A joint and survivor annuity is a kind of annuity contract that offers income payments to two people, typically a married couple, for the duration of their lifetime. It differs from other types of annuities in that it provides a continuous stream of income. This guaranteed income continues even after the death of one of the annuitants. The primary purpose of a joint and survivor annuity is to ensure that the surviving spouse or partner receives regular income payments after the death of the primary annuitant. This feature is particularly important for retirees who want to ensure their partner's financial stability. The key elements of a joint and survivor annuity include the choice of payout option, the length of the guarantee period, and the annuitant's age and health status. The payout options available for joint and survivor annuities include fixed payments, variable payments, or a combination of both. The length of the guarantee period refers to the time during which the annuity payments are guaranteed to be paid, even if the annuitants pass away. Retirees may choose a joint and survivor annuity for several reasons, such as securing their partner's financial future, protecting their retirement savings from market fluctuations, and receiving a guaranteed income for the rest of their lives. The annuity payments received through this type of annuity contract can provide a reliable income source that covers basic living expenses and may help to alleviate the financial burden on surviving spouses or partners. This annuity contract provides income payments to two annuitants: a primary and a secondary annuitant. The annuity buyer has the option to designate themselves and another person, usually their spouse, as joint annuitants. In the event of the primary annuitant's death, the surviving spouse or partner continues to receive regular payments for the duration of their life. If the secondary annuitant passes away before the primary annuitant, no survivor benefits are paid upon the primary annuitant's death. In order to purchase a joint and survivor annuity, the annuitants must first choose the type of annuity and the payout option. The type of annuity can be either a fixed annuity or a variable annuity, while the payout option can be either a level payout or an increasing payout. The level payout option provides a fixed income payment that remains the same throughout the annuity contract's term. In contrast, the increasing payout option allows for the annuity payments to increase over time to keep pace with inflation. The annuitant must also determine the length of the guarantee period. This refers to the number of years during which the annuity payments are guaranteed. A more extended guarantee period typically results in lower monthly payments. Another critical factor in determining annuity payments is the annuitants' age and health status. The older the annuitant, the higher the monthly payments will be, as the annuity provider assumes a shorter lifespan. Contributions to a joint and survivor annuity are made with after-tax dollars. The contributions are not tax-deductible. The annuity's growth is tax-deferred, meaning no taxes are owed on the investment's earnings until the annuitants begin receiving payments. When the annuitants begin receiving payments from the joint and survivor annuity, the payments are taxed as ordinary income. The amount of the payments subject to taxation is based on the portion of the annuity that represents earnings rather than the original contribution amount. Distributions from a traditional IRA or 401(k) are taxed at the annuitant's ordinary income tax rate. With non-qualified annuities, taxes are only owed on the portion of the payments representing earnings rather than the entire distribution. The following are the benefits provided by joint and survivor annuities: A joint and survivor annuity offers a unique benefit that gives peace of mind to married retirees. This type of annuity guarantees that payments will continue even after the death of one spouse. This is especially important for married couples who rely on each other's income. This guarantee of continued payments offers a level of security that can be highly valued by married retirees. It allows them to plan for their retirement with more confidence, knowing that they will continue to receive income even if one spouse passes away. Another benefit of this type of annuity is the ability to spread out tax liabilities over a longer period of time. When the secondary annuitant is designated as an annuitant rather than a beneficiary, the payment period is typically extended. The tax liabilities associated with the annuity payments are also spread out over a longer period, potentially resulting in a lower tax rate. Additionally, the money invested in a joint and survivor annuity grows tax-deferred until withdrawals are made. Annuity owners have the option to customize terms to meet specific needs. They can choose the frequency of payments, such as monthly or yearly payments, as well as the duration of the annuity payments. Additionally, they can opt for inflation-adjusted annuities that increase payments over time to help protect against inflation. This type of annuity is particularly beneficial for retirees who may be concerned about the eroding value of their income due to inflation. A joint and survivor annuity also has several drawbacks and limitations that should be considered: Income payments under a joint and survivor annuity may be lower than those of a single-life annuity. This is because the annuity issuer must factor in the likelihood that both annuitants will live longer than just one annuitant, resulting in a longer payout period for the annuity. The premiums may be higher than those for a single-life annuity. The annuity issuer must guarantee that the surviving annuitant will continue to receive income payments after the death of the primary annuitant, which requires a higher level of financial risk management. The payout structure cannot be changed once the contract is established. If the annuitant's circumstances change, such as a divorce or the death of a designated secondary annuitant, the annuity holder may be unable to adjust the payout structure to meet their new needs. A joint and survivor annuity is a kind of annuity contract designed to provide continued income payments to two people, typically a married couple, for the duration of their lifetime, and offers a crucial safeguard for the surviving partner. Its key elements include the payout option, guarantee period, and the annuitant's age and health status. The purpose of the annuity is to secure a reliable income source for both annuitants, even after one has passed away. The annuity payments are determined based on various factors, such as the payout option, guarantee period, and annuitant's age and health status. The payments may be lower than those of a single-life annuity, but it provides crucial financial security for both annuitants. It provides peace of mind, tax advantages and customizable options. However, its drawbacks include potentially lower income payments, higher premiums, and an inability to change the payout structure once it is established. Ultimately, couples considering a joint and survivor annuity should weigh all of these factors and consult with a financial advisor carefully to determine whether it is the right retirement plan option for couples.What Is a Joint and Survivor Annuity?

How Joint and Survivor Annuity Works

Tax Implications for a Joint and Survivor Annuity

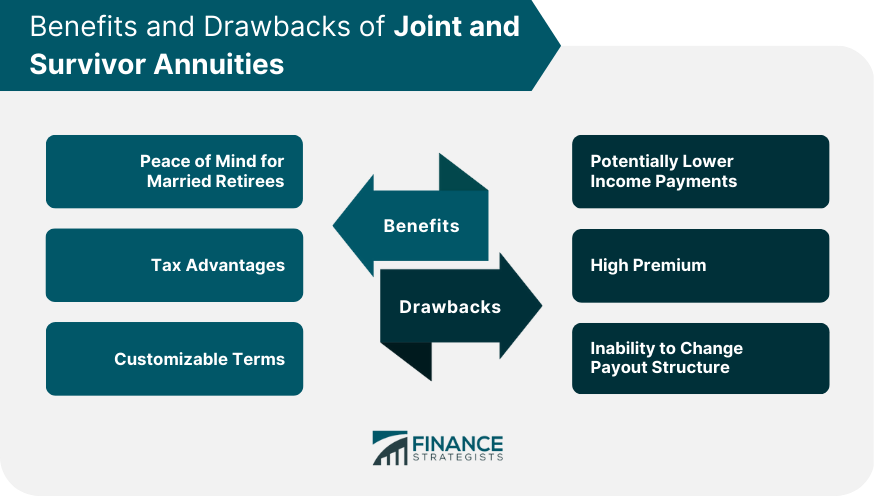

Benefits of Joint and Survivor Annuities

Peace of Mind for Married Retirees

Tax Advantages

Customizable Terms

Drawbacks of the Joint and Survivor Annuities

Potentially Lower Income Payments

High Premium

Inability to Change Payout Structure

Final Thoughts

Joint and Survivor Annuity FAQs

This is a type of retirement income plan that provides income to two individuals, usually a married couple, for as long as they both live. Under this arrangement, both annuitants receive income payments during the lifetimes of both the annuity owner and their survivor. In the event that one of the annuitants passes away, the surviving annuitant continues to receive payments for the remainder of their life.

A joint and survivor annuity covers two individuals, typically a married couple, who receive income payments for as long as both are alive. The first person is the primary annuitant, and the second person is the secondary annuitant. The payments continue for the rest of the secondary annuitant's life if the primary annuitant passes away.

The taxes on a joint and survivor annuity depend on the kind of annuity and how it is funded. Generally, the owner of the annuity pays taxes on the income received from the annuity. If the annuity is funded with pre-tax dollars, such as through a traditional 401(k) or IRA, the owner pays taxes on the full amount of the distribution at their ordinary income tax rate. If the annuity is funded with after-tax dollars, such as through a non-qualified annuity, the owner pays taxes only on the earnings portion of the distribution.

A jointly owned annuity is an annuity that is owned jointly by two or more individuals, who both have an equal claim to the funds invested in the annuity. In contrast, a joint and survivor annuity is an annuity that provides income to two annuitants, typically a primary annuitant and a secondary annuitant, during their lifetimes. Payments from a jointly owned annuity will stop upon the death of either joint owner.

A joint and survivor annuity offers guaranteed payments for the lifetime of both annuitants, providing security for married couples. It also provides tax benefits, as the money invested grows tax-deferred, helping manage tax liability in retirement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.