Series I savings bonds are a low-risk investment tool offered by the U.S. Department of the Treasury. These bonds generate income through a unique combination of a fixed interest rate, which remains the same for the life of the bond, and an inflation rate, adjusted semi-annually based on changes in the Consumer Price Index for Urban Consumers (CPI-U). Understanding how I Bonds make money is crucial for investors, as it allows them to gauge the potential return and risk involved, in addition to providing inflation protection. This knowledge assists in making informed decisions when diversifying their investment portfolio, offering a secure investment choice in the context of a balanced investment strategy. I Bonds earn money through a combination of fixed and inflation-adjusted interest rates. The fixed rate remains the same for the life of the bond, while the inflation rate adjusts semiannually based on changes in the Consumer Price Index for Urban Consumers (CPI-U). This ensures that the bond's value increases over time, regardless of inflation fluctuations. Additionally, because the interest on I Bonds is compounded semiannually, the bonds continue to earn interest on the previously accrued interest, further enhancing the earning potential. It's important to note, however, that interest is added to the bond monthly and paid when you cash the bond. I Bonds can be purchased directly from the Treasury via TreasuryDirect, a secure government website. They are available in electronic form and can be purchased in any amount from $25 to $10,000. The minimum purchase amount for an I Bond is $25, while the maximum is $10,000 per person per calendar year. It is important to note that these limits apply to the total purchases of electronic I Bonds in a year and do not include any paper I Bonds that you may own. I Bonds cannot be redeemed for the first year after purchase, and if you redeem them within the first five years, you lose the last three months' worth of interest. After five years, you can redeem your I Bonds without any penalty. EE Bonds, another type of savings bond offered by the Treasury, have a fixed interest rate for the life of the bond, unlike I Bonds. While both types are safe investments, I Bonds offer inflation protection that EE Bonds do not. However, EE Bonds are guaranteed to double in value if held for 20 years, which I Bonds do not promise. Treasury Inflation-Protected Securities (TIPS) are another form of Treasury security that provides protection against inflation. Like I Bonds, TIPS adjust with inflation. However, with TIPS, the principal amount adjusts with inflation, while with I Bonds, it's the interest rate that adjusts. Both have their advantages and are considered low-risk investments. Unlike government-issued I Bonds, corporate bonds are issued by companies. While they often offer higher returns, they also carry a higher level of risk. If a company goes bankrupt, it may not repay its bonds, leading to potential loss for investors. On the other hand, I Bonds, being backed by the U.S. government, offer a safer but usually lower-yielding alternative. I Bonds are backed by the full faith and credit of the U.S. government, making them one of the safest investments available. The government guarantees both the principal investment and the interest earned, providing a secure, low-risk investment choice. The unique structure of I Bonds provides protection against inflation. With the semi-annual adjustment of the inflation rate, I Bonds ensure that your investment keeps pace with changes in the cost of living. The interest earned from I Bonds is exempt from state and local taxes, and federal taxes can be deferred until the bond is redeemed or stops earning interest after 30 years. Additionally, if used for educational expenses, the interest may be entirely tax-free, subject to certain conditions.. If you need to cash your I Bond within the first five years, you'll forfeit the last three months' worth of interest. This can eat into your returns if you need to access the funds on short notice. Though rare, during periods of deflation, the inflation component of the I Bond can become negative. However, the composite earnings rate for I Bonds will never go below zero. The fixed rate will prevent your investment from losing value. You can only purchase a maximum of $10,000 per year in I Bonds. For those wishing to invest larger sums, this can limit the role of I Bonds in their overall portfolio. Because the inflation rate changes every six months, the timing of your purchase can affect your return. Buying just before the rate change can allow you to take advantage of a potential rise in rates. Diversifying your bond portfolio can help maximize profits and minimize risk. This means investing in different types of bonds, like I Bonds, corporate bonds, and other treasury securities, to balance potential returns and risks. I Bonds are best suited for long-term investment. The longer you hold an I Bond, the more you can potentially earn, especially considering that there's no penalty after five years. I Bonds, offered by the U.S. Department of the Treasury, provide a secure investment option with unique benefits. The combination of a fixed and inflation-adjusted interest rate makes I Bonds a viable tool for protecting your money's purchasing power. Although limitations exist, such as penalties for early redemption and purchase amount caps, the safety of the principal investment and tax advantages present appealing incentives. Diversifying your portfolio with I Bonds can balance risk and potential returns. Comparing them with other bonds, like EE Bonds and TIPS, underlines their worth in long-term investment strategies. To optimize profits, consider the timing of purchases and the role of diversification. By understanding these aspects, investors can make informed decisions to enhance their financial growth.Overview of I Bonds

How Do I Bonds Make Money?

Purchasing and Redeeming I Bonds

How to Purchase I Bonds

Minimum and Maximum Purchase Limits

Process of Redeeming I Bonds

Comparing I Bonds to Other Types of Bonds

I Bonds vs EE Bonds

I Bonds vs TIPS

I Bonds vs Corporate Bonds

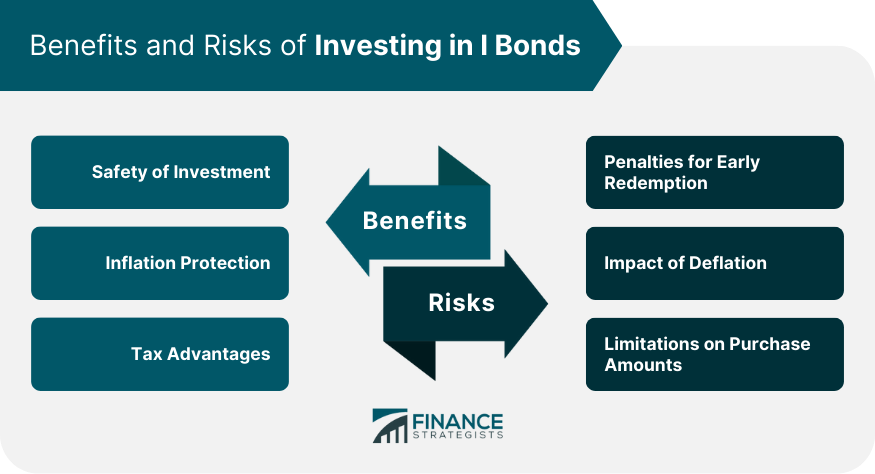

Benefits of Investing in I Bonds

Safety of Investment

Inflation Protection

Tax Advantages

Risks of I Bonds

Penalties for Early Redemption

Impact of Deflation

Limitations on Purchase Amounts

Strategies for Maximizing Profits From I Bonds

Understanding the Timing of Purchases

Role of Diversification in a Bond Portfolio

Long-Term Investing With I Bonds

Conclusion

How Do I Bonds Make Money? FAQs

I Bonds are U.S. government-issued savings bonds that earn money through a combination of a fixed interest rate, set at the time of purchase and remaining the same for the life of the bond, and an inflation rate, which is adjusted semi-annually based on changes in the Consumer Price Index for Urban Consumers (CPI-U).

The interest earned from I Bonds is exempt from state and local taxes, and federal taxes can be deferred until the bond is redeemed or stops earning interest after 30 years. Also, if used for educational expenses, the interest may be entirely tax-free, subject to certain conditions.

There are penalties for early redemption of I Bonds within the first five years, and during periods of deflation, the inflation component of the I Bond can become negative. Also, you can only purchase a maximum of $10,000 per year in I Bonds.

I Bonds offer inflation protection that EE Bonds do not, while both are considered safe investments. I Bonds adjust the interest rate with inflation, while Treasury Inflation-Protected Securities (TIPS) adjust the principal amount. Corporate bonds, on the other hand, offer higher returns but carry a higher level of risk compared to government-issued I Bonds.

Understanding the timing of purchases, diversifying your bond portfolio, and long-term investing can help maximize profits from I Bonds. The inflation rate changes every six months, so buying just before the rate change can boost your returns. Also, diversification can help balance potential returns and risks, and I Bonds are best suited for long-term investment.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.