A Single Life Annuity is an insurance product designed to provide a steady income stream to an individual for the remainder of their life. It is purchased through an insurance company. In exchange for a lump sum payment, the insurance company guarantees to make regular payments to the annuitant for the duration of their life. The payment amount is determined by several factors, including the initial lump sum payment, the annuitant's age, life expectancy, and the prevailing interest rates in the market. There are several types of Single Life Annuities, including the following: Fixed Single Life Annuity. These annuities provide a fixed payment amount for the duration of the annuitant's life. Variable Single Life Annuity. These annuities are invested in various underlying assets, such as stocks, bonds, and mutual funds. The payment amount is based on the performance of the underlying investments, which can fluctuate over time. Indexed Single Life Annuity. These annuities are tied to a particular index, such as the S&P 500, and the payment amount is based on the performance of that index. As with variable annuities, the payment amount can fluctuate over time. The advantages of a Single Life Annuity include the following: Steady Income Stream. Annuities provide a regular, predictable income stream, which can be especially beneficial for retirees looking to supplement their retirement income. Protection Against Longevity Risk. Annuities protect against the risk of outliving one's savings, as the payments are guaranteed to continue for the annuitant's lifetime. The disadvantages of a Single Life Annuity include the following: Lack of Flexibility. Once an annuity is purchased, it cannot be easily changed or canceled. This lack of flexibility may be a drawback for some individuals who want to access their money for unexpected expenses or changes in financial circumstances. Potential for Loss of Principal. Annuities are designed to provide income, not growth, and as such, the initial lump sum payment is typically not returned to the annuitant or their beneficiaries. There are several risks associated with Single Life Annuities, including the following: Longevity Risk. An individual who lives longer than expected may receive less total income from the annuity than they would have if they had not purchased the annuity. Inflation Risk. Annuity payments are fixed and may not keep pace with inflation over time, leading to decreased purchasing power. Interest Rate Risk. Changes in interest rates can impact the value of the annuity, and if interest rates rise, the value of the annuity may decrease. Strategies for mitigating these risks include the following: Purchasing a Joint and Survivor Annuity. A joint and survivor annuity will continue to provide payments to a surviving spouse or another beneficiary after the annuitant's death, helping to mitigate the risk of longevity. Considering an Inflation-Adjusted Annuity. An inflation-adjusted annuity will adjust the payment amount to keep pace with inflation over time. The process of purchasing a Single Life Annuity typically involves the following steps: When choosing a Single Life Annuity, there are several factors to consider, including the following: Age and Life Expectancy. Annuity payments are typically higher for older individuals, who are expected to have a shorter life expectancy. However, an individual with a particularly long life expectancy may want to consider other investment options. Financial Goals and Objectives. Annuities are designed to provide income, not growth, and may not be suitable for individuals looking for high investment returns. Risk Tolerance. Annuities offer a guaranteed income stream, but they may not be ideal for individuals willing to take on more risk to earn higher returns potentially. Investment Performance. When considering variable or indexed annuities, it is important to consider the past performance of the underlying investments and the fees associated with the annuity. In conclusion, Single Life Annuities can be a valuable investment option for individuals looking for a steady income stream in retirement. However, they have risks and drawbacks. It is important to carefully consider the various types of annuities and the individual's financial goals and objectives, risk tolerance, and tax situation before making a decision. With careful consideration and proper planning, a Single Life Annuity can be a valuable tool for ensuring financial security in retirement. Annuities should be viewed as long-term investments, not short-term solutions to financial problems. Additionally, while annuities can provide a steady income stream, they may not be better options for some. When making investment decisions, it is important to consider other investment options, such as stocks, bonds, and mutual funds. When purchasing a Single Life Annuity, it is important to work with an insurance broker who can provide guidance and help navigate the complex landscape of annuity products. Overview of Single Life Annuity

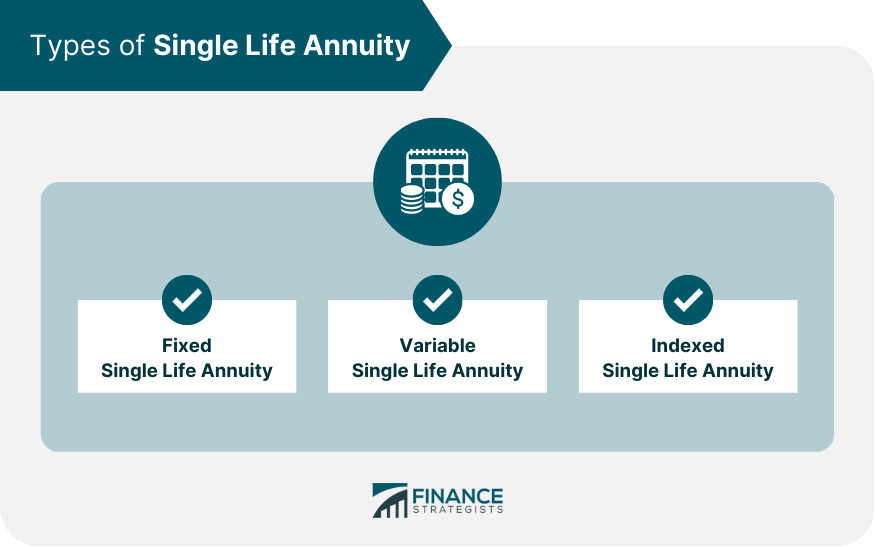

Types of Single Life Annuity

The payment amount is determined by the initial lump sum payment, the annuitant's age, life expectancy, and the prevailing interest rates in the market.

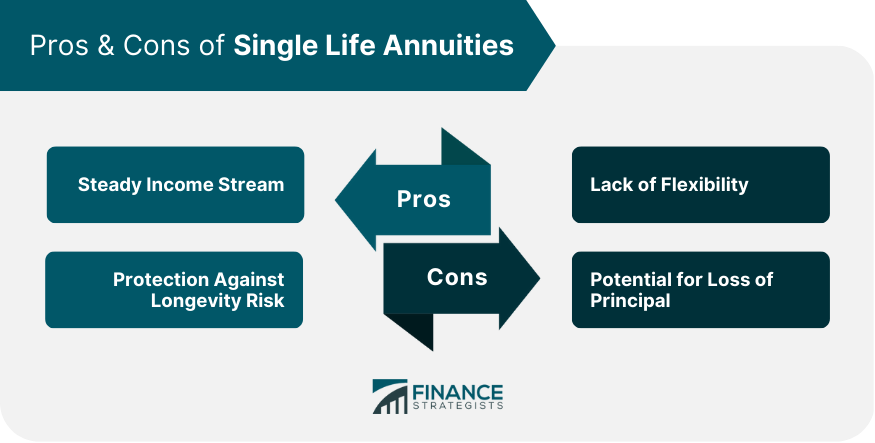

Advantages and Disadvantages of Single Life Annuity

This means that if the annuitant dies shortly after purchasing the annuity, they may not receive the full value of their investment.

Risks and Mitigation Strategies for Single Life Annuities

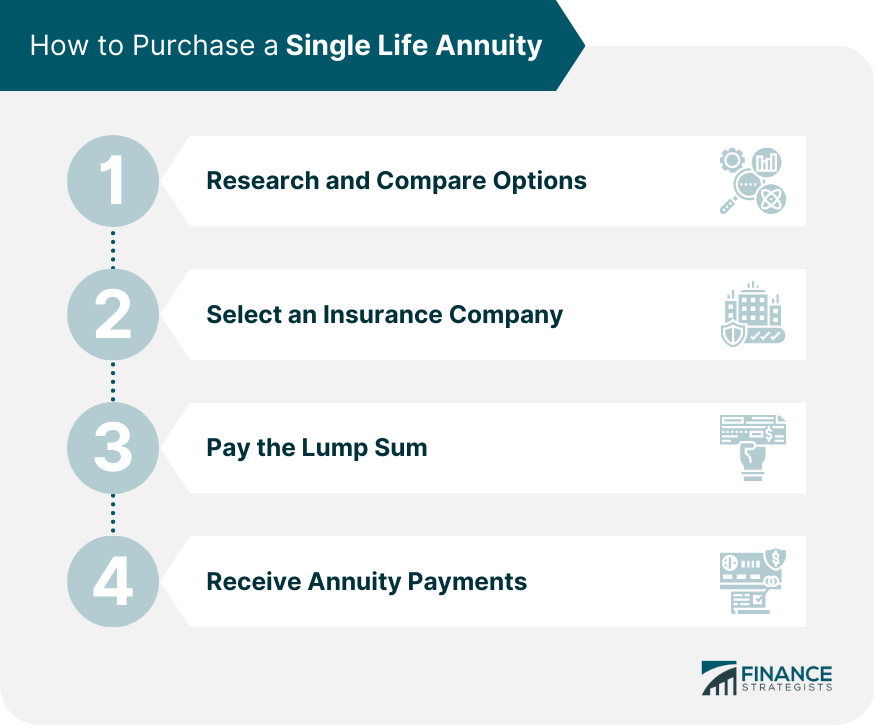

How to Purchase a Single Life Annuity

1. Research and Compare Options. An individual should research and compare different annuity products, considering fees and investment options,

2. Select an Insurance Company. Once an individual has selected an annuity product, they must choose an insurance company to purchase it from. Researching and comparing different insurance companies is important, considering financial strength, reputation, and customer service factors.

3. Pay the Lump Sum. The annuity is purchased by paying a lump sum to the insurance company. The lump sum amount will depend on the annuity product and the individual's financial situation.

4. Receive Annuity Payments. Once the lump sum payment is made, the annuity payments will begin according to the annuity contract terms.

Factors to Consider When Choosing a Single Life Annuity

Conclusion

Single Life Annuity FAQs

A Single Life Annuity is an insurance product that provides a steady income stream for an individual's life in exchange for a lump sum payment.

The advantages of a Single Life Annuity include a predictable income stream and protection against longevity risk.

The lump sum payment used to purchase a Single Life Annuity may be subject to income taxes, and the annuity payments are taxed as ordinary income.

An inflation-adjusted annuity can mitigate inflation risk by adjusting the payment amount to keep pace with inflation over time.

A financial advisor can guide the various types of annuities, the risks, and drawbacks, and help navigate the complex landscape of annuity products and insurance companies to ensure that the annuity is a suitable investment for an individual's unique financial situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.