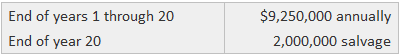

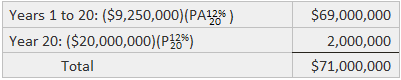

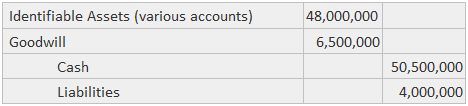

Goodwill is the future benefit that accrues to a firm as a result of its ability to earn an excess rate of return on its recorded net assets. Goodwill is reported in financial statements only if its valuation can be supported by a transaction involving the purchase of a firm. However, the existence of this unidentifiable asset should not be ignored by the potential buyer or seller in negotiating the amount to be paid for the firm. Even though the estimated numbers do not appear in the balance sheet, an accountant can be involved as a consultant to the buyer or seller in estimating the value of the firm. The estimate is typically based upon projections of future benefits to be received by the purchaser. Future benefits can be defined as the earnings generated during the life of an asset. Some methods of valuing a firm use compound interest techniques to discount future earnings. However, these approaches are inappropriate because earnings do not represent future fund flows. That is to say, depreciation and similar expenses reduce earnings but not funds. Present value techniques are based on an assumption that the future amounts to be discounted are equal to a return of the investment plus a return on the investment. Earnings, however, represent only the return on the investment. Therefore, a more appropriate measure of future benefits is fund flows, which can be calculated by adding non-fund expenses to earnings. This amount is provided for past periods on the statement of changes in financial position (SCFP). There are two different approaches to estimating the value of a firm. Because there are usually no well-established market values for entire firms, estimating the value of a business is perhaps best performed by discounting its future fund flows using the buyer's minimum desired rate of return. An estimate of the value of goodwill can be made by subtracting the value of identifiable assets from the present value of the entire firm; however, the main purpose of the analysis is to determine the firm's value, not the goodwill. The following example illustrates this method. Suppose that the management of Sample Company is considering the acquisition of ABC Company. According to the best estimates available, the future net fund flows from the purchased company would be as follows: If the managers at Sample Company seek a 12% rate of return, the present value of the future fund flow is found as follows (rounded to the nearest million dollars): This indicates that the entire firm is worth approximately $71,000,000 to Sample Company. The amount of goodwill is estimated to be $71,000,000 less the fair values of the assets less the liabilities. If, for example, the market value of the firm is estimated to be $48,000,000, the goodwill is approximately $23,000,000. This number should not be confused with the number that will actually be recorded by Sample Company for goodwill. That amount will be the difference between the total actually paid and the fair value of the identifiable assets and liabilities. If Sample's offer of $50,500,000 cash and the assumption of $4,000,000 of liabilities is accepted, the following entry would be recorded: A frequently used shortcut for approximating the value of a firm is known as the capitalization of earnings approach. This estimates the value of the business by assuming that earnings are achieved at a specified rate of return on the firm's assets. If the earnings and desired rate of return are known, the investment can be calculated using the following formula: Income = Investment x Rate of return

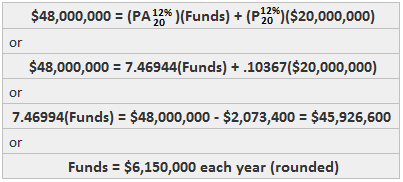

Investment = Income / Rate of return For example, suppose that the average annual earnings for ABC Company are $7,800,000 and the future earnings are expected to remain the same. If the desired rate of return is 12%, the value of a firm that would generate $7,800,000 of earnings each year would be: Investment = $7,800,000 / 0.12 = $65,000,000 This method is frequently used because it is easy to apply. However, it does not allow for uneven future cash flows or a limited life of the investment. The discounted fund flow approach is conceptually superior, but the capitalization of earnings approach may yield satisfactory results. A different approach to finding the value of a firm aggregates the estimates of values for its individual components, including identifiable and unidentifiable assets and liabilities to be assumed. The advantage of using a components approach as opposed to valuing the entire firm as one present value is the ability to use different discount rates for each component. Many accountants feel it is appropriate to use different discount rates to reflect what they believe are different levels of risk for each component. Future flows for liabilities to be assumed are generally known, and they can be discounted at the current market rate of borrowing. Future flows from identifiable assets can frequently be estimated with fairly high reliability, but they are not as definite as the flows for legal liabilities. For example, the flows from rent revenue to be received on a building can be estimated but are somewhat uncertain. Discounting these flows with a higher rate (to reflect the uncertainty) will result in a more conservative estimate of the building's value. Fund flow estimates for unidentifiable assets are much less certain than either of the other components. For example, if a firm has above normal flows due to high-quality management, an even higher discount rate should be used to obtain a more conservative estimate of the value of goodwill. The values of identifiable assets and liabilities can be established using the present value techniques described earlier. When no fund flow pattern can be projected for an identifiable asset, a value can usually be determined by referring to an established market for that asset. However, there is no established separate market for goodwill, meaning it must be determined differently. Relying on the definition of goodwill as an asset that produces above normal fund flows, a direct approach for estimating goodwill is to calculate the present value of future excess fund flows. These above normal flows are often defined as the amount in excess of the fund flows needed to provide the desired rate of return on the identifiable assets net of liabilities. Using the information presented earlier for Sample Company, normal fund flows on the assets net of liabilities other than goodwill are the amounts that would yield a present value equal to their fair value of $48,000,000 when discounted at 12%. Therefore, the operating flows attributable to normal earnings are computed as follows: Excess fund flows in each year would be $3,100,000 ($9,250,000 — $6,150,000). If those flows are discounted at 12%, the result is goodwill of $23,000,000. Notably, this is the same amount as computed under the entire firm valuation approach. If a higher rate of 20% is used to reflect the higher degree of uncertainty, a more conservative amount is $3,100,000 x PA 20% or $15,000,000 (rounded). A widely-used shortcut to approximate goodwill is known as the capitalization of excess earnings approach. In this approach, the first step is to separate total earnings into normal and excess earnings. This is done according to the average income experience of firms in the industry. Then, the excess earnings are capitalized at a higher rate to reflect the uncertainty of the goodwill value. For example, normal earnings based on $48,000,000 in identifiable assets would be $5,760,000 ($48,000,000 x 0.12). If total earnings per year are projected at $7,800,000, the excess earnings of $2,040,000 would then be capitalized at 20% (or some rate greater than 12%) to determine the amount of goodwill. The calculation is shown below. Goodwill = Excess earnings / 0.20

Goodwill = $2,040,000 / 0.20 = $10,200,000Goodwill: Definition

Goodwill: Explanation

Valuation of Goodwill

Entire Firm Valuation Approach

Example

Valuation of Components Approach

Example

Goodwill FAQs

Goodwill is an intangible asset that has a useful life beyond one year. Intangible assets such as patents, copyrights, and trademarks have a limited life span. Goodwill also will never become obsolete because of technological advances.

It is important to keep in mind goodwill examples are based on earnings and not current market value.

Goodwill is the future benefit that accrues to a firm as a result of its ability to earn an excess rate of return on its recorded net assets.

The 3 main components of goodwill are listed below: Future flows attributable to assets that can be identified (e.g., cash, Accounts Receivable, equipment), Future flows attributable to assets that cannot be identified (e.g., management skills) and Assets with no future flows (e.g., land)

The primary limitation when estimating goodwill is that it is based on future expectations, which are inherently uncertain. As a result, any estimate will have associated errors due to both measurement error and estimation error. Also, goodwill is intangible. As a result, it does not have the normal attributes of observable inputs that are typically required for any valuation exercise.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.