A multi-year guaranteed annuity (MYGA) is a type of fixed annuity that provides a guaranteed monthly income for a multi-year period. It offers a minimum rate of return for a set number of years that you choose. You can then access those earnings as a lump sum or through withdrawals over time, depending on the multi-year guaranteed annuity product you choose. Like other types of long-term care insurance, MYGAs are used by many retirees and pre-retirees to generate a lifetime income stream, and to help pay for an ongoing home or assisted living costs if needed. Have questions about a Multi-Year Guaranteed Annuity? Click here. The multi-year guaranteed annuity works much like a typical insurance policy. With a MYGA, you sign a contract that requires you to make regular premium payments. When the annuity is purchased, an initial lump sum payment is made to the insurer. In return, the issuer agrees to make regular monthly payments until either the contract period has ended or the account balance runs out. For example, a multi-year annuity might pay out monthly payments until you reach age 95. In some cases, the annuity has a default provision that guarantees that if you die during the term of your guaranteed annuity, your spouse or beneficiary will receive a percentage of what you have already received from the multi-year annuity. MYGAs typically have no surrender fees and low early withdrawal penalties. You may withdraw funds from the multi-year guaranteed annuity, provided that you've held the contract for at least five years. The money coming out of the annuity will be taxed as income, which means any interest earned during your accumulation period will be taxable. Some contracts may offer penalty-free withdrawals in the event of a terminal illness or injury, but they vary by contract and state law. There are also life settlement options that allow you to sell your multi-year guaranteed annuity, but these typically require a lump sum payout instead of periodic income. MYGAs must follow specific guidelines set forth by the state in which they're sold. These guidelines include a variety of restrictions around what you can do with the money during and after your multi-year period. There are three ways you can receive cash from your multi-year guaranteed annuity: There is no set expiration date for multi-year guaranteed annuities. In most cases, the multi-year period ends when you return to a community setting. In other words, multi-year guaranteed annuities are only relevant as long as the recipient requires assisted living and/or memory care services. Once the insured no longer requires annuity benefits, the owner has the option of converting the multi-year guaranteed annuity to a fixed income payout. As long as you’re cognitively able to understand how insurance works, then multi-year guaranteed annuities are right for you. For many, multi-year guaranteed annuities are the best way to generate a steady, reliable income stream in retirement or pre-retirement years without taking a great financial risk. For example, MYGA can be used to protect your assets by generating income that covers the costs of assisted living or memory care. This protects you from depleting your life savings on high-cost long-term care. Multi-year guaranteed annuities are also a good choice for those who may not have enough money saved up for a long-term care solution. In this case, MYGA helps to bridge the gap between what you have and what you actually need. However, MYGA may not be right for everyone. Some multi-year guaranteed annuity purchasers find that the cost of the product outweighs the benefits. For example, multi-year guaranteed annuities must be purchased at least years before you want to receive income and there may be a penalty if you start taking benefits early. Also, MYGA should not be considered if you can't afford the premiums, don't have a lump sum to invest, or want to outlive the income. There are several benefits to multi-year guaranteed annuities, including: While multi-year guaranteed annuities can be a sound choice for some, there are several drawbacks, including: MYGA can be a helpful tool for those who want to invest in a multi-year guaranteed product that will last their whole lifetime. However, these products must be carefully researched before you purchase one because there are many different multi-year guaranteed annuity options. If possible it is always best to talk with a qualified financial adviser before making such an important decision.How Does the Annuity Work?

When Can I Withdraw Money From My Annuity?

How Can I Withdraw Money From My Annuity?

However, in most cases, in-service withdrawals will reduce the income payment rate and could result in the loss of certain tax benefits.

If you no longer require a multi-year guaranteed annuity, you can convert the remaining balance to an immediate fixed annuity.Is There an Expiration Date on This Product?

Who Should Consider an Annuity, and Who Shouldn’t?

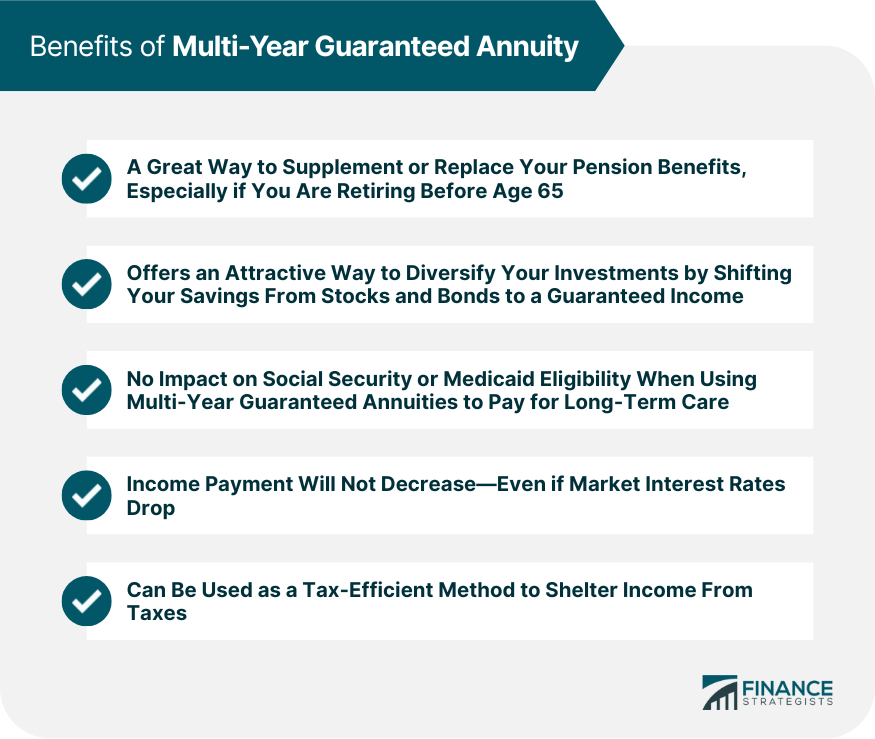

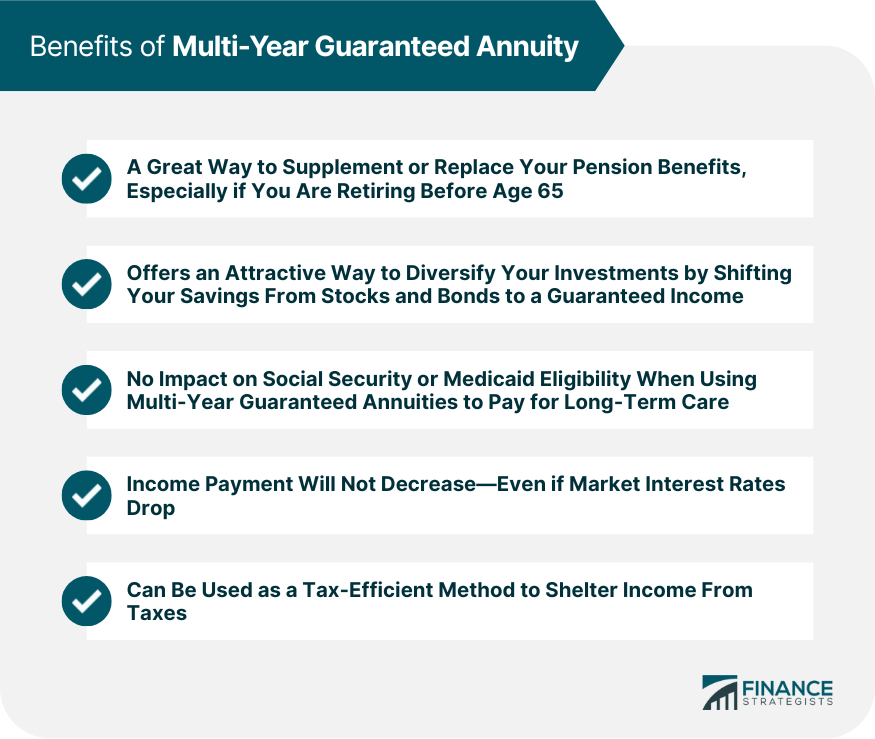

Benefits of Multi-Year Guaranteed Annuity

Drawbacks

Final Thoughts

Multi-Year Guaranteed Annuity FAQs

A multi-year guaranteed annuity (MYGA) works like any other annuity. It starts by purchasing an MYGA using a lump sum of money. The premium covers the cost of insurance and there are no further payments needed once the contract has been formed. Once the MYGA is purchased, guaranteed income payments begin after a waiting period of one to five years.

MYGAs are simple financial instruments that require premiums for coverage through an insurance company. The multi-year guaranteed annuity has predetermined rates and conditions set up by the issuing insurance company. After the annuity has been purchased and the waiting period is over, guaranteed income payments begin.

MYGAs differ from other investments in that withdrawals can only be initiated when the multi-year guaranteed annuity income begins. After that, you can withdraw money and use it for any purpose you want.

Multi-year guaranteed annuities are long-term contracts that last for the life of the owner or policyholder.

Multi-year guaranteed annuities are appropriate for some individuals who have retired or are planning to retire. MYGA can also provide more flexibility in your portfolio, especially if you are not able to contribute significant amounts of money each month.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.