Applying for bankruptcy involves several crucial steps. Firstly, determine if bankruptcy is the best option for you, considering its impact on your credit score and assets. Consult with a financial advisor or bankruptcy attorney to understand your options. If you decide to proceed, compile all your financial records, including debts, assets, income, and expenses. Then, complete a credit counseling course through an approved agency. Next, file your bankruptcy petition along with your financial records at your local bankruptcy court. Ensure you've chosen the correct bankruptcy chapter that fits your situation (commonly Chapter 7 or Chapter 13). After filing, you'll attend a meeting with your creditors. If all goes well, your eligible debts will eventually be discharged. Note this process varies depending on your location and personal financial situation. Always consult a professional for advice tailored to your circumstances. Before applying for bankruptcy, it's essential to determine if you're eligible. Your eligibility will depend on the type of bankruptcy you want to file—Chapter 7 or Chapter 13. Chapter 7 bankruptcy, also known as liquidation bankruptcy, involves the selling of your non-exempt assets to repay your debts. In contrast, Chapter 13 bankruptcy, or reorganization bankruptcy, involves creating a plan to repay your debts over time. Once you've determined your eligibility, the next step is to gather all your financial documents. These include income sources, major financial transactions, monthly living expenses, debts, and property ownership details. Having these documents ready will speed up the process and make it smoother. Before filing for bankruptcy, you must complete a credit counseling course from an approved provider. This course aims to help you understand your financial situation, the process of bankruptcy, and alternatives you could consider. Next, you will need to file a bankruptcy petition in court. This document contains your financial details, including debts, income, and assets. It's crucial to be accurate and complete when filling out this petition, as any discrepancy can lead to your case being dismissed. Upon filing for bankruptcy, a trustee is appointed to administer your case. The trustee's role involves reviewing your petition, selling your non-exempt assets (in Chapter 7), and distributing proceeds to your creditors. This meeting is a chance for the creditors to ask you questions about your financial situation and the information in your bankruptcy petition. Although it's called a "creditor's meeting," creditors rarely attend these meetings. Before you can receive a discharge of your debts, you must complete a debtor education course, also known as a financial management course. The course aims to teach you how to manage your finances better to avoid future bankruptcy. Finally, if you've met all the requirements, the court will discharge most, if not all, of your debts, which means you're no longer legally required to pay them. Once you file for bankruptcy, an automatic stay is put into effect, which stops most creditors from collecting debts. Bankruptcy can discharge most consumer debts, which means you're no longer obligated to pay them. However, some debts, like student loans, alimony, and child support, are usually not discharged. Bankruptcy provides an opportunity to start over financially. Although it has negative consequences, it can be the first step toward financial freedom. Filing for bankruptcy will significantly lower your credit score, making it harder to qualify for credit in the future. Bankruptcy is a public record, which means anyone can find out about your bankruptcy. Some debts cannot be discharged in bankruptcy, such as student loans, alimony, child support, certain tax debts, and debts resulting from fraud. In a Chapter 7 bankruptcy, you may have to give up some property to be sold to pay back your creditors. Bankruptcy can be a complex and daunting process, which is why seeking professional assistance from a bankruptcy attorney is highly recommended. Expert Guidance: A bankruptcy attorney possesses in-depth knowledge of bankruptcy laws and regulations. Their expertise allows them to provide personalized advice tailored to your unique financial situation, ensuring you make well-informed decisions throughout the process. Stress Reduction: Dealing with bankruptcy can be incredibly stressful and emotionally taxing. Hiring an attorney can alleviate this burden, as they take care of the legal complexities, paperwork, and communication with creditors, allowing you to focus on rebuilding your financial future. Representation in Court: In some bankruptcy cases, court appearances may be necessary. A skilled attorney will represent you in court, presenting your case professionally and advocating for your best interests before the judge and other parties involved. When searching for a bankruptcy attorney, it's essential to consider several factors to ensure you find the right fit for your needs: Experience: Look for an attorney with a solid track record of handling bankruptcy cases. Experienced attorneys are more likely to navigate potential challenges effectively and provide reliable guidance. Fees: Discuss the attorney's fee structure upfront to avoid any surprises. While seeking affordability is important, remember that the cheapest option may not always provide the best representation. Comfort and Trust: Building a rapport with your attorney is crucial, as you'll be sharing sensitive financial information with them. Choose someone you feel comfortable talking to and can trust to handle your case with professionalism and integrity. Enlisting the assistance of a bankruptcy attorney can significantly ease the bankruptcy process's burden. You can try negotiating directly with your creditors to settle for a lower amount than what you owe. It's like finding common ground with your creditors and reaching a deal that works for both sides. Consider working out a debt management plan with your creditors. This means coming to an agreement to pay off your debts over a longer period, and often with reduced interest rates. It's like making a practical arrangement with your creditors to ease your financial burden. Another option is getting a consolidation loan, where you combine all your debts into one single loan, often with a lower interest rate. It's like simplifying your debt repayments and potentially saving money on interest charges. Filing for bankruptcy is a significant decision with both potential benefits and drawbacks. It offers an opportunity to discharge eligible debts and provides a financial reset but also leaves a long-lasting negative impact on your credit score and public record. The process involves determining your eligibility, gathering financial records, undergoing credit counseling, and filing a bankruptcy petition in court. An appointed trustee administers your case, followed by a 341 meeting with creditors. Debt discharge is the final step, following a financial management course. Professional assistance from a bankruptcy attorney can be invaluable in navigating this complex process. However, alternatives such as debt settlement, debt management plans, and consolidation loans should be considered before proceeding with bankruptcy. It's crucial to understand every aspect of bankruptcy and consult a professional to make the decision that's best for your financial circumstances.How to Apply for Bankruptcy

Steps to Apply for Bankruptcy

Determine Eligibility

Gather Financial Documents

Complete Credit Counseling Course

File the Bankruptcy Petition

Attend 341 Meeting of Creditors

Complete a Financial Management Course

Discharge of Debts

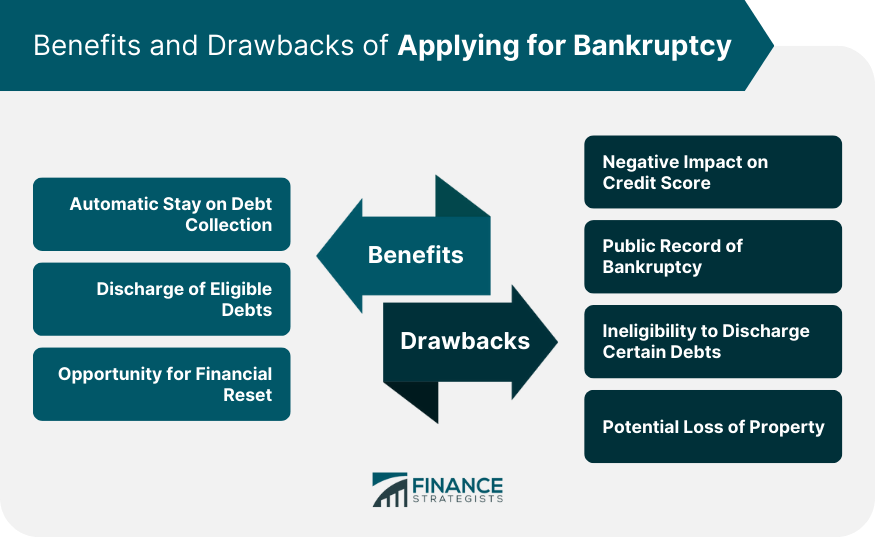

Benefits of Applying for Bankruptcy

Automatic Stay on Debt Collection

Discharge of Eligible Debts

Opportunity for Financial Reset

Drawbacks of Applying for Bankruptcy

Negative Impact on Credit Score

Public Record of Bankruptcy

Ineligibility to Discharge Certain Debts

Potential Loss of Property

Professional Assistance in Applying for Bankruptcy

Benefits of Hiring an Attorney

Finding the Right Attorney

Alternatives to Apply for Bankruptcy

Debt Settlement

Debt Management Plans

Consolidation Loans

Conclusion

How to Apply for Bankruptcy FAQs

Bankruptcy is a legal process that allows individuals or businesses unable to pay their debts to seek relief from some or all of their debts. In many cases, the debtor is totally discharged from their debts, giving them a fresh start.

Applying for bankruptcy involves determining if you're eligible, gathering all your financial records, completing a credit counseling course, and filing a bankruptcy petition in court. After filing, a meeting with your creditors occurs, followed by a discharge of eligible debts.

Benefits of applying for bankruptcy include an automatic stay on debt collection, discharge of eligible debts, and an opportunity for a fresh financial start.

Drawbacks of applying for bankruptcy include a negative impact on your credit score, public record of bankruptcy, ineligibility to discharge certain debts, and potential loss of property.

Alternatives to bankruptcy include debt settlement, debt management plans, and consolidation loans. These options involve negotiations with creditors to reduce or restructure your debts.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.