A total bond fund is a type of investment fund that aims to provide investors with exposure to a broad range of fixed-income securities. These funds often invest in government, corporate, municipal, and high-yield bonds, and can provide a diversified and relatively stable source of income for investors. Total bond funds serve an essential role in the financial market by allowing individual and institutional investors to gain exposure to a wide array of fixed-income securities. They help investors to achieve diversification, reduce risks, and generate income from a variety of sources. Total bond funds play a significant role in financial markets as they help in promoting market efficiency and liquidity. By investing in a diverse mix of fixed-income securities, these funds contribute to the overall stability and functioning of financial markets. Additionally, total bond funds offer investors a convenient and cost-effective way to access and invest in the bond market, which can be otherwise challenging for individual investors due to high minimum investment requirements and complex trading mechanics. Government bond funds primarily invest in bonds issued by national governments. These bonds are considered to be among the safest investments, as they are backed by the full faith and credit of the issuing government. Government bond funds typically provide lower returns compared to other bond fund types, but they offer relatively low risk and can be an attractive option for conservative investors seeking capital preservation and stable income. Corporate bond funds invest in bonds issued by corporations, which may include a variety of industries and credit ratings. These funds generally offer higher yields than government bond funds, as they are exposed to greater risks. Corporate bond funds can be an attractive option for investors seeking to diversify their fixed-income portfolio and potentially achieve higher returns, but they also come with increased credit risk and potential for price fluctuations. Municipal bond funds invest in bonds issued by state and local governments or their agencies, which are used to finance various public projects and services. The interest income generated from municipal bonds is typically exempt from federal income taxes, and in some cases, from state and local taxes as well, making them an attractive option for investors seeking tax-efficient income. High-yield bond funds invest in bonds with lower credit ratings, often referred to as "junk bonds." These funds typically offer higher yields than other types of bond funds, but they come with higher credit risk and potential for price volatility. High-yield bond funds can be suitable for investors willing to take on additional risk in exchange for potentially higher returns. Investing in a total bond fund provides investors with instant diversification, as these funds hold a wide range of fixed-income securities. This diversification can help reduce overall portfolio risk and improve the risk-return profile of an investor's portfolio. Total bond funds are generally considered to be more stable than individual bonds or stocks, as they invest in a diversified mix of securities. This can help to reduce the impact of individual security price fluctuations and provide a more stable source of income for investors. Total bond funds generate regular income through interest payments from the bonds they hold. This can be an attractive feature for investors seeking a consistent and reliable source of income, particularly during times of market uncertainty or volatility. Interest rate risk refers to the potential for bond prices to decrease as interest rates rise. As interest rates increase, the prices of existing bonds with lower yields become less attractive to investors, causing their prices to decline. Total bond funds, which hold a variety of bonds with different maturities and interest rates, are exposed to interest rate risk. Investors should be aware of this risk when investing in total bond funds and consider their investment time horizon and risk tolerance. Credit risk is the possibility that a bond issuer may default on its interest or principal payments, leading to a loss for the bondholder. Total bond funds, which invest in various types of bonds with different credit ratings, are exposed to credit risk. While diversification can help reduce the impact of credit risk on a total bond fund's performance, it's essential for investors to be aware of this risk and consider the fund's overall credit quality. Inflation risk is the potential for rising inflation to erode the purchasing power of an investor's fixed-income investments. Since bonds typically pay a fixed interest rate, their real value can decrease in an environment with high inflation. Total bond funds, as they invest in fixed-income securities, are also subject to inflation risk. Investors should be mindful of this risk and consider incorporating inflation-protected securities or other assets in their portfolios to help mitigate the effects of inflation. When choosing a total bond fund, it's crucial to consider the expertise and experience of the fund manager. A skilled fund manager can navigate market fluctuations, manage risks, and generate returns that outperform the benchmark. Investors should research the fund manager's track record and investment approach to ensure they align with their own investment objectives and risk tolerance. Each total bond fund has its investment objective, which outlines the fund's goals and strategies. Investors should carefully review the fund's investment objective to ensure it aligns with their own financial goals and risk tolerance. For example, some funds may prioritize capital preservation, while others may focus on generating higher yields at the cost of increased risk. The expense ratio is the annual fee charged by a fund to cover its operating expenses, expressed as a percentage of the fund's net assets. A lower expense ratio can have a significant impact on an investor's returns over the long term. When choosing a total bond fund, investors should compare the expense ratios of similar funds and consider the potential impact on their investment returns. The credit rating of the bonds held within a total bond fund can provide insight into the overall credit quality and risk profile of the fund. Investors should consider the fund's average credit rating and the proportion of high-quality bonds in the portfolio to ensure the fund aligns with their risk tolerance and investment objectives. Reviewing a total bond fund's historical performance can provide valuable insight into how the fund has performed over various market conditions and interest rate environments. While past performance is not a guarantee of future results, understanding the fund's historical performance can help investors assess the fund's potential for future success. Comparing a total bond fund's performance to a relevant benchmark, such as a bond index, can provide insight into how the fund has performed relative to the overall bond market. This comparison can help investors evaluate the fund's ability to generate returns that outperform the market and assess the fund manager's skill in managing the portfolio. Analyzing a total bond fund's returns can help investors understand the sources of the fund's performance and the risks associated with its investments. Factors such as interest rate changes, credit quality, and portfolio duration can impact a fund's returns. By assessing these factors, investors can make more informed decisions about the suitability of a total bond fund for their investment goals and risk tolerance. A total bond fund is a type of investment fund that provides exposure to a diverse range of fixed-income securities, offering diversification, stability, and regular income to investors. There are various types of total bond funds, including government, corporate, municipal, and high-yield bond funds, each with their unique characteristics and risk profiles. Investing in total bond funds has its advantages, such as diversification, stability, and regular income generation. However, there are risks associated with investing in these funds, including interest rate risk, credit risk, and inflation risk. When choosing a total bond fund, investors should consider factors such as the fund manager's expertise, the fund's investment objective, expense ratio, and credit rating. Evaluating a total bond fund's performance involves reviewing its historical performance, comparing it with a relevant benchmark, and analyzing the sources of its returns. By carefully considering these factors, investors can make informed decisions about whether a total bond fund is a suitable addition to their investment portfolio, taking into account their investment objectives and risk tolerance.What Is a Total Bond Fund?

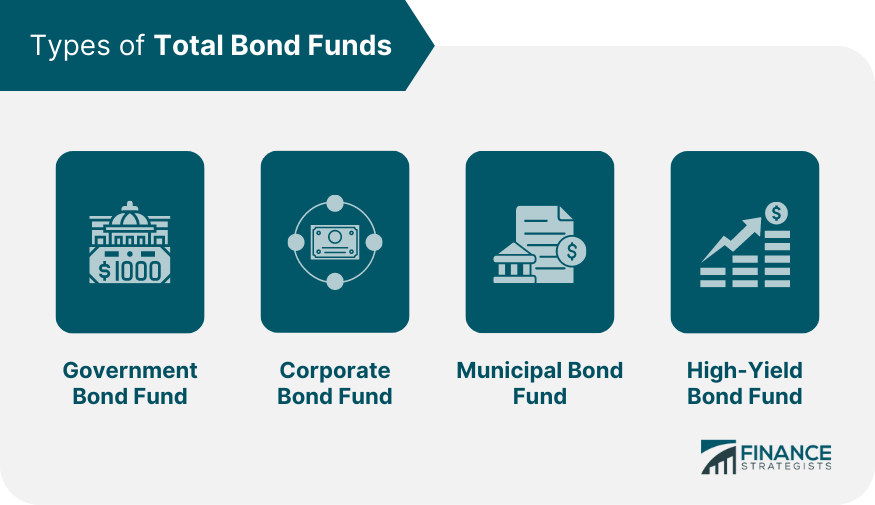

Types of Total Bond Funds

Government Bond Fund

Corporate Bond Fund

Municipal Bond Fund

High-Yield Bond Fund

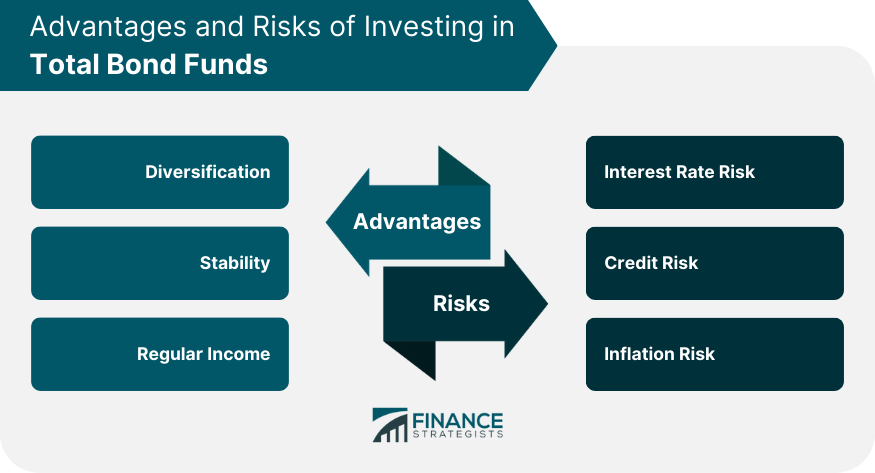

Advantages of Investing in Total Bond Funds

Diversification

Stability

Regular Income

Risks Associated With Investing in Total Bond Funds

Interest Rate Risk

Credit Risk

Inflation Risk

Factors to Consider When Choosing Total Bond Funds

Fund Manager

Investment Objective

Expense Ratio

Credit Rating

Performance of Total Bond Funds

Historical Performance

Comparison With Benchmarks

Analysis of Returns

Conclusion

Total Bond Fund FAQs

Total Bond Fund is a type of mutual fund that invests in a diversified portfolio of bonds, including government, corporate, and municipal bonds.

Investing in Total Bond Fund provides diversification, stability, and regular income.

The risks associated with investing in Total Bond Fund include interest rate risk, credit risk, and inflation risk.

When choosing Total Bond Fund, consider the fund manager, investment objective, expense ratio, and credit rating.

The performance of Total Bond Fund is compared to its benchmark, such as the Barclays U.S. Aggregate Bond Index, to analyze its returns and evaluate its performance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.