Liability insurance is a type of insurance policy that provides financial protection to an individual or a business in the event that they are held responsible for causing harm or damage to another person or their property. Liability insurance typically covers legal costs, damages, and other expenses associated with a covered claim. This type of insurance can be purchased by individuals, businesses, and organizations and is designed to provide protection against claims of negligence, wrongful acts, or other types of liability that may arise in the course of everyday life or business operations. Examples of liability insurance include general liability insurance, professional liability insurance, and product liability insurance. Coverage limits represent the maximum amount an insurer will pay for a covered claim. Businesses should carefully assess their risk exposure and choose coverage limits that provide adequate protection against potential losses. It is crucial to understand both per-occurrence limits, which apply to each individual claim, and aggregate limits, which cap the total amount payable during the policy period. A deductible is the amount a policyholder must pay out-of-pocket before the insurer begins to cover a claim. Higher deductibles typically result in lower premium costs but can increase the financial burden on a business in the event of a claim. Businesses should carefully weigh the trade-offs between deductible amounts and premium costs when selecting a policy. Exclusions are specific situations, events, or losses that are not covered by an insurance policy. Common exclusions include intentional acts, contractual liabilities, and certain types of damages or injuries. It is essential for policyholders to fully understand their policy's exclusions and consider purchasing additional coverage to fill any gaps in protection. Endorsements are amendments or additions to an insurance policy that modify coverage, exclusions, or other terms. They can be used to tailor a policy to better fit a business's unique needs and risk exposures. Common endorsements include additional insured status, waiver of subrogation, and increased limits for specific coverages. General liability insurance, also known as commercial general liability (CGL) insurance, provides coverage for bodily injury, property damage, personal and advertising injury, and medical payments arising from business operations. This coverage is essential for most businesses and can protect against a wide range of common claims. Examples of general liability claims include slip-and-fall accidents, property damage caused by a company's operations, and advertising injuries such as copyright infringement or defamation. Most businesses, regardless of size or industry, should carry general liability insurance. This includes retail stores, contractors, manufacturers, and professional service providers. Professional liability insurance, also known as errors and omissions (E&O) insurance, protects businesses against claims arising from professional services, such as negligence, errors, omissions, or misrepresentation. This coverage is especially important for businesses providing advice or services to clients. Examples of professional liability claims include a financial advisor providing incorrect investment advice, an architect designing a structurally unsound building, or a technology consultant implementing a faulty software system. Businesses in professional service industries, such as lawyers, accountants, consultants, and healthcare providers, typically need professional liability insurance. Product liability insurance covers businesses against claims arising from injuries, property damage, or other losses caused by a defective or unsafe product. Manufacturers, distributors, and retailers can all be held responsible for product-related claims. Examples of product liability claims include injuries caused by defective toys, property damage due to a malfunctioning appliance, or illness resulting from contaminated food products. Manufacturers, distributors, and retailers of consumer products are particularly vulnerable to product liability claims and should strongly consider this coverage. Employer's liability insurance protects businesses against claims arising from work-related injuries or illnesses that are not covered by workers' compensation insurance. This can include damages for pain and suffering, loss of consortium, or third-party claims. Examples of employer's liability claims include an employee's spouse suing for loss of consortium due to a work-related injury or an employee filing a lawsuit for negligence after a workplace accident. All businesses with employees should consider employer's liability insurance, as it provides an added layer of protection beyond workers' compensation coverage. Directors and officers (D&O) liability insurance covers the personal assets of directors and officers against claims arising from their actions or decisions made while serving in their capacity as leaders of the organization. It can also provide coverage for the organization itself in certain circumstances. Examples of D&O liability claims include shareholder lawsuits alleging mismanagement or breach of fiduciary duty, regulatory investigations, and claims arising from mergers and acquisitions. Businesses of all sizes and industries with a board of directors or executive leadership team should consider D&O liability insurance, as it helps attract and retain qualified individuals to serve in these critical roles. Cyber liability insurance covers businesses against claims arising from data breaches, cyber-attacks, and other cyber-related incidents. This can include costs associated with notifying affected individuals, public relations efforts, legal defense, and regulatory fines. Examples of cyber liability claims include a data breach exposing sensitive customer information, a ransomware attack resulting in business interruption, or a phishing scam leading to financial losses. Any business that stores, processes, or transmits sensitive electronic data, such as personal information, credit card numbers, or intellectual property, should strongly consider cyber liability insurance. To choose the appropriate liability insurance, businesses should first assess their risk exposure. This includes identifying potential sources of claims, evaluating the likelihood and severity of potential losses, and considering any industry-specific risks. Certain industries may have unique liability risks that require specialized coverage. For example, healthcare providers should consider medical malpractice insurance, while construction companies may need pollution liability coverage. When selecting a liability insurance provider, businesses should consider the financial stability and strength of the insurer. This can help ensure that the provider will be able to pay claims in the event of a loss. Liability insurance policies should be customized to fit the unique needs and risks of each business. This may include adding endorsements, increasing coverage limits, or purchasing additional policies to fill coverage gaps. To find the best coverage and pricing, businesses should compare quotes from multiple insurance providers. This can help identify the best fit for a company's specific risk profile and budget. A comprehensive risk management strategy can help businesses identify, assess, and mitigate liability risks. This may include regular risk assessments, implementing safety and security measures, and establishing policies and procedures to minimize risk exposure. Training and educating employees on best practices for preventing accidents, maintaining safety, and avoiding potential liabilities can significantly reduce the likelihood of claims. Proper documentation can help businesses defend against liability claims and demonstrate compliance with laws, regulations, and industry standards. This may include maintaining records of employee training, safety inspections, and incident reports. Complying with applicable laws, regulations, and industry standards can help businesses reduce liability risks and avoid costly fines, penalties, and legal action. Regular compliance audits and updates to policies and procedures can ensure ongoing adherence to these requirements. As industries evolve and new risks emerge, businesses should stay informed about potential liability exposures and adjust their risk management strategies and insurance coverage accordingly. This may involve monitoring industry news, attending conferences, or consulting with insurance professionals. Liability insurance is an essential component of a comprehensive risk management plan for businesses of all sizes and industries. By understanding the various types of liability insurance, considering key factors when selecting coverage, and implementing strategies to minimize liability risks, businesses can protect their financial stability and ensure long-term success. Remember, choosing the right insurance coverage is an investment in the future of your business, and careful consideration should be given to each aspect of your policy.What Is Liability Insurance?

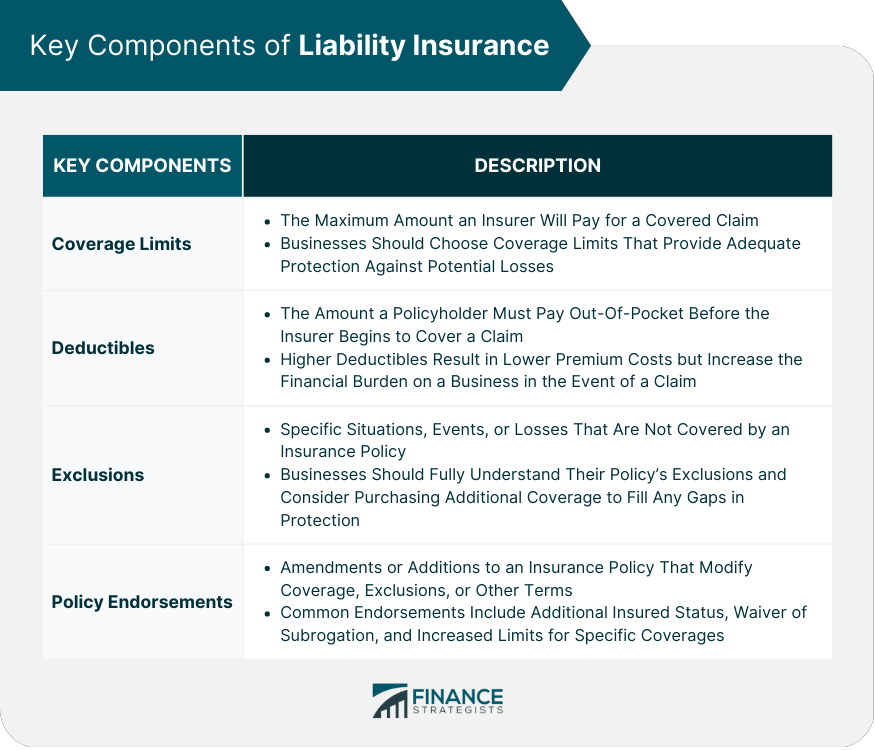

Key Components of Liability Insurance

Coverage Limits

Deductibles

Exclusions

Policy Endorsements

Types of Liability Insurance

General Liability Insurance

Coverage

Typical Claim Scenarios

Industries Requiring General Liability Insurance

Professional Liability Insurance (Errors and Omissions)

Coverage

Typical Claim Scenarios

Industries Requiring Professional Liability Insurance

Product Liability Insurance

Coverage

Typical Claim Scenarios

Industries Requiring Product Liability Insurance

Employer's Liability Insurance

Coverage

Typical Claim Scenarios

Industries Requiring Employer's Liability Insurance

Directors and Officers Liability Insurance

Coverage

Typical Claim Scenarios

Industries Requiring D&O Liability Insurance

Cyber Liability Insurance

Coverage

Typical Claim Scenarios

Industries Requiring Cyber Liability Insurance

Factors to Consider When Choosing Liability Insurance

Assessing Your Risk Exposure

Industry-Specific Considerations

Financial Stability of the Insurance Provider

Customizing Coverage to Fit Your Needs

Comparing Quotes From Multiple Providers

How to Minimize Liability Risks

Implementing Risk Management Strategies

Regular Employee Training and Education

Maintaining Proper Documentation

Ensuring Compliance With Regulations and Industry Standards

Staying Up-To-Date With Emerging Risks and Trends

Conclusion

Liability Insurance FAQs

Liability insurance is a type of insurance policy that protects the insured from legal liability arising from injuries or damages caused to third parties.

Anyone who may be held liable for injuries or damages to third parties should consider getting liability insurance. This includes businesses, homeowners, and even individuals with certain professions or hobbies.

Liability insurance typically covers legal fees, medical expenses, and damages awarded to the injured party in a lawsuit. The exact coverage and limits depend on the specific policy.

The amount of liability insurance you need depends on various factors, such as your profession, the value of your assets, and the potential risks you face. It's best to consult with an insurance professional to determine the appropriate amount of coverage for your situation.

There are several types of liability insurance, including general liability insurance for businesses, professional liability insurance for certain professions, and umbrella liability insurance that provides additional coverage beyond other policies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.