An Umbrella Insurance Policy is a supplementary coverage that operates above and beyond the limits of standard insurance policies such as homeowners, auto, or watercraft insurance. This policy is designed to kick in when the coverage of these other policies is exhausted, thereby providing extra liability protection. It covers a broader range of scenarios and offers higher limits, typically starting from $1 million. The need for this policy arises from potential personal liability risks that can lead to costly lawsuits or damages. This includes severe accidents, incidents on your property, or other situations where you're held responsible for injuries or property damages. An Umbrella Insurance Policy provides an additional layer of security, especially beneficial for those with substantial assets or high-risk lifestyles, protecting them from major claims and safeguarding their financial future. Extra liability refers to the potential financial responsibility you may bear that exceeds the standard coverages provided by your basic insurance policies. This could result from severe car accidents, incidents on your property, or other situations where you are found legally responsible for injuries or damages. In our litigious society, lawsuits can be costly. Legal fees, medical bills, and damage awards can easily exceed the standard liability coverage of home or auto insurance. An umbrella policy kicks in where these policies reach their payout limits, offering extra peace of mind. Umbrella insurance covers a much higher limit and goes above and beyond claims directly relating to your home and auto. The main purpose of an umbrella policy is to protect a policy owner’s assets from an unforeseen event, such as a tragic accident in which they are held responsible for damages or bodily injuries. Your umbrella policy comes into effect when the liability limits on your other policies, like auto or home, have been exhausted. It can also cover you for personal liability situations that other policies may not cover, such as libel, slander, or defamation. An umbrella policy supplements your basic liability policies, such as home, auto, or boat insurance. It provides coverage over and above the limits of these policies and may also cover some situations that aren’t covered by the other types of policies. Consider, for example, a serious car accident where the damage you cause exceeds your auto insurance's liability limit. Your umbrella insurance would help cover the remaining cost. Or, if a guest in your home falls and incurs medical bills that exceed your homeowners' liability limit, your umbrella insurance would cover the excess amount. Umbrella insurance policies typically offer high limits, ranging from $1 million to $5 million or more. These high limits are one of the key reasons why people opt for this kind of policy - it provides substantial protection in a litigious world where judgments can be high. Premiums for umbrella insurance policies tend to be relatively low, especially considering the amount of coverage they provide. However, the exact premium amount will depend on various factors, such as the amount of coverage, your personal risk factors, and the insurer you choose. Umbrella insurance policies typically don't have a deductible. However, they require that your underlying policies (like your homeowners or auto insurance) meet certain deductible levels. These amounts can vary by insurer and policy. Besides providing additional liability coverage, umbrella insurance also covers situations not covered by your other insurance policies. These can include coverage for libel, slander, false arrest, malicious prosecution, and other personal liability situations. The need for umbrella insurance largely depends on your personal risk factors. These can include owning property, having significant savings or assets, engaging in activities that can lead to injury lawsuits (like owning a swimming pool or a trampoline), or having young drivers in the household. Everyone faces some level of personal liability risk. If you cause an accident, damage someone's property, or injure someone, you may be found legally liable for the damages. If these damages exceed the liability limits of your existing insurance policies, an umbrella policy can protect you. Individuals with higher net worth or income are often more exposed to liability risks, as they have more to lose. Hence, they might consider an umbrella policy for the added protection. However, it's not just for the wealthy - even if you don't have significant assets now, a large judgment against you could impact your future earnings. The high coverage limits of umbrella policies provide significant financial protection. With coverage starting typically at $1 million, they can help safeguard your assets and future earnings from large liability claims. Umbrella insurance often covers a broad range of situations that other insurance policies may not, such as libel, slander, and false arrest. This makes it a versatile addition to your insurance portfolio. If you're sued, legal fees can add up quickly. One significant benefit of umbrella insurance is that it also provides coverage for defense costs, irrespective of the lawsuit outcome. Lastly, umbrella insurance can offer peace of mind, knowing that you're protected against potentially devastating lawsuits. This is especially important if you have significant assets or engage in activities that increase your liability risks. Like all insurance policies, umbrella insurance has exclusions. It doesn't cover damages you intentionally cause or liability you assume under a contract. It also doesn't cover your own injuries or damages to your own property. While the premiums for umbrella insurance are typically quite reasonable, they are an additional cost to consider. Moreover, umbrella policies often require you to carry certain minimum liability limits on your underlying policies, which could increase their cost. To purchase an umbrella policy, you must typically have auto or homeowners insurance with a certain minimum liability coverage. This means that individuals who don't qualify for these underlying policies might not be eligible for umbrella insurance. To choose the right umbrella policy, it's important to understand your liability risks and potential exposure. Factors to consider include your assets, income, lifestyle, and risk tolerance. It's essential to compare policies from different insurers, considering factors like coverage limits, exclusions, premiums, and the insurer's financial strength and reputation for customer service. The right policy limit for you depends on your personal situation. A common rule of thumb is to have enough umbrella insurance to cover your net worth. When considering premiums, remember that higher coverage limits typically come with higher premiums. If you need to make a claim on your umbrella policy, first, you must file a claim with your primary insurance policy. If the claim exceeds your primary policy's limits, you can then file a claim with your umbrella policy. Having proper documentation is key when filing an insurance claim. This can include police reports, medical bills, and other documents related to the claim. The more evidence you have, the smoother the claim process will typically be. Once you've filed a claim, your insurance company will investigate to determine if the claim is valid and how much they will pay. If you're found legally liable for damages, your umbrella policy will pay up to its coverage limit. It's essential to understand this process and cooperate fully with your insurer to facilitate a smooth claim settlement. Standard liability insurance, such as home or auto, provides coverage up to certain limits for specific types of risks. In contrast, umbrella insurance provides additional liability coverage beyond these limits and covers a broader range of situations. While both provide additional liability coverage, there are important differences. Excess liability insurance extends the limits of an underlying policy, but only for risks covered by that policy. Umbrella insurance, on the other hand, not only extends these limits but also covers additional risks. Specialized coverage policies provide protection against specific risks, such as flood or earthquake insurance. Umbrella insurance provides broad liability coverage that complements these policies, covering risks they may not and extending their coverage limits. An Umbrella Insurance Policy serves as a potent safety net, offering an additional layer of liability coverage beyond the limits of standard policies such as home, auto, or watercraft insurance. It functions by stepping in when the liability limits on other policies have been exhausted, or when certain personal liability situations are not covered by those policies. The key components of an Umbrella Insurance Policy include high policy limits, usually in the millions, relatively low premiums, and coverage for a broad range of potential risks and liabilities. This type of policy is crucial for protecting your assets from large liability claims and can bring significant peace of mind in a world where lawsuits are increasingly common. Understanding the mechanics and components of such a policy is key to making an informed decision about your personal liability coverage.Definition of Umbrella Insurance Policy

Understanding the Concept of Extra Liability

Importance and Relevance of an Umbrella Insurance Policy

How an Umbrella Insurance Policy Works

Coverage Beyond Standard Policies

Activation of Umbrella Insurance Policy

Interaction With Other Insurance Policies

Situational Examples and Scenarios

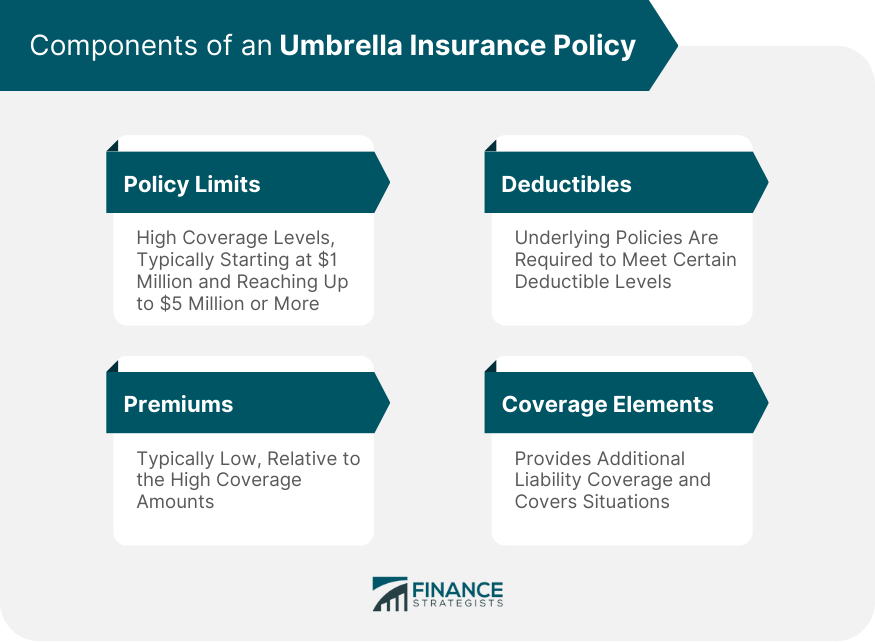

Components of an Umbrella Insurance Policy

Policy Limits

Premiums

Deductibles

Coverage Elements

The Need for an Umbrella Insurance Policy

Assessing the Need for Additional Coverage

Personal Liability Risks

Role of Net Worth and Income in the Decision

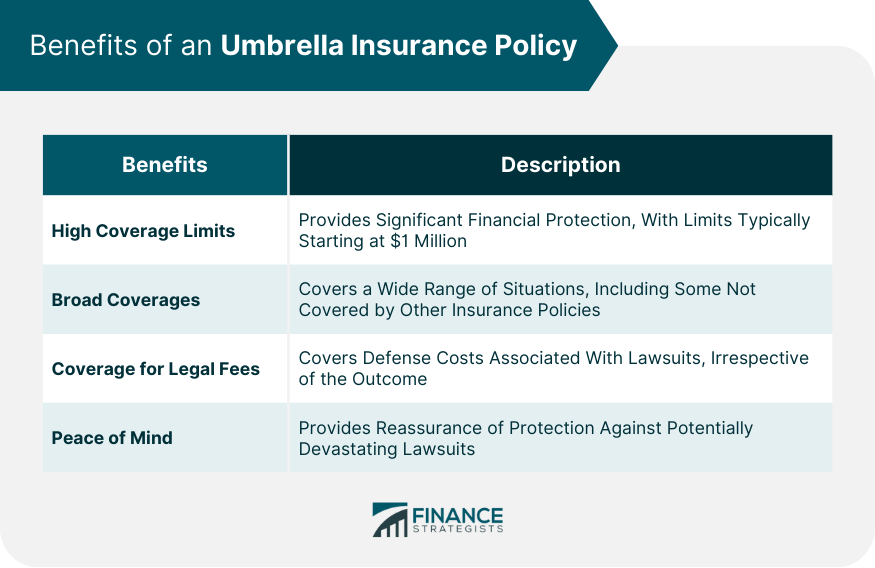

Benefits of an Umbrella Insurance Policy

High Coverage Limits

Broad Coverages

Coverage for Legal Fees

Peace of Mind

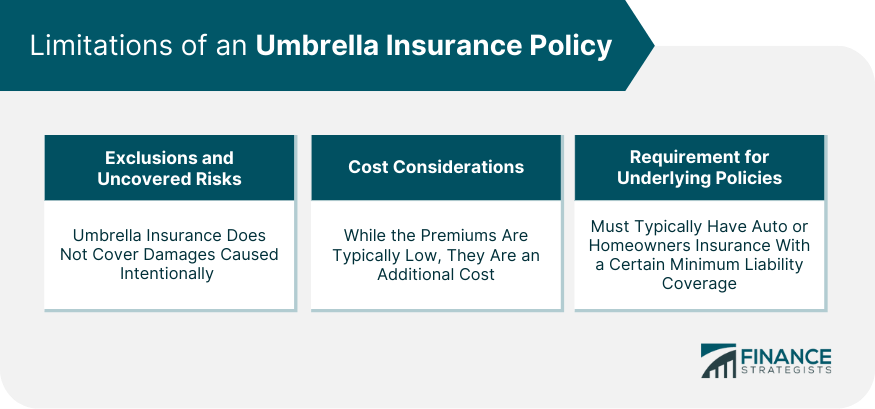

Risks of an Umbrella Insurance Policy

Exclusions and Uncovered Risks

Cost Considerations

Requirement for Underlying Policies

How to Choose the Right Umbrella Insurance Policy

Understanding Your Insurance Needs

Comparing Policies and Providers

Deciding on Policy Limits and Premiums

How to Make a Claim on an Umbrella Insurance Policy

Steps to Follow When Making a Claim

Documentation and Proofs

Process of Claim Settlement

Umbrella Insurance Policy vs Other Types of Insurance

Differences Between Umbrella and Standard Liability Insurance

Umbrella Insurance Policy vs Excess Liability Insurance

Umbrella Insurance Policy vs Specialized Coverage Policies

Conclusion

Umbrella Insurance Policy FAQs

An Umbrella Insurance Policy is a type of liability insurance that offers additional coverage beyond the limits of standard policies such as auto, home, or watercraft insurance. It comes into play when these basic policies have reached their coverage limits.

An Umbrella Insurance Policy activates when the liability coverage of your basic insurance policies is exhausted. It also covers certain situations not covered by standard insurance, such as slander, libel, and false arrest.

Key components of an Umbrella Insurance Policy include high policy limits, relatively low premiums, and broad coverage. These policies typically don't have a deductible, but they require that your underlying policies meet certain minimum coverage limits.

Limitations of an Umbrella Insurance Policy include exclusions for certain types of damages and risks, cost considerations, and the requirement to have certain underlying insurance policies.

An Umbrella Insurance Policy can be beneficial for anyone, but it's especially relevant for individuals with substantial assets or high income, those who engage in activities with increased liability risks, or those who want additional peace of mind from potential lawsuits.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.