus interest. Reinstatement offers policyholders a second chance to regain coverage after a lapse, while also protecting insurers from adverse selection by requiring evidence of insurability. However, reinstated policies may have different terms or higher premiums than the original policy, depending on the insured's health status and other factors at the time of reinstatement. The notice of claim provision requires policyholders to notify the insurer of a claim within a specified time frame, usually 20 to 30 days after the occurrence of a covered loss. This notification allows insurers to promptly investigate claims, gather relevant information, and determine the appropriate course of action. Timely notice also helps policyholders receive prompt payment of their claims. The claim forms provision ensures that policyholders receive the necessary forms to file a claim within a reasonable time after notifying the insurer of a loss, typically 15 days. The insured is then required to complete and return the claim forms to the insurer within a specified time frame, usually 90 days after the occurrence of the loss. This provision facilitates a structured, efficient claims process, benefiting both the insurer and the insured. The proof of loss provision establishes the requirement for policyholders to submit written proof of a covered loss to the insurer. This documentation may include medical records, bills, and other relevant information that substantiates the claim. The insured must provide the proof of loss within a specified time frame, typically 90 days after the loss, although some policies may allow for additional time under certain circumstances. This provision ensures that insurers receive the necessary information to evaluate and process claims, while also protecting policyholders by setting a clear expectation for the submission of supporting documentation. Timely submission of proof of loss helps facilitate a prompt and fair resolution of claims. The time of payment of claims provision specifies the time frame within which an insurer must pay a covered claim after receiving proof of loss. Insurers are typically required to make payments within 30 to 60 days, depending on the specific policy language and state regulations. This provision helps ensure that policyholders receive timely payment for covered losses, providing financial relief and support when it is most needed. In addition, this provision may also include interest penalties for insurers that fail to pay claims within the specified time frame. Such penalties serve as an incentive for insurers to handle claims promptly and efficiently, further protecting the interests of policyholders. The payment of claims provision outlines the manner in which claim payments will be made. Generally, benefits are paid directly to the insured or their designated beneficiary. However, in some cases, such as when a healthcare provider has rendered services to the insured, payments may be made directly to the provider. This provision helps ensure that payments are made to the appropriate party and in a timely manner. Additionally, the payment of claims provision may also include details regarding the frequency of benefit payments, such as whether they will be paid in a lump sum or on a periodic basis. This information allows policyholders to plan and manage their financial resources effectively in the event of a covered loss. The physical examinations and autopsy provision grants the insurer the right to request medical examinations or autopsies of the insured at the insurer's expense. This right is typically exercised in cases where there is a dispute or uncertainty regarding the cause of death or the nature of a claimed injury or illness. The provision helps insurers gather necessary information to accurately assess and process claims, ensuring that benefits are paid appropriately and in accordance with the policy terms. However, this provision also safeguards the privacy and dignity of the insured by requiring that examinations and autopsies be conducted in a reasonable manner and by a licensed medical professional. Additionally, the insurer's right to request such examinations or autopsies is typically subject to state laws and regulations, which may impose limitations or restrictions to protect the rights of policyholders and their families. The legal actions provision establishes a time frame within which a policyholder may initiate legal proceedings against the insurer to dispute a claim decision. This provision prevents legal disputes from arising indefinitely and encourages the timely resolution of disagreements between insurers and policyholders. The time frame for initiating legal action is usually specified as a minimum of 60 days and a maximum of three years after the insurer has provided proof of loss. By setting a clear time limit for legal actions, this provision helps maintain stability and predictability within the insurance market, as both insurers and policyholders can better anticipate and prepare for potential disputes. Furthermore, the provision encourages policyholders to pursue alternative dispute resolution methods, such as mediation or arbitration, before resorting to litigation. The change of beneficiary provision allows policyholders to designate or change the beneficiary who will receive the policy benefits in the event of the insured's death. This provision ensures that policyholders have the flexibility to adjust their beneficiary designations according to their needs and circumstances, such as changes in family structure, relationships, or financial obligations. Most policies allow policyholders to change their beneficiary at any time, without the consent of the current beneficiary, unless the designation is made irrevocable. An irrevocable beneficiary designation requires the consent of the beneficiary to make any changes, providing an additional layer of protection for the beneficiary's interests. The change of occupation provision addresses the impact of a policyholder's change in occupation on their health insurance coverage. If the insured changes to a more hazardous occupation, the insurer may reduce the benefits payable under the policy, increase the premium, or both. Conversely, if the insured changes to a less hazardous occupation, they may be entitled to a premium reduction or increased benefits. This provision recognizes the relationship between an individual's occupation and their risk of illness or injury, allowing insurers to adjust coverage and premiums accordingly. Policyholders must notify the insurer of any changes in occupation to ensure that their coverage remains appropriate and in force. The misstatement of age or gender provision addresses the consequences of an inaccurate representation of the insured's age or gender on the policy application. If such a misstatement is discovered, the insurer has the right to adjust the policy's benefits, premiums, or both, based on the correct information. In some cases, the insurer may also have the right to rescind the policy if the misstatement was material and intentional. This provision protects insurers from adverse selection and potential fraud while ensuring that policyholders pay premiums and receive benefits that are commensurate with their actual risk profile. Policyholders have a responsibility to provide accurate information during the application process to maintain the validity of their coverage. The other insurance with this insurer provision addresses the coordination of benefits when a policyholder has multiple policies with the same insurer. This provision prevents overinsurance and duplicate payments by specifying how benefits will be paid under each policy in the event of a covered loss. In most cases, the policy with the earliest effective date is considered primary and will pay benefits first, while the other policies will pay benefits only if the primary policy's limits have been exhausted. By coordinating benefits between multiple policies, this provision helps maintain the principle of indemnity, which aims to restore the insured to their pre-loss financial position without allowing for profit. It also ensures that insurers do not overpay on claims, helping to maintain the financial stability of the insurance market. The insurance with other insurers provision addresses the coordination of benefits when a policyholder has coverage with multiple insurance companies. Similar to the other insurance with this insurer provision, this clause prevents overinsurance and duplicate payments by outlining how benefits will be paid among different insurers in the event of a covered loss. In such cases, each insurer typically pays a proportionate share of the claim based on the ratio of its policy limit to the total amount of coverage available from all policies. This provision ensures that policyholders receive the appropriate benefits from each insurer while preventing overpayment and maintaining the principle of indemnity. The relation of earnings to insurance provision establishes a maximum limit on the benefits payable under a policy based on the insured's earnings. This clause is commonly found in disability income policies, which are designed to replace a portion of the insured's lost income due to illness or injury. By setting a maximum limit on benefits, this provision prevents overinsurance and discourages fraudulent claims. Moreover, the relation of earnings to insurance provision encourages policyholders to return to work as soon as they are able, as their benefits will not exceed their pre-disability income. This provision helps maintain the affordability and sustainability of disability income insurance by ensuring that benefits are paid only when needed and within reasonable limits. The unpaid premium provision allows insurers to deduct any outstanding premiums from the benefits payable under a policy. This clause ensures that policyholders fulfill their premium payment obligations before receiving benefits from the insurer. By allowing insurers to deduct unpaid premiums from claim payments, this provision helps maintain the financial stability of the insurance market and encourages timely premium payments from policyholders. The cancellation provision outlines the conditions and procedures for both the insurer and the policyholder to cancel a health insurance policy. Depending on the policy terms and state regulations, the insurer may be allowed to cancel a policy for reasons such as non-payment of premiums, material misrepresentation, or fraud. The policyholder, on the other hand, may cancel the policy at any time by providing written notice to the insurer. This provision provides flexibility to both parties, allowing them to terminate the insurance contract if it no longer meets their needs or if the relationship becomes untenable. In the event of cancellation, the insurer may be required to refund any unearned premiums to the policyholder, ensuring a fair and equitable resolution. The conformity with state statutes provision ensures that the policy terms and conditions comply with applicable state laws and regulations. If any provision in the policy conflicts with state law, the provision will be amended to conform to the minimum requirements of the law. This clause helps maintain the validity of the insurance contract and protects the rights of policyholders and insurers under the governing legal framework. The illegal occupation provision excludes coverage for injuries or illnesses resulting from the insured's participation in illegal activities or occupations. By excluding coverage for losses arising from illegal activities, this provision helps maintain the principle of insurable interest, which requires that policyholders have a legitimate and lawful interest in the subject of the insurance. The intoxicants and narcotics provision excludes coverage for losses that result from the insured's use of alcohol, drugs, or other intoxicants, to the extent permitted by law. This exclusion discourages policyholders from engaging in risky behaviors that could lead to illness or injury and helps maintain the affordability of health insurance by preventing claims for losses that are within the policyholder's control. However, this provision is subject to state laws and regulations, which may impose limitations on the scope of exclusions related to alcohol and drug use. Riders and endorsements are add-ons to health insurance policies that provide additional coverage or modify the terms of the policy. These provisions allow policyholders to customize their insurance coverage to better suit their individual needs, preferences, and risk profiles. By offering riders and endorsements, insurers can provide more comprehensive and tailored coverage options to their clients, enhancing customer satisfaction and retention. Some common health insurance riders and endorsements include: Waiver of Premium Rider: This rider waives the premium payments for the policyholder if they become disabled and unable to work for a specified period. Critical Illness Rider: This rider provides a lump-sum payment to the policyholder upon the diagnosis of a specified critical illness, such as cancer, heart attack, or stroke. Accidental Death and Dismemberment (AD&D) Rider: This rider pays additional benefits to the policyholder or their beneficiary in the event of accidental death or dismemberment. Maternity Coverage Endorsement: This endorsement extends coverage to include maternity-related expenses, such as prenatal care, delivery, and postnatal care. Mental Health Coverage Endorsement: This endorsement expands coverage to include mental health and substance abuse treatment, in compliance with state and federal parity laws. Uniform policy provisions serve to protect consumers by standardizing policy language, making it easier for policyholders to understand their coverage and compare different policies. This increased transparency enables consumers to make more informed decisions when purchasing health insurance and helps prevent disputes arising from misunderstandings or ambiguities in policy language. Additionally, uniform provisions help ensure that all policyholders receive a baseline level of protection, as they establish minimum standards for coverage, benefits, and policyholder rights. This baseline protection promotes fairness and equity in the insurance market, safeguarding consumers from potentially exploitative or unfair practices by insurers. Uniform policy provisions also benefit insurers by providing clear guidelines for compliance with state and federal regulations. By adhering to these standardized provisions, insurers can reduce the risk of regulatory fines, penalties, and legal disputes arising from non-compliant policies. Furthermore, uniform provisions can streamline the policy drafting and review process, resulting in cost savings for insurers. From a risk management perspective, uniform provisions help insurers maintain a consistent and predictable book of business. By incorporating standardized language and provisions, insurers can better anticipate potential claims and more accurately price their policies to reflect the risks they are assuming. As the healthcare landscape continues to evolve, regulators will likely update and revise uniform policy provisions to reflect emerging trends and changing needs. These ongoing developments will require insurers to remain vigilant and adaptive, ensuring that their policies remain compliant with the latest regulatory requirements. Policyholders, too, must stay informed about changes in their coverage and rights under new or amended provisions. Uniform policy provisions play a pivotal role in the health insurance market by promoting transparency, standardization, and consumer protection. By establishing a baseline for policy language and provisions, they ensure clarity and fairness for both policyholders and insurers. Key aspects of uniform policy provisions include standard provisions, optional provisions, and rider and endorsement provisions, which together address various aspects of health insurance coverage, benefits, and policyholder rights. As the healthcare landscape evolves, ongoing regulatory developments and technological advancements will continue to shape the future of uniform policy provisions. Insurers must remain vigilant and adaptive to ensure compliance with changing regulations, while policyholders should stay informed about any modifications to their coverage and rights. By working together and embracing these changes, insurers and policyholders can maintain a stable, equitable, and consumer-focused health insurance market that meets the needs of all stakeholders.What Are Uniform Policy Provisions in Health Insurance?

Standard Provisions in Health Insurance Policies

Entire Contract and Changes

Time Limit on Certain Defenses

Grace Period for Premium Payment

Reinstatement of Lapsed Policies

Notice of Claim and Claim Forms

Proof of Loss

Time of Payment of Claims

Payment of Claims

Physical Examinations and Autopsy

Legal Actions

Change of Beneficiary

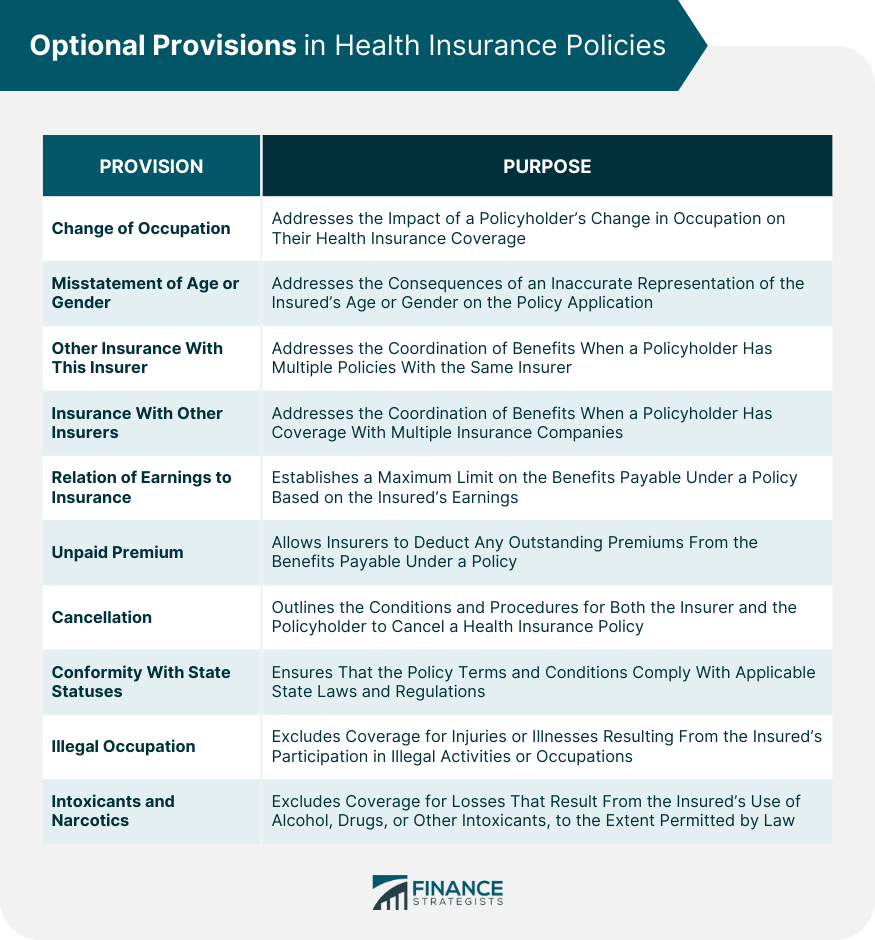

Optional Provisions in Health Insurance Policies

Change of Occupation

Misstatement of Age or Gender

Other Insurance With This Insurer

Insurance With Other Insurers

Relation of Earnings to Insurance

Unpaid Premium

Cancellation

Conformity With State Statutes

Illegal Occupation

Intoxicants and Narcotics

Rider and Endorsement Provisions

Definition and Purpose

Common Health Insurance Riders and Endorsements

Impact of Uniform Policy Provisions on Consumers and Insurers

Consumer Protection and Clarity

Insurer Compliance and Risk Management

Conclusion

Uniform Policy Provisions, Health Insurance FAQs

Uniform Policy Provisions are standardized provisions in health insurance policies that provide certain benefits and protections to policyholders.

The key features of Uniform Policy Provisions include guaranteed renewability, continuation of coverage, preexisting condition exclusions, and portability of coverage.

Uniform Policy Provisions provide consistency in coverage and enhanced consumer choice, while also protecting policyholders and ensuring that they have access to necessary medical care.

Some challenges associated with Uniform Policy Provisions include increased costs, potential for adverse selection, and administrative burden.

The future of Uniform Policy Provisions will likely involve ongoing efforts to balance the benefits and challenges associated with these provisions, while also ensuring that consumers are educated about their rights and options in health insurance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.