Bankruptcy is a legal procedure that allows individuals or businesses unable to pay their debts to seek relief from some or all of them. In the U.S., bankruptcies are often categorized as Chapter 7, which involves liquidating assets to clear debts, or Chapter 13, which arranges for debt repayment plans. Businesses typically file under Chapter 11, allowing them to continue operations while restructuring their debts. The process starts with the debtor filing a petition in court, followed by an automatic stay that temporarily stops creditors from collection efforts. After the examination of financial details, a repayment or discharge plan is determined. Bankruptcy, though often perceived negatively, can offer a crucial lifeline to those overwhelmed by debt. The main impact of filing for bankruptcy is the discharge of debts, providing individuals or businesses with a legal release from certain financial obligations, which offers a fresh start. However, it's not a clean sweep; some debts, like student loans and child support, are typically non-dischargeable. The implications of bankruptcy are wide-ranging. It can severely affect one's credit score, hindering the ability to secure new credit in the short term. It may also lead to the loss of non-exempt property. However, it can stop creditor harassment and collection attempts, providing emotional and financial relief. Thus, while bankruptcy is a serious decision with significant implications, it can pave the way towards financial recovery and stability. One of the primary goals of the bankruptcy process is to discharge certain debts to give an individual a "fresh start." A bankruptcy discharge is a court order that makes previously due debts permanently uncollectible from the debtor by a creditor. It is a permanent legal release from the obligation to pay the debt. Once the court discharges your debts, you are no longer legally obligated to pay them. This discharge happens at the end of your bankruptcy case, giving you a clean slate to start over financially. It's important to understand that not all debts can be discharged in bankruptcy. Dischargeable debts include credit card debt, medical bills, personal loans, and more. Non-dischargeable debts typically include student loans, most tax debts, child support, and alimony. A bankruptcy trustee plays a crucial role in the process. Appointed by the court, the trustee's primary duty is to see that the creditors are paid as much as possible. The trustee does this by reviewing the debtor's assets and making a determination about what property is exempt. Understanding how bankruptcy works involves comprehending the steps in the bankruptcy process. It can be a complex procedure, involving a series of legal actions. The bankruptcy process begins with the filing of a petition with the bankruptcy court. This petition, usually prepared with the assistance of a bankruptcy lawyer, includes detailed information about the debtor's assets, debts, income, and expenditures. After the filing of the bankruptcy petition, the court will schedule a meeting of creditors, also known as a 341 meeting. At this meeting, the bankruptcy trustee and creditors may ask questions about the debtor's financial situation and property. In some cases, there may be court hearings associated with the bankruptcy process. These might relate to objections to the bankruptcy plan, disputes about the value of assets, or challenges from creditors. Despite its negative connotations, bankruptcy can provide substantial relief for struggling debtors. The primary advantage of filing for bankruptcy is that it can eliminate most, if not all, of an individual's unsecured debt. After bankruptcy, debtors get a fresh start financially, which can open doors to new credit opportunities. Once a debtor files for bankruptcy, an automatic stay is put into place. This stay prevents creditors from making any collection attempts. Bankruptcy, while offering relief, also comes with certain disadvantages. A bankruptcy filing will significantly impact your credit score and remain on your credit report for seven to ten years. In some cases, the debtor might lose the property. Non-exempt assets—those not protected by an exemption—are sold in Chapter 7 bankruptcy to repay creditors. While bankruptcy can help you wipe out old debts, it can also make it more challenging to secure new credit in the near future. Bankruptcy is a structured process that provides a lifeline for individuals and businesses burdened by overwhelming debt. It offers a clear path toward financial recovery, starting with the filing of a petition and culminating in a debt discharge. Key elements of bankruptcy include the role of the trustee, the meeting of creditors, and court hearings. The bankruptcy discharge, granting legal release from certain debts, offers a fresh financial start. However, not all debts are dischargeable, with obligations like student loans and child support typically surviving the process. Despite the severe impact on credit scores and potential property loss, bankruptcy can provide substantial debt relief and put a stop to harassing collection practices. It's a complex system, designed to balance fairness and opportunity, that should be navigated with professional guidance.How Do Bankruptcies Work?

Impact and Implications of Bankruptcy

What Is Bankruptcy Discharge?

Effect of Discharge

Dischargeable and Non-dischargeable Debts

Role of Bankruptcy Trustee

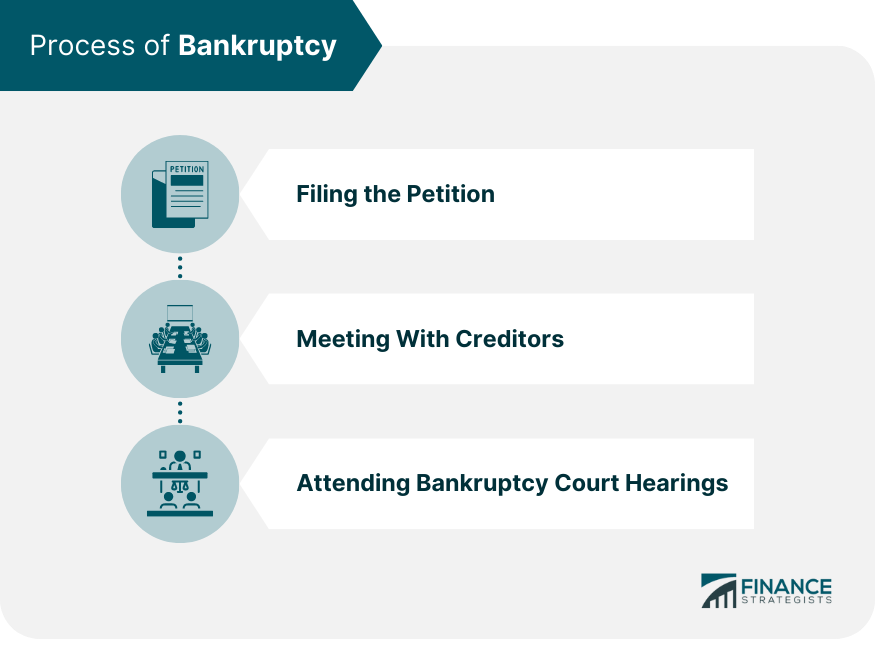

Process of Bankruptcy

File the Petition

Meet With Creditors

Attend Bankruptcy Court Hearings

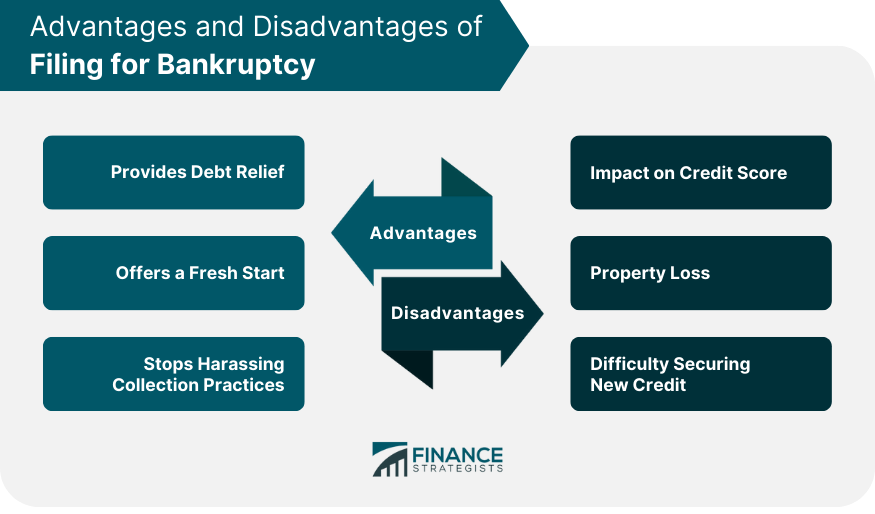

Advantages of Filing for Bankruptcy

Provides Debt Relief

Offers a Fresh Start

Stops Harassing Collection Practices

Disadvantages of Filing for Bankruptcy

Impact on Credit Score

Property Loss

Difficulty Securing New Credit

Conclusion

How Bankruptcies Work FAQs

A bankruptcy discharge is a court order that permanently absolves a debtor from the obligation to pay certain debts. It is often the final step in a bankruptcy case, offering the debtor a fresh financial start.

Dischargeable debts in bankruptcy often include unsecured debts such as credit card charges, medical expenses, and personal loans. However, not all debts can be discharged, including certain tax debts, student loans, and family support obligations like alimony or child support.

A bankruptcy filing can provide substantial debt relief, halting aggressive collection practices through the imposition of an automatic stay and facilitating a fresh financial start for the debtor by discharging certain debts.

Filing for bankruptcy can significantly lower a debtor's credit score, and it stays on the credit report for a period of seven to ten years. This can influence future credit opportunities and make securing new credit more challenging in the near term.

Yes, in certain cases, the debtor may face the loss of property. Non-exempt assets, which are not protected by an exemption, may be liquidated in a Chapter 7 bankruptcy to settle the claims of creditors. However, the specific laws can vary, so it's important to consult with a bankruptcy attorney for a more accurate understanding.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.