Watercraft insurance, often referred to as boat insurance, is a type of insurance coverage that protects you against losses or damages to your watercraft. It extends to motorboats, sailboats, yachts, jet skis, and other types of personal watercraft. Much like car insurance, watercraft insurance provides critical financial protection. It can cover the costs of damage from accidents, fires, theft, and other risks. It also provides liability coverage, which protects you if you're at fault in an accident that results in injuries or property damage. Insurance brokers act as intermediaries between clients and insurance companies. They help clients identify their insurance needs, understand policy terms, and select the best coverage options. Watercraft insurance covers a wide variety of vessels, including but not limited to sailboats, motorboats, fishing boats, pontoon boats, yachts, and personal watercraft like jet skis. A typical watercraft insurance policy includes property coverage (for damages to the boat itself), liability coverage (for injuries or damages to others), and other optional coverages such as medical payments and uninsured watercraft coverage. In the context of watercraft insurance, property insurance covers the vessel and its equipment, while casualty insurance (liability) covers the policyholder's legal responsibility for the damages caused to others. Several factors influence the cost of watercraft insurance, including the type, size, and age of the watercraft, the intended use (personal, commercial, racing, etc.), the owner's boating experience, and the geographical location. Insurance brokers can help clients understand the factors affecting their insurance premiums and find the best rates by comparing offers from different insurance companies. The deductible is the amount you pay out-of-pocket before your insurance kicks in, while the premium is the cost of the insurance policy itself. A higher deductible usually means a lower premium, and vice versa. Property coverage protects against damage to your boat and its equipment, whether caused by collision, fire, theft, or other covered perils. Liability coverage protects you if your boat causes injury to others or damage to their property. It can also cover legal fees if you're sued as a result of an accident. This optional coverage pays for medical expenses if you, your passengers, or water skiers towed by your boat are injured in an accident. This coverage protects you if you're involved in an accident with another boater who is uninsured or doesn't have enough insurance to cover the damages. Watercraft insurance claims should be filed as soon as possible after an incident. This could be a collision with another boat, damage from a storm, theft, or an accident resulting in injuries. The claim process typically involves notifying your broker or insurer, providing a detailed account of the incident, submitting any necessary documentation (like police reports or medical bills), and cooperating with the insurer's investigation. Brokers can provide invaluable assistance during the claim process. They can help gather necessary documentation, communicate with the insurer, and negotiate settlements on behalf of the client. Claims can be denied for various reasons, such as policy exclusions or late reporting. Brokers can help clients understand their policy terms, meet deadlines, and effectively challenge claim denials when appropriate. While not all states require watercraft insurance, many marinas do. Additionally, if your boat is financed, your lender likely requires insurance. Various states and territories also have specific laws and regulations relating to watercraft insurance and liability coverage. Insurance brokers typically keep up with changes in laws and regulations through continuing education, industry news, and membership in professional associations. Changes in laws or regulations can affect the requirements for watercraft insurance, potentially impacting coverage limits, policy terms, and premiums. Emerging trends in watercraft insurance include the increasing use of technology for risk assessment and claim processing and growing interest in sustainable boating practices. Brokers play a vital role in adapting to industry changes. They need to stay informed about new trends, adapt their advice accordingly, and help clients navigate changes in the insurance landscape. Climate change, with its associated increase in severe weather events, could lead to higher risks for watercraft and potentially higher insurance premiums. It's an area that both insurers and brokers will need to watch closely. Watercraft insurance serves as a critical safety net, protecting boat owners from significant financial losses due to accidents, theft, or other damages. The intricacies of watercraft insurance, from understanding different types of coverage to navigating the claims process, highlight the pivotal role of insurance brokers. These professionals offer invaluable assistance in identifying suitable policies, facilitating acquisition, managing claims, and ensuring regular policy reviews. They also stay abreast of changes in laws, regulations, and emerging trends, including the potential impact of climate change on insurance practices. In an ever-evolving insurance landscape, the guidance of a knowledgeable broker can be indispensable. Therefore, if you own a watercraft, or plan to purchase one, seeking the services of a professional insurance broker can help secure your investment and provide peace of mind as you navigate the waters of watercraft insurance.Definition of Watercraft Insurance

The Importance of Watercraft Insurance

How Brokers Facilitate Watercraft Insurance Acquisition

Understanding the Basics of Watercraft Insurance

Different Types of Watercraft Covered

Key Components of a Watercraft Insurance Policy

How Property and Casualty Insurance Applies to Watercrafts

How Watercraft Insurance is Priced

Factors Affecting Watercraft Insurance Rates

The Role of Insurance Brokers in Pricing

Understanding Deductibles and Premiums in Watercraft Insurance

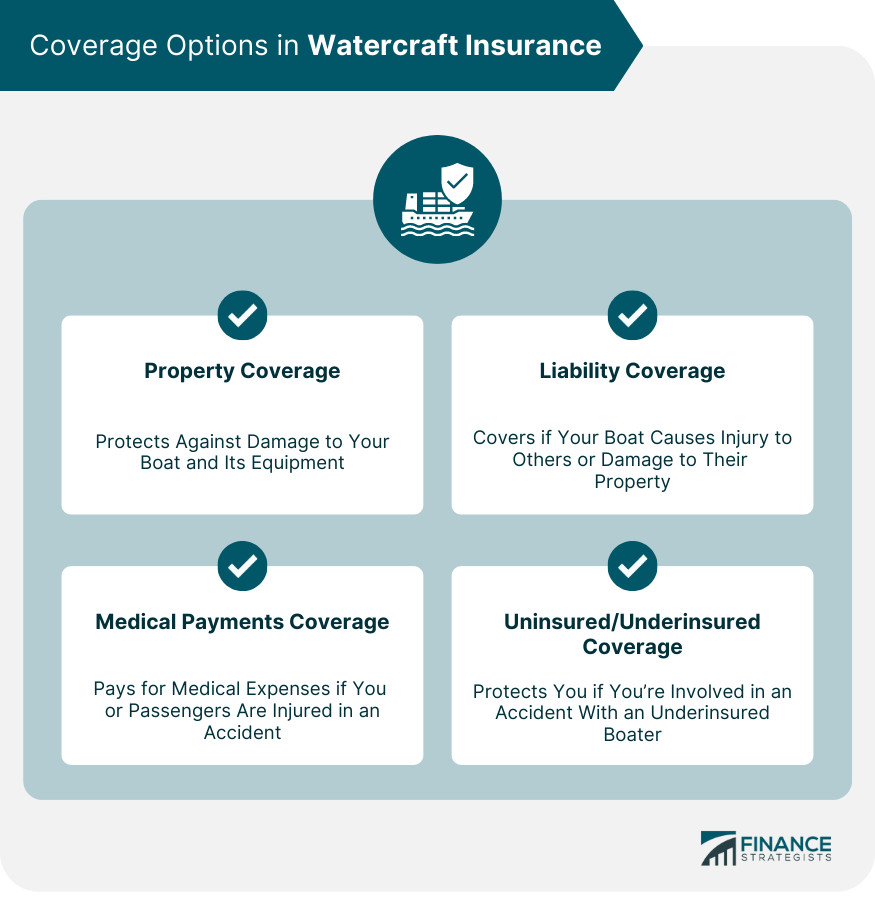

Exploring Coverage Options in Watercraft Insurance

Property Coverage

Liability Coverage

Medical Payments Coverage

Uninsured/Underinsured Watercraft Coverage

Understanding Watercraft Insurance Claims

When to File a Watercraft Insurance Claim

Steps in Filing a Watercraft Insurance Claim

Role of Insurance Brokers in Claim Settlements

Common Challenges in Watercraft Insurance Claims and How to Overcome Them

Watercraft Insurance Laws and Regulations

Overview of Laws and Regulations Governing Watercraft Insurance

How Insurance Brokers Stay Abreast With Changes in Laws and Regulations

Impact of Regulation Changes on Watercraft Insurance Policies

Future of Watercraft Insurance

Emerging Trends in Watercraft Insurance

Role of Insurance Brokers in Adapting to Industry Changes

Potential Impact of Climate Change on Watercraft Insurance

Conclusion

Watercraft Insurance FAQs

Watercraft insurance is a type of coverage that protects against losses or damages to your boat or other watercraft. It's important because it can cover the costs of repairs or replacement in case of damage, theft, or loss, and provide liability protection if you're involved in an accident that causes injury or damage to others.

The cost of watercraft insurance is influenced by various factors, including the type, size, and age of the watercraft, its intended use, the owner's boating experience, and geographical location. What role do insurance brokers play in watercraft insurance acquisition and management? Insurance brokers assist clients in understanding their insurance needs, selecting the best policies, and managing their coverage. They also help clients navigate the claims process and conduct regular policy reviews.

Common challenges in filing watercraft insurance claims include understanding policy exclusions, meeting reporting deadlines, and negotiating with insurance companies. These challenges can be overcome with the help of an insurance broker, who can guide you through the claims process, help you understand your policy terms, and advocate for a fair settlement.

You should file a watercraft insurance claim as soon as possible after an incident, such as a collision, storm damage, theft, or an accident causing injuries.

Climate change, with its increased frequency and severity of extreme weather events, could lead to higher risks for watercraft, potentially resulting in higher insurance premiums. Insurance brokers can help clients navigate these changes and ensure their coverage remains adequate.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.