Asset-Liability Management (ALM) is a critical practice in finance that focuses on managing the risks that arise due to mismatches between the assets and liabilities (debts and obligations) of a financial institution. It involves the careful organization of assets and liabilities to minimize risk and maximize profits. The importance of ALM in wealth management cannot be overstated. Its purpose is to ensure a sound financial standing by addressing liquidity risk, interest rate risk, credit risk, and operational risk. The principles of ALM serve as the foundation for an institution's strategic balance sheet management, focusing on optimizing returns for a given risk level. ALM is not a one-size-fits-all process. Its application can vary significantly depending on the unique characteristics of the institution implementing it. The following are some primary ways that ALM works. The Gap Analysis Method is a fundamental part of Asset Liability Management (ALM), used to measure an institution's exposure to interest rate risk. By assessing the difference between rate-sensitive assets and liabilities over a specific period, institutions can identify any mismatches and quantify their vulnerability to changes in interest rates. This helps in making informed decisions to manage interest rate risk and optimize the institution's financial position. The Duration Analysis Method is an advanced technique used in Asset Liability Management (ALM) to assess an institution's interest rate risk. It goes beyond gap analysis by incorporating the present value of cash flows and the timing of those cash flows. By calculating the weighted average timing of cash flows, duration analysis provides a more comprehensive measure of an institution's sensitivity to interest rate changes. This enables institutions to make more precise adjustments to their portfolio and risk management strategies based on the projected impact of interest rate fluctuations. Simulation models are advanced tools used in Asset Liability Management (ALM) to assess an institution's risk profile. These models go beyond simple analysis and consider a wide range of variables and scenarios. By simulating complex market conditions, they provide a comprehensive view of how an institution's balance sheet would respond under different circumstances. This allows financial institutions to better understand and manage their exposure to various risks, such as interest rate fluctuations and market volatility, and make more informed decisions to enhance their overall financial stability. Optimization models in Asset Liability Management (ALM) use sophisticated mathematical techniques to find the best allocation of assets and liabilities. By considering various constraints, such as regulatory guidelines and capital availability, these models aim to minimize risk while maximizing returns. They provide valuable insights to financial institutions, helping them make informed decisions on how to optimize their portfolios to achieve their financial objectives while staying within regulatory boundaries. ALM offers several benefits to financial institutions. Understanding these advantages can provide valuable insight into the utility and effectiveness of ALM practices. Asset Liability Management (ALM) significantly enhances risk management for financial institutions. By carefully identifying, quantifying, and managing various risks, such as interest rate risk, liquidity risk, and credit risk, ALM ensures the institution's financial stability. This comprehensive approach enables institutions to make well-informed decisions, optimize their balance sheet, and meet their obligations to stakeholders effectively. Asset Liability Management enhances cash flow management by strategically aligning assets and liabilities. By matching the maturity and cash flow characteristics of assets and liabilities, institutions can ensure that they have sufficient funds available at the right times to meet their financial obligations. This efficient cash flow management minimizes the risk of liquidity shortages and ensures smooth operations, allowing institutions to navigate through various economic conditions with confidence and stability. Asset Liability Management (ALM) optimizes investment strategies by considering institutions' liabilities alongside their investments. This approach ensures that investment decisions align with long-term obligations, allowing institutions to strike a balance between generating sufficient returns and meeting future financial commitments. ALM plays a vital role in facilitating regulatory compliance for financial institutions. Regulators often require institutions to demonstrate robust ALM practices to ensure financial stability and protect customers' interests. By implementing effective ALM strategies, institutions can meet regulatory requirements, demonstrate prudent risk management, and maintain a sound financial position, which fosters trust and confidence among stakeholders and regulatory authorities. Despite its numerous benefits, ALM is not without challenges. It's essential to understand these challenges to implement ALM effectively. ALM is a complex process that demands specialized knowledge and skills. It can pose challenges for smaller institutions with limited resources to ensure they have the necessary expertise. Seeking assistance from experienced professionals or employing technology solutions can help navigate the intricacies of ALM and enable institutions to effectively manage interest rate risk, liquidity, and other key financial factors. Traditional ALM models, like gap analysis and duration analysis, may fall short in capturing the intricacies of dynamic market conditions and accurately representing an institution's specific risk profile. These models often rely on historical data, making them less adaptable to sudden changes or unforeseen events. To address these limitations, financial institutions may need to explore more sophisticated ALM approaches, such as simulation models or optimization models. Anticipating market behaviors poses a major challenge for ALM due to the inherent difficulty in predicting market movements. Financial institutions must rely on assumptions about future interest rates, economic conditions, and customer behaviors, all of which are subject to high levels of uncertainty. The accuracy of these assumptions greatly impacts the effectiveness of ALM strategies, making it essential for institutions to continuously monitor and update their models to adapt to changing market conditions and mitigate potential risks. ALM implementation introduces operational risks, such as data integrity issues, model implementation challenges, and potential errors in executing strategic decisions. Data inaccuracies or errors in the ALM model can lead to flawed risk assessments and decision-making. Additionally, the effective execution of ALM strategies requires coordination and precise implementation, making operational risk management crucial for successful risk mitigation and overall financial stability of the institution. To overcome the challenges associated with ALM, institutions can employ various tools and techniques. Financial derivatives are valuable tools for managing interest rate risk in ALM. Institutions can utilize swaps, futures, and options to enter into contracts that hedge against unfavorable interest rate fluctuations. These derivatives provide a means to protect the institution's financial positions and optimize its risk exposure. However, their successful application requires a thorough understanding of market dynamics and expertise in utilizing these complex financial instruments effectively. When used judiciously, financial derivatives can enhance risk management practices and contribute to the overall stability and resilience of financial institutions. Stress testing plays a crucial role in ALM by offering a robust tool for assessing an institution's risk profile. Through the simulation of extreme yet plausible scenarios, financial institutions can gain insights into their vulnerability to severe market disruptions. Stress testing enables them to identify potential weaknesses, evaluate their resilience, and develop contingency plans to mitigate adverse impacts. By subjecting their balance sheets to rigorous stress tests, institutions can make informed decisions, enhance risk management practices, and ensure their preparedness to withstand adverse economic conditions and market shocks. Value-at-Risk (VaR) models play a crucial role in ALM by providing a statistical measure of potential losses an institution may encounter over a specific time period with a given level of confidence. These models offer a valuable benchmark for evaluating risk exposure and establishing risk limits. By quantifying the potential downside in various market scenarios, VaR models help institutions understand and manage their risk appetite. This enables them to make informed decisions about their investment and hedging strategies, ensuring they are better prepared to navigate adverse market conditions and safeguard their financial stability. Cash flow matching and immunization strategies are essential techniques in ALM that involve aligning an institution's assets and liabilities to mitigate the impact of interest rate changes. Cash flow matching ensures that cash inflows from assets match the cash outflows from liabilities, ensuring sufficient funds to meet obligations. On the other hand, immunization strategies aim to create an asset portfolio with a duration that matches the duration of liabilities, resulting in stable portfolio value despite interest rate fluctuations. By employing these strategies, institutions can enhance their ability to meet financial obligations, reduce interest rate risk, and maintain stability in their financial positions. Building an Asset-Liability Management (ALM) team is crucial for effective implementation. The team should comprise experts in finance, risk management, data analysis, and other relevant areas. They collaborate to assess the institution's risk profile, identify potential exposures, and develop appropriate strategies to manage risk. The ALM team plays a vital role in analyzing complex market dynamics, making informed decisions, and ensuring financial stability. Their expertise and collaborative efforts are essential in successfully executing ALM practices and optimizing the institution's asset and liability management to meet long-term objectives. Formulating comprehensive Asset-Liability Management (ALM) policies is essential for effective risk management. The ALM team should develop policies that cover critical aspects such as risk identification, measurement, monitoring, and mitigation strategies. These policies provide a framework for aligning assets and liabilities, managing interest rate risk, and ensuring financial stability. By establishing clear guidelines and protocols, the institution can navigate changing market conditions with confidence and make informed decisions to optimize its asset and liability management practices. These policies serve as a foundation for strategic decision-making and risk control, contributing to the institution's long-term financial success. In the implementation of Asset-Liability Management (ALM), technology plays a pivotal role. Advanced software tools enable the efficient processing of complex calculations, automate various ALM processes, and offer valuable data analysis insights. These technological solutions enhance risk management capabilities, facilitate accurate modeling of interest rate scenarios, and enable institutions to make data-driven decisions. By harnessing the power of technology, financial institutions can streamline ALM practices, improve operational efficiency, and effectively respond to changing market dynamics, ultimately ensuring greater financial stability and optimized performance. Institutions must establish robust processes to regularly assess the performance of their ALM strategies, measure the effectiveness of risk management practices, and analyze the impact of interest rate fluctuations on their financial position. These ongoing evaluations provide valuable insights for making informed decisions and allow institutions to promptly respond to changing market conditions. Effective reporting of ALM activities to key stakeholders, such as management, regulators, and shareholders, enhances transparency and accountability, ensuring that the institution's risk exposure and financial stability are well-understood and appropriately managed. Asset-Liability Management (ALM) is a critical practice in finance that involves managing the risks arising from the mismatch between a financial institution's assets and liabilities. The Mechanics of ALM can be implemented through various methods, such as Gap Analysis, Duration Analysis, Simulation Models, and Optimization Models. ALM offers several advantages, including enhanced risk management, efficient cash flow management, optimized investment strategies, and regulatory compliance facilitation. However, ALM also presents challenges, such as complexity and the need for specialized expertise, limitations of traditional models, difficulties in anticipating market behaviors, and management of operational risks. To overcome these challenges, institutions can utilize tools and techniques like financial derivatives, stress testing, Value-at-Risk models, and cash flow matching and immunization strategies. Implementing ALM requires a dedicated team with expertise in various areas, formulation of ALM policies, leveraging technology for efficient processing, ongoing monitoring, and comprehensive reporting. By following a robust ALM framework, institutions can effectively manage risks, optimize their financial positions, and ensure long-term stability and success.What Is Asset-Liability Management?

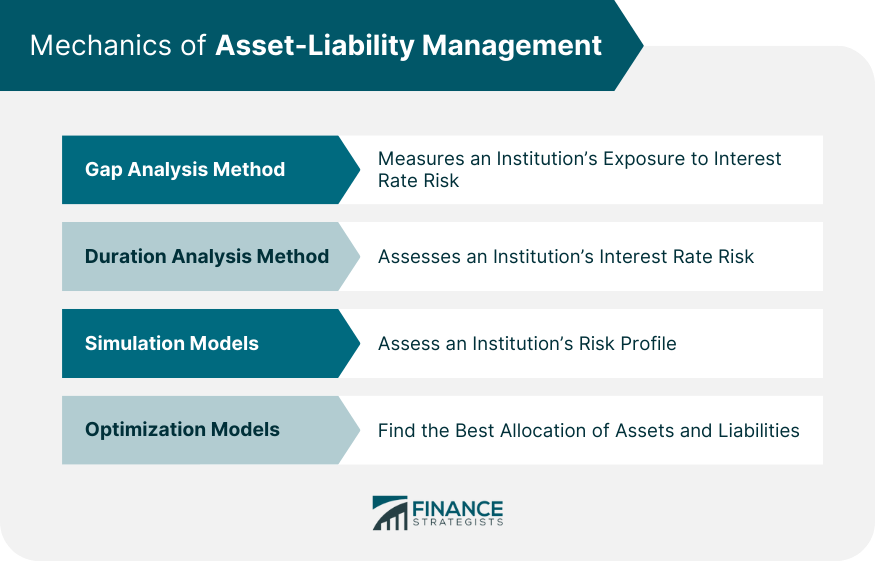

Mechanics of Asset-Liability Management

Gap Analysis Method

Duration Analysis Method

Simulation Models

Optimization Models

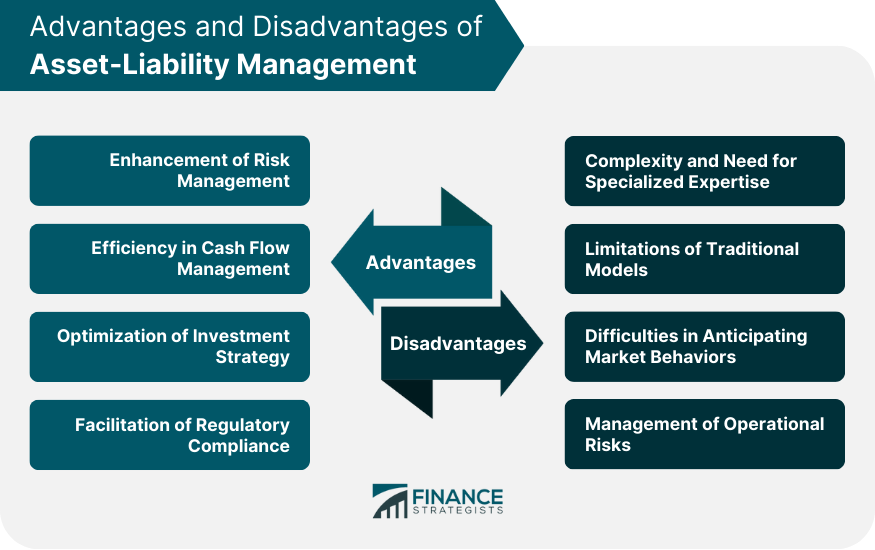

Advantages of Asset-Liability Management

Enhancement of Risk Management

Efficiency in Cash Flow Management

Optimization of Investment Strategy

Facilitation of Regulatory Compliance

Disadvantages of Asset-Liability Management

Complexity and Need for Specialized Expertise

Limitations of Traditional Models

Difficulties in Anticipating Market Behaviors

Management of Operational Risks

Tools and Techniques in Asset-Liability Management

Use of Financial Derivatives

Role of Stress Testing

Value-At-Risk Models

Cash Flow Matching and Immunization Strategies

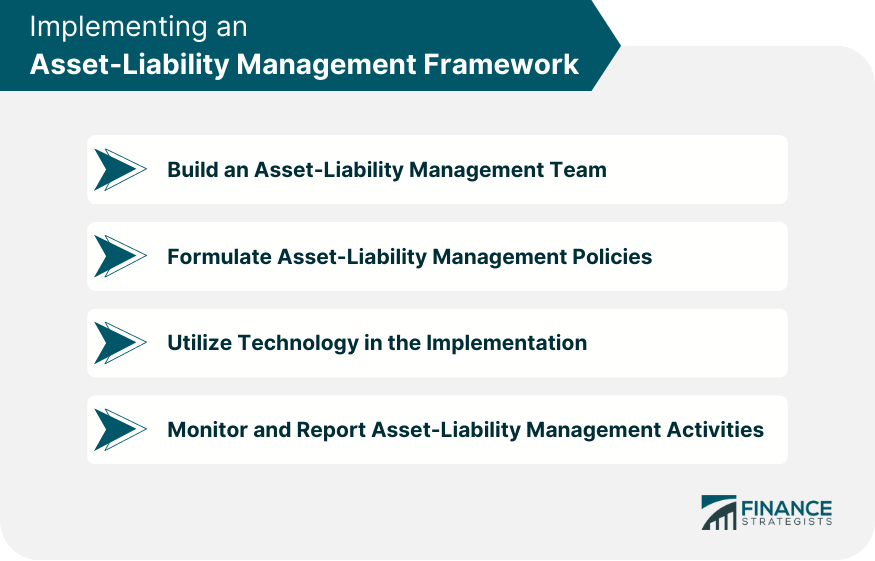

Implementing an Asset-Liability Management Framework

Building an Asset-Liability Management Team

Formulating Asset-Liability Management Policies

Utilizing Technology in the Implementation

Monitoring and Reporting of Asset-Liability Management Activities

Conclusion

Asset-Liability Management FAQs

Asset-Liability Management (ALM) is a financial practice that focuses on managing risks arising from mismatches between a financial institution's assets and liabilities.

ALM is crucial for financial institutions as it helps them address liquidity risk, interest rate risk, credit risk, and operational risk, ensuring financial stability and meeting obligations.

ALM enhances risk management, improves cash flow management, optimizes investment strategies, and facilitates regulatory compliance for financial institutions.

ALM employs methods like Gap Analysis and Duration Analysis to measure and manage exposure to interest rate fluctuations, allowing institutions to make informed decisions.

Financial derivatives, stress testing, Value-at-Risk models, and cash flow matching strategies are some of the tools utilized in Asset-Liability Management to manage risks effectively.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.