A waiver of premium rider is a clause in an insurance policy that waives premium payments if the policyholder becomes critically ill, seriously injured, or physically impaired before age 60 or 65. To purchase a waiver of premium rider, policyholders may need to meet certain age and health requirements. The rider is added to an insurance policy for an additional fee, which raises the cost of the life insurance policy. A waiver of premium rider can be added to most life insurance policies, such as universal, term, and whole life insurance policies. It is designed to provide policyholders with financial security in case they become disabled or unable to work. This rider can also be a valuable benefit for those who work in high-risk jobs or are concerned about staying financially healthy in case of injury. The conditions that must be met for a waiver of premium rider to take effect to depend on the policy but typically include a waiting period before the rider kicks in, the definition of "disability," and eligibility requirements. The waiting period varies depending on the policy and can range from six months to two years. If the policyholder becomes disabled or injured during the waiting period, they may receive a full refund of paid premiums. However, without a waiting period, the insurance company would assume much more risk and may not be able to provide coverage to policyholders. Examples of when a waiver of premium rider would be useful include instances of injury or illness that prevent the policyholder from working in a traditional capacity. The most commonly considered diseases are those that require significant hospital stays resulting in the policyholder being unable to work. Some riders stipulate that the condition need only adversely affect the policyholder's occupation. The coverage provided by policies with a waiver of premium rider significantly differs from those without it. Having a waiver of premium rider means that the policyholder will not be required to pay premiums during a period of disability or injury, which can provide significant financial relief during a difficult time. A waiver of premium rider is a valuable addition to a life insurance policy that provides several benefits to policyholders, such as the following: The primary benefit of a waiver of premium rider is that it waives premium payments in case of disability. This means that policyholders who become disabled or injured and are unable to work will not be required to make premium payments during this period. This can provide significant financial relief during a difficult time, allowing policyholders to focus on their recovery rather than worrying about making payments for their life insurance policy. For example, if a policyholder is injured on the job and is unable to work for several months, having a waiver of premium rider can provide the financial security they need to pay for their living expenses and other bills without worrying about paying for their life insurance premiums. This can be particularly important for those who do not have a significant amount of savings or other sources of income to rely on during a period of disability or injury. In addition to waiving premium payments during a period of disability or injury, a waiver of the premium rider also provides financial security to policyholders and their families. By waiving premium payments, policyholders can redirect their limited personal funds to palliative care, personal finances, and living expenses, which can be particularly important for those with significant medical bills or other expenses related to their disability or injury. Furthermore, a waiver of premium rider can provide peace of mind to policyholders and their families, knowing that their life insurance policy will continue to provide coverage during a difficult time. This can help alleviate some of the stress and anxiety that comes with being disabled or injured and can help policyholders focus on their recovery. Another benefit of a waiver of premium rider is that it can be added to most life insurance policies. This makes it an accessible option for many individuals who are concerned about the financial impact of disability or injury. Policyholders can add a waiver of premium rider to their life insurance policy for an additional fee, which varies depending on the policy, the policyholder's age, health, and other factors. Furthermore, a waiver of premium rider can be added to most types of life insurance policies, such as term, whole, and universal life insurance policies. This means that policyholders have various options to choose from and can select the policy that best suits their needs. Adding a waiver of premium rider to a life insurance policy is a straightforward process, but it is important for policyholders to understand the steps involved, cost considerations, and eligibility requirements. The first step to adding a waiver of premium rider to an existing policy is to contact your insurance company. They will provide you with the necessary information and paperwork to get started. Once you receive the paperwork, you will need to complete it and provide any required documentation, such as medical records or proof of income. There is typically an additional fee for adding a waiver of premium rider to a life insurance policy. This fee varies depending on the policy, the policyholder's age, health, and other factors. You will need to pay the fee to activate the rider. After submitting the paperwork and paying the fee, you will need to wait for approval from your insurance company. This process can take several weeks, so patience is important. Once your waiver of premium rider is approved, you will receive confirmation from your insurance company. This will include information about the coverage provided by the rider and any limitations or eligibility requirements. Adding a waiver of premium rider to a life insurance policy will result in an additional fee, which varies depending on several factors, such as the policyholder's age, health, and type of policy. This fee is typically added to the policyholder's premium, either as a separate charge or included in the overall premium amount. It is important to note that adding a waiver of premium rider to a life insurance policy will increase the policyholder's premiums. However, the cost of the rider is typically relatively low compared to the potential benefits it provides, such as financial security and peace of mind during a period of disability or injury. There are typically eligibility requirements and limitations associated with a waiver of premium rider. For example, policyholders may need to meet certain age and health requirements to qualify for the rider. Furthermore, pre-existing conditions or physical impairments may disqualify policyholders from receiving benefits from the rider. It is important to review the eligibility requirements of the rider before adding it to a life insurance policy. Policyholders should also consider any potential limitations or exclusions associated with the rider and ensure they fully understand the coverage provided. A waiver of premium rider is a valuable addition to a life insurance policy that provides financial security to policyholders and their families during a period of disability or injury. This rider waives premium payments in case of disability and provides significant financial relief, allowing policyholders to focus on their recovery rather than worrying about making payments for their life insurance policy. Policyholders can add a waiver of premium rider to most life insurance policies, including term, whole, and universal life insurance policies. The cost of the rider varies depending on several factors, such as the policyholder's age, health, and type of policy, but it is typically relatively low compared to the potential benefits it provides. Adding a waiver of premium rider to a life insurance policy is a straightforward process that involves contacting the insurance company, completing the necessary paperwork, paying the fee, and waiting for approval. Individuals who work in high-risk jobs or are concerned about staying financially healthy in case of injury should consider adding a waiver of premium rider to their life insurance policy. If you are considering adding a waiver of premium rider to your life insurance policy, it may be beneficial to speak with a financial advisor who can provide personalized advice and guidance. What Is a Waiver of Premium Rider?

How Does a Waiver of Premium Rider Work?

Benefits of a Waiver of Premium Rider

Waives Premium Payments in Case of Disability

Provides Financial Security to Policyholders and Their Family

Accessible Option for Many Insurance Policies

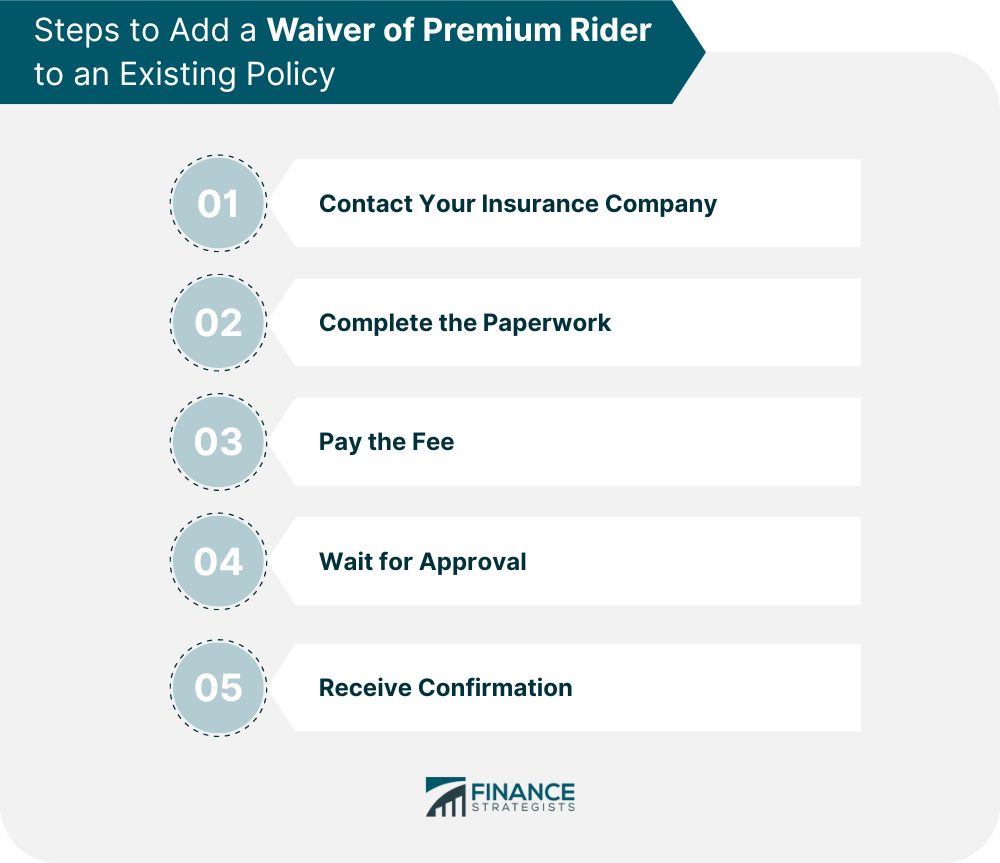

How to Add a Waiver of Premium Rider to a Life Insurance Policy

Contact Your Insurance Company

Complete the Paperwork

Pay the Fee

Wait for Approval

Receive Confirmation

Cost Considerations and Premium Adjustments

Eligibility Requirements and Limitations of a Waiver of Premium Rider

Final Thoughts

Waiver of Premium Rider FAQs

A waiver of premium rider is an insurance policy clause that waives premium payments if the policyholder becomes critically ill, seriously injured, or physically impaired.

Eligibility requirements for a waiver of premium rider may vary depending on the insurance company and policy. Generally, policyholders must meet age and health requirements and may need to provide proof of income or medical records.

A waiver of premium rider waives premium payments in case of disability or injury, allowing policyholders to redirect their funds to palliative care, personal finances, and living expenses. The rider typically includes a waiting period before it takes effect and may have other limitations or exclusions.

The cost of a waiver of premium rider varies depending on several factors, such as the policyholder's age, health, and type of policy. It is typically added to the policyholder's premium as a separate charge or included in the overall premium amount.

A waiver of premium rider can be added to most life insurance policies, such as term, whole, and universal life insurance policies. However, policyholders should review their policy and speak with their insurance company to determine their eligibility and any limitations or exclusions associated with the rider.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.