Guardianship is a legal arrangement that allows a responsible adult to make decisions on behalf of another individual who is unable to make decisions for themselves due to age, disability, or diminished capacity. The importance of guardianship in estate planning cannot be overstated, as it ensures the well-being of loved ones and helps to manage assets effectively. Guardianship can take various forms, such as temporary, permanent, limited, or full, depending on the specific needs of the individual and their family. One of the primary reasons for establishing guardianship is to protect minors. If parents die or become incapacitated, a guardian can be appointed to take care of the children and make decisions in their best interests. Guardianship may also be established for individuals with disabilities who cannot make decisions for themselves. A guardian can help manage their personal, medical, and financial affairs. As people age, they may experience cognitive decline or other medical issues that prevent them from managing their own affairs. Guardianship can be established to provide support and decision-making assistance for these elderly individuals. When someone becomes incapacitated due to illness or injury, a guardian can be appointed to manage their assets and ensure that their financial obligations are met. When selecting a guardian, it's essential to consider factors such as the individual's relationship to the person in need of assistance, their trustworthiness and reliability, and their ability to handle the responsibilities associated with guardianship. In some cases, alternatives to guardianship may be more suitable. These can include trusts, powers of attorney, or joint accounts, which provide varying levels of control and protection for the individual in need of assistance. The process of establishing guardianship varies by state, as different jurisdictions have their own laws and requirements. It is essential to familiarize yourself with your state's specific rules and procedures. The establishment of guardianship typically involves court intervention. This includes filing a petition, a court investigation, and a hearing where the judge decides whether to appoint the guardian. A guardian has several responsibilities and duties, including financial management, healthcare decisions, and advocating for the best interests of the individual they are responsible for. Guardians must comply with reporting requirements, which can include submitting financial statements and providing updates on the individual's well-being. Courts may conduct periodic reviews to ensure that the guardian is fulfilling their responsibilities and that the individual's needs are being met. Guardianship arrangements can be modified or terminated if circumstances change or if the individual no longer needs assistance. In some cases, family members or other interested parties may contest the appointment of a guardian, requiring legal intervention to resolve the dispute. Disagreements between guardians and the individuals they are responsible for may arise, necessitating mediation or court intervention to resolve the conflict. If a guardian is found to have engaged in misconduct or abuse, legal remedies may be available to protect the individual and hold the guardian accountable. When drafting a will, it is crucial to designate a guardian for any minor children or individuals with disabilities. This ensures that the individual's wishes are known and respected, and provides a clear plan for who will take on the responsibility of guardianship. Trusts can be an effective way to provide for the needs of an individual who may require assistance. A trustee can be appointed to manage the assets in the trust and distribute them according to the individual's needs, while a separate guardian can be designated to handle non-financial aspects of the individual's care. Powers of attorney can be used to grant decision-making authority to another individual in the event of incapacity. This legal document can cover financial, healthcare, or personal decisions and provide a level of protection without the need for formal guardianship. Advance healthcare directives, also known as living wills, allow an individual to specify their healthcare preferences and designate a healthcare proxy to make medical decisions on their behalf if they are unable to do so. This can prevent the need for court-appointed guardianship for medical decisions. The importance of proactive estate planning cannot be overstated. By establishing guardianship and incorporating it into estate planning documents, individuals can ensure the well-being of their loved ones and protect their assets. Considering the various aspects of guardianship, from selecting a guardian to understanding the legal processes involved, is essential for creating a comprehensive estate plan that addresses the unique needs of each individual and their family.What Is Guardianship?

Reasons for Establishing Guardianship

Protecting Minors

Supporting Individuals With Disabilities

Assisting Elderly Persons With Diminished Capacity

Managing Assets for Someone Who Is Incapacitated

Selecting a Guardian

Factors to Consider

Alternatives to Guardianship

Legal Process of Establishing Guardianship

State-Specific Laws and Requirements

Court Involvement

Responsibilities and Duties of a Guardian

Monitoring and Modifying Guardianship

Reporting Requirements

Periodic Reviews

Changing or Terminating Guardianship

Guardianship Disputes

Contesting Guardianship Appointments

Resolving Disagreements Between Guardians and Wards

Legal Remedies for Misconduct or Abuse

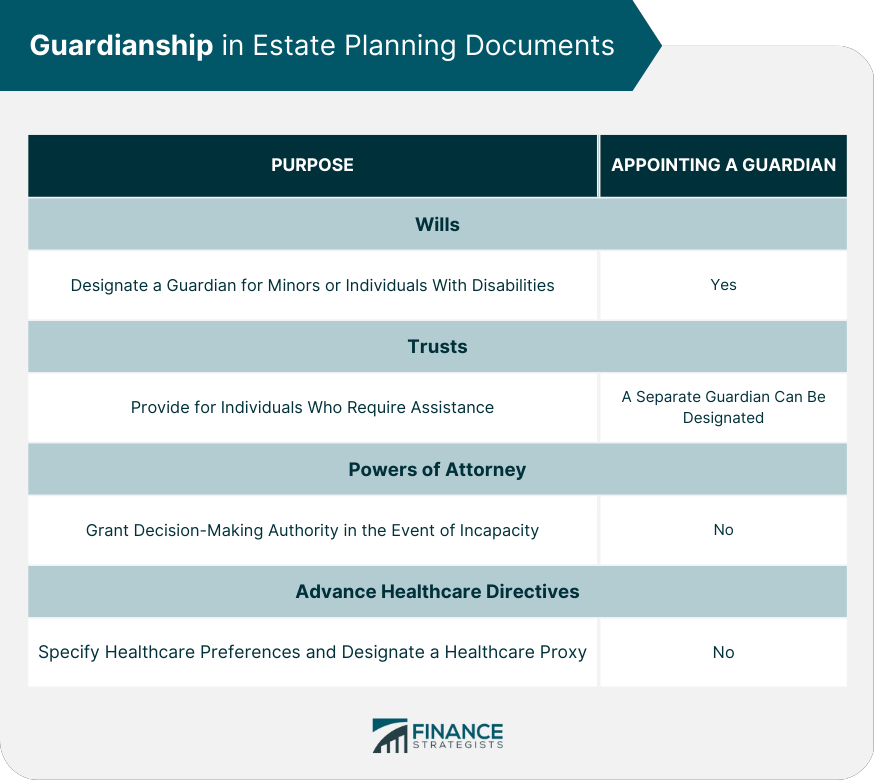

Guardianship in Estate Planning Documents

Wills

Trusts

Powers of Attorney

Advance Healthcare Directives

Conclusion

Guardianship FAQs

Guardianship refers to the legal process of appointing someone to take care of your minor children or any dependents who are unable to care for themselves in the event of your incapacity or death. It is a crucial aspect of estate planning as it ensures that your loved ones are taken care of in accordance with your wishes.

The person appointed as a guardian should be someone who is trustworthy and capable of taking care of your minor children or dependents. It is usually a family member or a close friend. However, it is essential to choose someone who is willing to take on the responsibility and has the necessary skills to care for your loved ones.

If you do not appoint a guardian in your estate plan, the court will appoint someone to take care of your minor children or dependents in the event of your incapacity or death. This person may not be someone you would have chosen, and it could cause conflict among your family members.

Yes, you can change the guardian you appointed in your estate plan at any time, as long as you are still of sound mind. You may want to change the guardian if the person you originally appointed is no longer willing or able to fulfill the role, or if your circumstances change.

The first step in appointing a guardian in your estate plan is to choose the person you want to appoint. Once you have chosen the guardian, you should discuss the role with them and ensure that they are willing to take on the responsibility. You should then include the appointment of the guardian in your will or trust, and make sure that your loved ones are aware of your wishes. It is also important to seek the advice of an estate planning attorney to ensure that your estate plan is legally valid and enforceable.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.