Immunization in wealth management refers to a strategy aimed at minimizing the impact of interest rate fluctuations on the value of a bond portfolio. This is accomplished by structuring the portfolio in such a way that its duration equals the investment horizon, ensuring that any changes in interest rates have a minimal effect on the overall value of the investment. In the context of wealth management, immunization is not related to medical vaccines, but instead is a method of protecting a bond portfolio against the adverse effects of interest rate changes. By carefully selecting and managing investments, investors can achieve a greater degree of stability and predictability in their portfolios. The primary purpose of immunization is to protect investors from interest rate risk, which can cause significant fluctuations in the value of their bond portfolios. This is particularly important for investors who have specific financial goals or liabilities that must be met at a certain point in time. By immunizing their portfolio, these investors can ensure that they will have the necessary funds to meet their obligations, regardless of changes in interest rates. Additionally, immunization helps investors minimize reinvestment risk – the risk that arises when an investor is forced to reinvest interest payments or principal repayments at lower interest rates. Through immunization, investors can maintain a stable and predictable income stream, making it easier to plan for future financial needs. The key objectives of immunization are twofold: protecting against interest rate risk and minimizing reinvestment risk. In order to achieve these objectives, investors must carefully select and manage their bond investments, taking into consideration the duration, cash flows, and other characteristics of their portfolio. One of the primary tools used in immunization is duration matching, which involves adjusting the duration of the bond portfolio to equal the investment horizon. By doing this, investors can ensure that changes in interest rates will have a minimal effect on the overall value of their portfolio, thereby reducing interest rate risk. Another important aspect of immunization is cash flow matching, which involves selecting bonds with cash flows that match the investor's future liabilities. This can help minimize reinvestment risk by ensuring that funds are available when needed, regardless of changes in interest rates. Asset-liability matching is a fundamental component of immunization that involves aligning the cash flows of a bond portfolio with the investor's future liabilities. This is essential for ensuring that investors have the necessary funds to meet their financial obligations, regardless of changes in interest rates. In practice, asset-liability matching involves selecting bonds with maturities that coincide with the investor's anticipated future liabilities. This can be achieved through a combination of duration matching and cash flow matching, as well as ongoing monitoring and rebalancing of the portfolio. Duration matching is another key component of immunization, which involves adjusting the duration of a bond portfolio to equal the investment horizon. By doing this, investors can minimize the impact of interest rate fluctuations on their investments, reducing overall portfolio risk. In practice, duration matching can be achieved by selecting bonds with varying maturities and coupon rates, as well as by using financial derivatives such as interest rate swaps. By carefully managing the duration of their bond portfolio, investors can effectively immunize their investments against interest rate risk. Cash flow matching is a critical component of immunization that involves selecting bonds with cash flows that match the investor's future liabilities. This can help minimize reinvestment risk by ensuring that funds are available when needed, regardless of changes in interest rates. In practice, cash flow matching involves selecting bonds with maturities and coupon rates that align with the investor's anticipated future cash flow needs. This can be achieved through careful analysis of the investor's financial goals and liabilities, as well as ongoing monitoring and rebalancing of the portfolio. The first step in implementing an immunization strategy is to identify the investor's investment objectives, including their financial goals and time horizon. This involves determining the investor's future liabilities, such as college tuition, retirement, or other financial obligations. By clearly defining their investment objectives, investors can select the most appropriate bond investments to achieve their goals while minimizing risk. In addition, investors must also consider their risk tolerance, as this will influence the types of bonds and investment strategies they choose to implement. A more risk-averse investor may opt for a more conservative immunization strategy, while a risk-seeking investor may be willing to take on greater interest rate risk in pursuit of higher returns. Once the investment objectives have been identified, the next step is to assess the investor's liabilities and cash flow needs. This involves analyzing the investor's future financial obligations and determining the timing and magnitude of these liabilities. This information is crucial for selecting bonds with cash flows that match the investor's future needs, thereby minimizing reinvestment risk. Additionally, investors should consider their current and projected cash flow needs, as well as any potential changes in their financial situation. This can help ensure that the immunization strategy remains effective and adaptable to changing circumstances. With a clear understanding of their investment objectives, liabilities, and cash flow needs, investors can now select the most appropriate bond investments to implement their immunization strategy. This involves choosing bonds with maturities, coupon rates, and credit quality that align with the investor's financial goals and risk tolerance. In practice, this may involve diversifying the bond portfolio across various issuers, sectors, and credit ratings to achieve the desired level of risk and return. Additionally, investors may consider using financial derivatives, such as interest rate swaps or options, to further manage interest rate risk. Once the bond portfolio has been constructed, it is essential to regularly monitor and rebalance the portfolio to ensure that the immunization strategy remains effective. This involves tracking changes in interest rates, credit ratings, and other factors that may impact the performance of the bond investments. Rebalancing may be necessary if the duration or cash flow characteristics of the portfolio change due to market fluctuations or changes in the investor's financial situation. By actively managing their bond portfolio, investors can maintain the desired level of immunization and ensure that their financial goals are met. One of the primary benefits of immunization is its ability to protect against interest rate risk. By matching the duration of the bond portfolio to the investment horizon, investors can minimize the impact of interest rate fluctuations on their investments, providing greater stability and predictability in their portfolio's performance. Immunization also helps investors minimize reinvestment risk – the risk that arises when an investor is forced to reinvest interest payments or principal repayments at lower interest rates. By selecting bonds with cash flows that match their future liabilities, investors can maintain a stable and predictable income stream, making it easier to plan for future financial needs. By effectively managing interest rate risk and reinvestment risk, immunization can enhance the overall stability of a bond portfolio. This can provide investors with greater confidence in their ability to meet their financial goals and obligations, regardless of changes in market conditions or interest rates. Immunization relies on certain assumptions, such as parallel shifts in the yield curve and the stability of interest rates over time. However, these assumptions do not always hold true in practice, and deviations from these assumptions can reduce the effectiveness of the immunization strategy. Additionally, immunization does not protect against other risks, such as credit risk or inflation risk, which can also impact the performance of a bond portfolio. Implementing an immunization strategy may require investing in bonds with specific maturities and cash flow characteristics, which can limit the liquidity of the portfolio. This may make it more difficult for investors to sell their bond investments if they need to raise cash or adjust their portfolio. In some cases, this lack of liquidity can also lead to higher transaction costs and potentially impact the overall performance of the portfolio. Immunization does not protect investors against credit risk – the risk that a bond issuer will default on its interest or principal payments. While investors can diversify their bond portfolios across various issuers and credit ratings to mitigate credit risk, it is still an important factor to consider when implementing an immunization strategy. While both immunization and duration matching involve adjusting the duration of a bond portfolio to equal the investment horizon, duration matching does not consider the cash flow characteristics of the portfolio. This means that duration matching may not provide the same level of protection against reinvestment risk as immunization. However, duration matching can still be an effective strategy for managing interest rate risk, particularly for investors who do not have specific future liabilities to consider. Cash flow matching is another alternative strategy that involves selecting bonds with cash flows that match the investor's future liabilities. While this strategy can be effective in minimizing reinvestment risk, it does not offer the same protection against interest rate risk as immunization. In practice, immunization combines elements of both cash flow matching and duration matching to provide a more comprehensive approach to managing bond portfolio risk. Convexity matching is an advanced strategy that involves matching both the duration and convexity of a bond portfolio to the investment horizon. Convexity is a measure of a bond's sensitivity to changes in interest rates beyond duration and can provide additional protection against interest rate risk. While convexity matching can offer greater risk management potential than immunization, it is more complex and may require the use of financial derivatives, making it less accessible for some investors. Immunization refers to a strategy aimed at protecting investment portfolios from interest rate risks while ensuring cash flow stability. It involves matching the duration of assets with liabilities and cash flows. By implementing immunization, investors can minimize the impact of changing interest rates on their portfolio's value and income. . Immunization is a valuable investment strategy that can help investors protect their bond portfolios against interest rate risk and minimize reinvestment risk. By carefully selecting and managing bond investments, investors can achieve greater stability and predictability in their portfolios, making it easier to meet their financial goals and obligations. However, immunization is not without its limitations, and investors must consider the inherent assumptions, liquidity risk, and credit risk associated with the strategy. By comparing immunization with alternative investment strategies, such as duration matching, cash flow matching, and convexity matching, investors can make informed decisions about the most appropriate approach for managing their bond portfolios.What Is Immunization?

Purpose of Immunization

Key Objectives of Immunization

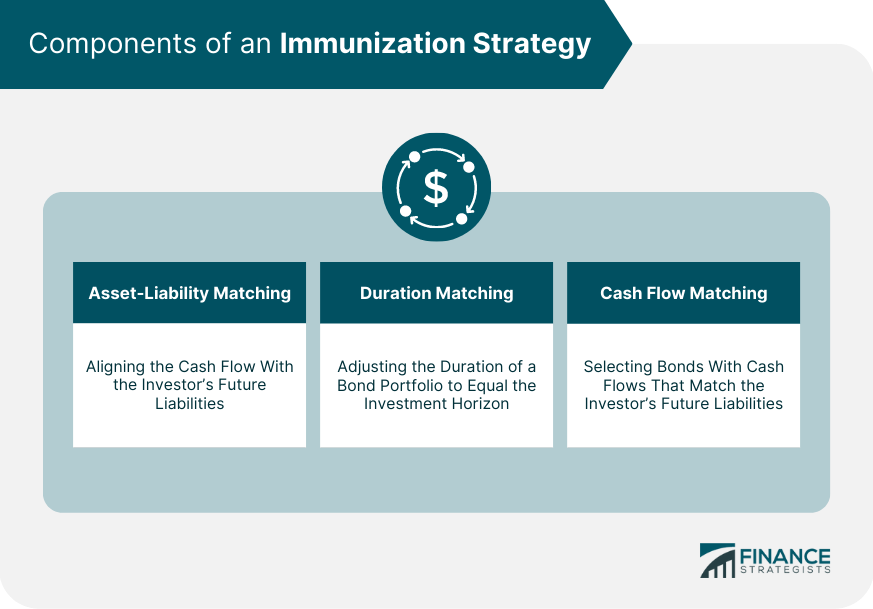

Components of an Immunization Strategy

Asset-Liability Matching

Duration Matching

Cash Flow Matching

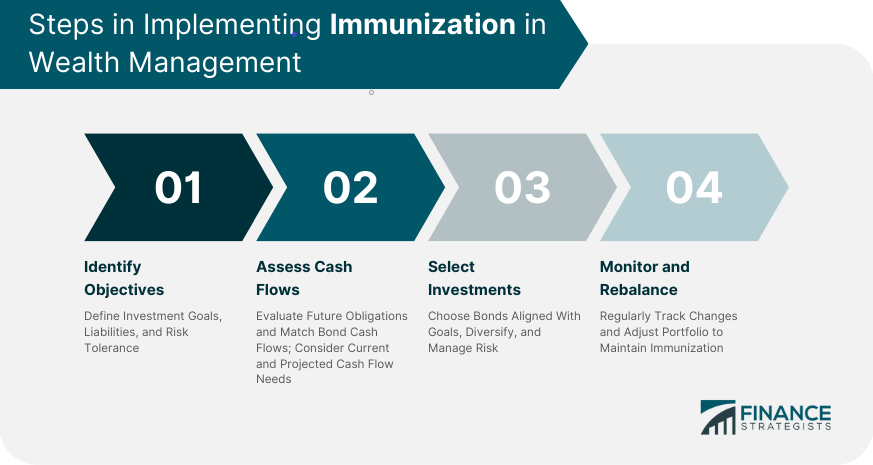

Steps in Implementing Immunization

Identifying Investment Objectives

Assessing Liabilities and Cash Flows

Selecting Appropriate Investments

Monitoring and Rebalancing the Portfolio

Advantages of Immunization

Protection Against Interest Rate Risk

Minimization of Reinvestment Risk

Enhanced Portfolio Stability

Limitations of Immunization

Inherent Assumptions and Limitations

Liquidity Risk

Credit Risk

Comparison With Other Investment Strategies

Immunization vs Duration Matching

Immunization vs Cash Flow Matching

Immunization vs Convexity Matching

Bottom Line

Immunization FAQs

Immunization in wealth management is a strategy designed to minimize the impact of interest rate fluctuations on the value of a bond portfolio by matching its duration to the investment horizon and selecting bonds with cash flows that align with the investor's future liabilities.

The key objectives of immunization are to protect against interest rate risk and minimize reinvestment risk by carefully selecting and managing bond investments based on their duration, cash flows, and other characteristics.

The main components of an immunization strategy include asset-liability matching, duration matching, and cash flow matching. These components collectively help protect investors from the risks associated with interest rate fluctuations.

The advantages of immunization include protection against interest rate risk, minimization of reinvestment risk, and enhanced portfolio stability. By effectively managing these risks, immunization can help investors achieve their financial goals and meet their future obligations.

Some limitations of immunization include inherent assumptions and limitations, liquidity risk, and credit risk. These factors can reduce the effectiveness of the immunization strategy and should be considered when implementing an immunization plan.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.