Personal finance is the art of managing an individual's monetary resources for financial stability and achieving life goals. It's not just about making day-to-day decisions on spending or saving but understanding deeper concepts such as budgeting, cash flow, risk management, and investment strategies. Mastering these areas leads to informed and responsible money decisions, enhancing financial well-being and reducing stress. This lifelong journey of financial literacy empowers individuals to avoid unnecessary debt, achieve both short-term and long-term objectives, and work towards true financial independence. It's a continuous learning process, adapting to ever-changing life circumstances, and is foundational to taking genuine control of one's financial future." Setting financial goals is a cornerstone of successful money management. These goals provide direction and motivation for financial decisions. Short-term goals, such as building an emergency fund, can help navigate unexpected expenses, while long-term goals, like saving for retirement or purchasing a home, require disciplined planning and patience. When setting financial goals, it's important to use the SMART criteria—ensuring they are Specific, Measurable, Achievable, Relevant, and Time-Bound. This framework helps individuals map out their aspirations clearly and track their progress effectively. Creating a budget is a fundamental practice in personal finance that enables individuals to allocate their income wisely. A budget outlines income sources, fixed expenses (such as rent and utilities), variable expenses (like groceries and entertainment), and savings goals. Regularly tracking expenses against the budget helps identify potential areas for savings and ensures that financial priorities remain aligned. Modern tools, such as expense tracking apps, simplify this process by categorizing expenditures and providing real-time insights into spending patterns. Not all debt is created equal, and managing debt wisely is crucial for maintaining financial health. While some debt, like a mortgage for a home, can be considered an investment, high-interest debt, such as credit card debt, can quickly become a financial burden. Developing a repayment strategy and focusing on paying off high-interest debt first can save money in the long run and alleviate financial stress. Avoiding unnecessary debt and being cautious about borrowing ensures that individuals maintain control over their financial future. Life is full of unexpected events, and having an emergency fund can be a financial lifesaver. An emergency fund, typically equal to three to six months' worth of living expenses, acts as a safety net during unforeseen circumstances like medical emergencies or sudden job loss. Building this fund requires consistency and discipline, but the peace of mind it provides is invaluable. It prevents individuals from resorting to high-interest debt in times of crisis and supports financial stability. Saving and investing are key strategies for building wealth over time. Saving involves setting money aside for future use while investing aims to grow wealth through opportunities like stocks, bonds, and real estate. It's essential to strike a balance between saving for short-term goals and investing for long-term financial growth. Diversifying investments and aligning them with risk tolerance and time horizon are vital to creating a well-rounded financial portfolio. Retirement planning is an integral part of personal finance that ensures individuals can maintain their desired lifestyle after leaving the workforce. Retirement accounts like 401(k)s and IRAs offer tax advantages and compound interest, making early contributions highly beneficial. Calculating retirement needs involves considering factors such as current expenses, inflation, and potential medical costs. A well-structured retirement plan provides peace of mind and the freedom to enjoy the golden years. Insurance coverage acts as a safeguard against unexpected financial setbacks. Health, life, property, and liability insurances offer protection in the face of medical emergencies, accidents, or damage to personal belongings. Evaluating insurance needs requires assessing personal circumstances and potential risks. Having adequate coverage prevents a single event from derailing financial progress and provides a sense of security for the future. Tax planning involves strategic decisions to minimize tax liability while remaining compliant with tax laws. Implementing tax-efficient strategies, such as maximizing deductions and utilizing tax-advantaged accounts, can significantly impact long-term wealth accumulation. Seeking professional tax advice ensures that individuals are aware of available options and can capitalize on opportunities to optimize their tax situation. Financial management is an ongoing process that requires regular monitoring and adjustment. Tracking financial goals and investment performance ensures that individuals stay on course. Periodic assessments allow for modifications to the financial plan based on changes in income, expenses, or market conditions. Staying proactive in financial decision-making leads to a more stable and successful financial future. Personal finance best practices are the foundation for achieving financial stability and pursuing life goals. By understanding the importance of setting financial goals, managing expenses, saving, investing, and planning for retirement, individuals can take control of their financial journey. Engaging in thoughtful practices such as evaluating insurance coverage and tax planning further solidifies a secure financial foundation. Continuous monitoring and adjustment ensure that financial goals remain attainable and adaptable to changing circumstances. Through informed decision-making and a commitment to financial education, individuals can navigate the complex landscape of personal finance with confidence and optimism.What Is Personal Finance?

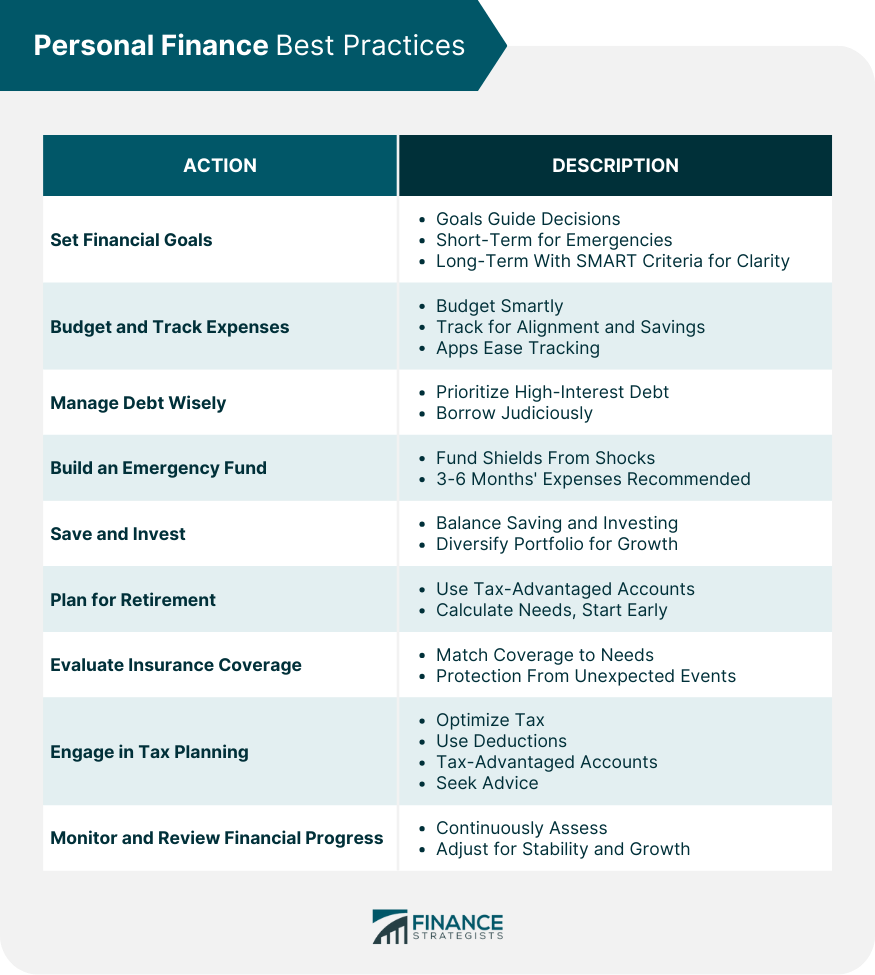

Personal Finance Best Practices

Set Financial Goals

Budget and Track Expenses

Manage Debt Wisely

Build an Emergency Fund

Save and Invest

Plan for Retirement

Evaluate Insurance Coverage

Engage in Tax Planning

Monitor and Review Financial Progress

Conclusion

Personal Finance Best Practices FAQs

Personal finance empowers individuals to make informed decisions about their money, ensuring financial stability and the ability to achieve life goals.

Budgeting helps individuals allocate their income effectively, prioritize expenses, and work towards savings goals.

Building an emergency fund involves setting aside a portion of income consistently, typically aiming for three to six months' worth of living expenses.

Investing allows individuals to grow their wealth over time, leveraging opportunities like stocks, bonds, and real estate for long-term financial growth.

Effective retirement planning includes contributing to retirement accounts early, considering inflation and medical costs, and adjusting the plan as circumstances change.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.