The lifetime gift tax exemption is a federal tax law that allows an individual to give gifts of up to a certain amount without incurring gift taxes. As of 2024, the exemption is $13.61 million per person. This means that an individual can give away up to $13.61 million in gifts over their lifetime without having to pay gift tax. The exemption is a cumulative limit, which means that the total amount of gifts given over a person's lifetime is tallied up, and once that amount exceeds the exemption limit, gift taxes may be due on any additional gifts. The Lifetime Gift Tax Exemption is a provision within the United States federal tax code that allows individuals to transfer a specific amount of assets to others without incurring gift tax. This exemption plays a critical role in estate planning and wealth transfer strategies.

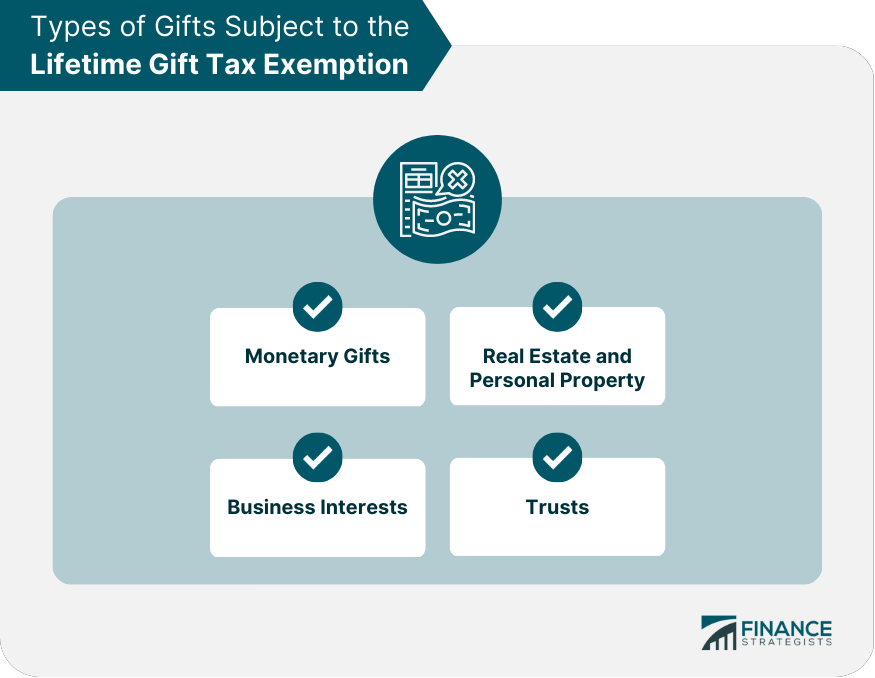

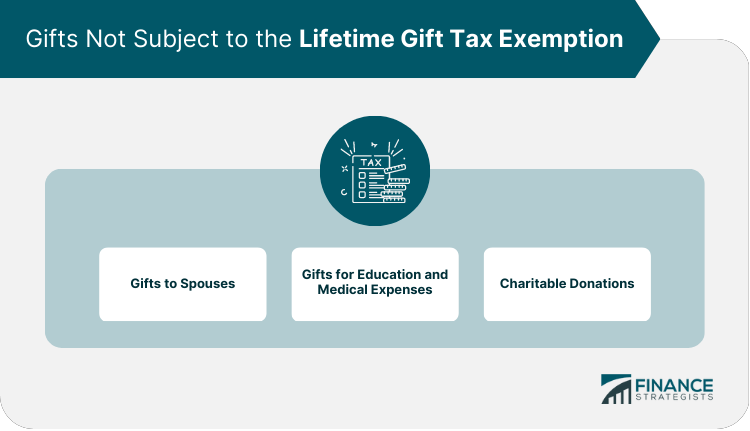

Gift tax is a federal tax imposed on the transfer of assets from one person to another without receiving anything or receiving less than the full value of the assets in return. It applies to cash, property, and other valuable items. The person giving the gift, or the "donor," is generally responsible for paying the gift tax. In some cases, the recipient or a third party may agree to pay the tax on the donor's behalf. Gift tax rates vary based on the value of the gift and the donor's cumulative lifetime gifts. Rates can range from 18% to 40%, depending on the amount gifted above the annual exclusion and lifetime exemption limits. The annual exclusion is the amount that an individual can gift to another person each year without incurring gift tax. As of 2024, the annual exclusion is $18,000 per recipient. This amount is subject to change based on inflation adjustments. The lifetime exemption is the total amount an individual can give away over their lifetime without incurring gift tax. As of 2024, the lifetime exemption is $13.61 million per individual. This amount is also subject to change based on inflation adjustments and legislative changes. The United States tax code utilizes a unified credit system that combines the lifetime gift tax exemption with the estate tax exemption. This means that any amount used from the lifetime gift tax exemption reduces the available estate tax exemption upon the individual's death. Using the lifetime gift tax exemption strategically can help reduce the overall estate tax liability upon an individual's death. By gifting assets during their lifetime, an individual can reduce the value of their estate, which may lead to lower estate taxes. There are several strategies for maximizing the benefits of the lifetime gift tax exemption, including: Making annual exclusion gifts to multiple recipients Utilizing trusts and other estate planning tools Gifting assets with high appreciation potential Deciding when to make gifts can significantly impact the overall tax consequences. Gifting during one's lifetime allows the donor to take advantage of the lifetime gift tax exemption, while gifting at death may result in higher estate taxes. Cash gifts, including checks and electronic transfers, are subject to the lifetime gift tax exemption. Gifts of real estate, vehicles, artwork, and other personal property are also subject to the lifetime gift tax exemption. Transfers of ownership in businesses, such as stocks or partnership interests, are subject to the exemption as well. Gifts made to trusts, either irrevocable or revocable, can be subject to the lifetime gift tax exemption, depending on the terms and structure of the trust. Gifts made to a spouse who is a U.S. citizen are generally exempt from gift tax, regardless of the amount, due to the unlimited marital deduction. Payments made directly to educational institutions for tuition or to medical providers for medical expenses on behalf of another person are excluded from gift tax and do not count toward the annual exclusion or lifetime exemption. Gifts made to qualified charitable organizations are exempt from gift tax and do not count toward the annual exclusion or lifetime exemption amounts. If an individual makes a gift exceeding the annual exclusion amount, they must file a federal gift tax return (Form 709) to report the gift, even if no tax is due because of the lifetime exemption. It is crucial to track the cumulative lifetime gifts to ensure compliance with exemption limits. Proper record-keeping and regular consultation with tax professionals can help prevent unintended tax liabilities. Failure to file a required gift tax return or underreporting the value of gifts may result in penalties, interest, and additional tax liabilities. If a person exceeds their lifetime gift tax exemption, they may be required to pay a gift tax on the excess amount. In addition to the tax, the IRS may also assess interest and penalties on any unpaid gift tax. It's important to note that intentional failure to report gifts or other assets can also result in civil or criminal penalties, including fines, imprisonment, or both. Therefore, it's important to comply with gift tax laws and to consult with a tax professional or financial advisor to ensure that you're making the most of your available exemptions and minimizing your tax liability. The lifetime gift tax exemption has undergone significant changes in the past, with amounts fluctuating due to legislative and economic factors. It is essential to stay informed about current exemption limits. Future legislative changes could impact the lifetime gift tax exemption, potentially altering the exemption amount or the overall structure of the gift and estate tax system. Individuals should monitor potential changes and adjust their estate planning strategies accordingly. Given the potential for changes to the lifetime gift tax exemption, it is crucial to work with estate planning and tax professionals to develop flexible strategies that can adapt to evolving tax laws. Being knowledgeable about the lifetime gift tax exemption is essential for individuals who wish to pass on their wealth tax-efficiently. Utilizing the exemption strategically can minimize tax liabilities and maximize the value of gifts to loved ones. Given the complexity of gift and estate tax laws, it is crucial to consult with tax and estate planning professionals for personalized advice and guidance. Working with experts can help ensure that individuals make informed decisions and comply with all applicable tax requirements.What Is the Lifetime Gift Tax Exemption?

Overview of Gift Tax

What Is Gift Tax?

Who Pays the Gift Tax?

Gift Tax Rates

Lifetime Gift Tax Exemption Basics

Annual Exclusion Amount

How the Lifetime Exemption Works

Unified Credit System

Impact of Lifetime Gift Tax Exemption on Estate Planning

Reducing Estate Tax Liability

Strategies for Maximizing the Exemption

Gifting During Life vs at Death

Types of Gifts Subject to the Exemption

Monetary Gifts

Real Estate and Personal Property

Business Interests

Trusts

Gifts Not Subject to the Exemption

Gifts to Spouses

Gifts for Education and Medical Expenses

Charitable Donations

Reporting and Compliance

Filing Gift Tax Returns

Tracking Lifetime Exemption Usage

Penalties for Non-compliance

Future Changes and Legislation

Past Changes to Lifetime Gift Tax Exemption

Proposed Changes and Potential Impacts

Planning for Uncertainty

Conclusion

Lifetime Gift Tax Exemption FAQs

The lifetime gift tax exemption is a federal tax law that allows a person to give gifts of up to a certain amount without incurring gift taxes. As of 2024, the exemption is $13.61 million per person. This means that an individual can give away up to $13.61 million in gifts over their lifetime without having to pay gift tax.

Yes, the lifetime gift tax exemption can be used more than once. The exemption is a cumulative limit, which means that the total amount of gifts given over a person's lifetime is tallied up, and once that amount exceeds the exemption limit, gift taxes may be due on any additional gifts.

Yes, in addition to the lifetime gift tax exemption, there is also an annual gift tax exemption. As of 2024, the annual gift tax exemption is $18,000 per person. This means that a person can give up to $18,000 in gifts to any number of individuals each year without incurring gift tax.

Yes, the lifetime gift tax exemption applies to gifts given to a spouse. There is no gift tax on transfers of property between spouses, regardless of the amount.

If the lifetime gift tax exemption is exceeded, gift taxes may be due on any additional gifts. However, there are various strategies and planning techniques that can be used to minimize or avoid gift taxes, such as making gifts to charitable organizations or creating a trust.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.