Program-Related Investments are a powerful financial tool used by private foundations to support charitable organizations and advance their mission. PRIs differ from traditional grants in that they involve the use of loans, equity investments, and other financing vehicles that are expected to be repaid or generate a return on investment. The Internal Revenue Service (IRS) provides guidelines and requirements for PRIs, as they can qualify as a part of a private foundation's mandatory annual charitable distribution. Key criteria for PRIs include a primary focus on furthering the foundation's charitable purposes, a lack of significant investment purposes, and no lobbying or political activities. Compliance with IRS regulations is crucial to ensure that PRIs are not subject to excise taxes or penalties. In addition to IRS guidelines, foundations must also adhere to other federal and state laws governing nonprofit and charitable organizations. These may include securities regulations, lending laws, and anti-discrimination statutes. Legal counsel should be sought to ensure that PRIs are structured and executed in compliance with all applicable laws. Foundations are responsible for monitoring their PRIs and ensuring that they meet the applicable legal and regulatory requirements. This includes tracking the progress of PRI-funded projects, measuring their impact, and reporting any significant events or changes. Foundations must also provide information about their PRIs on their annual IRS Form 990-PF. Loans are a common form of PRI, providing nonprofit organizations with capital to support their operations or projects. Loan guarantees, on the other hand, involve the foundation agreeing to repay a loan made by a third-party lender to the nonprofit organization in case of default. Both types of PRIs can offer more favorable terms and interest rates than traditional commercial loans. Equity investments involve a foundation purchasing ownership stakes in nonprofit organizations or social enterprises. This type of PRI allows the foundation to support the growth of mission-driven organizations while potentially generating financial returns if the organization is successful. Recoverable grants are similar to loans but do not require the nonprofit to pay interest. Instead, the grant is structured with the expectation that it will be repaid if certain conditions are met, such as achieving specific milestones or generating revenue. Linked deposits involve a foundation placing a deposit in a financial institution under the condition that the institution lends a specific amount to a designated nonprofit organization or project. This type of PRI can help to lower the borrowing costs for the nonprofit and support projects that may not otherwise qualify for traditional financing. As the field of PRIs continues to evolve, foundations are developing new and innovative financing structures to support their charitable objectives. These may include pay-for-success contracts, royalty agreements, and blended finance models that combine grants and investments. PRIs allow foundations to maximize their impact by using their financial resources more efficiently. Since PRIs are expected to be repaid or generate a return, they can be recycled and redeployed to support additional charitable activities. PRIs enable foundations to take on riskier projects that may not qualify for traditional grant funding or commercial loans. This can lead to innovative solutions and breakthroughs in addressing social and environmental challenges. PRIs can foster innovation and collaboration among nonprofits, social enterprises, and other stakeholders by offering flexible financing options. This can lead to the development of new models and approaches for addressing pressing social issues. PRIs provide nonprofits and social enterprises with much-needed capital that may not be available through traditional grant funding or commercial loans. This can enable organizations to launch new projects, scale up existing initiatives, or invest in their long-term sustainability. With access to capital through PRIs, nonprofit organizations can improve their financial stability, diversify their revenue streams, and invest in growth opportunities. This can lead to increased impact and long-term success for the organization. The process of applying for and managing a PRI can help nonprofit organizations strengthen their financial management, strategic planning, and evaluation capabilities. This can enhance their overall effectiveness and resilience. PRIs involve inherent financial risks, as there is a possibility that the investments may not be repaid or generate the expected returns. Foundations must carefully assess and manage these risks to protect their charitable assets. As discussed earlier, PRIs are subject to complex laws and regulations. Foundations must ensure that they remain in compliance with these requirements to avoid potential legal and financial penalties. Implementing and managing PRIs can require specialized expertise and resources that may not be readily available within many foundations. Building the necessary capacity and knowledge can be time-consuming and costly, especially for smaller foundations with limited staff and budgets. PRIs can create financial burdens or operational challenges for grantee organizations if not structured and managed carefully. Foundations must consider potential unintended consequences and work closely with their grantees to ensure that PRIs support their mission and objectives rather than hinder them. Before embarking on PRIs, foundations should develop a clear strategy that aligns with their mission, goals, and risk tolerance. This should include an assessment of the types of projects and organizations they wish to support and the desired outcomes and impact. Foundations must conduct thorough due diligence on potential PRI recipients to assess their financial health, management capacity, and mission alignment. This process should also involve a careful evaluation of the risks associated with each investment and the development of appropriate risk mitigation strategies. Foundations should establish systems for monitoring and evaluating the performance of their PRIs, including tracking financial metrics, project progress, and social impact. Regular reporting and communication with grantee organizations can help to identify challenges and opportunities for improvement. Collaborating with other foundations and investors can help to pool resources, share knowledge and expertise, and amplify the impact of PRIs. Joint initiatives and co-investments can also help to reduce risk and increase the likelihood of success for PRI-funded projects. The role of PRIs in modern philanthropy continues to grow, offering foundations and nonprofits a powerful tool to support their missions and drive positive social change. By understanding the legal and regulatory framework, embracing best practices, and learning from the experiences of others, organizations can unlock the full potential of PRIs to address some of the world's most pressing challenges. As PRIs continue to evolve and gain traction, they hold the promise of fostering innovation, collaboration, and impact across the philanthropic and social sectors. In light of the complexities involved in implementing PRIs, it is crucial for foundations and nonprofits to seek professional tax planning services to ensure compliance with legal and regulatory requirements. Consult with qualified tax planning professionals who can guide foundations through the process and help them make informed decisions that align with their mission and objectives. The future of PRIs is bright, and their potential to transform philanthropy and the social sector is immense, offering new opportunities for both foundations and nonprofits to create lasting and meaningful change. By seeking the appropriate tax planning services and support, organizations can confidently explore the potential of PRIs and harness their power to drive positive change in the world.What Are Program-Related Investments (PRIs)?

Legal and Regulatory Framework for PRIs

IRS Guidelines and Requirements

Other Relevant Laws and Regulations

Monitoring and Reporting Requirements

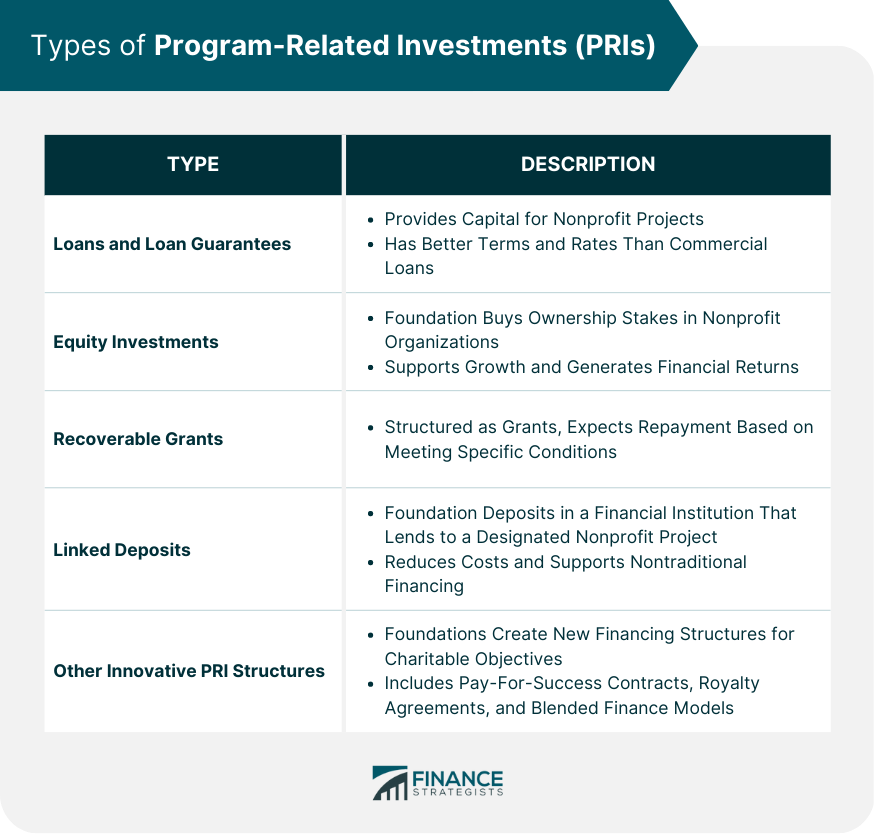

Types of Program-Related Investments

Loans and Loan Guarantees

Equity Investments

Recoverable Grants

Linked Deposits

Other Innovative PRI Structures

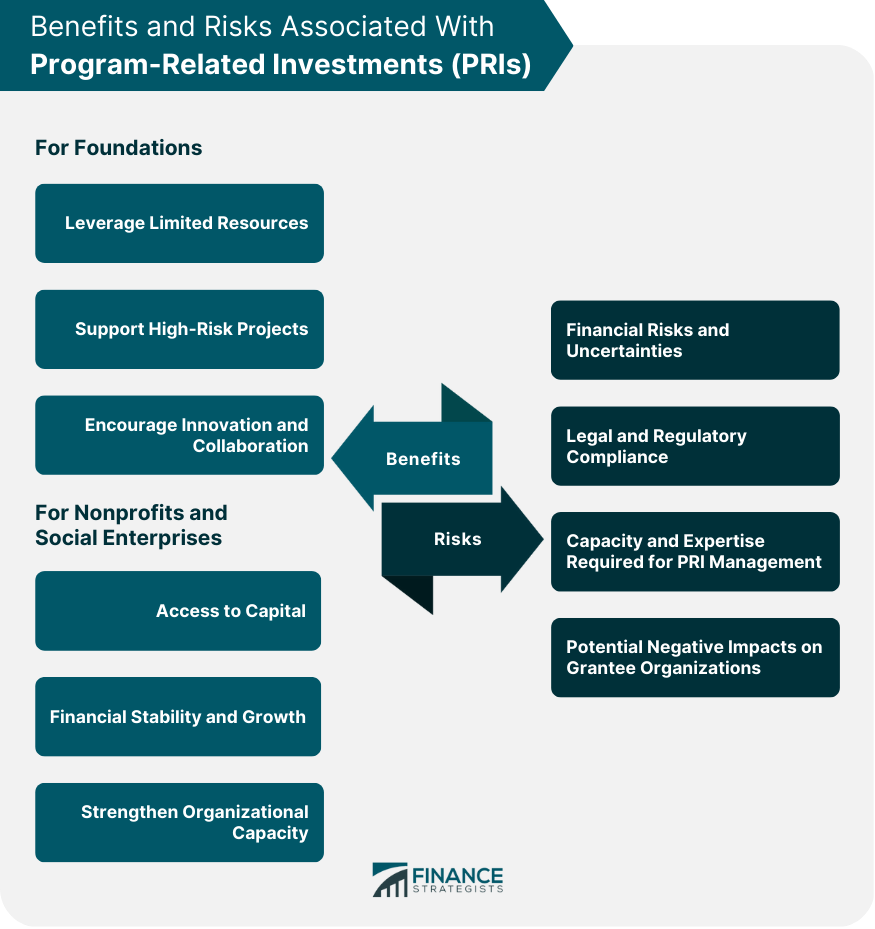

Benefits of PRIs for Foundations and Nonprofits

Advantages for Foundations

Leveraging Limited Resources

Supporting High-Risk Projects

Encouraging Innovation and Collaboration

Advantages for Nonprofits and Social Enterprises

Access to Capital

Financial Stability and Growth

Strengthening Organizational Capacity

Challenges and Risks Associated with PRIs

Financial Risks and Uncertainties

Legal and Regulatory Compliance

Capacity and Expertise Required for PRI Management

Potential Negative Impacts on Grantee Organizations

Best Practices for Implementing PRIs

Developing a PRI Strategy

Due Diligence and Risk Assessment

Monitoring and Evaluation

Collaboration and Partnership With Other Foundations and Investors

Final Thoughts

Program-Related Investments (PRIs) FAQs

Program-Related Investments (PRIs) are a type of financing used by private foundations to support charitable organizations while generating financial returns. Unlike traditional grants, PRIs involve loans, equity investments, or other financial vehicles that are expected to be repaid or generate a return.

The IRS provides guidelines for PRIs, which must primarily focus on furthering the foundation's charitable purposes, lack significant investment purposes, and avoid lobbying or political activities. Compliance with IRS regulations is critical to ensure that PRIs are not subject to excise taxes or penalties.

PRIs include loans and loan guarantees, equity investments, recoverable grants, linked deposits, and other innovative financing structures like pay-for-success contracts and blended finance models.

PRIs allow foundations to leverage limited resources, support high-risk projects, and encourage innovation and collaboration. For nonprofits, PRIs provide access to capital, financial stability, growth opportunities, and the chance to strengthen organizational capacity.

PRIs involve financial risks and uncertainties, legal and regulatory compliance requirements, the need for specialized expertise and resources, and the potential negative impacts on grantees. It is crucial to implement best practices, such as developing a PRI strategy, conducting due diligence and risk assessment, and monitoring and evaluating performance to mitigate these challenges and risks.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.