An annuity is a long-term investment that is often used for retirement planning. You make a lump sum or a series of payments to an insurance company, and in return, the company promises to make periodic payments to you at some point in the future. Annuities provide a steady stream of income. Depending on the contract terms, this income can be paid out for a certain number of years or for the remainder of your life, providing financial security. There are various types of annuities, including fixed, variable, and indexed. Fixed annuities provide a guaranteed interest rate and a minimum amount of payment. Variable annuities are linked to the performance of a portfolio of investment funds, often mutual funds. Lastly, indexed annuities are a hybrid of fixed and variable annuities. Their returns are based on a stock index, like the S&P 500. Note that annuities also come with fees, potential penalties for early withdrawal, and other considerations, so it's vital to fully understand these products before investing in them. Annuities are typically long-term investment vehicles. As such, they commonly have conditions and penalties for early withdrawals. If you find yourself needing to withdraw your funds within the first 7-10 years of the contract, you will likely face surrender charges. These are often structured on a sliding scale, decreasing each year until they phase out entirely. They can be significant, particularly in the early years of your contract, and this could lead to a reduction in your original investment. The potential for financial loss becomes particularly pertinent with variable and indexed annuities, where returns are closely tied to market performance. These types of annuities expose you to market risk. If the markets perform poorly, the value of your annuity can decrease. In worst-case scenarios, you may end up recouping less than your original investment. Inflation slowly erodes the purchasing power of your money over time. While the dollar amount of your annuity payments may remain fixed, inflation can decrease what that money can buy in the future. If your annuity doesn't have an inflation-protection feature, and inflation rates rise significantly, you could lose money in real terms. Inflation-indexed annuities or cost-of-living adjustments can help guard against this risk, but they may come at an additional cost. Annuity fees and charges can be numerous and complex, including administrative fees, mortality and expense risk charges, investment management fees, rider fees, and surrender charges. These costs can quickly accumulate, cutting into your returns, and in some cases, could lead to a net loss on your investment. While somewhat rare, it's possible for an insurance company to default or go bankrupt. In such cases, the guarantees of your annuity are only as good as the health of the issuing company. Most states have guarantee associations that provide some level of protection for annuity owners in the event of an insurer's insolvency. However, there are typically limits to the coverage provided. Annuities often have guarantees embedded in the contract, providing a safety net to annuitants. For fixed annuities, this usually takes the form of a guaranteed minimum rate of return. This assurance means that regardless of market fluctuations, your fixed annuity is contractually obliged to provide a minimum return, ensuring a predictable income stream. Variable annuities, despite being subject to market volatility, often come with death benefit guarantees. These guarantees promise a defined payout to your beneficiaries if you, as the annuitant, pass away before the annuity has started to make payments. This feature offers peace of mind, knowing that your investment can provide for your loved ones even if you're not there. These entities serve as a crucial backstop in the event an insurance company fails and is unable to fulfill its obligations under the annuity contract. These associations are established by state law and are intended to provide a limited degree of protection to policyholders. Every state, along with the District of Columbia and Puerto Rico, has a guarantee association, and insurance companies must be members as a condition of doing business in the state. If an insurance company fails, the guarantee association steps in to protect policyholders. Coverage limits vary from state to state, typically ranging from $100,000 to $300,000 in the present value of annuity benefits. Although these associations provide an essential layer of protection, it's worth noting that they aren't federally insured like the FDIC and their coverage isn't absolute. Understanding your state's specific provisions can give you a clearer picture of the protections available to you. Insurance companies often offer extra protective features or riders that can be added to annuity contracts. These riders, though often coming with additional costs, can provide benefits tailored to your specific needs and further mitigate the risks associated with annuities. For instance, some annuities offer income riders that guarantee a certain level of income, irrespective of the market performance. Longevity riders can provide increased income if you live beyond a certain age. Cost-of-living riders can help offset the effects of inflation on your annuity income. It's important to carefully consider any riders. While they can offer additional protection, they also increase the cost of the annuity, and not all riders may be beneficial or necessary for your situation. One of the most crucial steps in minimizing potential losses with annuities is ensuring you completely understand the product you're investing in. Annuities can be quite complex with a multitude of different features, fees, and charges that may apply. It's important to grasp the terms of the annuity, including the period of surrender charges, the conditions for early withdrawal, and the fees associated with the product. All these factors can significantly impact your potential return on investment. If certain aspects of the contract seem unclear, it's advisable to seek guidance from a financial advisor or request clarification from the insurance provider before committing your funds. Every investor has a unique risk tolerance, reflecting how much risk they're comfortable taking on for a potential return. It's essential to understand your risk tolerance before deciding on the type of annuity to invest in. Fixed annuities offer a low-risk option, providing a guaranteed rate of return, albeit relatively modest. On the other hand, variable and indexed annuities can offer higher potential returns, but they're subject to market volatility. Therefore, if you're someone with a low risk tolerance, a fixed annuity might be the more suitable choice, whereas if you're comfortable with taking on more risk for potentially greater returns, a variable or indexed annuity might be more appealing. A key principle of investing is not to put all your eggs in one basket. This means that you should consider having a mix of different types of investments to spread your risk. Even within the context of annuities, this can mean purchasing different types of annuities, or annuities from different insurance companies. Moreover, consider annuities as part of your overall investment portfolio, which can also include stocks, bonds, mutual funds, and other investment vehicles. Diversification can help protect against market volatility and reduce the risk of significant losses. Annuities can come with various fees and charges, some of which can be quite substantial. These can include management fees, mortality and expense risk charges, surrender charges, and rider fees. High fees can significantly eat into your investment and reduce your overall returns. Before purchasing an annuity, make sure you understand all the fees involved and calculate their impact on your potential return. This can also involve comparing products from different providers, as fees can vary. It's not enough just to buy an annuity and then ignore it. To ensure that your annuity is performing as expected and to identify any potential issues early on, you need to regularly monitor its performance. This can involve reviewing your statements, keeping up with market trends, and being proactive in seeking professional advice if you notice any red flags. The complexities of annuities, combined with the potential risks involved, make it highly advisable to consult with a financial advisor before making any decisions. A financial advisor can explain the intricacies of annuities, guide you through the selection process, and help develop strategies to mitigate risks and maximize returns. They can provide personalized advice based on your financial situation, goals, and risk tolerance. Remember, investing in an annuity is a significant financial decision, and professional advice can be invaluable in making an informed choice. Investing in annuities can provide a steady stream of income and financial security, especially during retirement. However, it's important to be aware of the potential risks and factors that could lead to financial loss. Early withdrawal penalties, poor market performance, inflation, high fees, and provider default are instances that can lead you to potentially lose money with annuities. Despite these risks, annuities do offer safeguards and protections. Contractual guarantees, state guarantee associations, and additional protective features or riders can provide a safety net and mitigate potential losses. Understanding the product, assessing your risk tolerance, diversifying your portfolio, paying attention to fees and charges, and regularly reviewing your annuity's performance are important steps in minimizing potential losses. Seeking the guidance of a financial advisor is highly recommended when considering annuities. They can provide valuable insights, explain the complexities, and help you make an informed decision based on your financial goals and risk tolerance. Ultimately, with a thorough understanding of annuities and careful consideration of the associated risks and protections, you can make a well-informed investment choice that aligns with your financial objectives and provides the level of security you desire.Overview of Annuities

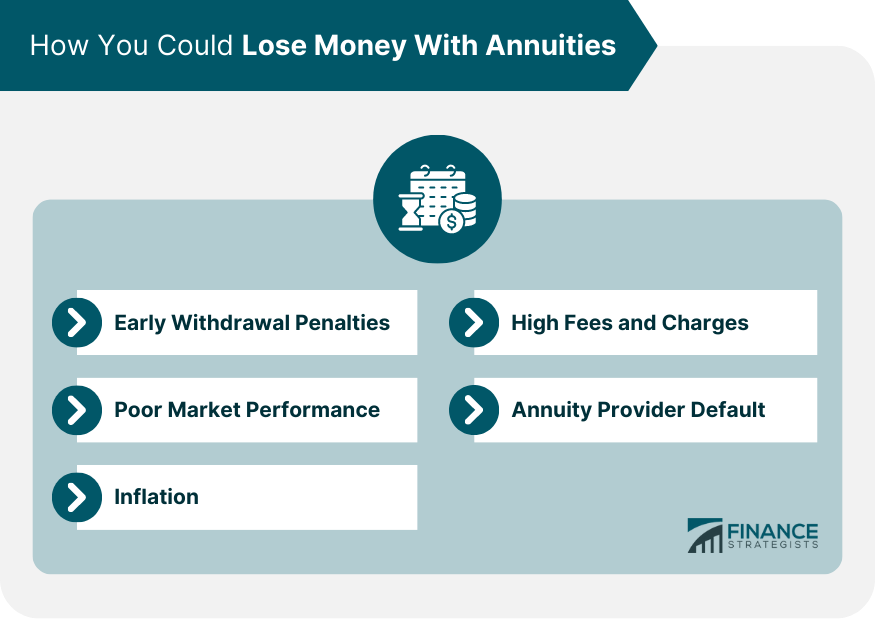

How You Could Lose Money With Annuities

Early Withdrawal Penalties

Poor Market Performance

Inflation

High Fees and Charges

Annuity Provider Default

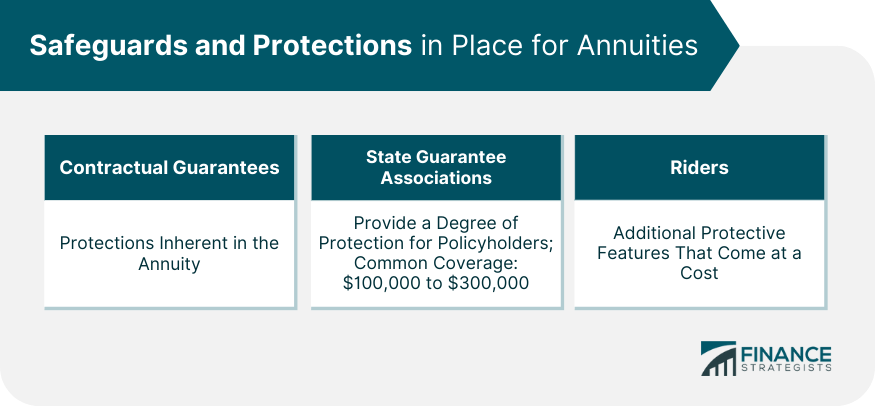

Safeguards and Protections in Place for Annuities

Contractual Guarantees

State Guaranty Associations

Riders

Tips for Minimizing Potential Losses With Annuities

Understand the Product

Assess Your Risk Tolerance

Diversify Your Portfolio

Pay Attention to Fees and Charges

Regularly Review Your Annuity Performance

Consult With a Financial Advisor

Final Thoughts

Can You Lose Money With an Annuity? FAQs

Yes, it is possible to lose money with an annuity. Market performance, early withdrawal penalties, and high fees can all contribute to potential financial losses. Additionally, if an insurance company defaults or goes bankrupt, the guarantees of your annuity may be impacted.

If you need to withdraw money from your annuity before the specified duration in the contract, you may face surrender charges, especially in the early years of the contract. These charges can be significant and lead to a reduction in your original investment.

To protect against inflation, you can consider investing in annuities that offer inflation-protection features, such as inflation-indexed annuities or cost-of-living adjustments. These options help to maintain the purchasing power of your annuity income as inflation rates rise.

Annuities often come with contractual guarantees. Fixed annuities typically offer a guaranteed minimum rate of return, ensuring a predictable income stream regardless of market fluctuations. Variable annuities may provide death benefit guarantees, which promise a defined payout to beneficiaries upon the annuitant's death.

To minimize potential losses, it is important to fully understand the terms and conditions of the annuity contract, assess your risk tolerance, diversify your investment portfolio, pay attention to fees and charges, and regularly review your annuity's performance. Seeking the guidance of a financial advisor can also help develop strategies to mitigate risks and maximize returns.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.