When it comes to investing, there are many different investment vehicles to choose from. Two popular options are annuities and mutual funds. Although both can play an important role in an investment portfolio, they are very different in terms of structure, fees, and potential returns. Annuities and mutual funds are both financial products that allow investors to earn money through their investments. However, the two are very different in terms of how they work and what they offer to investors. An annuity is essentially a contract between an individual and an insurance company. The individual pays a premium to the insurance company, and in return, the insurance company agrees to make regular payments to the individual at some point in the future. They are often used as retirement savings vehicles, as they can provide a guaranteed stream of income in retirement. On the other hand, a mutual fund is a type of investment fund that pools money from many different investors to purchase a portfolio of stocks, bonds, or other securities. The mutual fund is managed by a professional portfolio manager, who makes investment decisions on behalf of the fund's investors. Mutual funds are a popular investment option because they offer diversification and professional management. Deciding between Annuities and Mutual Funds? Click here. An annuity is a financial product that provides a fixed income stream to an investor for a specified period of time or the remainder of the annuitant's life. It is issued and distributed by financial institutions, usually insurance companies, and is purchased through either a lump sum or monthly premiums. Annuities can be structured according to various factors, such as the duration of time that payments from the annuity can be guaranteed to continue. Some of the common types of annuities include: As the name suggests, immediate annuities begin paying out immediately after the annuitant deposits a lump sum. These annuities are often purchased by people who have received a large lump sum of money and who prefer to exchange it for cash flows into the future. In exchange for the lump sum payment, the insurance company immediately makes regular payments to the annuitant. The payout amount for immediate annuities will depend on market conditions and interest rates. Rather than paying out immediately after the investment, deferred annuities allow the investor to choose an age at which they want to receive payments from the insurance company. These annuities are structured to grow on a tax-deferred basis and provide annuitants with guaranteed income that begins on a date they specify. Fixed annuities provide regular periodic payments to the annuitant. The interest rate on a fixed annuity is usually guaranteed for a specific period, and the annuitant receives a fixed payment amount regardless of market conditions. These annuities are considered low-risk investments, as the insurance company assumes all of the investment risks. Variable annuities allow the owner to receive larger future payments if investments of the annuity fund do well and smaller payments if its investments do poorly, which provides for less stable cash flow than a fixed annuity but allows the annuitant to reap the benefits of strong returns from their fund's investments. These annuities carry some market risk and the potential to lose principal. Contract owners can benefit from upside portfolio potential while enjoying the protection of a guaranteed lifetime minimum withdrawal benefit if the portfolio drops in value. Annuities are designed to provide a steady stream of income for individuals during their retirement years and to alleviate the fear of outliving their assets. An annuity contract is issued by a financial institution, and investors purchase it by making monthly premiums or lump-sum payments. These payments are accumulated during the accumulation phase of the annuity, which is the period before payouts begin. During the accumulation phase, the invested cash grows on a tax-deferred basis, which means the investor does not have to pay taxes on the growth until they start receiving payments. The second phase of an annuity is the annuitization phase, which begins once payments commence. During this phase, the insurance company begins to pay out a stream of payments to the annuitant. These payments can be received either for a fixed period or for the remainder of the annuitant's life, depending on their preference. The amount of payments an annuitant receives during the annuitization phase depends on several factors, including the annuitant's age, life expectancy, and the interest rates prevailing at the time of purchase. The insurance company uses these factors to calculate the payments and ensure the annuitant receives a guaranteed income stream during retirement. Annuities can provide a guaranteed income stream and protection against market volatility, but they can also be complex and come with high fees and limited liquidity. Guaranteed Income Stream. Annuities offer a guaranteed income stream, which can provide peace of mind and help ensure that the investor does not outlive their savings. Tax-Deferred Growth. During the accumulation phase, any money invested in an annuity grows on a tax-deferred basis, meaning that the investor does not have to pay taxes on the gains until they start taking withdrawals. Protection Against Market Volatility. Annuities can provide protection against market volatility, as they offer a fixed rate of return that is not subject to fluctuations in the stock market. Flexibility. Annuities can be structured in different ways, allowing investors to choose the annuity that best meets their needs. Death Benefit. Many annuities come with a death benefit, which ensures that the annuitant's beneficiaries will receive a payout if the annuitant dies before the end of the contract term. High Fees. Annuities can come with high fees, eroding the investment returns over time. Limited Liquidity. Annuities are illiquid, meaning that the investor cannot access their money without paying significant penalties, which may make them unsuitable for those who may need to access their money in the short term. Complexity. Annuities can be complex financial products, which may make them difficult to understand for some investors. Lack of Flexibility. Annuities typically come with withdrawal restrictions, which may limit the investor's ability to access their money when needed. Inflation Risk. Annuities may not keep up with inflation, meaning that the purchasing power of the payments received may decrease over time. Mutual funds are investment vehicles that pool money from many investors to purchase a diversified portfolio of securities, such as stocks, bonds, or other assets. The fund is managed by a professional fund manager, who makes investment decisions based on the fund's objectives and investment strategy. Each investor in the mutual fund owns a share of the portfolio and receives a portion of the returns generated by the fund in proportion to their investment. Mutual funds can be broadly categorized into different types based on the underlying assets they invest in, investment goals, and management strategies. Some of the most common types of mutual funds are: These mutual funds invest in equity securities or stocks of publicly traded companies. They can focus on different types of stocks, such as large-cap, mid-cap, or small-cap companies, or a combination of these. Stock funds are ideal for investors seeking long-term capital appreciation and can tolerate short-term volatility in their investments. These mutual funds invest in fixed-income securities such as bonds, treasury bills, and other debt instruments. Bond funds are generally considered less risky than stock funds and offer lower returns. Bond funds are ideal for investors seeking regular income, diversification, and capital preservation. These mutual funds track a specific market index, such as the S&P 500 or the NASDAQ, and aim to replicate the performance of the index. Index funds are ideal for investors seeking low-cost, passive investment options that can deliver market returns. These mutual funds invest in both stocks and bonds in a pre-determined ratio, usually 60:40 or 70:30. Balanced funds are ideal for investors seeking a combination of income and capital appreciation while maintaining a moderate risk profile. These mutual funds invest in short-term, low-risk debt instruments such as treasury bills, commercial paper, and certificates of deposit. Money market funds are ideal for investors seeking low-risk investments with easy liquidity and quick access to cash. These mutual funds primarily invest in fixed-income securities such as bonds, preferred stocks, and dividend-paying stocks. Income funds are ideal for investors seeking regular income and can tolerate some level of risk. These mutual funds invest in securities outside the investor's home country. International/global funds can be region-specific, such as European or Asian funds, or can be global funds that invest in companies worldwide. International/global funds are ideal for investors seeking diversification and exposure to international markets. These mutual funds invest in specific sectors, themes, or asset classes such as real estate, natural resources, or socially responsible companies. Specialty funds are ideal for investors seeking exposure to specific industries or themes that align with their investment goals or values. It is worth noting that mutual funds can have different investment strategies, such as active management or passive management, and different fee structures, such as load funds or no-load funds. Investors should carefully evaluate each mutual fund's investment objectives, risks, and costs before investing. Mutual funds pool money from multiple investors to purchase securities such as stocks, bonds, or a combination of both. When an individual buys shares in a mutual fund, they become a shareholder and indirectly owns a portion of the fund's investment portfolio. The value of the mutual fund is determined by the performance of the underlying assets in the portfolio. Mutual funds are managed by professional fund managers responsible for making investment decisions based on the fund's investment objectives and policies. They buy and sell securities within the fund's portfolio, and any capital gains or losses are distributed to shareholders in proportion to the number of shares they own. Investors can buy or sell mutual fund shares at the end-of-day net asset value (NAV) price, which is calculated by subtracting the total liabilities of a company from its total assets. The NAV per share can fluctuate daily based on the portfolio's securities performance. Mutual funds can charge investors various fees, such as an expense ratio covering the fund's cost, and shareholder fees, such as sales charges or commissions. Some mutual funds may also have a minimum investment requirement, which can vary depending on the fund. Investing in mutual funds can provide benefits and drawbacks to various investors. Below are the advantages and disadvantages of investing in mutual funds. Diversification. Investing in mutual funds allows for diversification, as they hold a portfolio of securities. This helps to spread out the investment risk by investing in a variety of assets. Professional Management. Mutual funds are managed by professional fund managers who have experience in selecting and managing investments. This allows for better investment decisions and monitoring of the portfolio. Variety and Flexibility. Mutual funds offer a range of investment options, allowing investors to select a fund that aligns with their investment goals and risk tolerance. Additionally, mutual funds can be bought and sold easily, providing investors with flexibility in managing their investments. Economies of Scale. Mutual funds provide economies of scale by pooling investors' money, enabling them to access a broader range of investments with lower transaction costs. Transparency. Mutual funds are regulated by industry authorities and must provide periodic reports on their performance, portfolio holdings, fees, and expenses. This transparency provides investors with more information to make informed investment decisions. Fees and Expenses. Mutual funds charge fees and expenses that can impact the overall return of an investment. These fees include management fees, administrative expenses, and sales charges. No Guarantees. Mutual funds are not guaranteed investments, and their value can fluctuate based on market conditions. Investors should be aware that there is a risk of losing money with mutual funds. Dilution and Diworsification. A successful mutual fund may grow too large, leading to the dilution of returns. Additionally, some investors may over-diversify their portfolios, leading to a loss of the benefits of diversification, known as diworsification. End of Day Trading. Mutual funds can be bought and sold at the end of each trading day, meaning investors may not be able to take advantage of intraday price fluctuations. Taxes. Mutual funds can trigger capital gains taxes when securities are sold. Taxes can be mitigated by investing in tax-sensitive funds or holding non-tax-sensitive mutual funds in a tax-deferred account. Annuities and mutual funds are two different types of investment products with distinct characteristics. Their differences are discussed below. An annuity is an insurance product that pays out income over time, while a mutual fund is an investment vehicle that pools money from multiple investors to invest in stocks, bonds, or other assets. Here are some key differences between the two: Annuities are insurance products, while mutual funds are investment products. An annuity is a contract between the investor and the insurance company, while mutual funds are held in an investment account. An annuity provides a guaranteed income stream, while a mutual fund does not guarantee a specific return. An annuity is designed to provide retirement income, while mutual funds can be used for a variety of investment goals. An annuity may have surrender charges and penalties for early withdrawals, while mutual funds do not. The risk profile of annuities and mutual funds varies depending on the type of product. Annuities generally have a lower risk profile than mutual funds because they are designed to provide guaranteed income. However, the level of risk depends on the type of annuity. For example, fixed annuities have a lower risk profile than variable annuities because they provide a fixed rate of return. On the other hand, mutual funds have a higher risk profile because they invest in stocks, bonds, or other assets that are subject to market fluctuations. Annuities and mutual funds are designed to meet different investment goals. Annuities are designed to provide retirement income, while mutual funds can be used for various investment goals, including retirement savings, college savings, or short-term investing. Annuities are typically used by investors who want to ensure a steady stream of income during retirement, while mutual funds are used by investors who want to grow their wealth over time. Annuities and mutual funds have different fee structures. Annuities typically have higher fees and expenses than mutual funds because they provide guaranteed income. Annuities may have surrender charges and fees for early withdrawals, while mutual funds typically do not. Mutual funds have expense ratios, which are annual fees that cover the costs of managing the fund. Annuities and mutual funds have different tax implications. Annuities are tax-deferred, which means that the investor does not pay taxes on the earnings until the money is withdrawn. Mutual funds are taxed annually on capital gains, dividends, and interest income. However, mutual funds in a tax-advantaged account, such as an IRA or 401(k), are not subject to annual taxes. Annuities and mutual funds have different levels of liquidity. Annuities are typically less liquid than mutual funds because they may have surrender charges and penalties for early withdrawals. Mutual funds are generally more liquid because they can be bought and sold on a daily basis. However, some mutual funds may have redemption fees or restrictions on when investors can withdraw their money. The decision between an annuity and a mutual fund ultimately depends on your retirement objectives and future strategy. Before deciding between annuities and mutual funds, it is important to determine your investment goals. Are you looking for a steady stream of income or long-term capital appreciation? Do you want to minimize risk or are you comfortable with taking on more risk for potentially higher returns? Understanding your investment goals will help you choose the investment product that best aligns with your objectives. An important factor to consider when choosing between annuities and mutual funds is your risk tolerance. Annuities generally offer more stability and predictability, but lower potential returns. Mutual funds, on the other hand, can offer higher potential returns but come with higher levels of risk. It is important to evaluate your risk tolerance and choose an investment product that aligns with your comfort level. Your age and time horizon can also play a role in determining whether annuities or mutual funds are the right choices for you. If you are close to retirement or in retirement, an annuity may provide stability and predictable income stream you need to support your retirement lifestyle. However, if you have a longer time horizon, mutual funds may provide higher potential returns and greater flexibility. It is important to compare the costs and fees associated with annuities and mutual funds. Annuities typically come with higher fees and expenses due to the added benefits and guarantees they offer. Mutual funds generally have lower fees and expenses but may also have additional fees such as load fees and expense ratios. It is important to understand all the costs associated with each investment product and choose the most cost-effective one for your investment goals. Ultimately, the decision between annuities and mutual funds should be made after careful consideration of your investment goals, risk tolerance, age, time horizon, and costs. Seeking professional advice from a financial advisor can help you make an informed decision and choose the investment product that best aligns with your needs and objectives. Annuities and mutual funds are two popular investment options that can provide investors a steady income stream and professional management. Annuities are essentially a contract between an individual and an insurance company, providing a guaranteed income stream in retirement. On the other hand, mutual funds are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of securities. The two investment options differ in their structure, fees, potential returns, and risk profiles. Investors should determine their investment goals, evaluate their risk tolerance, consider their age and time horizon, compare costs and fees, and seek professional advice before investing in either annuities or mutual funds. While annuities provide a guaranteed income stream and protection against market volatility, they can be complex and come with high fees and limited liquidity. In contrast, mutual funds offer diversification, professional management, and flexibility but come with fees and expenses that can impact overall returns. To make an informed decision, investors should carefully evaluate the advantages and disadvantages of each investment option and seek advice from a financial advisor who can help them tailor their investments to their individual needs and goals.Annuity vs Mutual Fund: Overview

What Are Annuities?

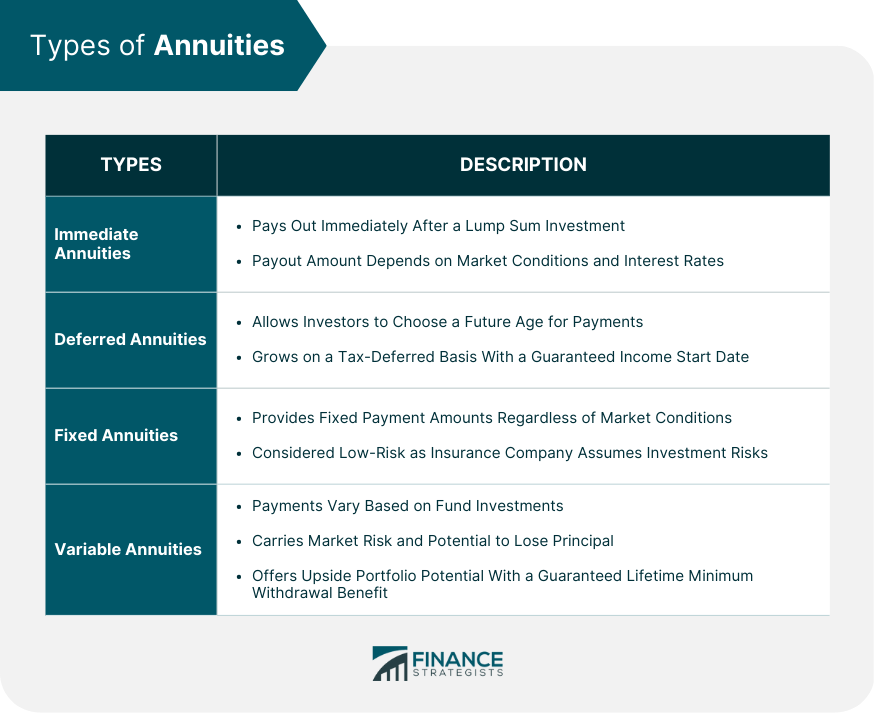

Types of Annuities

Immediate Annuities

Deferred Annuities

Fixed Annuities

Variable Annuities

How Annuities Work

Advantages and Disadvantages of Annuities

Advantages of Annuities

Disadvantages of Annuities

What Are Mutual Funds?

Types of Mutual Funds

Stock Funds

Bond Funds

Index Funds

Balanced Funds

Money Market Funds

Income Funds

International/Global Funds

Specialty Funds

How Mutual Funds Work

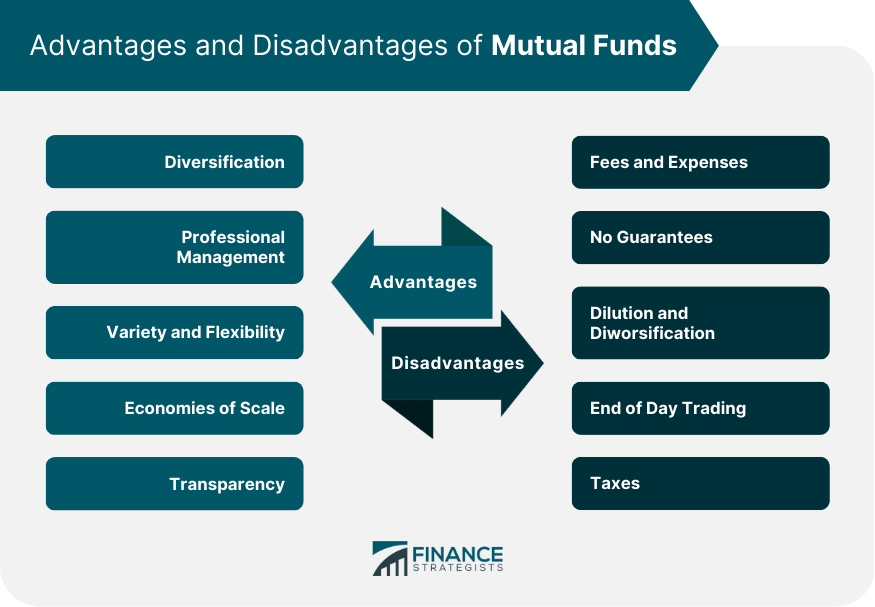

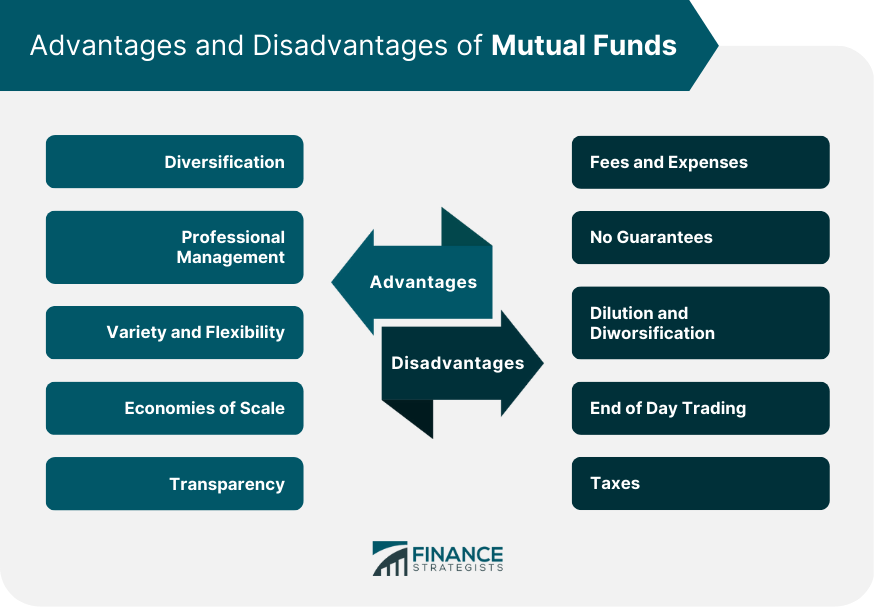

Advantages and Disadvantages of Mutual Funds

Advantages of Mutual Funds

Disadvantages of Mutual Funds

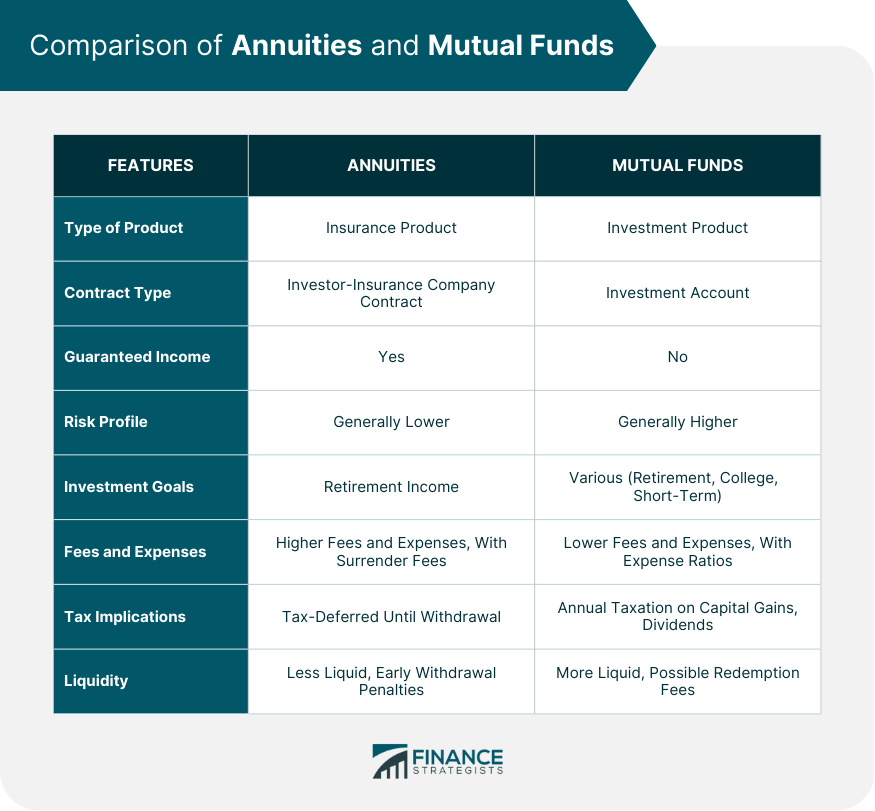

Comparison of Annuities and Mutual Funds

Key Features

Risk Profile

Investment Goals

Fees and Expenses

Tax Implications

Liquidity

Annuity vs Mutual Fund: Which is Right for You?

Determining Your Investment Goals

Evaluating Your Risk Tolerance

Considering Your Age and Time Horizon

Comparing Costs and Fees

Seeking Professional Advice

The Bottom Line

Annuity vs Mutual Fund FAQs

Annuities are financial products issued by insurance companies that provide a guaranteed income stream for a specified period or the annuitant's lifetime. Investors purchase annuities by making lump-sum payments or monthly premiums, and the insurance company pays out a stream of payments during the annuitization phase.

Mutual funds are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of securities such as stocks, bonds, or other assets. Mutual funds are managed by professional fund managers, who make investment decisions based on the fund's objectives and investment strategy.

Annuities are insurance products that provide a guaranteed income stream, while mutual funds are investment products that offer diversification and professional management. Annuities are illiquid, whereas mutual funds can be bought and sold easily. Annuities offer protection against market volatility, while mutual funds are subject to market risk.

Annuities and mutual funds are both subject to taxes, but the tax implications can differ depending on the type of investment and the investor's tax situation. For example, annuities grow on a tax-deferred basis, which means taxes are not paid until withdrawals are taken. Mutual funds may trigger capital gains taxes when securities are sold, but investors may be able to mitigate taxes by investing in tax-sensitive funds or holding non-tax-sensitive mutual funds in a tax-deferred account.

It is possible to switch between annuities and mutual funds, depending on an investor's needs and goals. However, there may be fees and tax implications associated with switching investments. It is important to carefully evaluate the costs and benefits of each investment and seek professional advice before making any changes to an investment portfolio.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.