A non-security refers to any type of investment or financial instrument that does not fall under the security category. Securities are typically tradable financial assets, such as stocks, bonds, or derivatives, representing ownership or a debt obligation. Non-securities encompass a wide range of investments, including tangible assets like real estate, commodities, and collectibles, as well as non-traditional financial instruments like cryptocurrencies or peer-to-peer lending agreements. Non-securities may have different characteristics, risks, and regulations than securities, and investors should carefully consider their unique features before engaging in such investments. Residential properties are homes and other dwellings intended for private use. They include single-family houses, duplexes, and multi-family units such as apartments and condominiums. Investing in residential properties can provide rental income and potential appreciation over time. Commercial properties are buildings and land used for business purposes. This category includes office buildings, retail spaces, warehouses, and industrial properties. Commercial real estate investments can generate income through rent, lease agreements, or capital appreciation. REITs are companies that own and manage income-producing real estate properties. They are traded on stock exchanges, providing investors with a way to access real estate investments without directly owning property. REITs offer the potential for income through dividends and capital appreciation. Investing in art and antiques involve the acquisition and sale of valuable objects such as paintings, sculptures, and historical artifacts. These investments can appreciate over time due to their rarity and cultural significance, but they also carry risks associated with market trends and changing tastes. Collectible coins and stamps can serve as alternative investments for those interested in numismatics or philately. These assets can appreciate in value due to their rarity, historical significance, or condition. However, the market for collectible coins and stamps can be volatile and influenced by factors such as economic conditions and collector demand. Investing in wine and classic cars involve the purchase and sale of rare or vintage items that can appreciate in value over time. These investments are often driven by the passion and knowledge of collectors, but they also carry risks related to market trends, storage conditions, and maintenance costs. Investing in precious metals such as gold and silver can offer a hedge against inflation and currency fluctuations. These assets have intrinsic value and are often seen as a safe haven during times of economic uncertainty. Investors can invest in precious metals through physical ownership or financial instruments such as ETFs and futures contracts. Investing in energy commodities such as oil and gas can provide exposure to the global energy market and its fluctuations. These investments can be made through futures contracts, options, or shares in energy-related companies. Energy investments are sensitive to geopolitical events, environmental regulations, and technological advancements. Agricultural products include crops such as corn, wheat, and soybeans, as well as livestock like cattle and hogs. Investors can gain exposure to these markets through futures contracts, options, or investments in agribusiness companies. Agricultural investments can be affected by factors such as weather conditions, global demand, and government policies. Investors can directly own non-security assets, such as purchasing real estate or collectibles. This approach allows for greater control over the investment but also requires more time, effort, and expertise to manage effectively. Active trading involves buying and selling non-security investments frequently to capitalize on short-term price fluctuations. This strategy requires a deep understanding of the asset class, market trends, and technical analysis to identify profitable opportunities. The buy-and-hold strategy involves purchasing non-security investments and holding them for an extended period, with the expectation that their value will appreciate over time. This approach requires less ongoing management and can be suitable for investors with a long-term investment horizon. Investing in non-security assets through funds or exchange-traded funds (ETFs) allows investors to gain exposure to a diversified portfolio of alternative investments without directly owning the assets. This approach can provide professional management, lower costs, and greater liquidity compared to direct ownership. Non-security investments are subject to capital gains tax when they are sold at a profit. The tax rate depends on the investor's income and the length of time the asset was held. Long-term capital gains are generally taxed at a lower rate than short-term gains. Income generated from non-security investments, such as rent or dividends, is typically subject to income tax. The tax rate depends on the investor's income and the type of income received. Investors should consult a tax professional to understand the tax implications of their specific investments. Non-security investments can be subject to estate and gift taxes when they are transferred to heirs or gifted to others. The tax rate and exemption thresholds depend on the value of the assets and the relationship between the giver and the recipient. Proper estate planning can help minimize the impact of these taxes. Investors can employ various tax planning strategies to minimize their tax liability associated with non-security investments. These strategies may include tax-efficient asset allocation, tax-loss harvesting, and utilizing tax-deferred accounts such as IRAs and 401(k)s. Consulting with a tax professional can help investors develop a tax-efficient investment strategy tailored to their specific situation. One of the primary advantages of non-security investments is the diversification they can provide to an investor's portfolio. By allocating capital to alternative assets, investors can reduce the overall risk of their investments and potentially improve returns. Non-security investments tend to have a low correlation with traditional securities, which means their performance is not closely tied to stock or bond markets. Non-security investments can offer protection against inflation, as they often maintain or increase their value over time. Real assets such as real estate, commodities, and collectibles can serve as a hedge against rising prices, helping to preserve the purchasing power of an investor's capital. Non-security investments can provide opportunities for higher returns than traditional securities. Alternative assets such as real estate, private equity, or venture capital can offer significant upside potential, especially during periods of strong economic growth or market disruption. Investing in non-security assets can generate income through rent, dividends, or interest payments. This can provide investors with a steady stream of cash flow, which can be reinvested or used to cover living expenses. Non-security investments are often less liquid than traditional securities, which means they can be more difficult to buy and sell quickly. This can create challenges for investors who need to access their capital in a short period or who wish to rebalance their portfolio. Some non-security investments can be subject to significant price fluctuations, making them more volatile than traditional securities. This can result in higher potential gains but also increased risk of loss. Investors should carefully consider their risk tolerance and investment objectives before venturing into volatile non-security investments. Non-security investments may have less available information compared to traditional securities, making it more challenging for investors to conduct thorough research and make informed decisions. This can result in higher risks and potential losses if the investment does not perform as expected. Non-security investments can be subject to changes in government regulations and policies, which can impact their value or potential returns. Investors should be aware of the regulatory environment surrounding their investments and monitor any changes that could affect their assets. Before investing in non-security assets, investors should assess their risk tolerance and investment objectives. This will help them determine the appropriate allocation to alternative investments and ensure their portfolio aligns with their financial goals and risk preferences. Investors should carefully consider the proportion of their portfolio allocated to non-security investments. This allocation will depend on factors such as risk tolerance, investment goals, time horizon, and market conditions. A diversified portfolio that includes both traditional securities and alternative investments can help reduce risk and potentially enhance returns. Non-security investments should be integrated with an investor's overall portfolio to ensure proper diversification and risk management. This may involve rebalancing the portfolio periodically to maintain the desired asset allocation and adjusting the mix of investments in response to market conditions and changes in personal circumstances. Non-security investments represent a diverse range of alternative assets that are not traded on traditional exchanges or markets. These investments offer investors opportunities to diversify their portfolios, protect against inflation, and potentially achieve higher returns than traditional securities. The main types of non-security investments include real estate, collectibles, and commodities. Each asset class offers unique advantages and risks, making them suitable for different investment objectives and risk tolerances. Non-security investments can provide diversification benefits, inflation protection, higher return potential, and alternative sources of income. However, they also carry risks related to illiquidity, volatility, limited access to information, and regulatory changes. Investors should carefully consider their risk tolerance and investment goals before allocating capital to non-security investments. By understanding the various types of non-security investments and their associated advantages and risks, investors can make informed decisions about how to incorporate alternative assets into their portfolios. In the modern financial landscape, non-security investments play a crucial role in helping investors achieve their financial goals while managing risk and navigating market fluctuations.Definition of Non-Security

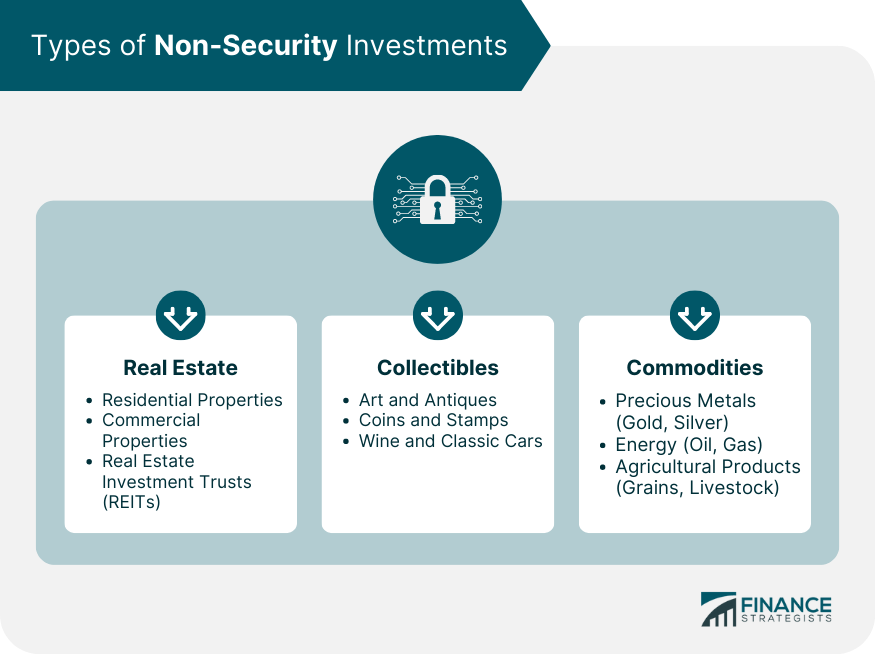

Types of Non-Security Investments

Real Estate

Residential Properties

Commercial Properties

Real Estate Investment Trusts (REITs)

Collectibles

Art and Antiques

Coins and Stamps

Wine and Classic Cars

Commodities

Precious Metals (e.g., Gold, Silver)

Energy (e.g., Oil, Gas)

Agricultural Products (e.g., Grains, Livestock)

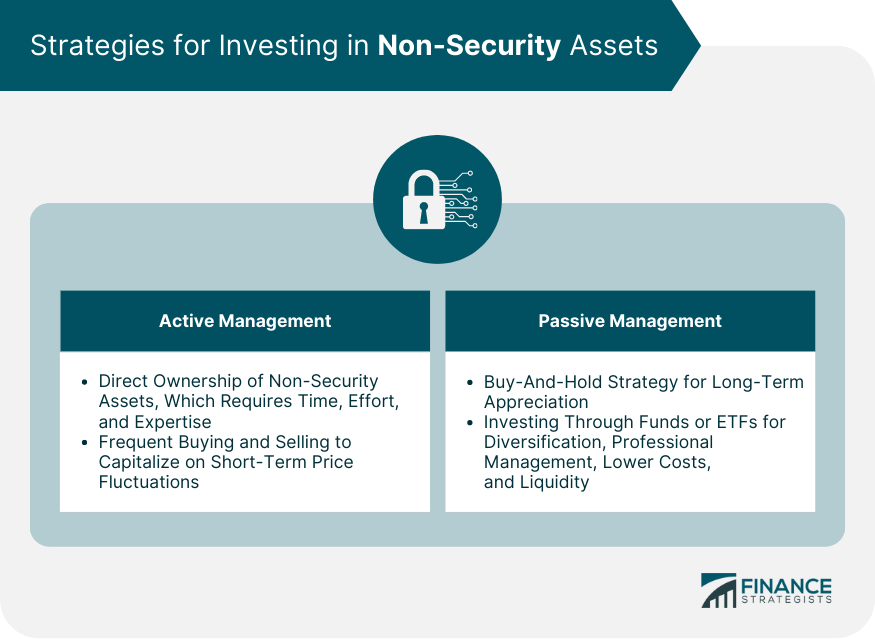

Strategies for Investing in Non-Security Assets

Active Management

Direct Ownership

Active Trading

Passive Management

Buy-and-Hold Strategy

Investing Through Funds or ETFs

Tax Implications of Non-Security Investments

Capital Gains Tax

Income Tax

Estate and Gift Tax

Tax Planning Strategies for Non-Security Investments

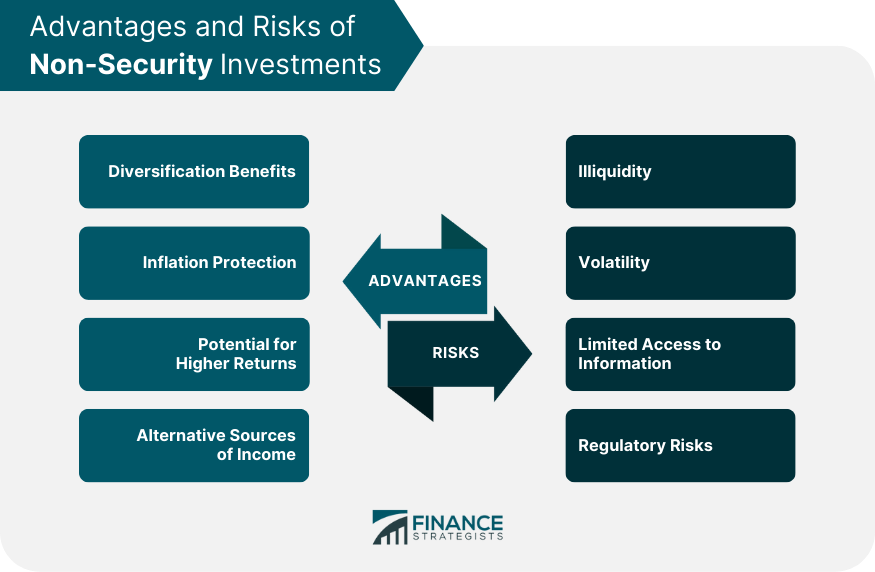

Advantages of Non-Security Investments

Diversification Benefits

Inflation Protection

Potential for Higher Returns

Alternative Sources of Income

Risks Associated With Non-security Investments

Illiquidity

Volatility

Limited Access to Information

Regulatory Risks

Role of Non-Security Investments in Portfolio Management

Assessing Risk Tolerance and Investment Goals

Determining the Appropriate Allocation to Non-Security Assets

Integrating Non-Security Investments With Other Portfolio Holdings

Conclusion

Non-Security FAQs

Non-security investments include a wide range of alternative assets such as real estate (residential properties, commercial properties, and real estate investment trusts), collectibles (art, antiques, coins, stamps, wine, and classic cars), and commodities (precious metals like gold and silver, energy resources like oil and gas, and agricultural products such as grains and livestock).

Non-security investments can offer diversification benefits because their performance is often not closely correlated with traditional securities like stocks and bonds. By including non-security assets in your portfolio, you can reduce overall risk and potentially improve returns, as these investments may perform well when traditional securities underperform.

Some of the main risks associated with non-security investments include illiquidity (difficulty in buying and selling assets quickly), volatility (price fluctuations), limited access to information (less available research and data), and regulatory risks (changes in government policies and regulations that can impact the value of investments).

There are two primary strategies for investing in non-security assets: active management and passive management. Active management involves direct ownership of assets or active trading to capitalize on short-term price fluctuations. Passive management includes the buy-and-hold strategy or investing through funds or exchange-traded funds (ETFs) that provide exposure to a diversified portfolio of non-security investments.

Taxes can impact non-security investments in several ways, including capital gains tax on profits from the sale of assets, income tax on earnings generated from investments (e.g., rent or dividends), and estate and gift taxes when assets are transferred or gifted. Tax planning strategies, such as tax-efficient asset allocation and utilizing tax-deferred accounts, can help minimize your tax liability associated with non-security investments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.